- An attack on US forces in Jordan has increased geopolitical risk premiums in crude oil and gold

- Attacks on shipping infrastructure continue in the Red Sea, adding to supply chain and inflation risks

- Higher energy prices could reverse disinflationary pressures in advanced economies, leading to a potential scaling back of rate cut bets

Geopolitical risks in the Middle East and the US interest rate outlook will be two of the dominant market themes traders will be grappling with this week, creating the potential for renewed volatility in the likes of crude oil and gold.

Big event risk this week

There’s no shortage of risk events in the coming days: tech earnings, the Fed’s January FOMC decision, nonfarm payrolls and the US Treasury’s quarterly refunding announcement, and that’s just the US calendar. There’s also the Bank of England interest rate decision along with inflation reports from the euro area and Australia.

While all carry the potential to generate short-term volatility once released, it’s debatable whether any – including the Fed announcement – will inflict meaningful damage to the soft-landing narrative markets have been running with since the December quarter last year. To do that, it will likely something that either questions the disinflationary forces seen globally or the expected trajectory for global economic growth.

But nothing looks like it could damage the soft-landing narrative

Looking at the known event risk calendar, nothing stands out as being able to do this week. The Fed may attempt to push back again against dovish market pricing, but coming off the back of another soft core PCE report last Friday, will markets believe it? With recent history as a guide, the answer is likely no.

It begs the question as to what could do damage to the soft-landing narrative this week?

Geopolitics the wildcard

For mine, the worsening geopolitical situation in the Middle East looms as one such threat, not only because of possible broadening of the conflict and disruptions that may bring, but what higher energy prices may do to the disinflationary trend at a time when economic activity looks to be holding up in most parts of the world, especially the United States.

With the crude oil price up around 17% since mid-December, the longer higher prices feed into related downstream products and trade prices, the greater the risk the global disinflationary trend could be reversed. With services inflation in many developed nations remaining uncomfortably high, such an outcome could lead to a collective rethink of just how many rate cuts central banks will be able to deliver this year.

That’s why the performance of WTI crude oil could be important beyond the geopolitical headlines this week.

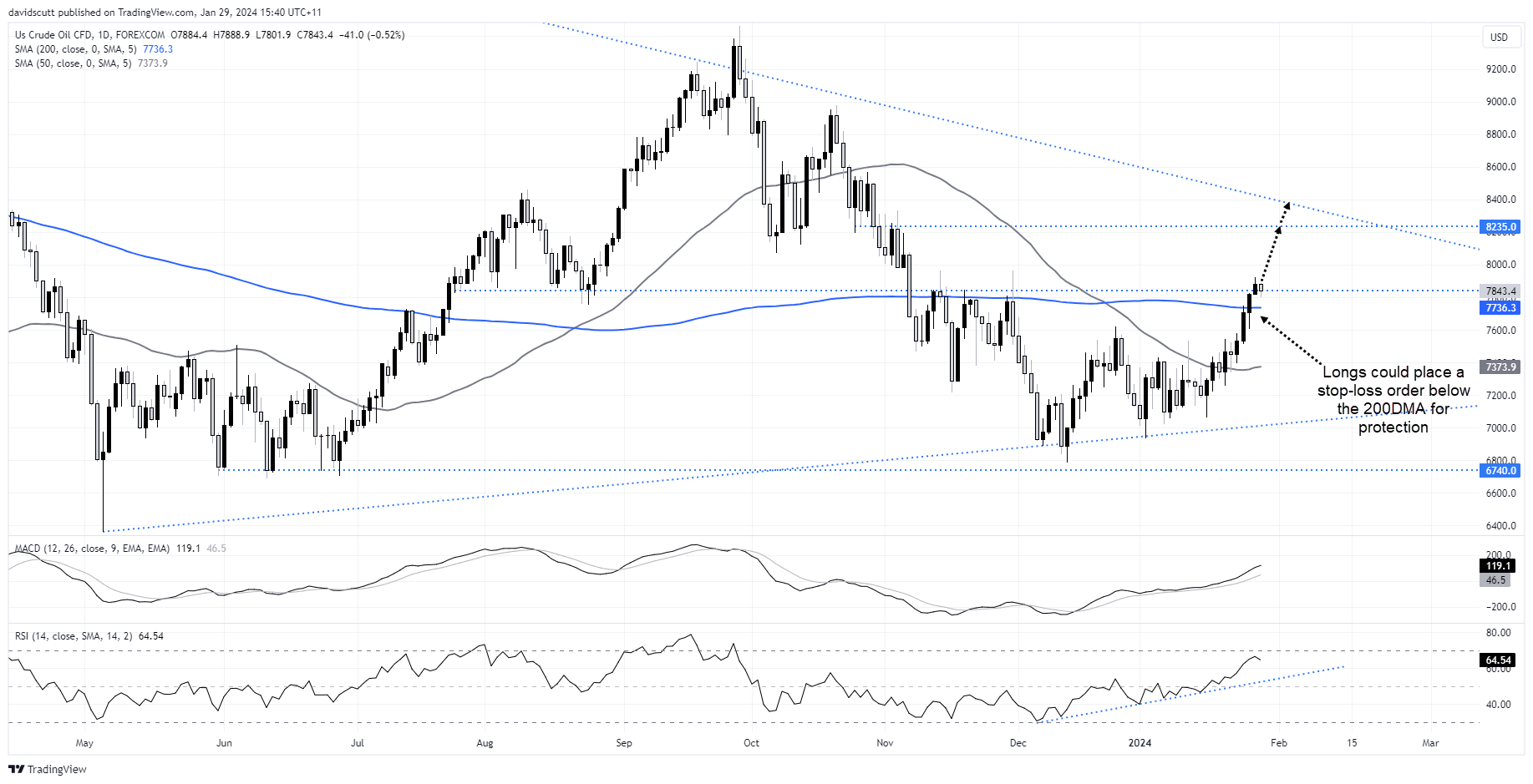

Crude oil closes above 200DMA for the first time since November

Already trading above its 200-day moving average having closed there for the first time since November on Friday, the price is now sitting above $78.40 following news of a drone attack on US forces stationed in Jordan which killed several soldiers, allegedly conducted by Iranian-backed militia. The level has acted as both support and resistance dating back to the middle of last year. With the 200DMA just below, and given how respectful traders have been of it in recent years, it may prompt bulls to add or initiate long positions given the favourable setup and geopolitical tailwinds.

Above, rallies ahead of $80 stalled at $79.60 late last year, suggesting minor resistance could be encountered again around this level. Beyond, $82.35 and downtrend resistance currently located just above $84 are the next levels of note. Those considering longs could place a stop-loss order below the 200DMA for protection.

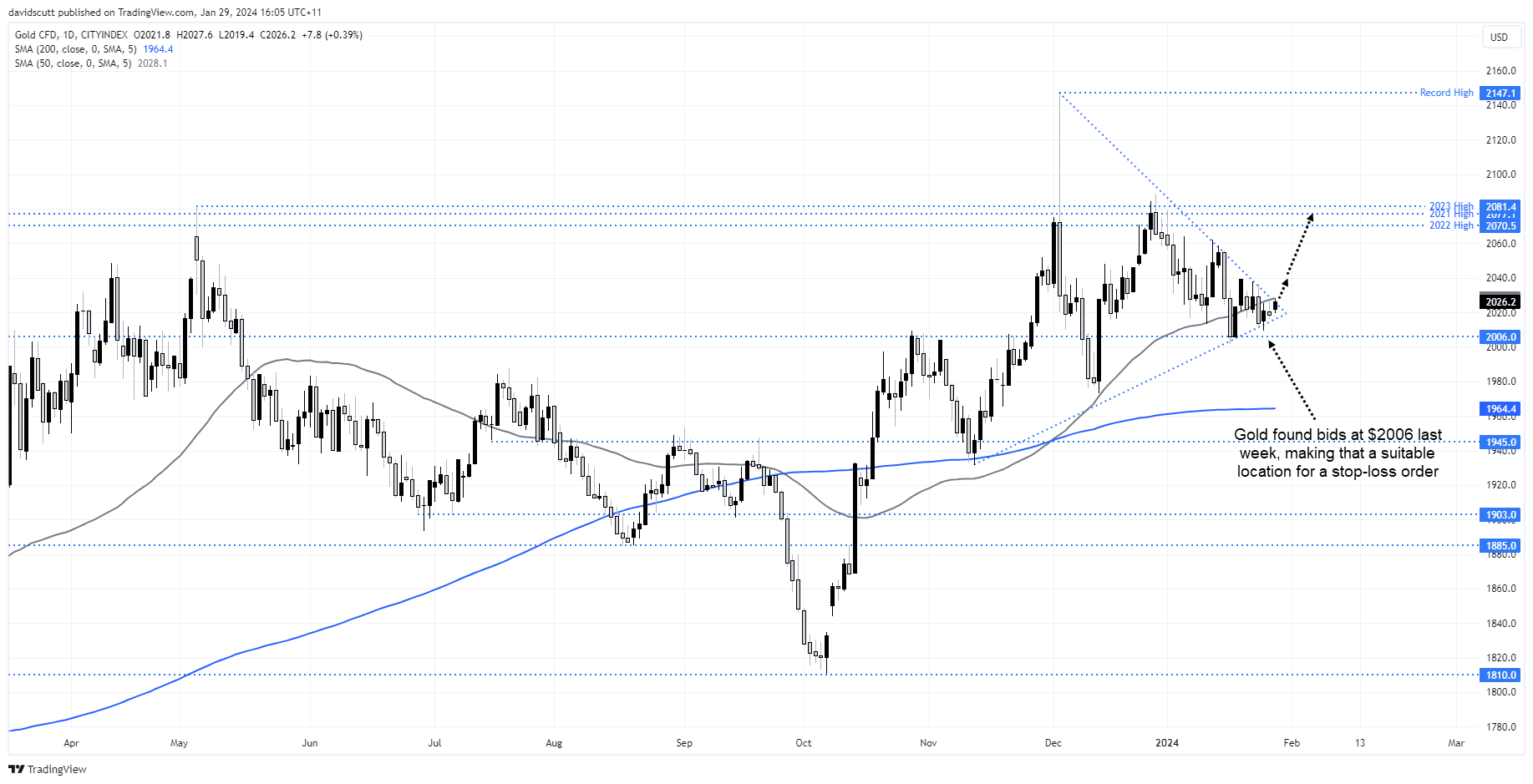

Gold’s trading range continues to narrow

Outside crude, gold is another market that will be paying close attention to development in the Middle East, especially with the daily range narrowing within a triangle pattern. Any escalation hostilities could lead to a topside breakout, putting a retest of the record highs potentially in play.

Gold found buyers earlier this month on dips towards $2006, making that a possible location to place a stop-loss order below for those considering longs. Above, the confluence of prior yearly highs above $2070 looms as a potential target, although it will have to overcome $2040 where the price ran into sellers last week.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade