- The Bank of Japan kept key policy rates unchanged at its October meeting.

- It abandoned its hard cap on benchmark bond yields, making 1% an upper bound for its yield curve control program instead.

- Japanese yields remain artificially depressed, keeping interest rate differentials with the rest of the world elevated.

- USD/JPY has popped above 150 while the Nikkei 225 has bounced.

USD/JPY and Nikkei 225 are rising in the wake of the Bank of Japan’s (BOJ) latest interest rate decision, reacting to a smaller-than-expected adjustment to the banks yield curve control (YCC) program.

What did the BOJ just do?

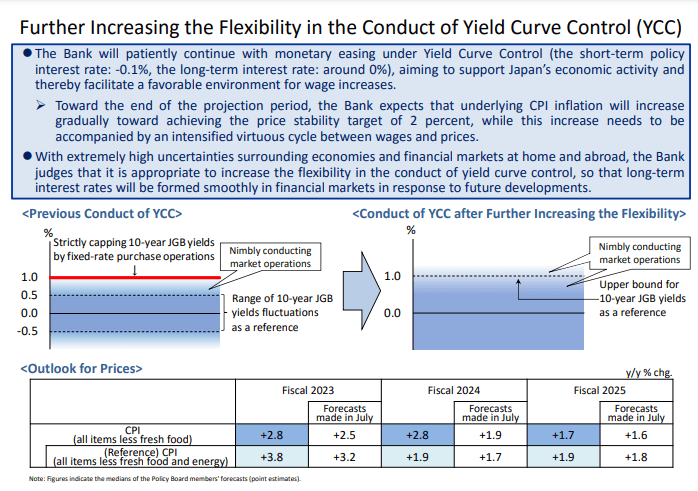

Without getting bogged down in pedantic analysis of the adjustment, the BOJ now has 1% as an "upper bound" for benchmark 10-year Japanese Government Bond (JGB) yields, rather than hard cap of 1% previously in place. It also dropped its pledge to buy unlimited amounts of bonds, stating instead that it will continue with large-scale JGB purchases and make “nimble” responses depending on market conditions.

Source: BOJ

The BOJ left its key policy rate and yield curve target unchanged at -0.1% and 0% respectively, the latter effectively redundant given the increase in yields already seen. For those looking for a primer on how YCC works, click here to access analysis we’ve previously released.

Why are USD/JPY and Nikkei bouncing back?

In the lead up to today’s decision, markets were speculating benchmark yields may be permitted to move more than 100 basis points away from the BOJ’s 0% YCC target, or potentially that YCC would be scrapped altogether, allowing market forces to dictate where Japanese bonds should be trading.

While the change rom a hard cap to “upper bound” for YCC may see markets test the BOJ’s resolve by attempting to push benchmark yields through 1%, no one really knows how the BOJ will respond if they do. Will it be defended or will it tolerate some form of deviation, allowing market forces to play a greater role?

For now, markets are relieved YCC's trading range wasn't widened or abandoned altogether. But that optimism may change if yields is move meaningfully through the 1% upper bound.

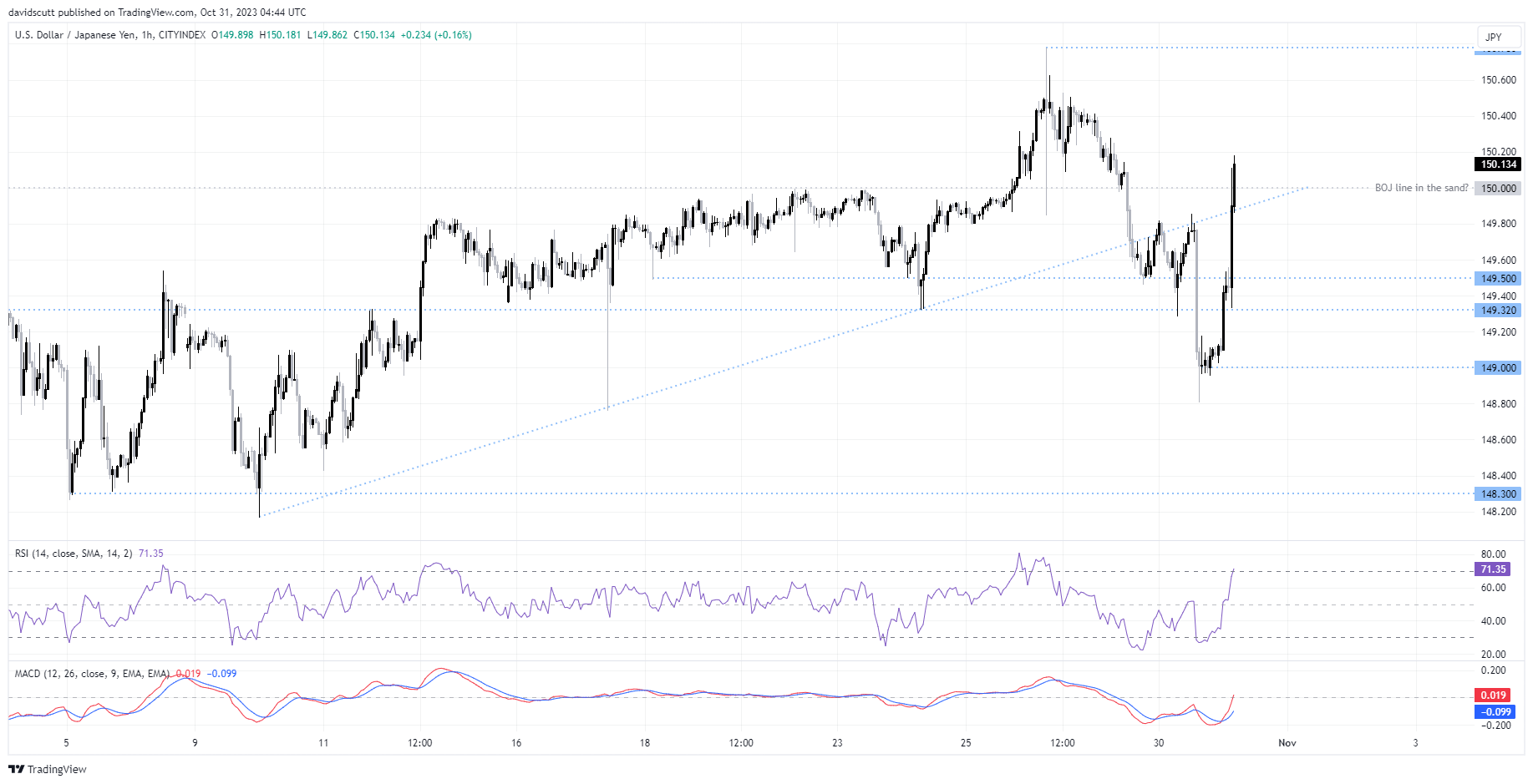

USD/JPY reclaims 150

Having fallen below 149 briefly on Monday following an article from the Nikkei newspaper speculating the BOJ may permit benchmark yields to rise more than 1% from target, USD/JPY has snapped back hard in the wage of the underwhelming tweak, surging back above 150 within seconds, not only putting it on track to retest the recent highs around 150.78 but also raising the risk of BOJ intervention on behalf of the Japanese government.

Former uptrend located around 149.90 has already repelled one attempt to push USD/JPY lower, suggesting it may cap downside in the near-term. Below, 149.50 and 149.32 are the next downside levels to watch. On the topside, a break of 150.78 may encourage fresh longs to test the multi-decade high of 151.95 hit last year.

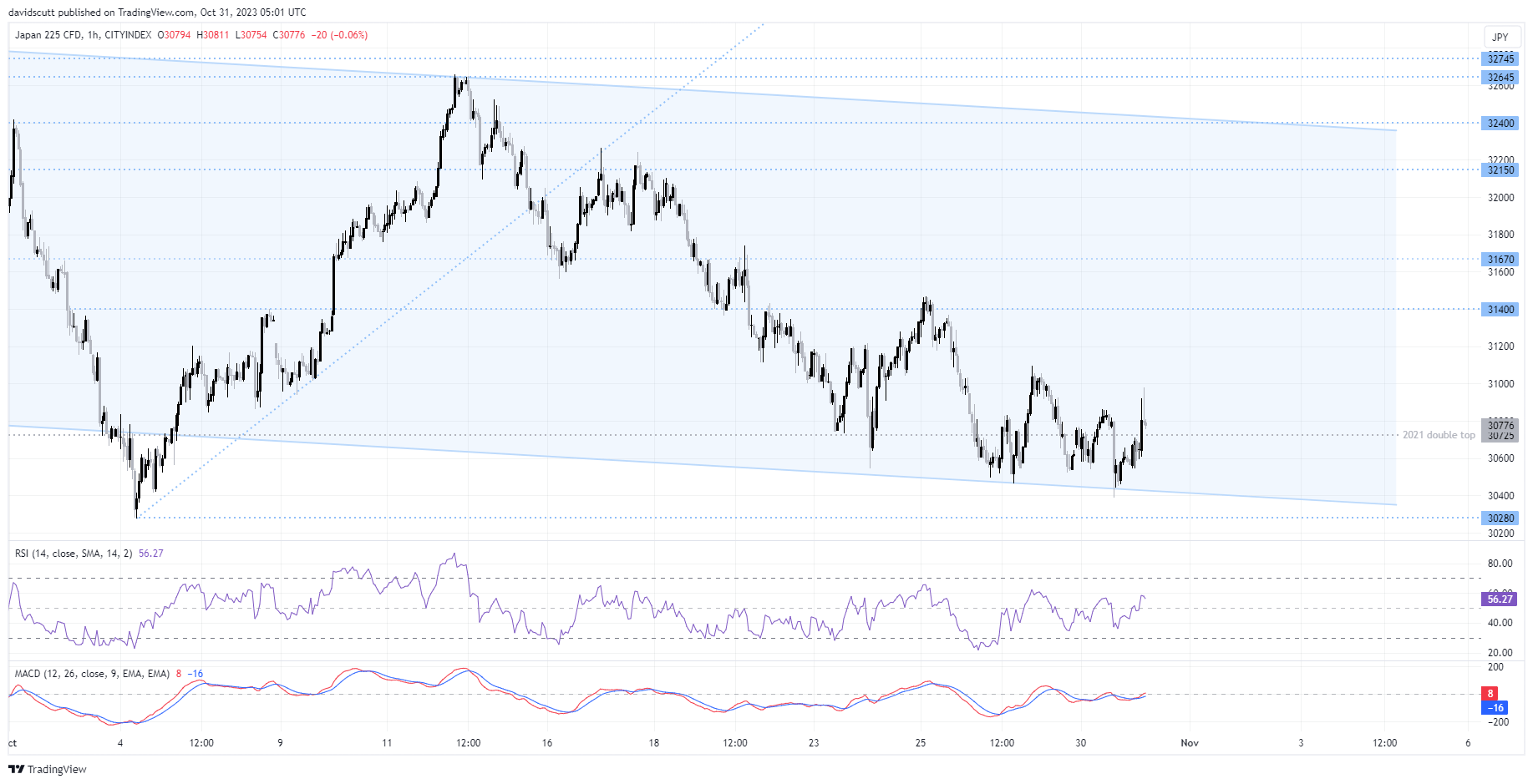

Nikkei 225 bounces from channel support

The weaker Japanese yen has also acted as a release valve for the export-heavy Nikkei 225, seeing the index pop higher after threatening to break channel support. With that level around 30400 holding firm for now, traders may look to initiate longs targeting resistance starting at 31400, 31670 and again around 32150.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade