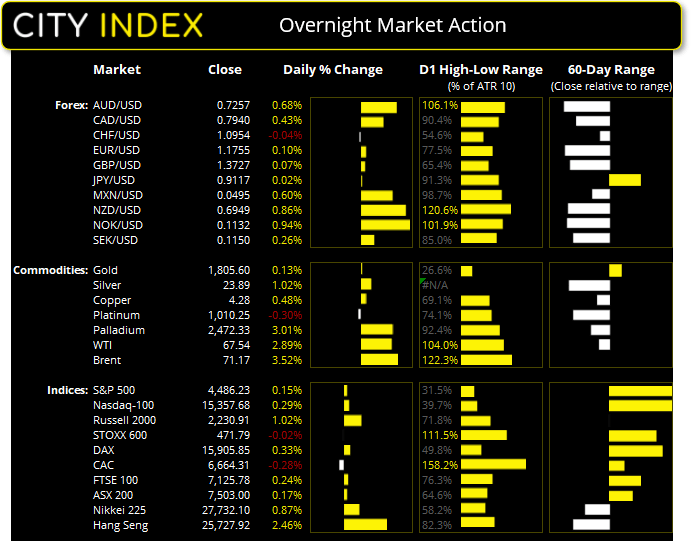

Asian Futures:

- Australia's ASX 200 futures are up 24 points (0.32%), the cash market is currently estimated to open at 7,527.00

- Japan's Nikkei 225 futures are up 30 points (0.11%), the cash market is currently estimated to open at 27,762.10

- Hong Kong's Hang Seng futures are up 98 points (0.38%), the cash market is currently estimated to open at 25,825.92

UK and Europe:

- UK's FTSE 100 index rose 16.76 points (0.24%) to close at 7,125.78

- Europe's Euro STOXX 50 index rose 1.66 points (0.04%) to close at 4,178.08

- Germany's DAX index rose 53.06 points (0.33%) to close at 15,905.85

- France's CAC 40 index fell -18.79 points (-0.28%) to close at 6,664.31

Tuesday US Close:

- The Dow Jones Industrial rose 30.55 points (0.09%) to close at 35,366.26

- The S&P 500 index rose 6.7 points (0.15%) to close at 4,486.23

- The Nasdaq 100 index rose 44.864 points (0.29%) to close at 15,357.68

US Indices edge higher:

It was another positive session on Wall Street ahead of tomorrow’s Jackson Symposium, as recovery hopes remained buoyant following the FDA’s approval of Pfizer-BioNTech’s COVID-19 vaccine. Late reports also arrived that the $3.5 trillion budget blueprint and $1 trillion infrastructure bill has secured enough votes to pass the house of representatives.

Bond yields were higher across the curve and the S&P 500 hit a record high for its 50th time this year, even if it was only a marginal gain with 6 of its 11 sectors rising, led by energy and consumer discretionary stocks. The Nasdaq 100 was the strongest large-cap index on the day, rising 0.3% compared to the Dow’s 0.29% and S&P’s 0.15% gains. Volumes were lightly overall though as traders keep Jackson Hole in mind.

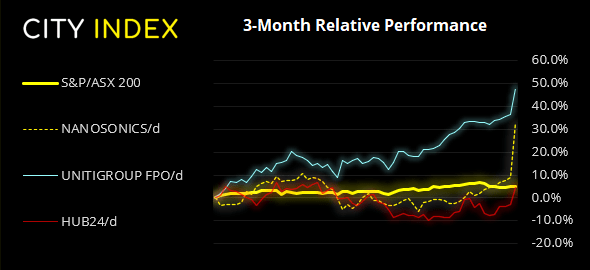

The ASX 200 closed just above 7503 and its 20-day eMA, although formed a bearish hammer by the day’s close. It’s rebound has not been particularly strong so we are conscious of its ability to print new lows should sentiment take a turn for the worse.

ASX 200 Market Internals:

ASX 200: 7503 (0.17%), 24 August 2021

- Materials (0.84%) was the strongest sector and Consumer Staples (-1.2%) was the weakest

- 6 out of the 11 sectors closed higher

- 4 out of the 11 sectors outperformed the index

- 106 (53.00%) stocks advanced, 83 (41.50%) stocks declined

- 68.5% of stocks closed above their 200-day average

- 61.5% of stocks closed above their 50-day average

- 64% of stocks closed above their 20-day average

Outperformers:

- + 21.9% - Nanosonics Ltd (NAN.AX)

- + 8.40% - Uniti Group Ltd (UWL.AX)

- + 7.43% - Hub24 Ltd (HUB.AX)

Underperformers:

- -15.8% - Kogan.com Ltd (KGN.AX)

- -14.4% - Monadelphous Group Ltd (MND.AX)

- -9.19% - Ansell Ltd (ANN.AX)

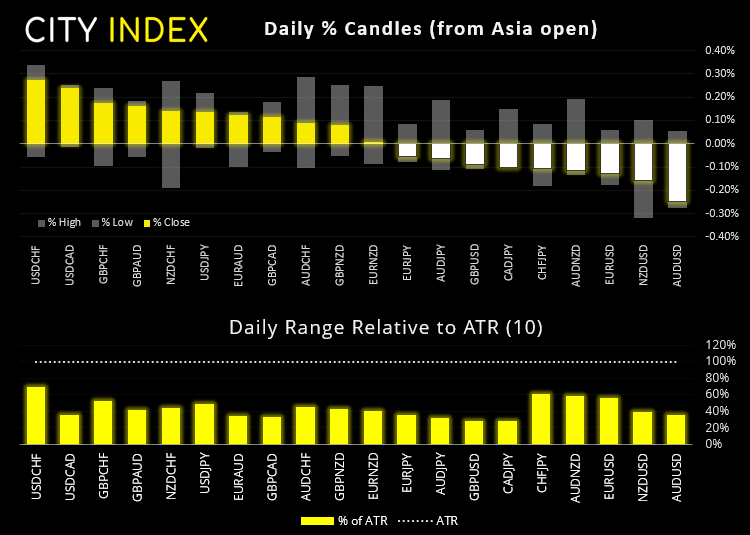

Forex: Commodity currencies extend gains

Commodity currencies NZD, AUD and CAD retained their place at the top of the FX major leader board whilst safe havens CHF, USD and JPY were the weakest yesterday. The British pound took the baulk of the selling and accounted for the higher levels of volatility, with GBP/NZD and GBP/AUD daily ranges close to 150% of their ATR(10).

The US dollar was slightly weaker with the dollar index (DXY) falling -0.07%, although found support at its 20-day eMA. AUD/USD rallied 0.6% to a 5-day high and honed-in on it next resistance level at the 0.7290 low. USD/CAD continued to unwind thanks to higher oil prices, falling -0.44%.

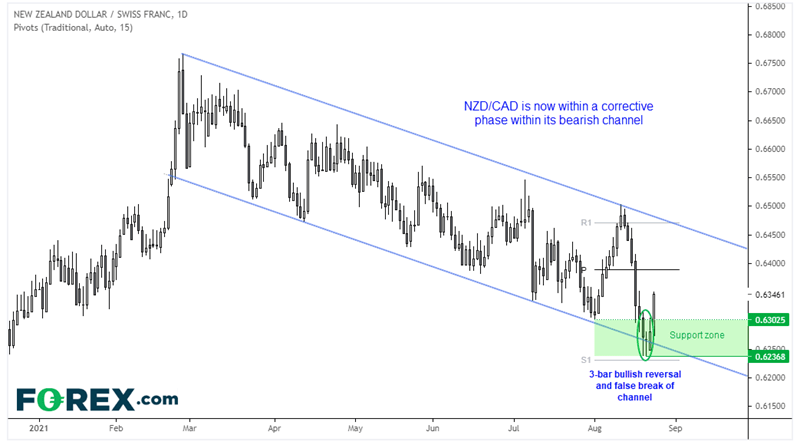

NZD/CAD remains in a downtrend and within a bearish channel, although now in a corrective phase despite higher oil prices. New Zealand remains in level-4 lockdown and cases rose to 41 yesterday, its highest level during the pandemic. But if they can curb the breakout and ease restrictions over the next couple of weeks then NZD appears oversold as RBNZ (lockdown aside) remain the most hawkish central bank. And this could help NZD/CAD continue higher, so our bias remains bullish above the August low and keen on low volatility retracements towards 0.6300.

NZ trade data is released at 08:45, although it is more likely to be risk sentiment, how traders are viewing the dollar ahead of Jackson Hole and NZ’s daily covid case count which drive the Kiwi dollar today.

Learn how to trade forex

Commodities lifted by weaker US dollar

Oil continued to climb higher for a second day amid the positive tone for risk. WTI has risen nearly 10% over the past 2-days to recoup about 2/3rd of its 7-day decline. The 20-day eMA is now capping as resistance around 67.60.

Gold prices continues to coil up into a smaller bull flag pattern around the 200-day eMA, and this may continue to be the case ahead of Jackson Hole unless we see a much weaker US dollar.

Silver rose to a 5-day high although 24.0 continues to cap as resistance. Again, we may find this level holds until Jackson Hole barring a new catalyst to drive the dollar and risk sentient.

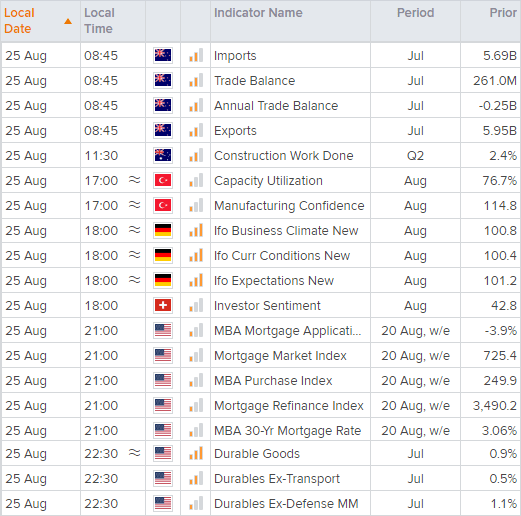

Up Next (Times in AEST)>

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.