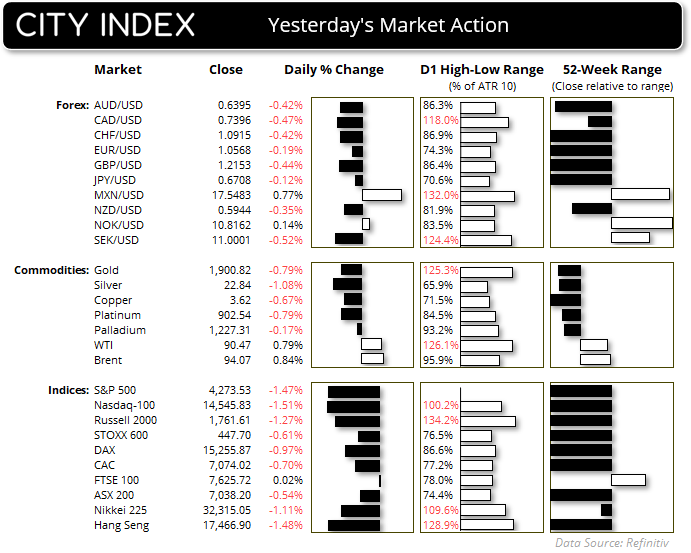

Market Summary:

- A combination of softer US consumer sentiment, house prices and hawkish comments from a key FOMC member continued to weigh on sentiment on Wednesday, which saw US and European stock market indices follows APAC stocks lower

- Voting FOMC member Kashkari sees a 60% of a US soft economic landing according to an article he authored no Tuesday, which could still warrant another 25bp hike. But if inflation “proves to be more entrenched than expected” the FOMC would then “have to raise rates further”

- However, he also said the Fed have several months to make such decisions, which is a good job with some Fed members suggesting a 70% chance of a US government shutdown over the interim (which will make data hard to a “data dependant” Fed to come access).

- US confidence slipped to a 4-month low according to the Conference Board, and the expectations index slipped below 80 (a level associated with a recession) down to 73.7

- The VIX (volatility index) reached a 4-month high, the DAX hit a 6-month low and Nasdaq 100 led Wall Street lower and closed at its lowest level since June.

- The US dollar index was the strongest forex major and the dollar index touched a fresh YTD high whilst US bond yields advanced slightly beyond their multi-year highs

- AUD/USD closed below 64c although 0.6386 support came to the rescue, but all eyes are now on whether the market can finally break beneath 0.6350. Take note that CPI data is up shortly.

- BOJ governor Ueda said on Monday that the central bank cannot pre-set timing of policy change, although ex-BOJ board member Sakurai suggested yesterday that they may end negative rates around April 2024.

- WTI crude oil looked beyond the negative sentiment of the US consumer and stock markets and focussed on tighter supply concerns to close back above $90. A double bottom pattern has formed ~$88.30, although price action on the daily chart continues to suggest a choppy sideways rage at best over the near-term

Events in focus (AEDT):

- 09:50 – BOJ monetary policy meeting minutes

- 11:30 – Australian weighted mean CPI is expected to increase to 5.2% y/y, from 4.9% prior. What if it comes in hot, like we saw in Canada? Well it might give the battler another reason to deny the record level of net-short AUD bears a sustainable break below 64c

- 11:30 – China industrial profits YTD

- 23:00 – SNB quarterly bulletin

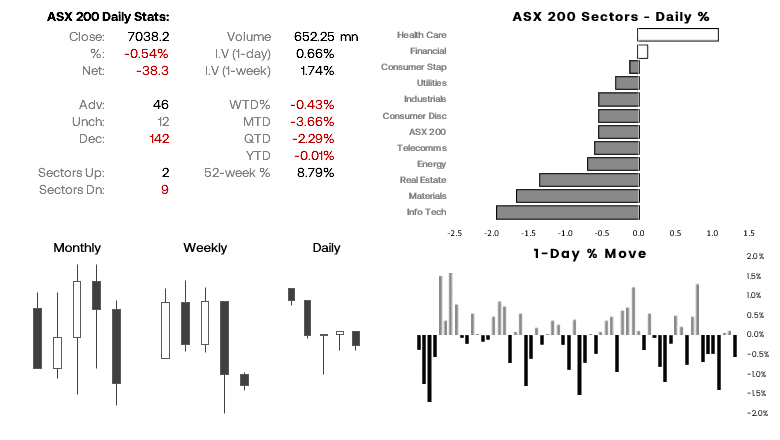

ASX 200 at a glance:

- The ASX 200 closed at its lowest level since 11 July, although its low held above Friday’s and Monday’s pinbar lows

- Yet with a weak lead from Wall Street and SPI futures down -0.34%, the 7,000 support level the ASX is trying to form a base above could be challenged

- Either way, we prefer to seek bearish setups around resistance levels (7100, 7135, 7200) or assume a move towards key support at 6900 if prices break and hold below 7000

Gold technical analysis (1-hour chart):

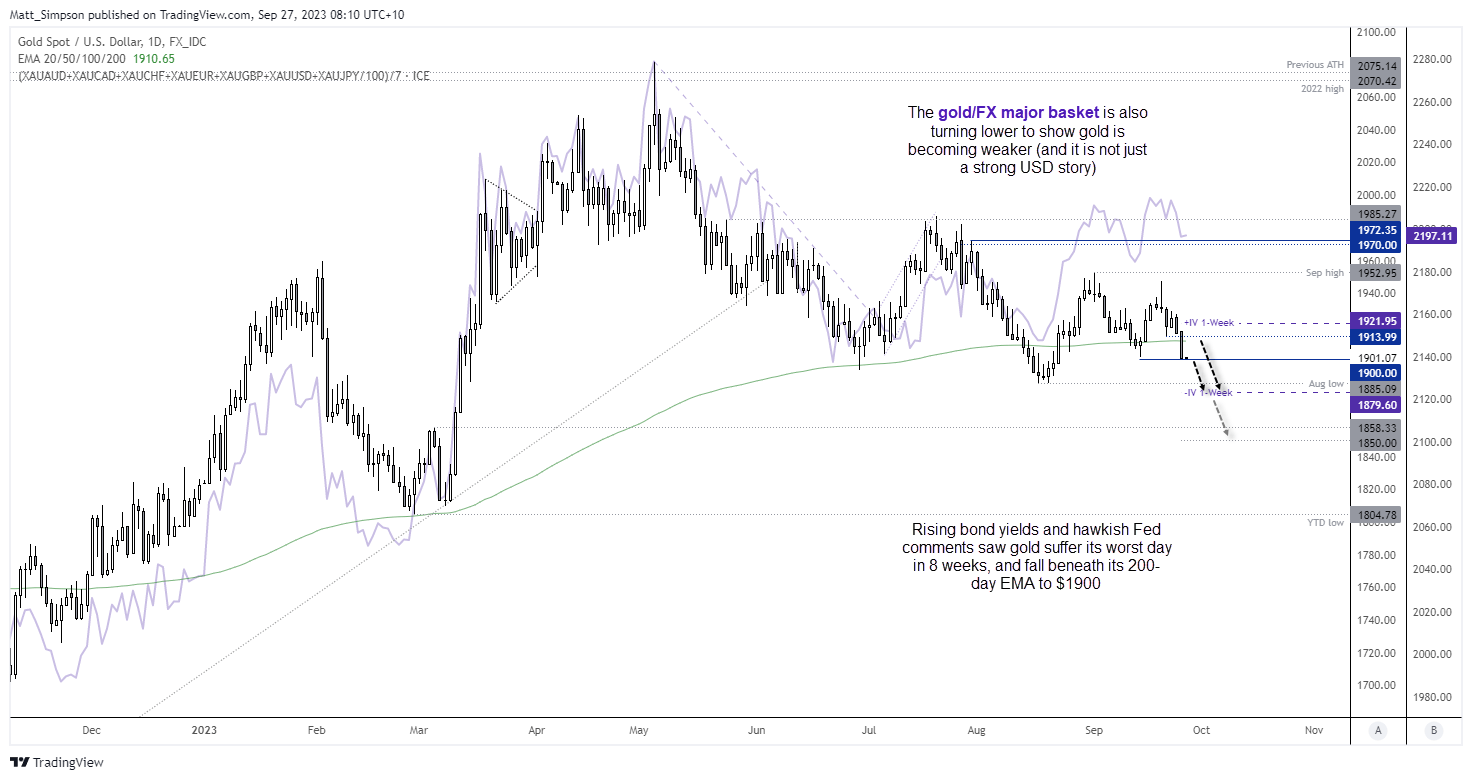

Gold finds itself at the mercy of bond yields much like Wall Street. The higher they rise and the longer they remain elevated, the more bearish the case becomes. And with the US dollar moving higher and yields extending their multi-year gains, gold prices suffered its worst day in 8 weeks on Tuesday with spot prices falling below the 200-day EMA and closing on the key $1900 level. The gold/FX basket also turned lower to show gold prices are facing pressure, as opposed to it simply being a strong US dollar story.

It’s plausible to expect at least a minor bounce from current levels, but I am not expecting a large bounce given it closed the NY session at the low of the dat. And that leaves gold vulnerable to a break below $1900, and a market that bears may consider fading into any moves higher towards the 200-day EMA. The $1885 low is the next key level for bulls to defend, a break above which opens up the floor for a move to the $1850 area.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade