- AUD/USD bounced strongly in Asian trade on Monday, mirroring similar strength in Chinese stocks and CNY

- Chinese financial market movements are likely to be more influential than Chinese economic data released today

- The path of least resistance for AUD/USD is undeniably lower right now

Contrary to what you may expect, movements in AUD/USD on Tuesday may be dictated by the performance of Chinese financial markets rather than the latest batch of Chinese economic data including Q1 GDP.

AUD/USD was a star performer in Asia on Monday

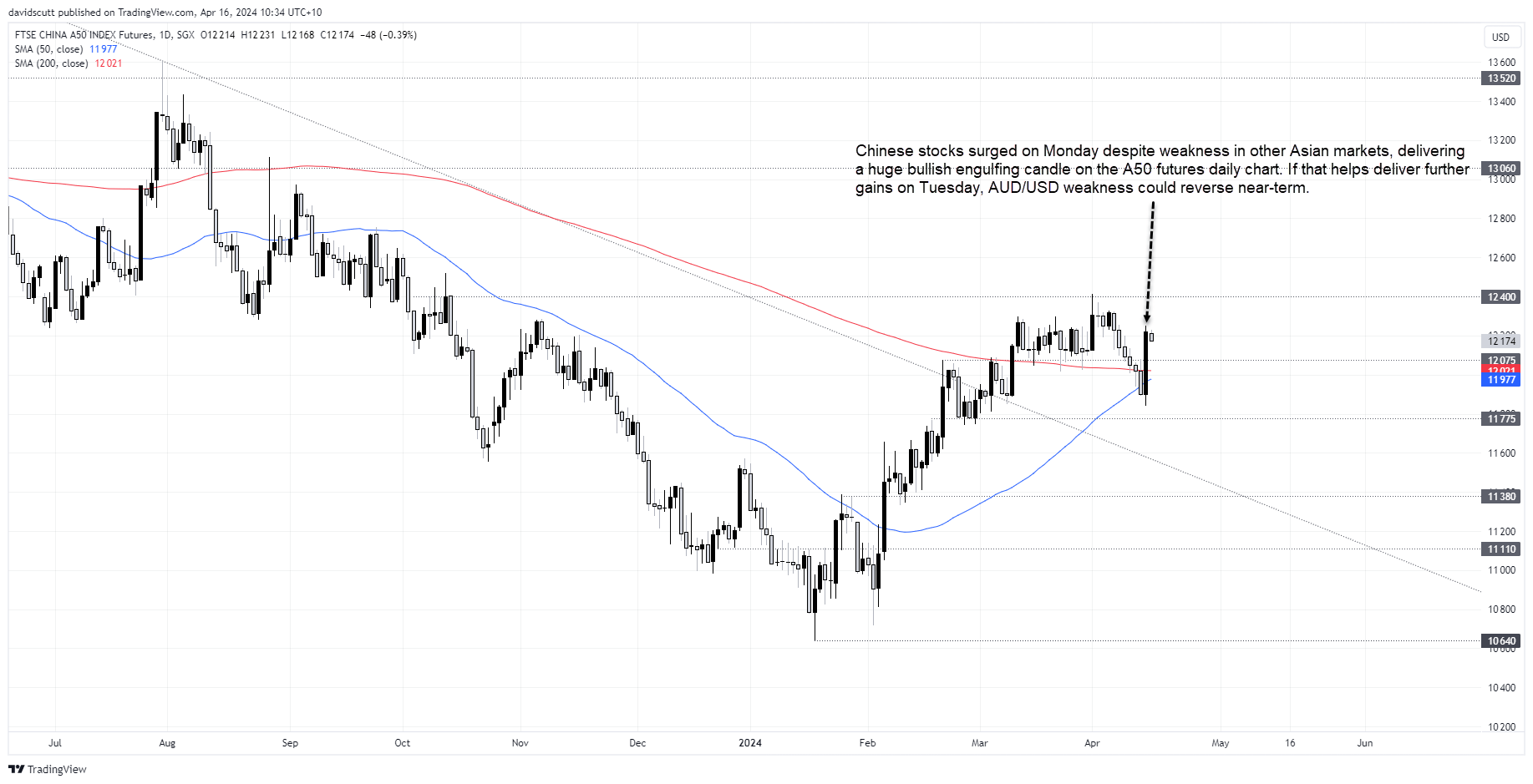

AUD/USD was a star performer in Asia to start the trading week, gaining strongly after tumbling on Friday. While short covering and relief over geopolitical events over the weekend may have contributed to the gains, it wasn’t until the People’s Bank of China (PBOCX) conducted its daily USD/CNY fix, and mainland stock markets opened sharply higher following a pledge from the government on Friday to take measures to boost capital markets, that AUD/USD really took off.

The PBOC’s continued pushback against market forces seeking to weaken the Chinese yuan has been a supportive factor for the Aussie dollar in Asia recently, helping to limit downside in AUD/USD. And as we saw on Monday, when Chinese stocks rally, AUD/USD often does too.

Which means China’s market should be on the radar today

That suggests near-term AUD/USD price action may be again influenced by Chinese market movements, rather than the economic data which hasn’t really moved the Aussie meaningfully since before the GFC. Traders know to expect a result roughly in line with what the government has been guided for GDP. If the latest batch of PMIs are to be believed, the improvement should be mirrored in monthly readings on retail sales, industrial production and fixed asset investment.

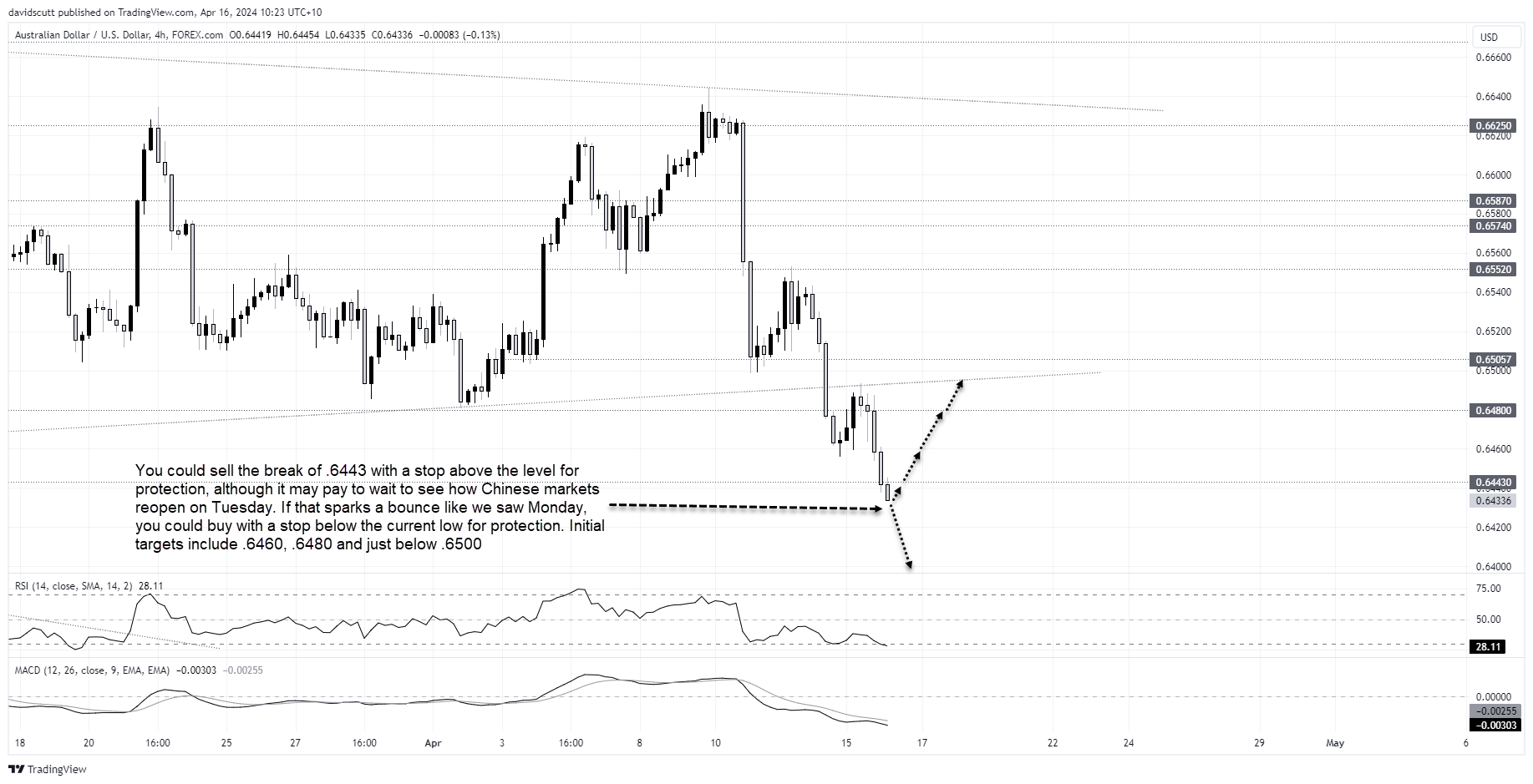

AUD/USD hits 2024 lows

Right now, AUD/USD needs all the help it can get, falling to fresh 2024 lows on Tuesday following another super strong US economic data print, this time for retail sales. With the probability of rate cuts from the Fed evaporating rapidly, it’s now not only widening the United States’ yield advantage over the rest of the world but also starting to generate wobbles in riskier asset classes, generating further downside pressure on the Aussie.

With AUD/USD through support at .6443, bears will be eying off a return to .6390, a level the pair did plenty of work either side of in 2023. However, while traders can sell the break with a stop above .6443 for protection, given how AUD/USD responded to the opening of Chinese markets on Monday, I’d want to see how that goes today before entering a bearish position.

If we do see a bounce in Chinese stocks and another strong CNY fix from the PBOC, traders may want to consider taking long positions with a stop below the current lows for protection. Possible trade targets include .6460, .6480 or former uptrend support just under .6500.

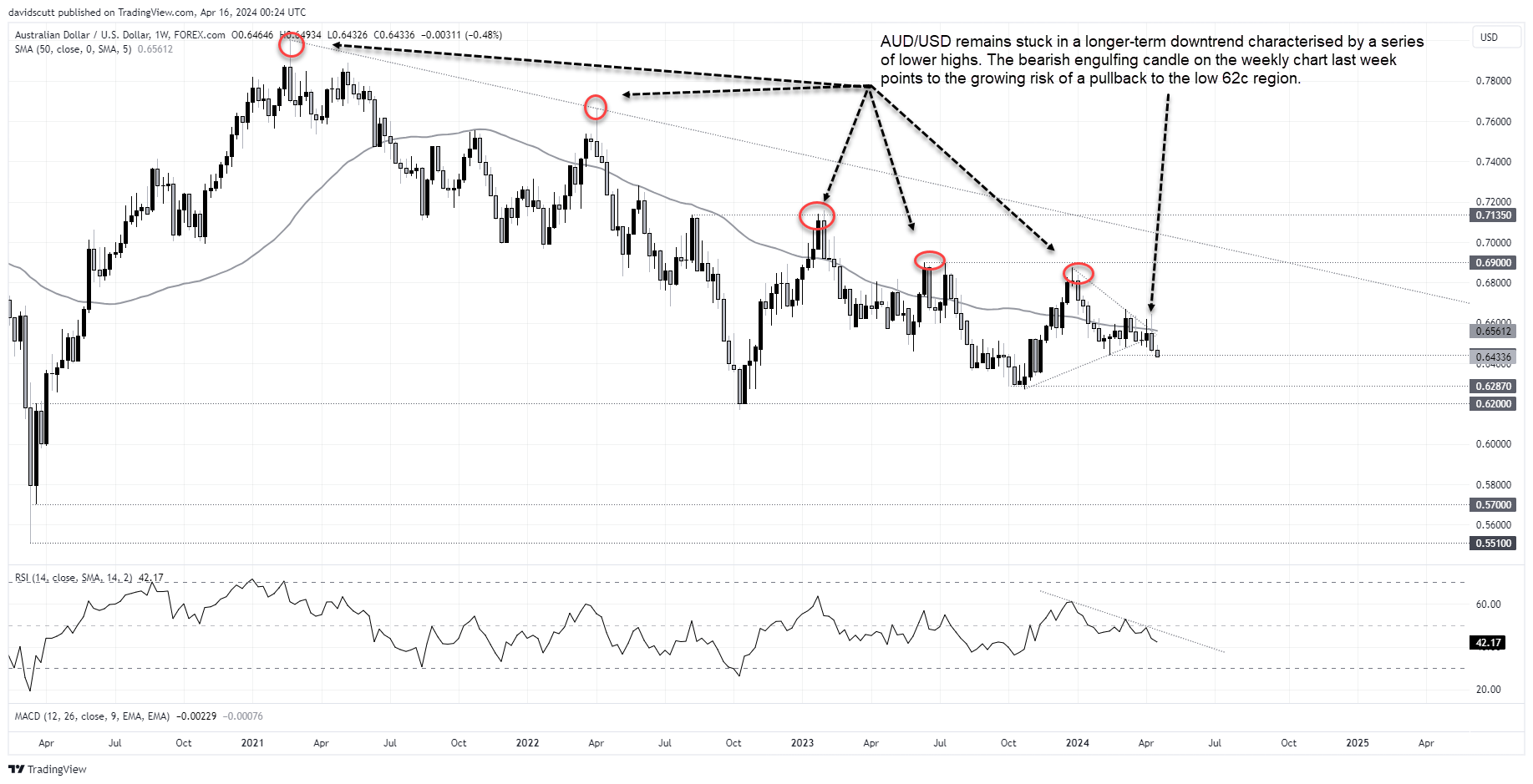

And remains a sell-on-rallies prospect

While the near-term bearish trajectory may reverse, the longer-term picture for AUD/USD remains lower when looking at the weekly chart. Since early 2021 it’s been nothing but a string of lower highs in an elongated downtrend, with the bearish engulfing candle last week pointing to the risk of further downside ahead.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade