Market Summary:

- The US dollar rallied for a second day on Friday, closed above 104 and was the strongest forex major last week following hawkish comments from a key Fed member

- Fed member Bostic anticipates just one 25bp cut this year (down from two previously) and is less confident about the inflation path

- Yet US yields were lower, with the 10-year and 20-year closing beneath their 200-day average at 4.2% and 4.46% respectively

- President Biden signed a $1.2 trillion spending package to keep the government funded through the rest of the fiscal year

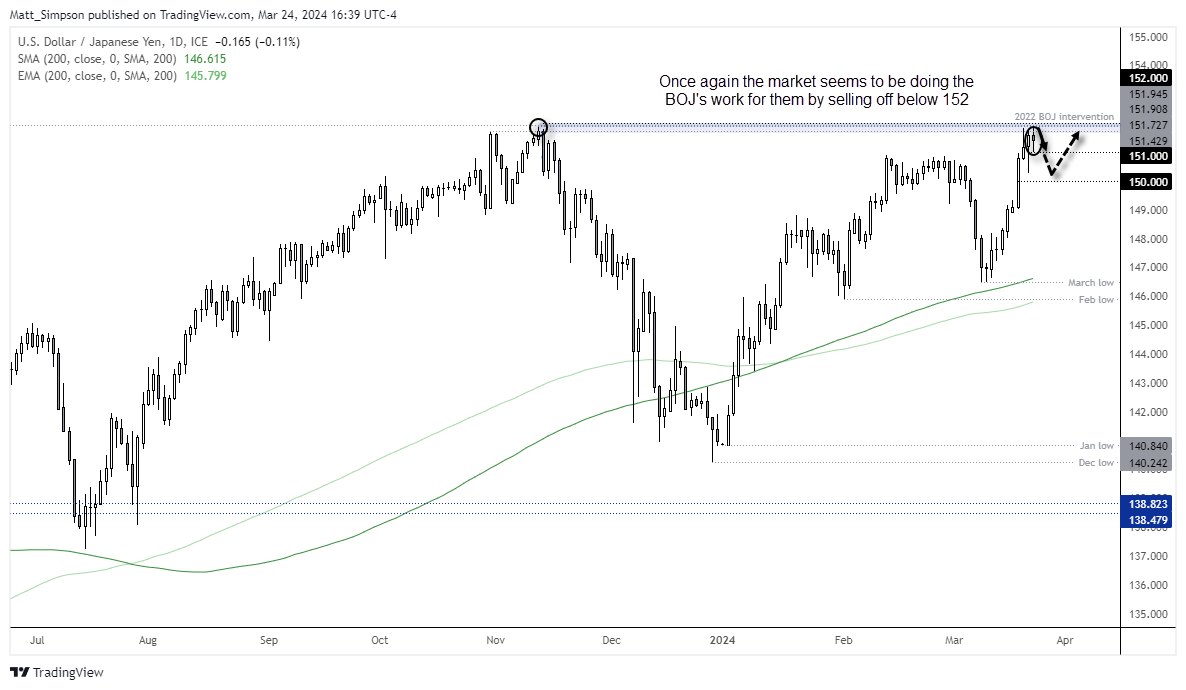

- Whilst the US dollar was stronger on Friday overall, it failed to rise against the Japanese yen which saw USD/JPY retrace lower without testing 152 – a level it has not traded at since 1990

- AUD/USD is forming a potential head and shoulders pattern on the daily chart, with a break below 65c confirming the move and bring 64c into focus (although the pattern projects a downside target around 0.6336

- EUR/USD closed beneath its 200-day average and 200-day EMA on Friday, with a break below 1.08 now on the agenda for bears

- The Japanese yen was the second weakest currency last week (behind the New Zealand dollar0, helping to send the Nikkei 225 to a fresh record high and extend its lead above 40k

- 54% of economists polled by Reuters expect the BOJ to hike interest rates again this year, and possibly take the cash rate to 0.25% (it’s currently 0% after a 10bp hike this month)

- Gold prices fell for a second day following its failed attempt to break and hold above $2200

- Crude oil prices were lower on Friday and flat last week, on talks of a ceasefire in Gaza

View our weekly outlooks:

- AUD/USD weekly outlook: RBA, AU employment at the helm

- US dollar, Nasdaq 100, Gold forward returns over Easter: The Week Ahead

Events in focus (AEDT):

- 10:50 – BOJ monetary policy minutes

- 16:00 – Japan’s coincident and leading indicators

- 23:00 – US building permits

- 23:35 – Fed member Bostic speaks

- 23:30 – Canadian manufacturing sales

- 01:15 – BOE member Mann speaks

- 01:30 – US Dallas Fed manufacturing business index

- 01:30 – Fed governor Cook speaks

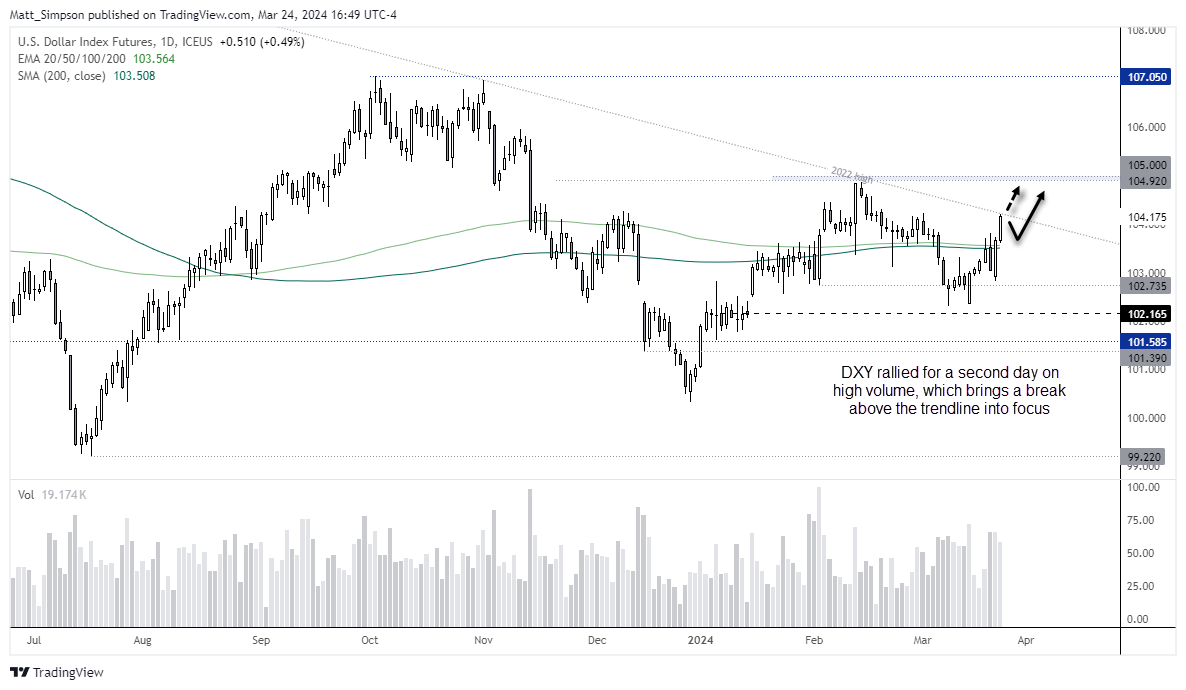

US dollar index technical analysis:

The US dollar index has more than reversed its post-FOMC losses, rising to a 14-day high and closing above its 200-day average and EMA for a second day. A bullish engulfing candle also formed on Thursday to show demand for the US dollar around 103. The next key level for bulls to conquer is the bearish trendline form the 2022 high. Given its significance, the bias is for a retracement ahead of an anticipated breakout. Therefore, pullbacks towards the 200-day averages (~103.57) could be appealing to bullish dip buyers. 105 is the next upside target if or when prices break above the 2022 trendline.

USD/JPY technical analysis:

The market seems to be doing the BOJ’s work for them by selling off below 152. We saw a similar scenario back in November when USD/JPY remained hesitant to test, let along break above, the 152 level. A small doji formed on Friday and snapped an 8-day wining streak, so the bias for today is to fade into any move towards 152 with a stop above, with 151 being an initial target – a break beneath which brings 150 into focus.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade