Market Summary:

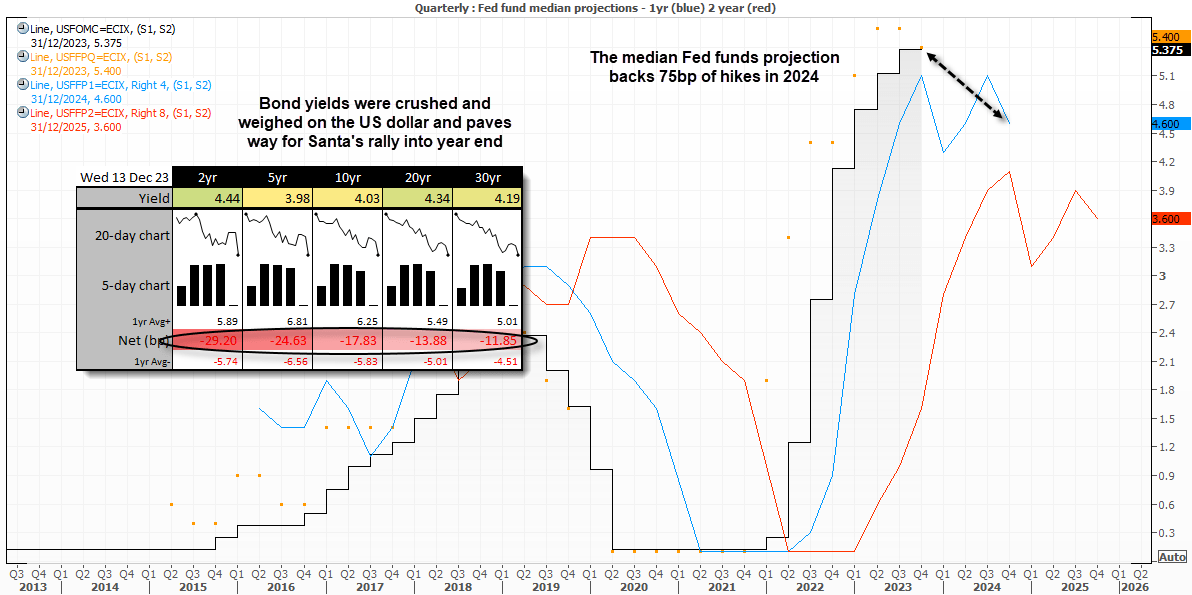

The Fed gave markets what they wanted for Christmas by signalling that rate cuts are likely coming in 2024. The dot plot showed that the median Fed funds rates for 2024 was lowered by 50bp from 5.1% to 4.6%, which allows three full 25bp from the current rate by the end of 2024. The staff projections also saw PCE inflation lowered in 2023 through to 2025, although growth was slightly downgraded to 1.4% from 1.5% in 2024 - but this still plays into the soft landing scenario.

This is a huge development for markets as we head into the new year and provides much needed clarity. And clarity in this instance meant risk on.

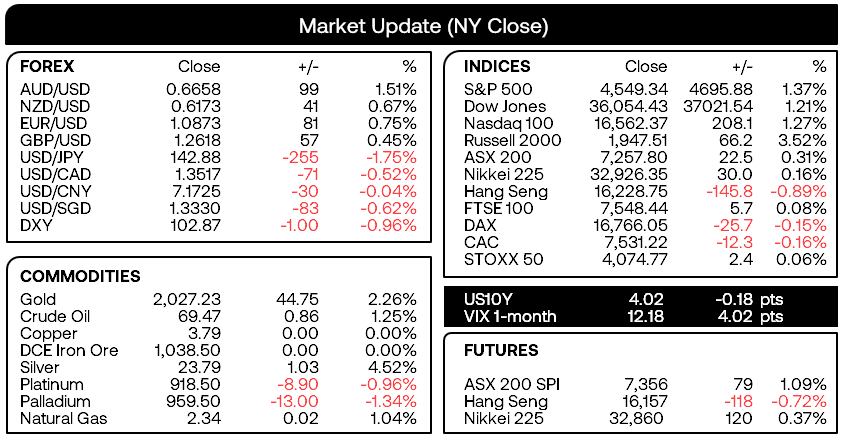

- The S&P 500 closed above 4700 for the first time since January 2022 and trades -2.3% from its record high. Also note that the seasonality pattern suggests a swing low tends to develop around the middle of December for a strong rally into the year end – which places a break to a new record high on the cards.

- The Nasdaq 100 needs to rise just 1.2% to reach a new record high, whilst the Dow Jones sits pretty at a record high.

- The USD dollar was the weakest major, with JPY, AUD and NZD leading the way. The US dollar index suffered its worst day in 22 and closed back beneath its 200-day MA. Whilst we’d usually expect to see AUD or NDZ take the lead, bets that the BOJ are closer to tightening policy saw the Japanese yen take pole position and send USD/JPY back to a 3-day low around 143.

- Bond yields were crushed which weighed on the US dollar, with the US 2-year yield moving decisively back beneath its 200-day MA / EMA.

- Gold enjoyed its best day in 44 and broke convincingly back above $2000 to close around $2027

Events in focus (AEDT):

- 09:00 – Australian manufacturing, construction index (AIG)

- 10:50 – Japan’s core machinery orders, foreigner’s bond/stock buying

- 11:00 – Australian inflation expectations (Westpac-Melbourne Institute)

- 11:30 – Australian employment report, RBA assistant governor Jones to speak

- 23:00 – BOE interest rate decision

- 00:15 – ECB interest rate decision

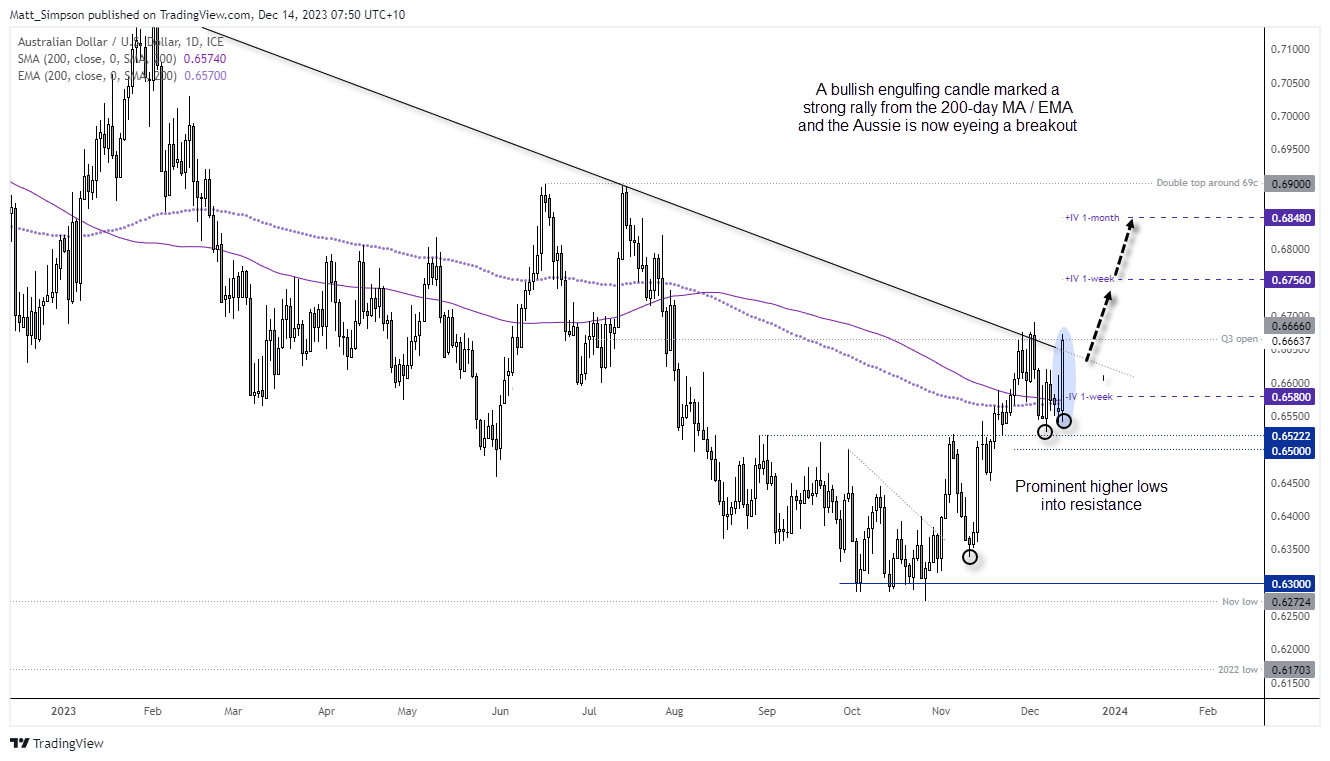

AUD/USD technical analysis (daily chart):

The Australian dollar looks set for a bullish breakout from a cluster of key resistance levels, following the Fed’s dovish pivot. A bullish engulfing candle formed on Wednesday as part of a strong rally from the 200-day MA / EMA, and marks another prominent higher low during its strong rally form 63c.

From here, bulls can consider breaks higher or seek to enter on pullbacks, with a view for it to head for 0.68 at a minimum but also the double top highs around 0.69.

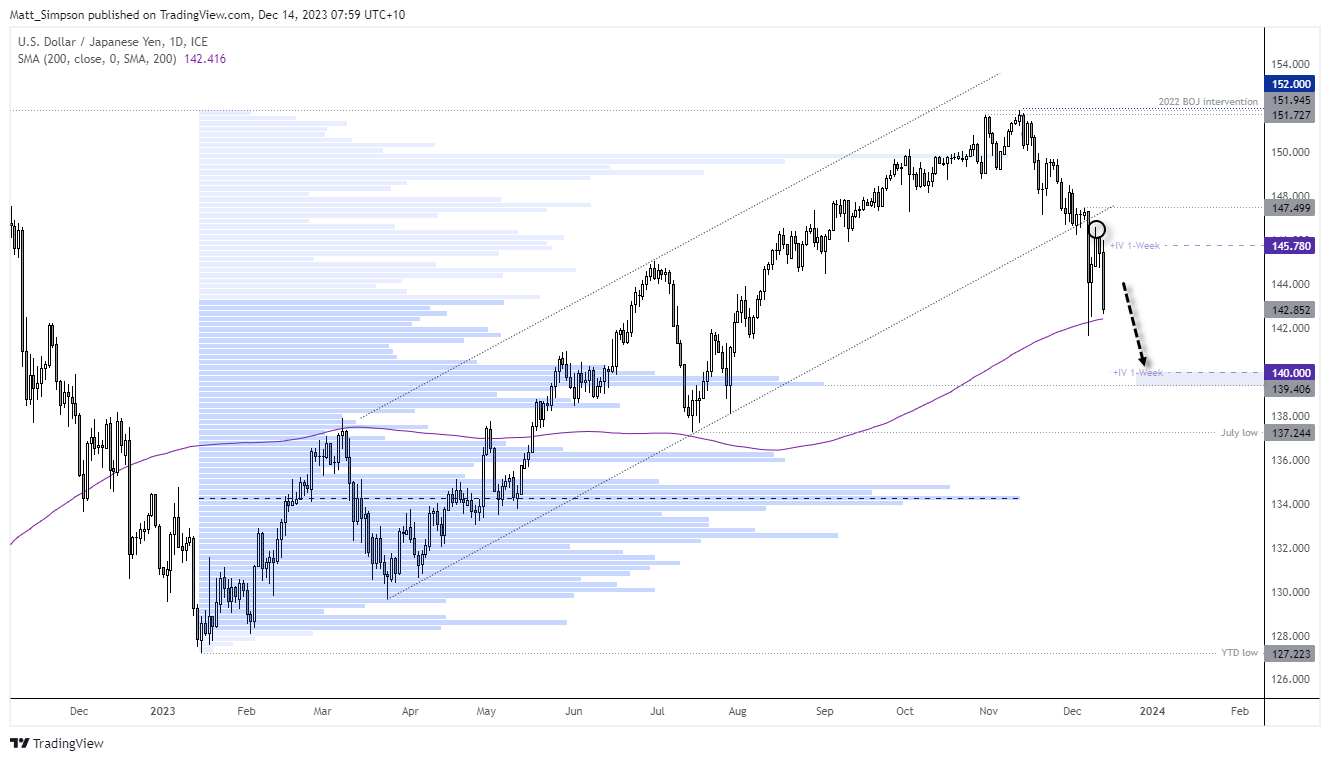

USD/JPY technical analysis (daily chart):

Wednesday’s bearish momentum mark’s Monday’s 146.6 level as a swing high for USD/JPY. Whilst the 200-day MA has come to the rescue again, my bias is for an eventual break beneath it now the Fed have delivered their dovish pivot. Moreover, with it looking more likely the BOJ are heading towards some form of tightening next year and the yen is strengthening across the board, the path of least resistance appears to be lower.

Perhaps we’ll see a minor bounce from yesterday’s lows as it reconsiders a break of the 200-day MA / 142 handle. But retracements within yesterday’s range could allows bears to fade into a bounce in anticipation of a break lower. Take note of the volume cluster around 139.4, near the 140 handle and lower 1-week implied volatility band – making the zone a potential support area.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade