- Australian OIS markets are fully priced for an RBA rate cut by June

- AUD/USD remains rangebound despite a heavy macro calendar

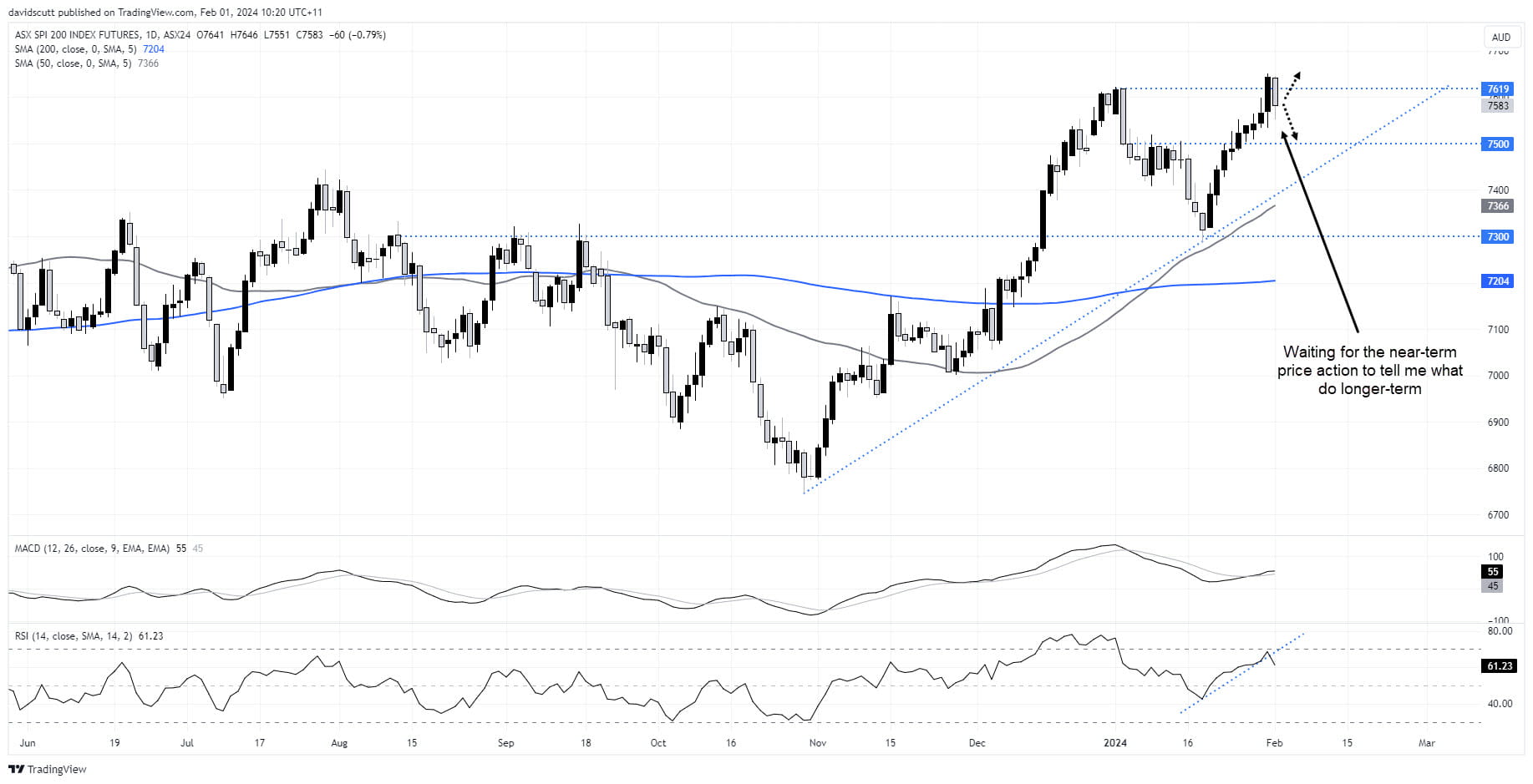

- Australia’s ASX 200 rallied to record highs on Wednesday but futures fell heavily overnight

Australian overnight index swaps (OIS) markets are fully priced for the Reserve Bank of Australia (RBA) to cut its overnight cash rate by 25 basis points in June to 4.1%, adding pressure on AUD/USD following the release of a softer-than-expected Australian consumer price inflation (CPI) report on Wednesday. With volatility in the US S&P 500 and Nasdaq 100 lifting on the back of disappointing corporate earnings reports, and a strong pushback from the Fed on expectations it may begin cutting interest rates as soon as March, it’s no surprise not only the risk-sensitive AUD/USD is looking worse for wear but also the high-flying ASX 200 which soared to record highs yesterday before reversing hard in overnight trade.

AUD/USD rangebound despite widening yield spreads

Despite having a lot thrown at it recently; an Australian retail sales and inflation report and the Fed’s January FOMC rate decision just to name three events the pair has had to digest, AUD/USD has hardly budged over the past week, trading in a narrow range throughout. But just because its not doing much doesn’t mean there’s not opportunity. If it wants to respect the range, trade the range until the price tells you otherwise.

Having tested former horizontal resistance around .6520 last week, AUD/USD has spent much of the time since dueling it out with resistance located above .6600, regularly pulling back towards .6560 before having another crack again. It’s now testing the lower end of that range within in a range, reacting to rising risk aversion surrounding the health of US regional lenders and the Fed’s messaging that it’s in no rush to cut rates.

However, one thing that is interesting is that despite the Fed’s pushback, US two-year yields finished the session sharply lower than where they started, seeing Australia’s yield advantage over that tenor widen to levels not seen in six weeks. While yield differentials are not the only driver of AUD/USD, it lessens the risk of continued downside beyond that already seen.

Source: Refinitiv

Ahead of US nonfarm payrolls on Friday, those considering initiating long AUD/USD positions could so around these levels, with a stop below the overnight low of .6524, targeting a move back to the top of the range at .6620. With no known major risk events locally over the remainder of the week, the performance of Chinese equity markets, and CNH, may be influential on the pair on Thursday.

ASX 200 battles elevated reversal risk

While the softer AUD contributed to the index surging to record highs following the release of Australia’s inflation report, that failed to assist Australian ASX 200 futures overnight, reversing hard in line with the declines seen on Wall Street. The bearish daily candle screams potential reversal risk, especially with futures already looking stretched after a bullish run rarely witnessed before. However, it must be acknowledged the price action up until recently has been entirely bullish, and the latest pullback may be used by some to buy the dip.

This on the watchlist for the moment. A recovery during Thursday’s day session back above the previous highs at 7619 would be unambiguously bullish, pointing to the potential for further upside following the breakout. Alternatively, should the price continue to slide towards former resistance at 7500, how it interacts with this level will help inform whether to position for a bounce or downside break. While Australia’s preliminary earnings season kicks off today, my experience is that it creates plenty of noise at the individual level but rarely impacts at the index level.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade