There’s an old saying in trading that crude oil bulls should be keep top of mind this week: If a market can’t rally on good news, it’s likely headed much lower.

On Monday, OPEC+ surprised markets by cutting production by 100K bpd starting in October, suggesting that the oil cartel would like to see prices supported, despite fears of a global recession. Crude prices rallied briefly above $90 before rolling over to reverse those gains yesterday.

Then, earlier today, top US officials reportedly told Israel’s PM that a nuclear deal with Iran was unlikely in the foreseeable future. Most analysts view a nuclear deal as a precursor for Iranian oil supplies to come back on the world market, so the report that that first step was further away than previously thought suggests that there will be less supply (and, theoretically, higher prices) for longer than assumed.

Rather than using that report as an opportunity to buy WTI (US Oil) off technical support at 85.00, traders have instead sold crude down to its lowest level since January, before the war in Ukraine even began. In other words, oil traders have now had two chances to bid up oil on better-than-expected news this week, and on both occasions, crude was trading much lower in just a handful of hours.

Technical view: West Texas Intermediate crude oil (US Oil)

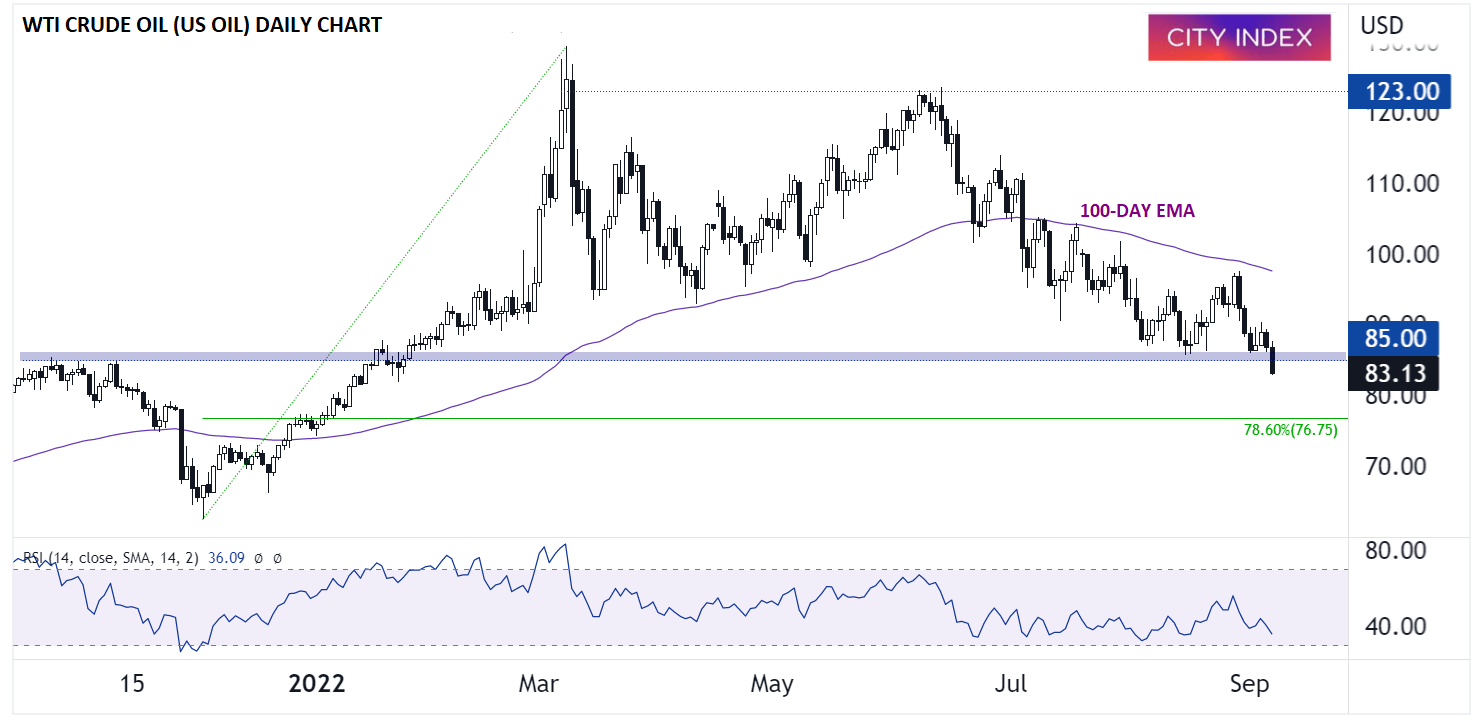

As we mentioned above, oil is breaking below previous support at 85.00 to its lowest level in nearly eight months. Crude is clearly putting in a series of lower highs and lower lows below its downward-sloping 100-day EMA, signaling a clear bearish trend over the last couple months. Despite the new lows in price, the 14-day RSI indicator is not even in oversold territory, hinting that prices may have further to fall before seeing any technical respite from the selling:

Source: TradingView, StoneX

To the downside, the next important level to watch will be $80.00 round number, followed by the 78.6% Fibonacci retracement of the 2022 rally near $77.00. To flip the near-term bias in favor of the bulls, traders would need to see prices rally sharply from here to regain the 100-day EMA at $98.00.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade