EUR/USD falls ahead of German inflation data, central bank speak

EURUSD fell 0.6% in the previous session after dismal German consumer confidence, which fell to a record low as inflation and recession risks surged.

Today, the pair is extending losses for a second day after ECB’s Christine Lagarde failed to rally buyers, despite hinting towards larger interest rate hikes after a 0.25% hike in July.

Attention now turns to German inflation data, which is expected to show that consumer prices rose to 8.8% YoY in May, a fresh record high, up from 8.7%.

Following the inflation data, ECB’s Lagarde is to join Powell and BoE’s Andrew Bailey on stage at the annual ECB forum. More hawkish commentary from ECB’s Lagarde could help the EUR high.

Meanwhile the USD is finding support from risk-off flows on recession fears and ahead of US GDP figures and Fed Powell.

US GDP is the third reading for Q1 so is not expected to be market moving and looks to confirm -1.5% contraction annually.

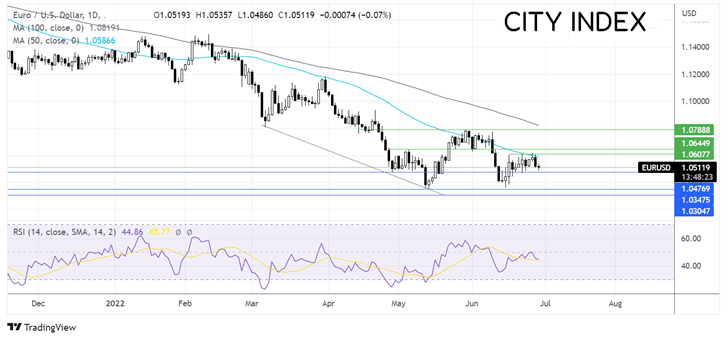

Where next for EURUSD?

EURUSD’s rebound from 1.0360 ran into resistance at the 50 sma and last week’s high of 1.06. The RSI remains in bearish territory suggesting more losses to come.

Sellers will look for a move below support of 1.0470 last week’s low, with a break below here opening the door to 1.0360 and the creation of a lower low.

Meanwhile, buyers could look for a move over 1.06 and 1.0650 the early May high, to rise towards 1.0790 the May high.

Gold looks to Powell & Co for direction

Gold prices are holding steady after two days of losses.

Gold fell yesterday after China eased COVID restrictions reviving growth expectations and a more aggressive Federal Reserve, which lifted the USD.

Today the precious metal is unchanged as investors are reluctant to take on a large position ahead of the Policy Panel at the annual ECB forum.

This will see Fed Powell joined by Lagarde and Bailey. Their discussions will shape market expectations. A hawkish stance from Powell could see the USD rise and drag non-yielding USD-denominated gold lower.

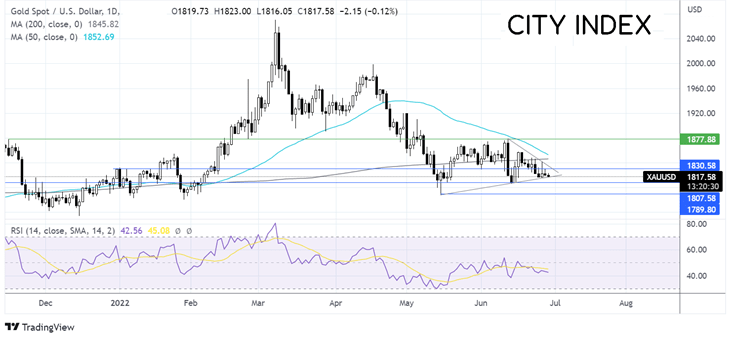

Where next for Gold prices?

Gold trades below its 50 & 100 sma. The 50 sma is looking to cross below the 200 sma which would provide another bearish signal. The RSI is supportive of further downside.

Gold is testing the multi-week rising trend line support at 1816 a break below here could open the door to 1807 the mid-June low at 1800 the May low.

Buyers could look for a move over 1830 the falling trend line support and yesterday’s high. A move above here exposes the 200 sma at 1847 and the 50 sma at 1854. It would take a move over 1877 to create a higher high.