Market Summary:

- Odds of a June Fed cut have fallen below 50% following Monday’s strong ISM manufacturing report, although Fed fund futures still favour a June cut with a 61.6% probability.

- US bond yields rallied for a second day, the Dow Jones fell around -1% and led the Nasdaq 100 and S&P 500 lower and the VIX rose to a 2-week high as markets repriced in the ‘higher for longer’ narrative

- Regardless, the US dollar retraced after traders presumably booked profits when the US dollar index tapped 105 on Monday, resulting in a mild pullback from its 6-week high

- AUD/USD bounced from the March 5th low and closed back above 65c in line with yesterday’s bias, to further underscore we’re not witnessing a head and shoulders top.

- The RBA said it plans to change how it provides liquidity to the banking system, through regular money market operations to provide ample liquidity

- The BOE are considering mimicking the Fed’s ‘dot plot’, to show where members think interest rates could be in the future whilst remaining anonymous

- The relentless rally on gold continued higher for a seventh day, with spot prices rising above $2080 and closing just off the daily high

- The equally-weighted gold basket was also at a record high to show the rally is based on gold strength, not on US dollar weakness

- Crude oil prices continued higher, above my prior $84 target and closing comfortably above $85 on supply concerns ahead of today’s OPEC meeting, with Ukraine continuing to attack Russian oil facilities

Events in focus (AEDT):

- 09:00 – Australian manufacturing, construction index (AIG)

- 11:30 – Japan Services PMI

- 12:45 – China services PMI (Caixin)

- 20:00 – Eurozone inflation, unemployment

- 20:15 – OPEC meeting

- 23:15 – ADP employment change

- 00:45 – FOMC member Bowman speaks, US services and composite PMIs (Final – S&P Global)

- 01:00 – ISM services PMI

- 03:00 – Fed Goolsbee speaks

- 03:10 – Fed Powell speaks

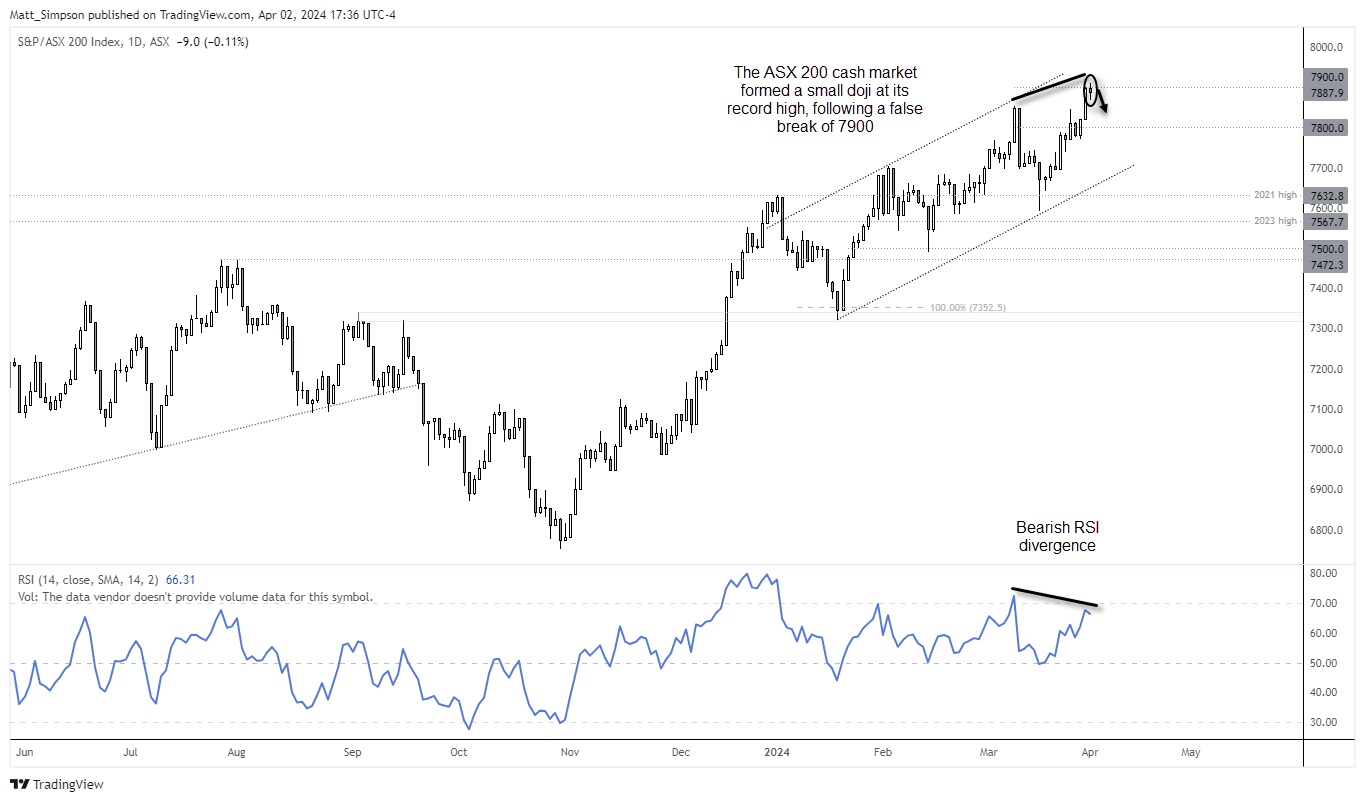

ASX 200 technical analysis:

- The ASX 200 cash market reached a fresh record high on Tuesday with a intraday break above 7900, although it closed back beneath that key level to form a narrow-ranged doji at the highs to hint at trend exhaustion (see the daily chart here)

- The ASX 200 futures chart formed a 3-day bearish reversal pattern at the highs (evening star formation) which also hints at a pullback.

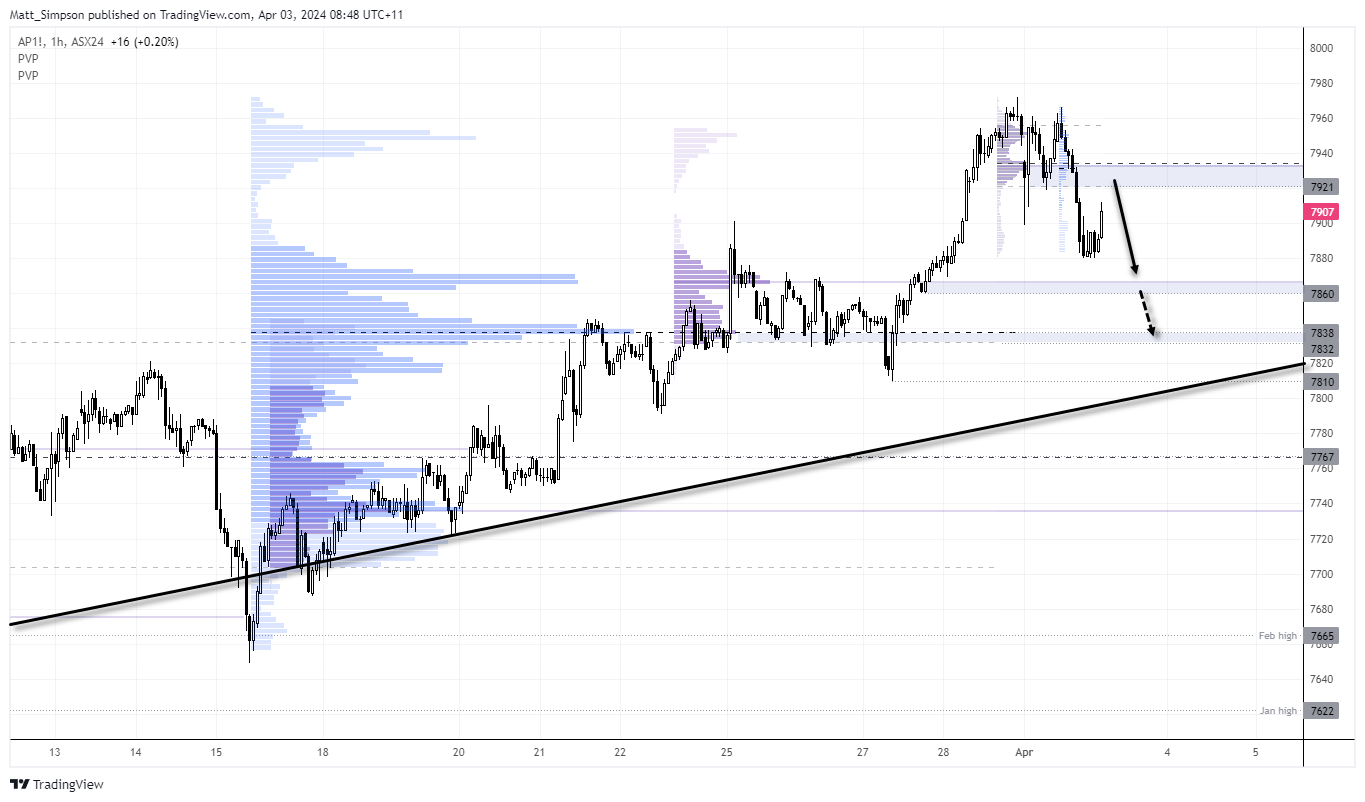

- The 1-hour chart of the ASX 200 futures chart shows momentum turned swiftly lower before consolidating around 7880.

- We saw a bounce in the final hour of NY trade, but the bias is to fade into rallies up to the 7920-7935 level for a move towards support zones around 7860, 7835 or 7800 / lower trendline

AUD/JPY technical analysis:

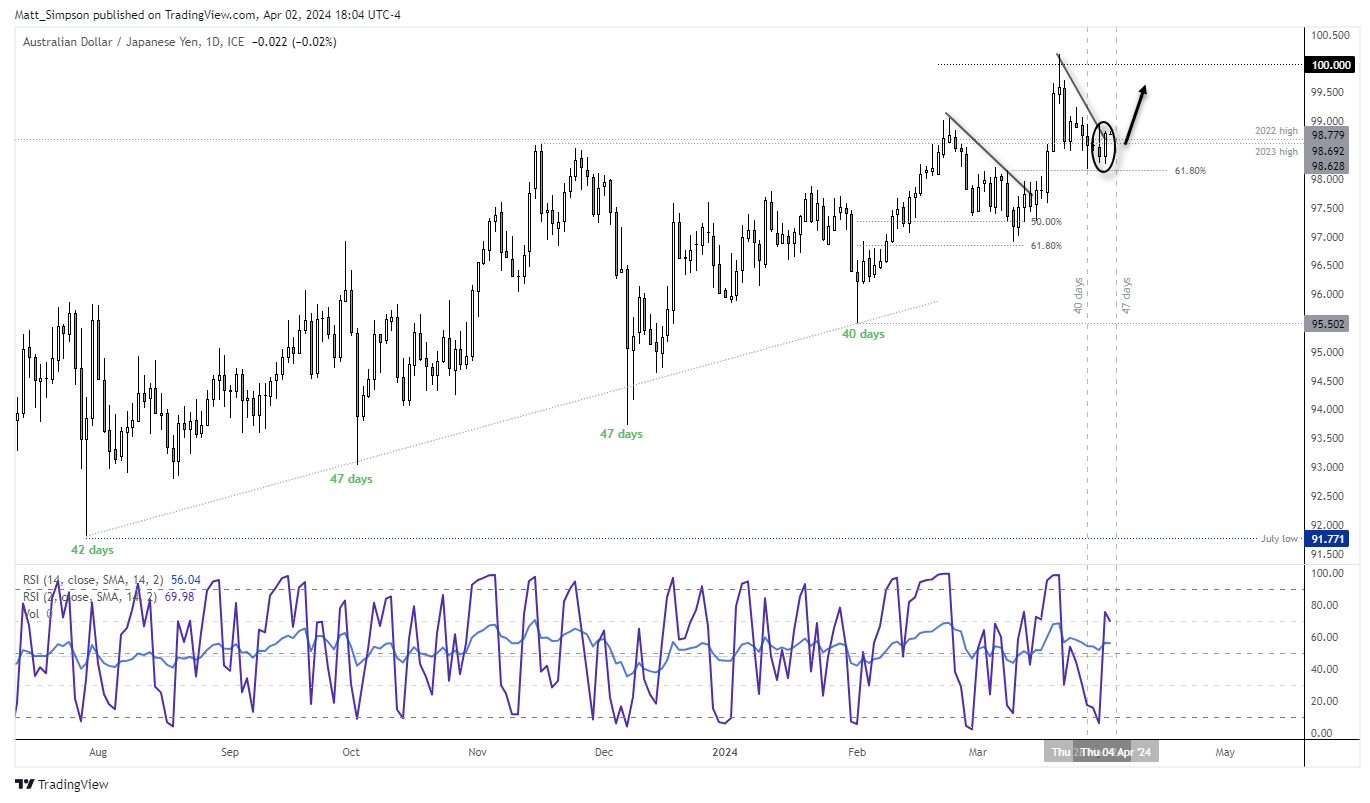

The daily chart shows an established uptrend for AUD/JPY, which entered a corrective phase after its failed ‘bid’ to close above 100. After a 7-day correction, a bullish engulfing day formed above the 61.8% Fibonacci retracement level to hint at a swing low. It also closed above the 2022/2023 highs. What is also interesting is that the potential ow landed right in the 40-47 day cycle estimate which I highlighted back in February. RSI (14) is curling higher above 50 and RSI 2 is above 50 after touching the oversold zone on Monday.

The bias remains bullish above this week’s low, and bulls could seek to enter dips within Tuesday’s range in anticipation of a break above 99. The upside target is open, although 99.50 and 100 make obvious resistance levels to expect some sort of profit taking along the way.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade