- Both USD/JPY and Nikkei 225 within touching distance of range highs

- US inflation report, bond auction sees yield differentials relative to Japan widen

- China will release key economic data on Friday, including trade and inflation figures

It’s been a turbulent 24 hours for USD/JPY and Nikkei 225 as traders attempt to digest the impact rom the hot “supercore” inflation reading in the US released overnight on Thursday.

We outlined in an earlier post why there may reason to be cautious about extrapolating the 0.61% monthly increase in the Fed’s closely watched core services ex-shelter inflation reading, something that may keep the prospects of a rate increase at the FOMC meeting next month in check for the moment.

However, the strength of the reading, combined with weak demand at an auction of 30-year Treasuries during the session, contributed to a sharp rise in longer-dated US bond yields, helping to spur on gains in the US dollar and widen yield differentials to other monetary jurisdictions, including Japan.

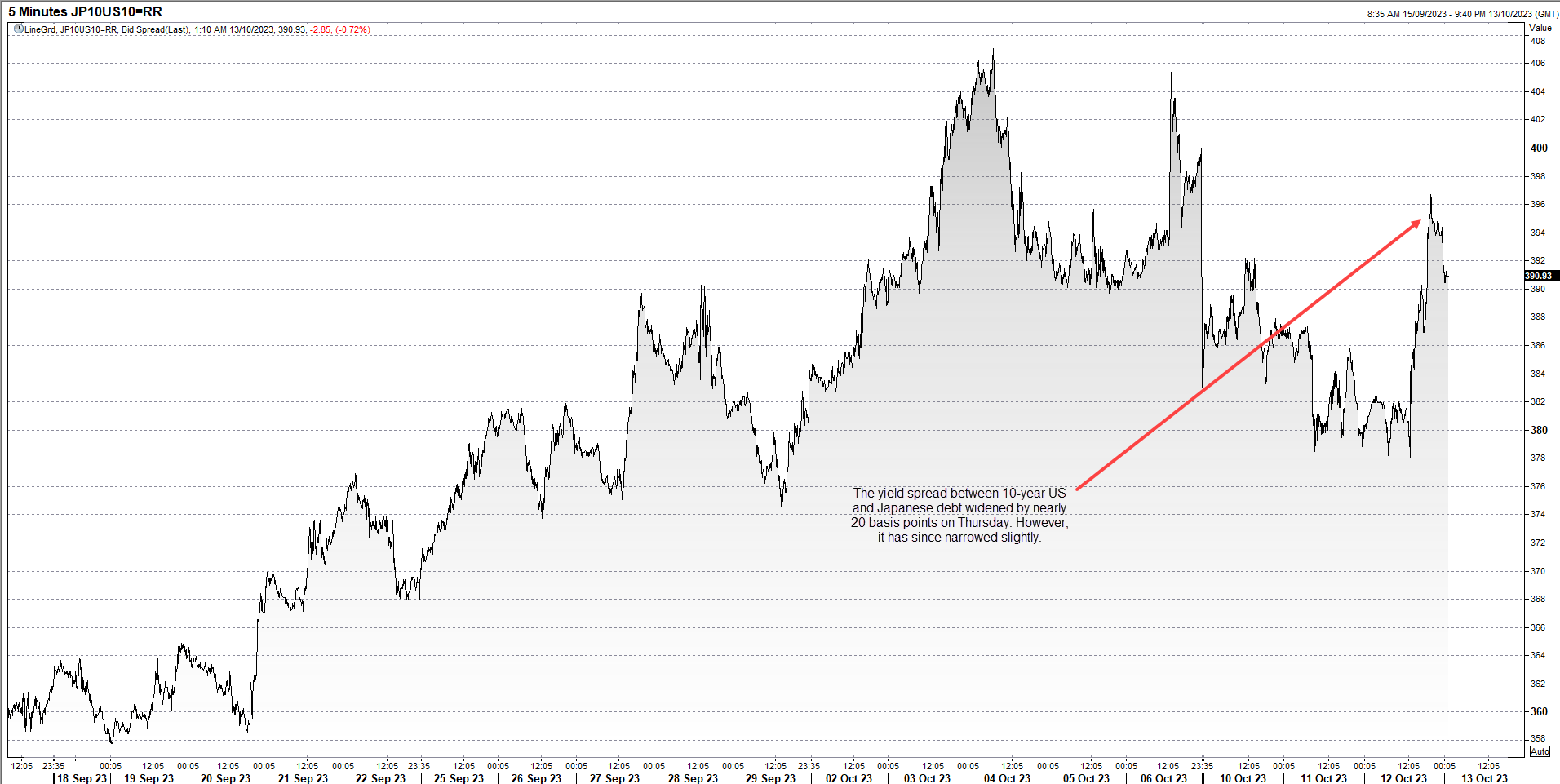

US-Japan bond yield differentials widen again

The differential between US and Japanese 10-year yields is shown in the chart below, widening in response to the auction result and inflation report, taking it back towards highs seen earlier this month when USD/JPY briefly topped 150 before reversing sharply lower, leading to speculation the Bank of Japan may have intervened to support the yen.

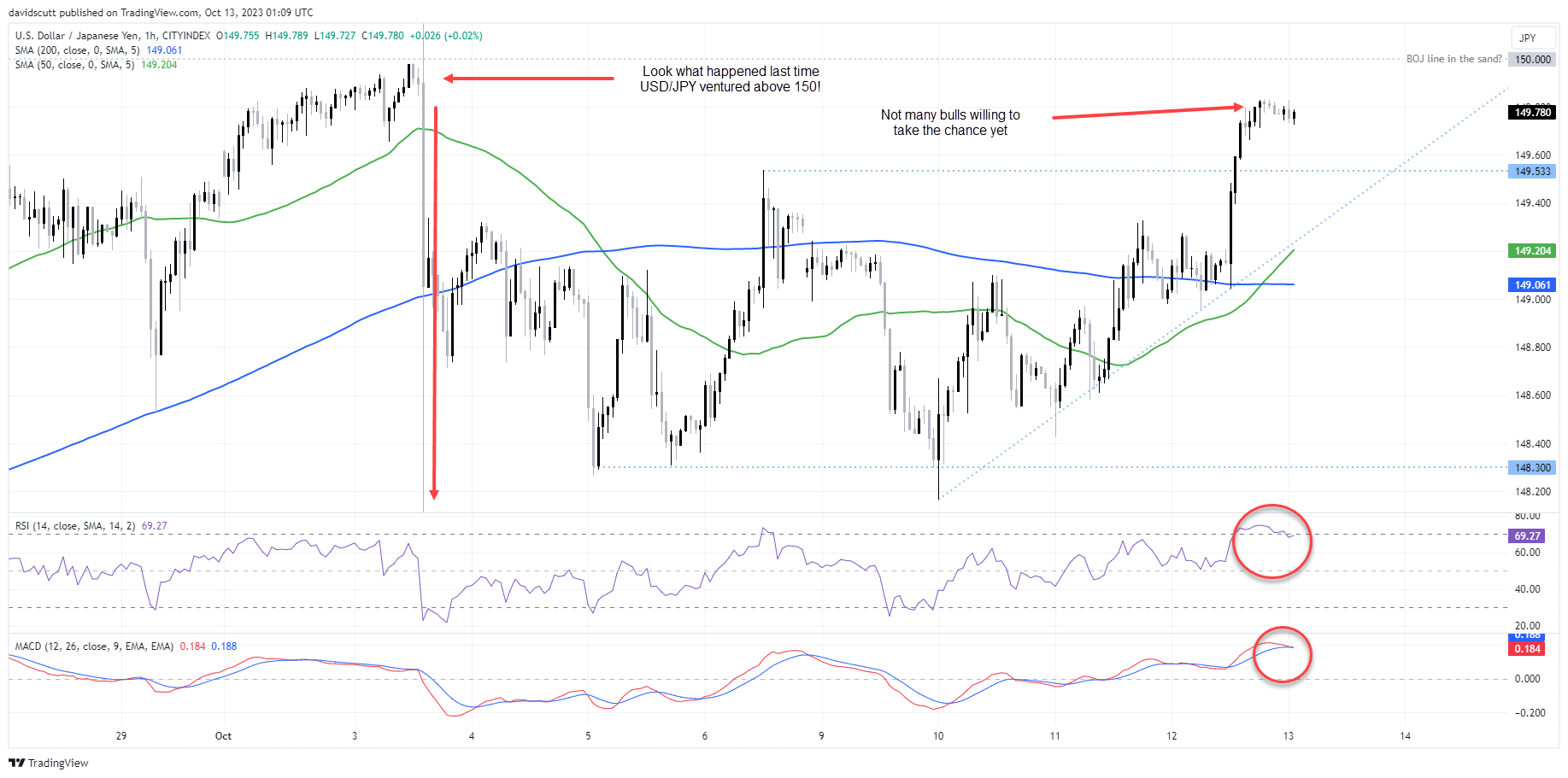

USD/JPY nearing 150 again

You can see the steep reversal on the USD/JPY hourly chart, likely explaining the reticence of traders to push USD/JPY towards 150 today. With the pair overbought on hourly and signal line on MACD looking like it will crossover from above, we may see USD/JPY ease towards 149.50 or even uptrend support another 20 pips lower. Anything more substantial seems unlikely at this stage.

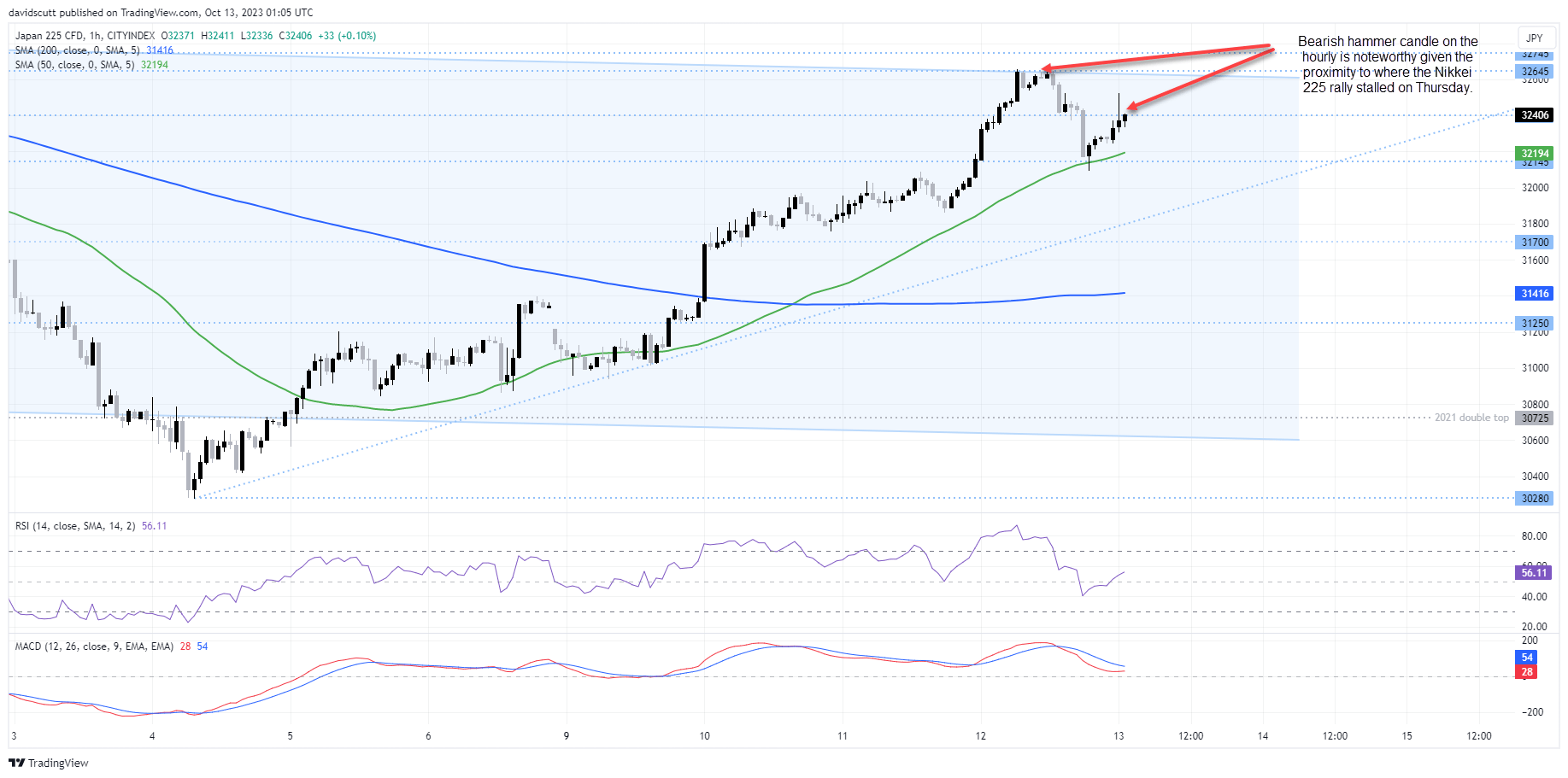

Nikkei looking fatigued after huge rally

For the high-flying Nikkei 225, the weaker yen may actually be supporting Japan’s big exporters, helping the index outperform many others across the Asian region. However, the bearish hammer printed on the hourly chart, starting just below where the index stalled out on Thursday at the top of the recent range, suggest further upside may be hard work in the short-term.

A resistance zone is located between 32645 to 32745. On the downside, 32145, uptrend support around 31800 and 31700 are the levels to watch.

From a fundamental perspective, Chinese trade, inflation and possibly credit data released today could prove to be influential on the performance of both USD/JPY and the Nikkei.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade