US futures

Dow futures -0.03% at 37509

S&P futures -0.06% at 4752

Nasdaq futures -0.08% at 16663

In Europe

FTSE -0.25% at 7661

Dax -0.48% at 16684

- All eyes are on Thursday’s inflation report

- Market prices in a 65% chance of a March rate cut

- Apple attracts another broker downgrade

- Oil rises as Mid East tensions offset growth concerns

Little movement ahead of CPI data

US stocks to a subdued open ahead of tomorrow’s US inflation data and the start of earnings season on Friday.

Stock markets have remained relatively range-bound since the end of December as investors dial back their expectations for the pace of rate cuts after robust economic data and hawkish comments from Federal Reserve officials.

The early optimism that boosted stocks across November and early December has faded as investors rein in rate-cut bets. According to the CME fed watch tool, the market is pricing in a 65% probability of a rate cut in March, down over 20% since mid-December.

Attention is now squarely on tomorrow's consumer price index for further clues over the inflation trajectory and the pace at which the Fed may cut rates. Few are prepared to take on large positions ahead of the report, which could show that inflation is ticking higher again.

Hotter-than-expected inflation could see the market dial back further aggressive rate-cut bets, which could pull stocks lower. Meanwhile, cooler than expected inflation data could reinforce the view that inflation is heading towards 2% and revive those rate-cut bets, which could re-ignite.

Corporate news

Coinbase fell 4.4% following the sell-off in Bitcoin after the post on X, which appeared to show the SEC had approved a Bitcoin ETF before being removed as false.

Apple is set to fall as it attracts another breaker downgrade. The tech giant received its third broker downgrade from Redburn, which cited concerns over limited upside growth for iPhones in the coming years and lofty valuations. Barclays and Piper Sandler also downgraded the stock last week.

Tesla is set to open higher after the EV manufacturer released an updated version of its Model 3 sedan in North America after its previous release in China and Europe.

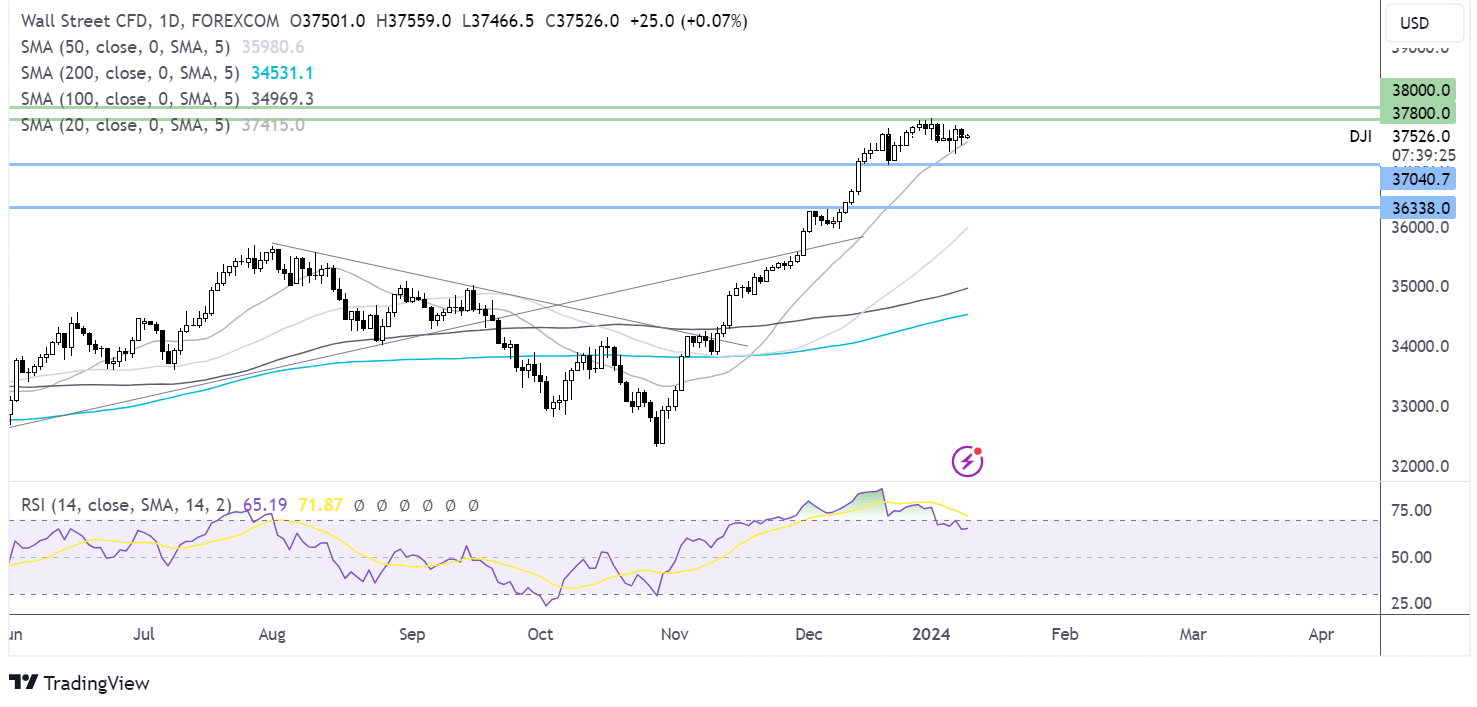

Dow Jones forecast – technical analysis

The Dow Jones has eased back from the 37800 high and is finding support on the 20 SMA. The RSI is coming out of overbought territory. Should the 20 SMA hold, buyers will look to retest resistance at 37800 and a new all-time high. Meanwhile, a break below the near term support brings 37000 round number and mid December low into focus.

FX markets – USD rises GBP/USD rises

The USD is falling after gains in the previous session as investors continued to assess the outlook for interest rates ahead of US inflation data tomorrow.

EUR/USD is rising despite comments from ECB vice president Luis De Guindos, who warned that the eurozone economy could slip into a recession. He offered no new guidance on the future path for interest rates reaffirming that the 4% current rate was appropriate and should be maintained for a sufficiently long period to bring inflation back to the 2% target.

GBP/USD is right then capitalizing on the weaker USD as investors await Bank of England governor Andrew Bailey's appearance before the Treasury Select Committee. Any comments surrounding inflation or the interest rate outlook could influence sterling. UK GDP data on Friday is expected to show a contraction -0.1% in November raising the likelihood of a recession in the UK at the end of 2024.

EUR/USD -0.18% at 1.0934

GBP/USD -0.24% at 1.2717

Oil rises as Mid East tensions offset growth concerns

Oil prices are rising as tensions in the Middle East and a fall in inventories offset rising non-OPEC oil production and concerns over global growth.

Libya's largest oil field, which produces around 300,000 barrels a day, remains offline due to a force majeure, which is supporting prices as well as the ongoing Israeli-Hamas war.

Meanwhile, while OPEC is slowing oil production, non-OPEC producers such as the US are ramping up output. According to the EIA US production will reach a record high in 2024.

This record output comes as the World Bank warns that the global economy is set for the weakest growth since the pandemic, with global GDP expected to be just 2.4% this year.

The last stockpile figures from API showed a larger-than-expected draw in crude stockpiles, but this was offset by a rise in refinery products.

EIA stockpile data is due later today.

WTI crude trades +1.3% at $72.07

Brent trades +1.3% at $77.20