US futures

Dow futures +0.33% at 34013

S&P futures +0.25% at 4364

Nasdaq futures +0.11% at 15240

In Europe

FTSE -1.25% at 7443

Dax -0.60% at 15264

- Fed Chair Powell leans towards the hawks

- University of Michigan consumer confidence

- Apple settles $25 million with the DoJ

- Oil is set for a third weekly decline.

Markets brush off Powell's hawkish tilt

US stocks are pointing to a higher start on the final day of the trading week, keeping an eye on treasury yields after hawkish comments from the Federal Reserve chair in the previous session.

The leading indices on Wall Street ended lower on Thursday after Federal Reserve chair Jerome Powell raised doubt over whether the Fed had indeed finished its rate hiking cycle. He said that the central bank was not confident that they had achieved sufficiently restrictive policy in order to bring inflation back to the central bank's 2% target.

The market reined in expectations that the Fed was done hiking rates. The slightly more hawkish tilt from Powell yesterday could have been a result of the recent softening of financial conditions as yields have fallen significantly in recent weeks. If yields continue falling, they'll no longer be doing the heavy lifting the Fed needs them to do. Still it is not affecting the market today and yields are falling and stocks are rising.

Looking ahead, attention now turns to University of Michigan consumer sentiment data, which analysts expect to fall to 63.7, down from 63.8. This would mark the fourth straight month that U.S. consumer confidence has fallen as inflation concerns remain.

Elsewhere, the markets are also digesting news that China's ICBC bank’s financial services were hit by a ransomware attack, which then disrupted trade in the US treasury market.

Corporate news

Apple is set to open higher after the iPhone maker agreed to pay a $25 million settlement to claims by the DOJ that the company illegally favoured immigrant workers for certain positions.

Wynn Resorts is set to fall on the open despite hospitality workers reaching a preliminary deal with the casino operator, ending a threat to strike.

Illumina slumped 11% after the gene testing firm slashed its annual profit fall cards for a second straight quarter amid weakness in demand for its sequencing instruments.

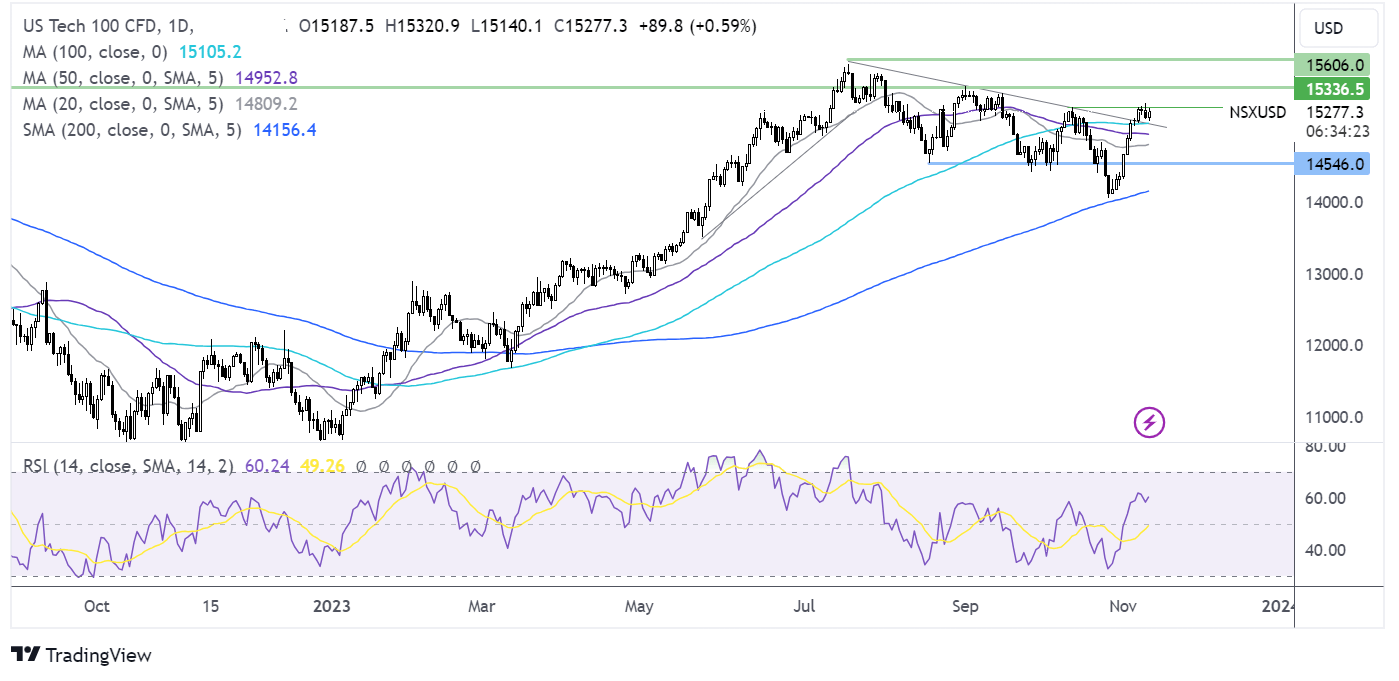

Nasdaq100 forecast – technical analysis

The Nasdaq is consolidating below 15300 the October high. It holds above the 100 sma and the falling trendline support, which combined with the RSI above 50 keeps buyers hopeful of further upside. A rise above 15300, open the door to 15600 the September high and 16000. Support can be seen at 15100 the 100 sma and falling trendline support ahead of 14800 the 20 sma and 14550 the August low.

FX markets – USD rises, GBP falls

The USD is rising and is set to book gains across the week after hawkish commentary from Federal Reserve members, including Federal Reserve chair Powell in the previous session. The prospect of another possible rate hike or higher for longer supports the USD.

EUR/USD is holding steady below 1.07 as the euro finds some support from hawkish commentary from ECB policymakers. However, the euro is still set to fall 0.5% across the week as the weaker economic outlook for the eurozone compared to the US means a rate cut is expected in the area test.

GBP/USD is falling and is set to drop across the week after UK GDP data revealed the economy stalled in the third quarter of the year. GDP for Q3 was 0%, down from 0.2% in Q2 and slightly ahead of the 0.1% contraction forecast. However, the stagnating growth has done little to quell concerns that the UK economy is in a weak place. The data has fueled bets that the Bank of England is at the end of its hiking cycle, with rate cuts forecast for August next year even after Bank of England governor Andrew Bailey spoke of keeping rates elevated for an extended period of time just earlier this week.

EUR/USD -0.07% at 1.0698

GBP/USD -0.15% at 1.2267

Oil is set for 3rd weekly decline

Oil prices are edging higher today but is still set to fall for a third straight week on concerns that demand is slowing and as attention turns towards an APEC meeting later this month.

Both WTI and Brent are set to fall around 5% across the week as demand worries have replaced concerns of the conflict in the Middle East impacting supply there.

Weak Chinese data and refiners in China asking for less supply from Saudi Arabia in December, added to concerns over the oil demand outlook.

OPEC is set to meet on November 26th to discuss production output policy. The focus will be firmly on whether Saudi Arabia extends its voluntary 1,000,000 barrel-a-day cut, which is expected to expire at the end of this year.

WTI crude trades +1.3% at $76.75

Brent trades +0.7% at $80.98

Looking ahead

15:00 US Michigan Consumer Confidence