Tuesday US cash market close:

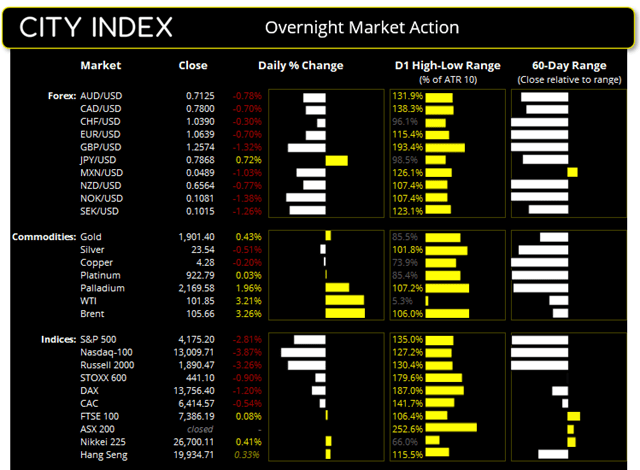

- The Dow Jones Industrial rose 565 points (0.08%) to close at 7,386.19

- The S&P 500 index rose -120.92 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -523.511 points (-3.87%) to close at 13,009.71

Asian futures:

- Australia's ASX 200 futures are down -65 points (-0.89%), the cash market is currently estimated to open at 7,253.00

- Japan's Nikkei 225 futures are down -650 points (-2.44%), the cash market is currently estimated to open at 26,050.11

- Hong Kong's Hang Seng futures are down -262 points (-1.31%), the cash market is currently estimated to open at 19,672.71

- China's A50 Index futures are down -116 points (-0.9%), the cash market is currently estimated to open at 12,840.29

Bearish sentiment stemming from a hawkish Fed, growth concerns and fresh threats from Russia overshadowed earnings season on Wall Street. Russia have vowed to cut of the gas supply to Poland and Bulgaria on Wednesday – their first such move to a NATO member – in retaliation for the West’s involvement in the Russia-Ukraine war.

The Nasdaq 100 stalled just shy of key support at 13,000 and has now fallen over -22% from its record high. The cash market opened at its high and closed at the low of the day, although Tesla was the main ‘driver’ of the move as investors sold the stock on concerns Elon Musk may sell some of his stake to fund his Twitter purchase. Weak earnings from Alphabet also dented sentiment.

ASX 200:

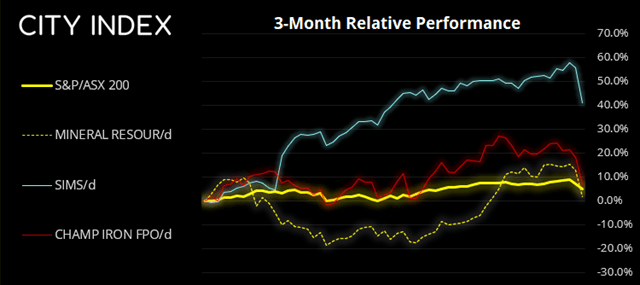

It was another drubbing for the ASX 200 yesterday with all sectors in the red and 80.5% of its stocks declining. And whilst it was only its fifth worst day of the year, it was enough to see the index trade back beneath this year’s opening price to add insult to injury. 7300 is the next obvious level for bears to conquer, and a strong inflation report today could be just the trigger for a firm close beneath it.

ASX 200: 7318 (-2.08%), 25 April 2022

- Industrials (-0.67%) was the strongest sector and Materials (-5.1%) was the weakest

- 11 out of the 11 sectors closed lower

- 9 out of the 11 sectors outperformed the index

- 32 (16.00%) stocks advanced, 161 (80.50%) stocks declined

Outperformers:

- +3.34% - Yancoal Australia Ltd (YAL.AX)

- +2.32% - Virgin Money UK PLC (VUK.AX)

- +1.96% - Block Inc (SQ2.AX)

Underperformers:

- -9.93% - Mineral Resources Ltd (MIN.AX)

- -9.49% - Sims Ltd (SGM.AX)

- -9.22% - Champion Iron Ltd (CIA.AX)

Fed Vice Chair confirmed

Lael Brainard has been confirmed as the Fed Vice Chair in a widely expected move. Whilst she is considered a dove at heart it is not expected, her appointment as is not expected to dampen the Fed’s current hawkish stance.

The dollar remains supreme

USD remained supreme against all except the Japanese yen overnight and was the strongest major, whilst the yen also received safe-haven inflows as US stock markets fell further on weaker earnings. GBP/USD was the weakest major and fell around -1.3%.

The US dollar is also on track for the strongest major this month, rising over 5% against NZD, 4.8% against AUD ad 4.3% against JPY. The dollar index closed above 102 to a fresh 25-month high and was its fourth consecutive bullish close.

NZD/USD has now fallen over -4% since the RBNZ’s hawkish hike of 50-bps and the pair is less than half a day’s trade away from the YTD low. AUD/USD has fallen over -7% since this month’s high and is just 19 pips above the 71c handle

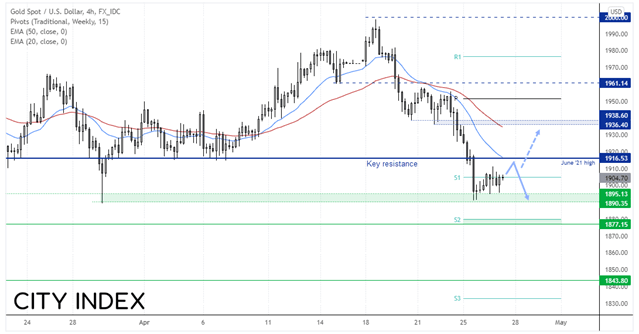

Gold breaks 3-day losing streak

Bearish momentum for gold has been strong overall since its rally failed to test $2000 last Monday. As outlined yesterday our bias is for a move to 1870 whilst prices remain below 1916, but there is the potential for a minor bounce before losses continue.

A small bullish inside candle formed yesterday above the 1890.35 – 1895.13 support zone. ON the four-hour chart a bullish outside candle has formed which is also a higher low – so it appears this is part of a 3-wave countertrend move. We are therefore bullish above 1890 and now targeting 1916. If we see a bearish reversal around 1916 we will flip back to the bearish bias for a move to 1890. But if we see a strong break (or daily close) above 1916.50 then it suggests a deeper countertrend move.

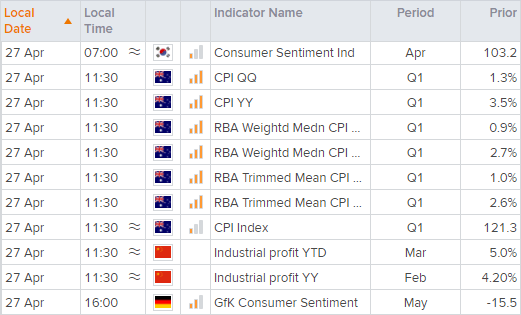

Up Next (Times in AEST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade