- For a commodity currency, AUD has not benefitted significantly from booming commodity prices, nor signs of a pickup in the world’s largest commodity consumer, China

- But with ample good news priced into the USD outlook and near record bearish speculative positioning in AUD, it’s not difficult to see the risk of a near-term squeeze higher

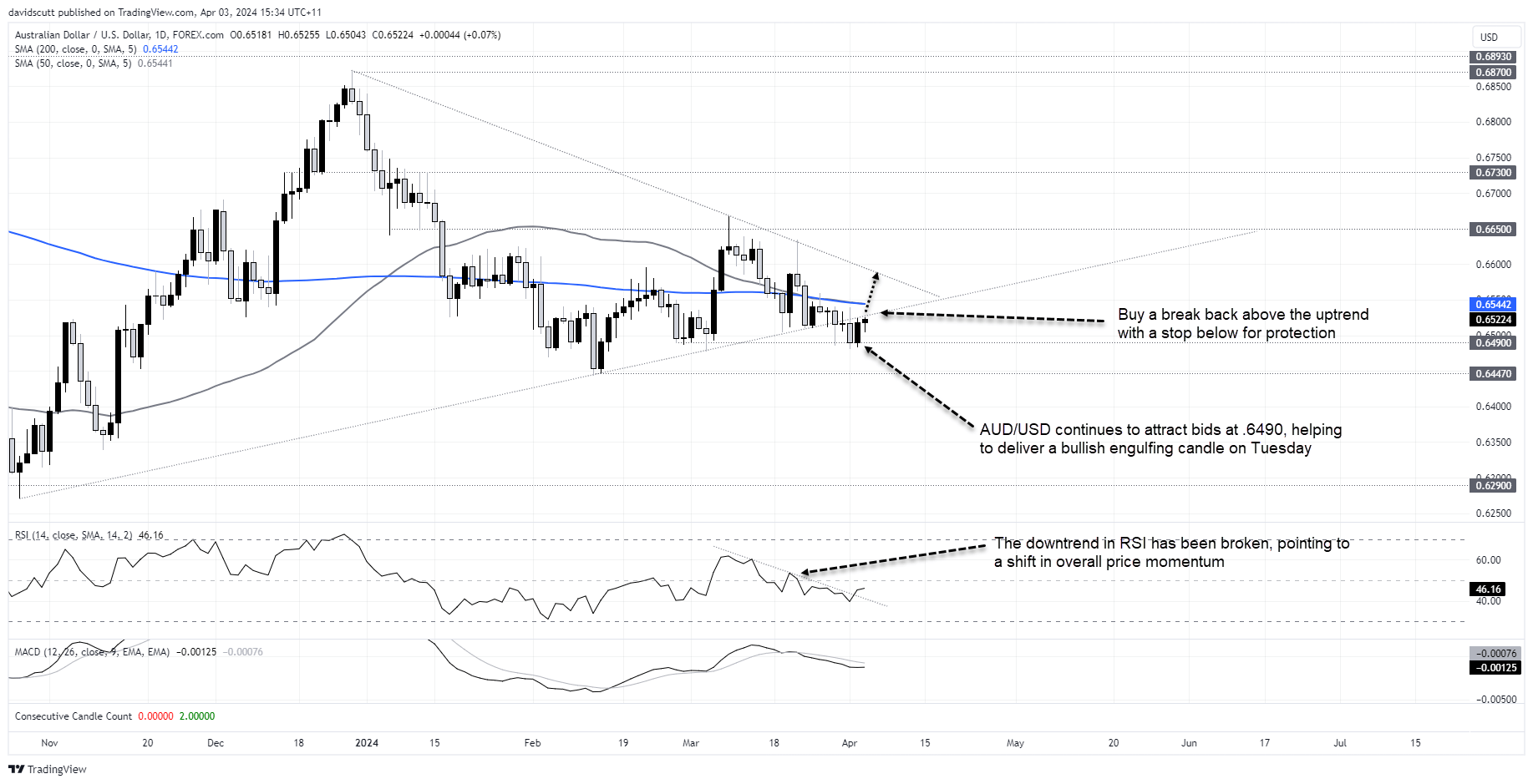

- AUD/USD reversed hard from .6490 on Tuesday, sending the price back towards former uptrend support

The overview

The Australian dollar continues to struggle despite surging commodity prices, breaking down as many names across the complex break higher. Not even stronger Chinese PMIs delivered any meaningful benefit this week. However, with ample good news priced into the US dollar outlook and a big reversal in the AUD/USD on Tuesday, there are signs the torrent of bearish sentiment may be slowly turning around.

The background

For what is arguably the prominent commodity name among G10 currency complex, the Australian dollar hasn’t looked flash recently despite booming commodity prices.

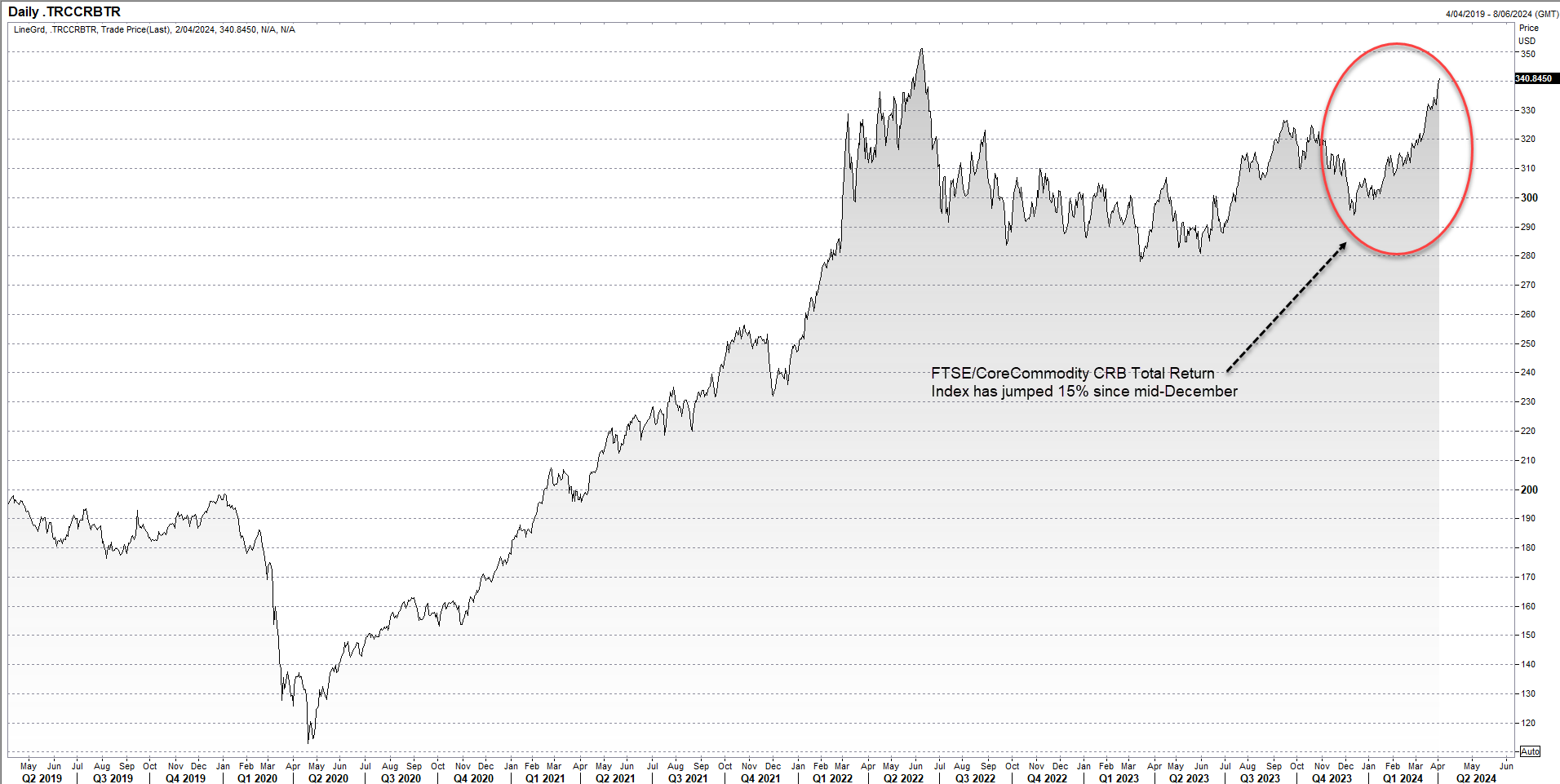

Yes, iron ore has been wobbling, falling sharply over the past month. And the USD is benefitting not only from ongoing economic resilience but also its enormous energy assets, making it a commodity currency too. But when you consider so many individual commodities are breaking higher, it’s noteworthy the AUD/USD has broken lower.

Even with upside surprises from Chinese PMIs in March, AUD/USD failed to benefit, breaking uptrend support rather than bouncing. It’s remarkable just how dismissive traders have been to any good news.

The largest commodity consumer globally reporting stronger activity levels. Commodity price indices hitting fresh 2024 highs. Yeah, nah. Traders simply aren’t buying it or the Aussie.

But I wonder whether that may be about to change?

After breaking the uptrend last Friday and going on with the move on Monday, it appeared only a matter of time until AUD/USD tested its 2024 lows. But the price action on Tuesday was bullish, with bids below .6490 managing to reverse the price back above Monday’s open, delivering a bullish engulfing candle.

Coupled with gains in commodity prices, plenty of good news priced into the US dollar and near record bearish AUD speculative positioning, it suggests near-term risks for AUD/USD may be skewed higher.

The trade setup

Should AUD/USD break back into the uptrend, it will allow traders to establish longs with a stop below for protection. While the 50 and 200-day moving averages are close by, the price has traded through both consistently in recent months, indicating it’s not an important level to watch.

The first upside target would be downtrend resistance located just below .6600 with horizontal resistance around .6640 the next level after that. Of note, the downtrend in RSI has been broken, pointing to a shift in momentum, adding to the case for upside.

My preference would be to see the price break convincingly above the uptrend before initiating the trade. Otherwise, a failure opens the door to flip it, allowing for shorts to be established below the trendline with a stop above for protection. That trade was looked at earlier this week and is still valid despite the ongoing strength in commodity prices.

The wildcards

It’s a busy calendar on Wednesday, meaning many of the questions traders are pondering right now may be answered before the day is out.

The key economic reports are the US ISM services PMI and Eurozone inflation reports. While it’s always difficult to assume how the broader markets is thinking, continued USD economic resilience is widely expected with downside risks in Europe. Both reports should be viewed through this prism.

Jerome Powell will also be speaking but it’s difficult to see what he could add to what was communicated on Friday.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade