- ASX 200 futures have broken uptrend support dating back to when the Fed pivoted away from rate hikes

- As a cyclical index with low-growth constituents, the ASX 200 is vulnerable to anything that questions the soft-landing narrative

- Wednesday’s close may be important for the longer-term trajectory

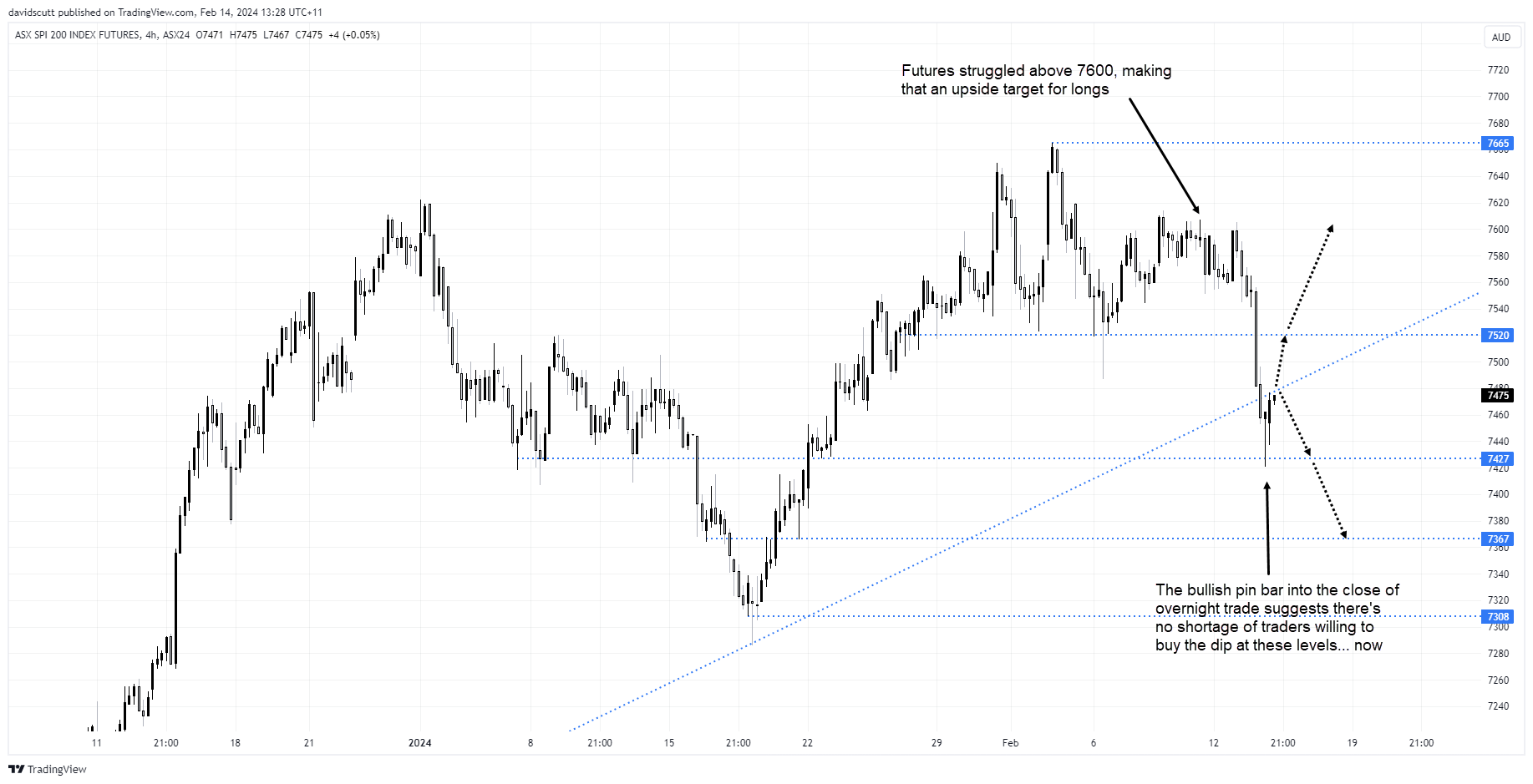

Having been a major benefactor from the soft-landing narrative, the combination of higher global interest rates and stretched valuations has Australia’s ASX 200 index under pressure, seeing futures slice thorough uptrend support dating back to when the Federal Reserve pivoted away from delivering further policy tightening in November.

ASX 200 dip-buyers swoop in

However, dip-buying off the lows suggests bulls aren’t willing to call time on the uptrend just yet, making today’s close potentially important when it comes to the indices longer-term trajectory.

Having cracked the uptrend in the overnight session on the back of steep falls on Wall Street, the bullish pin bar printed into the North American close suggests there’s no shortage of traders willing to buy the modest pullback. The move has since extended during physical trade, seeing futures retest the former trendline.

Wednesday’s close potentially important

The resilient price action makes me think Wednesday’s close will be important: finish above and it may facilitate a quick return to 7600 where it struggled to overcome for much of the past week. However, if rebound reverses late, it will get plenty of bulls nervous about the potential for a deeper pullback.

Risks skewed to the downside but respect the price

Fundamentally, as an index that ran extremely hard on the back of the soft landing narrative, the ASX 200 is vulnerable to downside given its low growth cyclical attributes. Stretched valuations in large cap names also creates headwinds as seen in the performance from CSL and Commonwealth Bank post earnings results this week.

With only a limited pool of high quality growth companies listed in Australia, which have also rallied hard on the prospect of large scale rate cuts, it suggests upside from these levels is limited with near-term risks skewed to the downside.

A failure to recover the uptrend presents an opportunity for traders to get short targeting a move to 7427, horizontal support futures bounced from today. A break of that level will open the door for a larger unwind to 7367 or even 7308, still far above where futures were trading prior to the Fed pivot. A stop above the trendline – located currently around 7478 – would offer protection against reversal.

Should the bulls get their way and jam futures back above the trendline, a stop below will allow fresh longs to be established above looking for a return to 7600. It's also worthwhile pointing out the 50-day moving average is running parallel to the trendline marginally below, a level futures have respected on several occasions recently. I’m going to let the price action into the close dictate on how to proceed.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade