Gold has jolted above $2,000 to reach a new high for the year, and silver has broken out above $24 resistance to close in on the $25 handle. Both metals have been supported by renewed weakness in bond yields and US dollar, thanks to soft US data. The gold outlook thus appears shiny, as we await more economic data from the US later in the week.

- Gold underpinned by weakness in US data

- Rate cut expectations rise

- Gold technical analysis

Gold outlook brightened by weakness in US data

The US dollar dropped sharply as US JOLTS Job Openings & Factory Orders both come in weaker than expected. The data raised concerns about a recession and thereby reduced the probability of further policy tightening from Fed.

There were some suggestions that the sharp crude supply cuts from the OPEC+ will lift oil prices significantly further and thus provide fresh inflationary jolt to world economy.

Well, while that may still happen, traders have had other ideas as the weaker data has raised fears about an economic downturn. If that was the case, bonds would have sold off, causing their yields to rise. For the same reason, we would not have seen fresh 2023 highs for gold and silver today, or a move above 1.25 handle on the GBP/USD. But let’s see how much further will oil go up in the coming days and whether the market’s perception changes. For now, the market is applying pressure on the Dollar Index (DXY) and this should help to keep precious metals supported on the dips.

Rate cut expectations rise

Indeed, following the weaker data releases, rate-hike expectations have fallen across the curve. The market is now pricing in a less than 50% chance that the Fed will raise rates by 25bps in May. What’s more, the year-end Fed rates are now expected to be around 65 basis points below current levels, implying that there could be two or three 25 bp rate cuts by then from the Fed.

In other words, market participants appear not too concerned about the impact on inflation of higher crude oil prices, as a result of the OPEC’s surprise decision to sharply cut oil production. However, the market does appear to be more concerned about the economic recovery prospects, especially when combined with the impact of one of the fastest rate-hiking cycles ever undertaken by central banks around the world.

If weakness in US data continues this week, the market will likely grow in confidence that the Fed will not speed up the pace of interest-rate hikes and will instead start loosening its belt after the second half of the year. That, in turn, should be good news for the gold outlook, and other low- and zero-yielding assets like the Japanese yen and silver.

Gold outlook: technical analysis

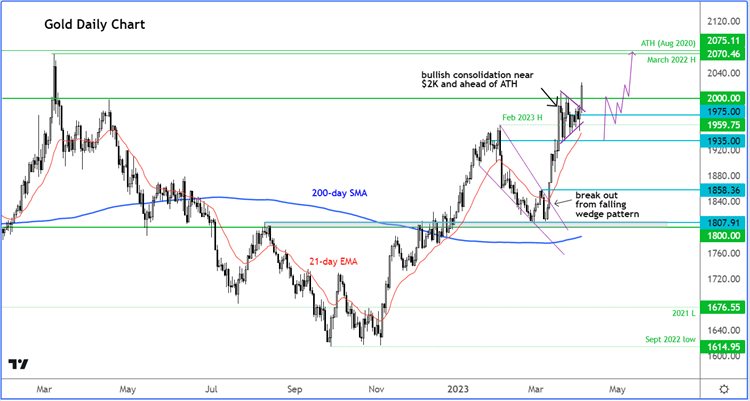

From a purely technical point of view, gold’s current price action continues to point to further gains. We can’t entertain the idea of gold topping out until we see a concrete reversal signal.

Source: TradingView.com

That big breakout at the start of the month of March from the falling wedge pattern saw gold quickly climb to $2000, where it then stalled for a couple of weeks. But the downward move from that hurdle has been limited and the buyers have continually stepped in to defend key levels such as $1935, and now $1960 (December’s high).

With gold now clearing the $2K hurdle, this has potentially paved the way for a continuation towards the March 2022 high at $2070 and then the all-time high 5 bucks higher at $2075, hit in August 2020.

This bullish technical view would become weak, if support at $1960ish breaks. If that happens, then the bulls will be in trouble again. Fundamentally, a rise in interest rates expectations could weigh on gold outlook should we see renewed strength in US and global data.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade