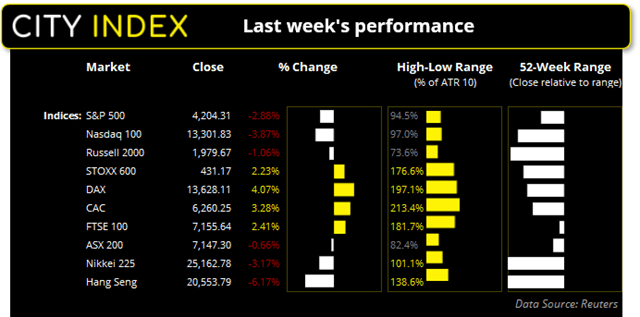

Upon initial inspection, it appears the European and US indices went their separate ways last week with the former posting gains. Yet in the case of Europe, volatility was considerably higher for the week and the rebound simply clawed back some losses from much deeper declines in recent weeks. Despite the prospects of peace talks once again resurfacing between Ukraine and Russia, the war rages on and it is likely to remain a volatile theme for European equity markets in particular. And as wars can be unpredictable at the best of times, it makes forecasting those relevant markets the more difficult. We therefore have a neutral bias for European indices this week.

S&P 500 and Nasdaq hold key support

We’re now half the way through March and the S&P 500 is doing its best to close lower for a third consecutive month. It has not managed to fall for three months since the pandemic, where it declined around -35% from its record high before finding its low. Yet this time around the index has only fallen around -15% from its record high to last week’s low, so from that perspective the market is holding up pretty well.

Of its 11 sectors, only three has posted gains this month – which include energy (+8.9%), utilities (3.7% and real estate (1.8%). 7 of its 11 sectors trade lower, led by tech stocks (-3.8%) and consumer discretionary (-6.0%).

The Nasdaq is the weakest mega-cap index on Wall Street in March and currently trades -6.5% lower, or -18.5% YTD. Technically it is with a bear market as it fell over -20% from its record high week. But a key level for traders to watch are the support levels around 13,000.

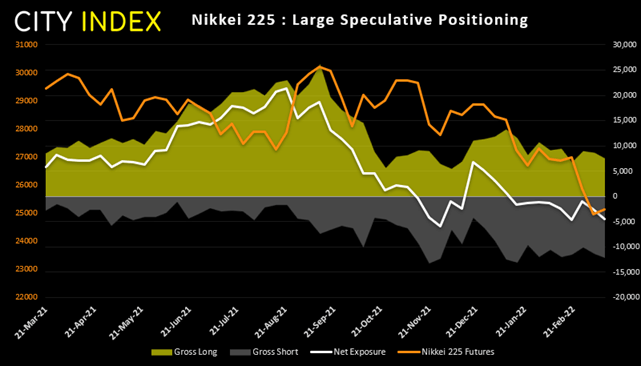

Nikkei futures positioning (priced in yen):

Large speculators remained net-short Japanese yen futures for a ninth consecutive week, and at their second most bearish level since November 2020. Over the past two weeks we have seen new shorts initiated whilst longs have fallen. Separately, foreign investors remained net-sellers of Japanese stock markets for a second consecutive week.

The technology-heavy index is essentially tracking the Nasdaq 100 lower due to dented sentiment surrounding the Ukraine crisis. The Nikkei has fallen closed enough to the triangle target around 24,500 to call it a success, although its decline stalled at the 200-week eMA. Like the Nasdaq, the Nikkei also has several support levels nearby which has softened the blow, so until we see a decent break below 24,000 the index is at risk of a countertrend bounce. And we would take a break above 26,000 as a strong clue the low was seen last week.

Lockdowns weigh on China’s equity markets

The Hang Seng was a notable underperformer last week, having fallen over six percent by Friday’s close. Yet prices have continued lower during Monday’s Asian session after reports that Hong Kong’s neighbour, Shenzhen, has gone into lockdown. With a population of around 17.5 million and an important economic zone for China, traders have been quick to offload Chinese equities in general and Hong Kong remains the worst performer today, having fallen over 5% today alone.

The index trades below 20,000 for the first time since June 2016 and trades less than a day’s range away from the May 2016 low. A break beneath which brings the 2016 low into focus around 18,300.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade