* Please note - the next Asian Open report will be on Monday 19th July

Asian Futures:

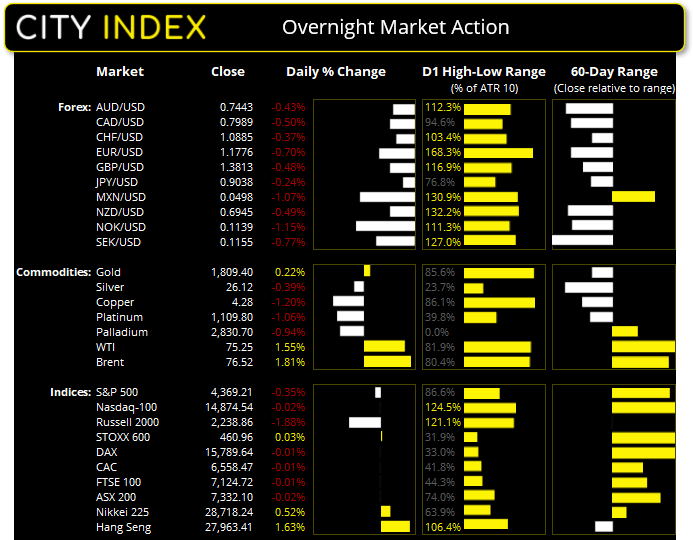

- Australia's ASX 200 futures are up 4 points (0.05%), the cash market is currently estimated to open at 7,336.10

- Japan's Nikkei 225 futures are down -140 points (-0.49%), the cash market is currently estimated to open at 28,578.24

- Hong Kong's Hang Seng futures are down -35 points (-0.13%), the cash market is currently estimated to open at 27,928.41

UK and Europe:

- UK's FTSE 100 index fell -0.7 points (-0.01%) to close at 7,124.72

- Europe's Euro STOXX 50 index rose 1.18 points (0.03%) to close at 4,094.56

- Germany's DAX index fell -0.87 points (-0.01%) to close at 15,789.64

- France's CAC 40 index fell -0.78 points (-0.01%) to close at 6,558.47

Tuesday US Close:

- The Dow Jones Industrial fell -107.37 points (-0.31%) to close at 34,888.79

- The S&P 500 index fell -15.42 points (-0.36%) to close at 4,369.21

- The Nasdaq 100 index fell -3.348 points (-0.02%) to close at 14,874.54

Learn how to trade indices

Indices: Wall Street shaken, but not stirred

A positive start on Wall Street ended with a weak finish as investors juggled earnings, treasury auctions and US inflation reports. Whilst lower than expected demand for 30 year treasuries gave back early gains, selling continued as core CPI rose to 4.5% YoY (its highest rise in thirty years).

The Russell 2000 (small-cap) value stocks fell -2.03% compared to the Russell 2000’s -1.74% decline. The Nasdaq 100 printed a pinbar reversal after failing to hold onto its intraday record high, effectively closing flat. The Nasdaq banks index fell -2.00%, biotech sector was down -1.09% whilst FAANGS escaped the pressure by closing -0.01% on the day. The S&P 500 printed a bearish outside day and closed at a two-day low, falling -0.35%. 10 of its 11 sectors closed in the red led by real estate (-1.3%) and consumer discretionary (-1.17%). Still, these are not terrifying numbers overall and there is plenty of earnings reports to mull over before we see if equities extend their downside or break to new highs.

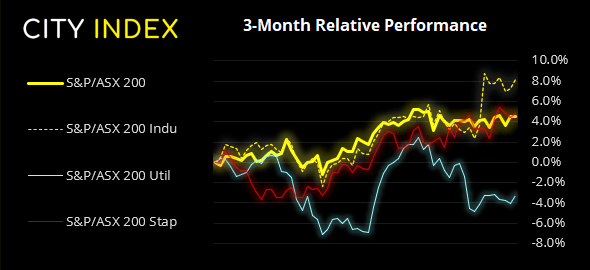

The ASX 200 is expected to open 4-poijnts higher (effectively flat). Take note of yesterday’s bearish pinbar which reaffirmed its sideways range around 7216 – 7370, which is basically within the bearish engulfing candle on June 21st. That said, bulls may need to wait for a break above 7403 before popping open the champagne. Until then, range-trading strategies are preferred between 7216 – 7403.

ASX 200 Market Internals:

ASX 200: 7332.1 (-0.02%), 13 July 2021

- Industrials (0.86%) was the strongest sector and Real Estate (-0.85%) was the weakest

- 8 out of the 11 sectors closed higher

- 105 (52.50%) stocks advanced, 83 (41.50%) stocks declined

- 9 hit a new 52-week high, 0 hit a new 52-week low

- 69.5% of stocks closed above their 200-day average

- 59.5% of stocks closed above their 50-day average

- 44.5% of stocks closed above their 20-day average

Outperformers:

- + 14.3% - Nearmap Ltd (NEA.AX)

- + 5.76% - Incitec Pivot Ltd (IPL.AX)

- + 5.20% - NRW Holdings Ltd (NWH.AX)

Underperformers:

- -8.26% - Platinum Asset Management Ltd (PTM.AX)

- -2.93% - Whitehaven Coal Ltd (WHC.AX)

- -2.23% - Challenger Ltd (CGF.AX)

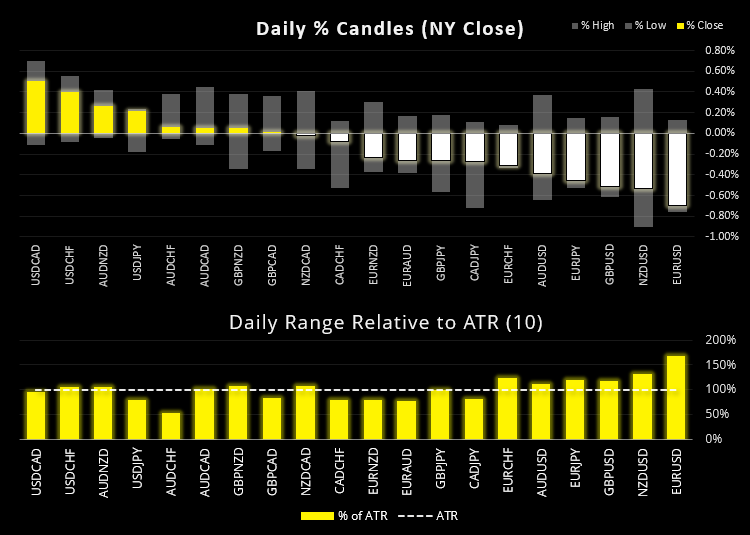

Forex: USD strongest major, RBNZ up next

The US dollar index (DXY) was the clear victor overnight (and now the strongest of the past week) after strong CPI data brought forward expectations for Fed tightening. EUR/USD fell -0.7% to close beneath 1.1800 to a 3-month low. GBP/USD rolled over from the 1.3910 high mentioned in yesterday’s European open report. NZD/USD fell briefly to a 7-month low although recovered back above the March low. And USD/CAD rose 0.5% to close the day with a three-bar bullish reversal pattern (Morning Star Reversal) which places support at 1.2440 ahead of today’s BOC meeting.

Month-to-date the Swiss franc and Japanese yen remain the strongest currencies and the US dollar has moved its way up to the centre of the pack.

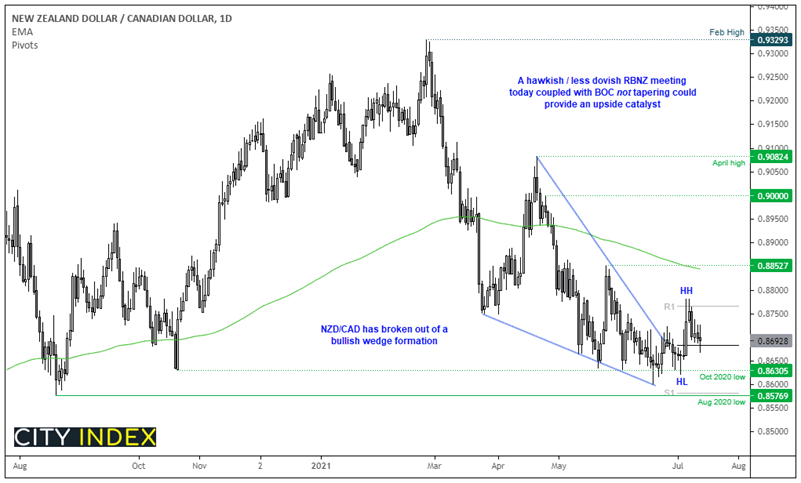

The main event in Asia today is RBNZ’s Monetary Policy Review (MPR) at 12:00 AEST. Whilst there are no expectations for a policy change today, data has mostly outperformed expectations over the past month with a notable print coming from the NZIER business confident report which expanded for the first quarter since Q3 2017. Given it’s a closely watched indicator by RBNZ and prompted several local banks to bring forward expectations of a hike around November this year, markets promptly went long NZD. So perhaps we’ll see another sprinkle of hawkishness in today’s statement, but this also leaves NZD vulnerable to a downside reaction if we see a ‘copy and paste’ statement.

With RBNZ and BOC holding meetings over the next 24 hours we’ll revisit our NZD/CAD analysis. Technically we see the potential for rising prices due the bullish wedge which formed above the August 2020 low. A higher high and higher low has formed since breaking outside of the wedge and, if successful, the pattern projects a target at the wedge base of 0.9082. Although 0.8852 (swing high and 200-day eMA) and 0.9000 are likely interim targets. However, to see NZD/CAD form a low today we would need to see a less dovish / more hawkish RBNZ statement. And to see the upside hold onto early gains we’d likely need to see BOC not taper and provide a more hawkish / less dovish statement.

Learn how to trade forex

Commodities: Oil rises on tight supply expectations

Commodities were broadly higher for a fourth consecutive session, with the CRB commodity index rising to a five-day high in part to a weaker US dollar.

Oil prices defined the stronger dollar to rise 1.5% following a report from IEA (International Energy Agency) forecasting a tight oil supply. WTI futures rose to 75.21 which places intraday support at 73.68 whilst brent rose 0.6% to close at 76.44 and retest its broken trendline.

Gold remained confined within its $30 range as it faced conflicting signals between a rising dollar and rising inflation. Therefore, in the current environment we need to see real rates (which we used TIPS as a proxy) to break out of its own range as higher real rates should weigh on gold prices and falling real rates help support gold prices. We’ll wait.

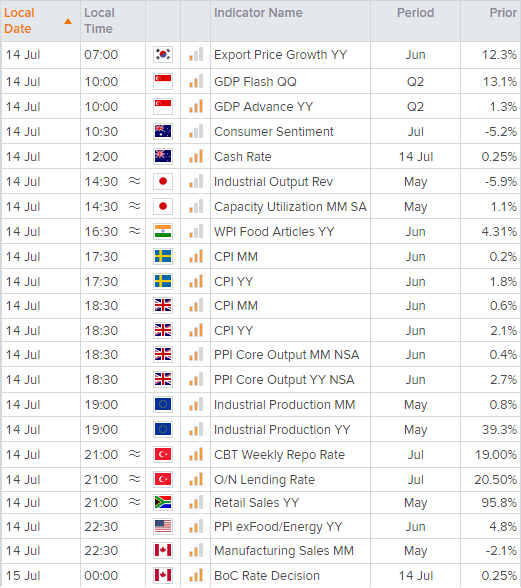

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.