If you imagine the US economy as a rollercoaster ride, then the Conference Board’s Consumer Confidence report is the barometer that measures the thrill level of the ride; in other words, it gauges how consumers feel about the present situation and their future expectations.

In January, the barometer came in at 107.1, a drop from 108.3 in December and below the expected 109.0 reading. This dip in consumer confidence can be compared to a sudden dip in a rollercoaster ride, leaving riders feeling uncertain and nervous.

Expectations and Present Situation Components

The report is split into two components: the present situation and expectations.

The present situation component measures how consumers feel about their current financial status and the job market. In January, this component rose slightly to 132.9, up from 132.6 in December. This stability in the present situation could be compared to a rollercoaster rider's comfort level as they go through a smooth section of the ride.

The expectations component measures how consumers feel about their future financial prospects and the overall economy. In January, this component dropped to 92.6, down from 96.9 in December. This drop in expectations could be compared to a rollercoaster rider's fear of the unknown as they crest the top of a hill, just as many consumers fear the US economy is about to nosedive.

According to Ataman Ozyildirim, Senior Director, Economics at The Conference Board, “Consumers’ assessment of present economic and labor market conditions improved at the start of 2023. However, the Expectations Index retreated in January reflecting their concerns about the economy over the next six months. Consumers were less upbeat about the short-term outlook for jobs. They also expect business conditions to worsen in the near term. Despite that, consumers expect their incomes to remain relatively stable in the months ahead. Meanwhile, purchasing plans for autos and appliances held steady, but fewer consumers are planning to buy a home—new or existing. Consumers’ expectations for inflation ticked up slightly from 6.6 percent to 6.8 percent over the next 12 months, but inflation expectations are still down from its peak of 7.9 percent last seen in June.”

Implications for the US Economy and Federal Reserve Policy

The Consumer Confidence report is an important indicator of consumer spending, which accounts for over two-thirds of the US economy. A drop in consumer confidence often leads to a decrease in consumer spending, which can slow down the economy.

Additionally, the Federal Reserve closely watches consumer confidence levels (specifically the inflation expectations component) when determining monetary policy. A decrease in consumer confidence may lead the Federal Reserve to stop raising interest rates sooner to boost consumer spending and keep the economy on track.

In conclusion, the January Consumer Confidence report is a reminder that the US economy is like a rollercoaster ride, full of ups and downs. While the dip in consumer confidence may lead to a decrease in consumer spending and prompt the Federal Reserve to take action, the stability in the present situation component provides a glimmer of hope. The next few months will be critical in determining the future direction of the US economy and the Federal Reserve's policy stance.

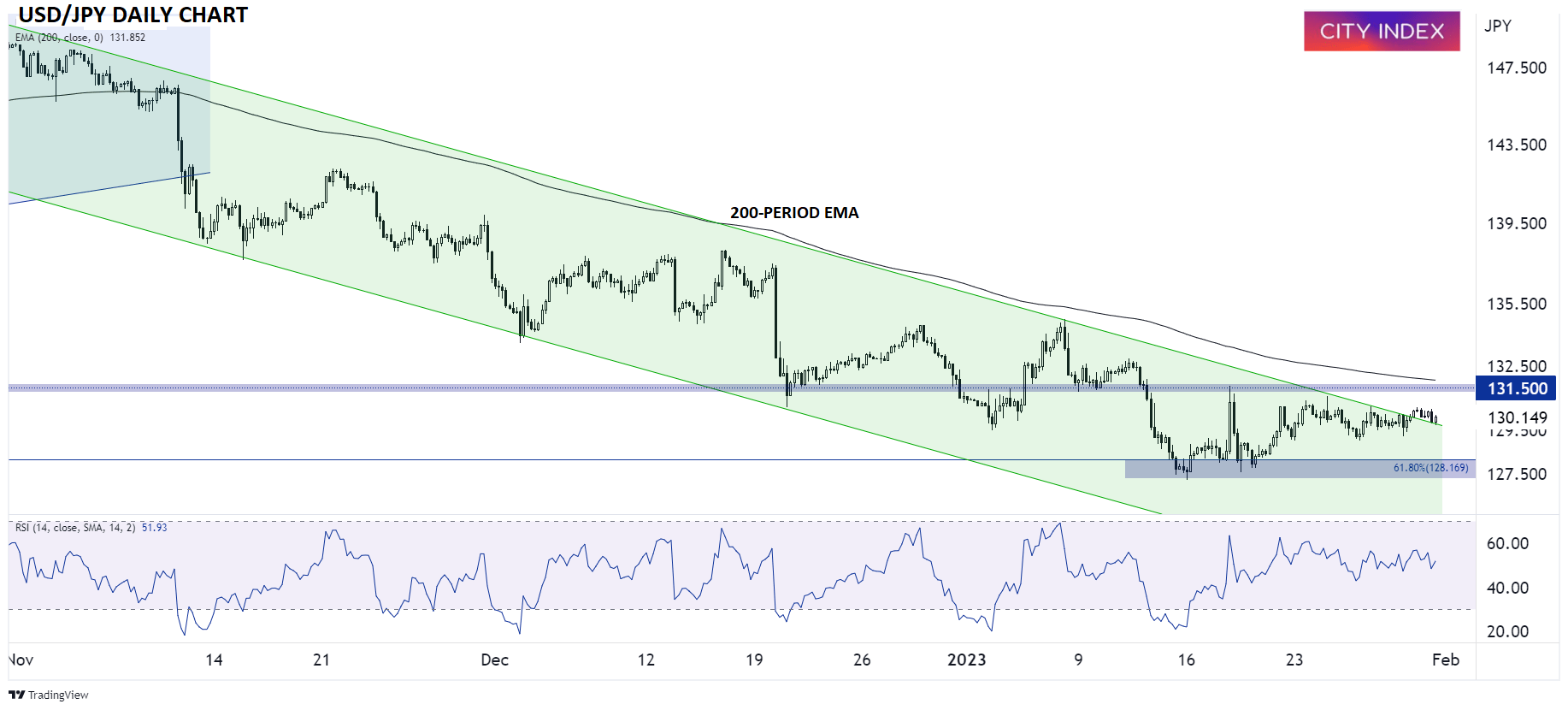

Technical view: USD/JPY

USD/JPY has bounced off the day’s lows in the wake of the report, but it still remains in a longer-term downtrend. However, rates are peeking out above the top of the bearish channel that has driven prices lower since October, suggesting that a bullish breakout could be nigh. With the Fed’s monetary policy meeting and the highly-anticipated NFP report on tap for the latter half of the week, USD/JPY traders should watch for a confirmed breakout above previous-support-turned-resistance near 131.50 to signal a potential shift to a near-term bullish trend.

Source: TradingView, StoneX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade