- AUD/JPY and crude oil are trending higher on the hourly charts

- In the FX space, Australian and Tokyo area inflation reports are the key releases to watch

- Crude oil likely to remain supported given supply-side threats

Geopolitics, inflation reports and sentiment towards Chinese markets will likely dominate proceedings for AUD/JPY and crude oil this week, putting their respective uptrends to the test during a time when investor risk appetite is particularly weak.

CPI reports set to influence AUD/JPY performance

When it comes to AUD/JPY, both sides of the currency pair will receive important inflation reports this week, potentially setting the tone for near-term tweaks to monetary policy settings from the Reserve Bank of Australia (RBA) and Bank of Japan (BOJ) in the coming weeks.

Full rate hike priced in from RBA

In Australia, the data highlight will undoubtedly be the release of Q3 consumer price inflation (CPI) on Wednesday, especially after hawkish commentary in the minutes of the RBA’s October monetary policy meeting released last week, and repeated by new governor Michele Bullock a day later, saw rates markets move to price in a full 25 basis point hike from the RBA by early next year. Some forecasters believe a hot trimmed mean CPI print may force the RBA to lift interest rates again when it meets on November 7.

The RBA cash rate currently sits at 4.1%, where it has remained since June.

Talk of tweaks to BOJ YCC

In Japan, the government will release October CPI data for Tokyo on Friday, providing traders a lead on how the national CPI figure may print when released next month. Over the weekend, the influential Nikkei newspaper suggested BOJ officials are considering whether to adjust its yield curve control program in response to the rise in bond yields globally, without naming any sources.

Benchmark 10-year JGB yields are permitted to trade 100 basis points either side of the BOJ’s 0% target. The bank has progressively been widening the trading band, allowing JGB yields to drift higher to where they presently reside around 84 basis points.

Given the implications for monetary policy and yield differentials which play a crucial role in determining the value of the JPY against other currencies, these two known risk events, along with developments in the conflict between Israel and Hamas, may prove to be influential on the performance of the AUD/JPY this week.

Mainland Chinese markets may also be worthwhile watching if trading the FX pair given many Australian assets have underperformed this year given deteriorating sentiment towards Chinese stocks and currency.

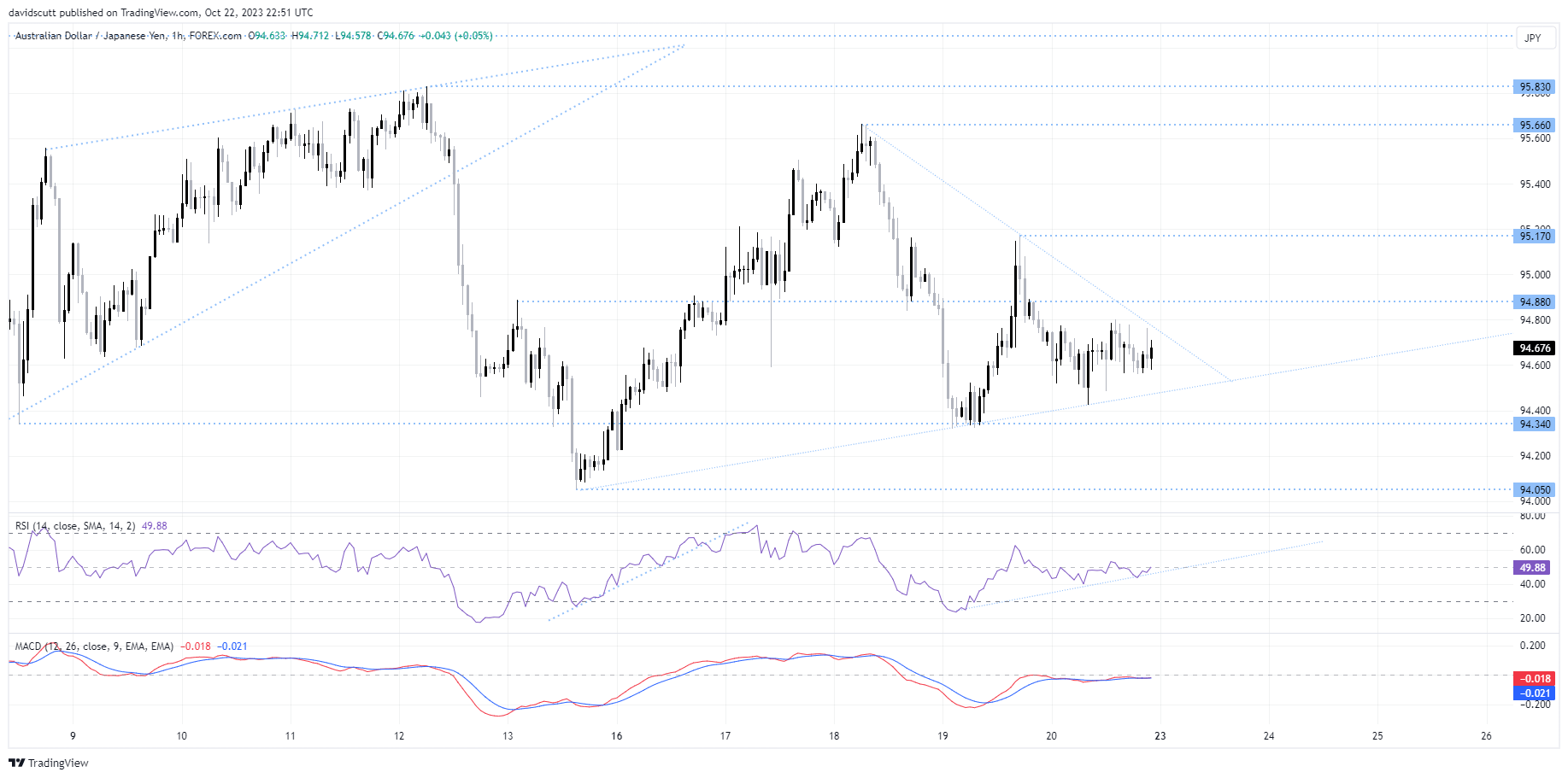

AUD/JPY arrives at important juncture

Looking at AUD/JPY on the hourly, the pair faces an interesting test early this week, sandwiched between uptrend support and downtrend resistance. RSI suggests uptrend momentum continues to build, suggesting the path of least resistance may be higher near-term.

On the topside, a break of downtrend resistance opens the door for a potential push to 94.88. Above that, 95.17, 95.66 and 95.83 are the levels to watch. On the downside, uptrend support is fond around 94.50 before a more pronounced support kicks in at 94.34.

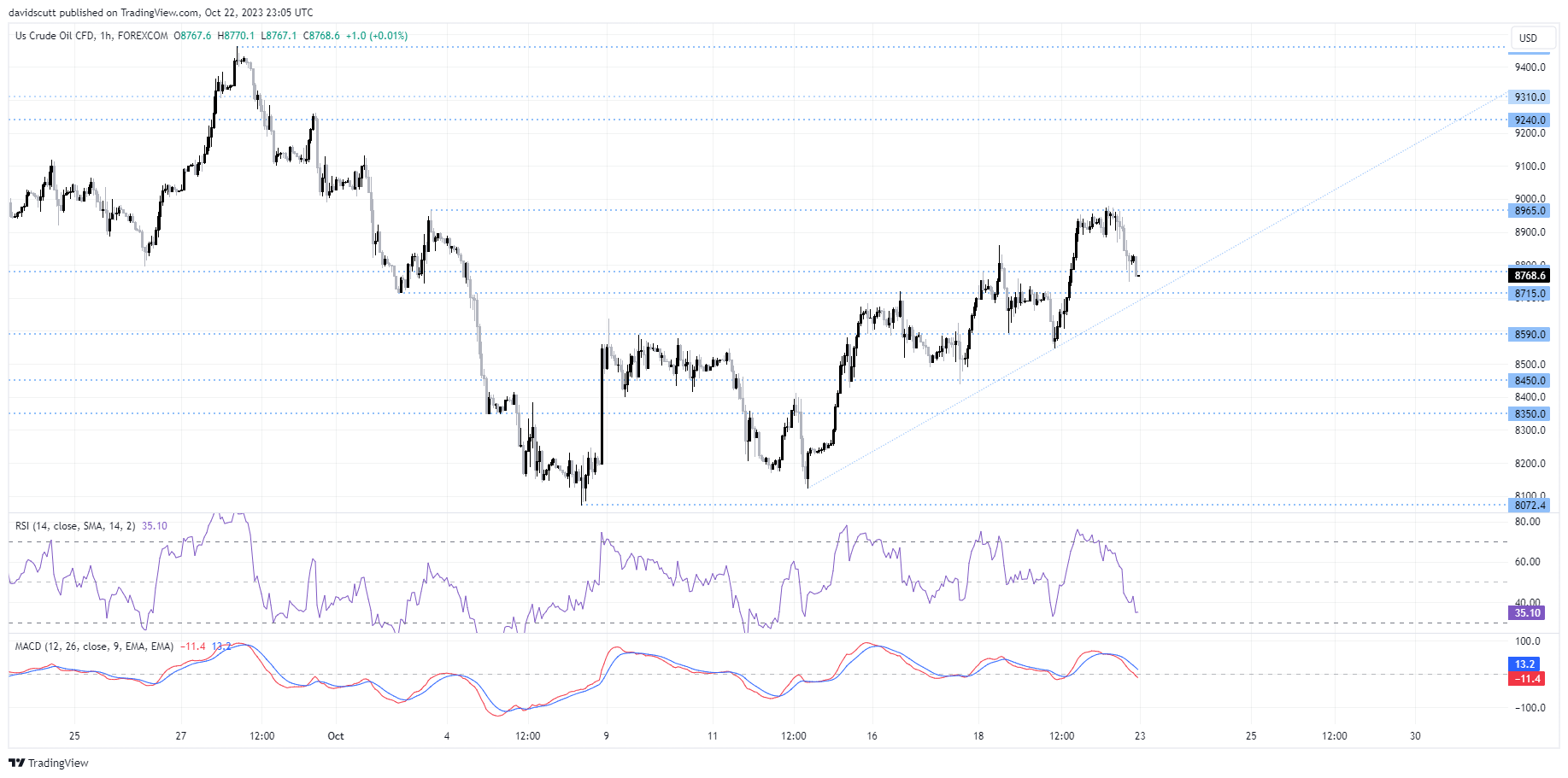

Crude oil looking toppy near-term

For crude oil traders, headlines relating to the Middle East conflict remain in the drivers’ seat, although crude and distillate information from the United States later in the week may also provide volatility for traders.

Right now, it appears that traders are unwinding weekend hedges with no significant escalation in the Israel-Hamas conflict since Friday, seeing WTI ease back a support zone between $87.80 and $87.15 having failed to clear resistance at $89.65 on multiple occasions on Friday. Uptrend support is also nearby around $86.80. MACD has also staged a bearish crossover while RSI suggests the move is approaching oversold levels.

A break of the uptrend may see traders target multiple layers of support located at $85.90 and again between $83.50 to $84.50. On the topside, a bounce off nearby support would likely lead to a retest of $89.65 and potentially a push back towards $92.40.

Fundamentally, in the absence of a significant negative demand and positive supply shock, crude is likely to remain supported on dips as long as the Middle East conflict continues.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade