Guaranteed Stop Loss Orders FAQs

Looking for something specific?

Use our advanced search to explore support pages- What is a Guaranteed Stop Loss Order (GSLO)?

- How does a GSLO work?

- How does a GSLO benefit my trading?

- How does using a GSLO fit into my trading plan?

- How much does a GSLO cost?

- How do I place a GSLO?

- Can I change my GSLO after making a trade?

- Can I add a GSLO to an existing position?

- Can I cancel a GSLO?

What is a guaranteed stop loss order (GSLO)?

A guaranteed stop loss order (GSLO) is an order that closes your trade at an exact level chosen by you, regardless of market gapping. A regular stop loss order may not cover you in times of heightened volatility where markets can “gap” between one price and the next without trading at the prices in between.

A GLSO is also a useful way to reduce the margin requirement for your trade. When you choose your stop level, you determine your maximum risk level (the maximum amount you could lose on the trade if your stop is reached), and we therefore ask for lower margin compared to trade without a stop trade attached.

At City Index, you can GSLO on thousands of financial markets financial markets and will only pay a premium for added protection if your GSLO is triggered, making them a cost-effective way to manage your trading risk, whilst also providing the opportunity to increase your leverage.

How does a GSLO work?

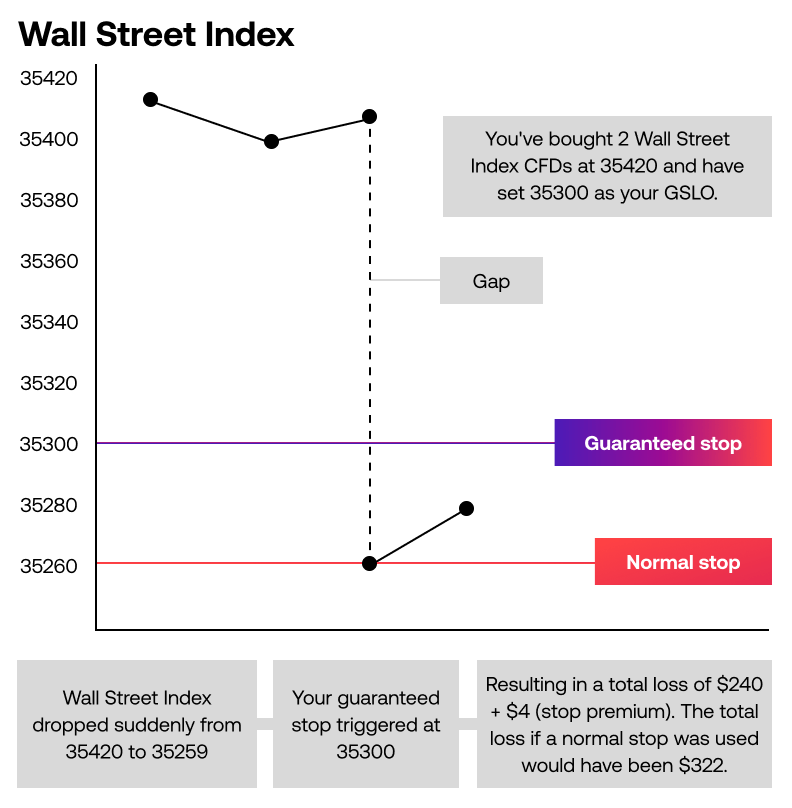

You believe the Wall Street market price is going to rise, so you buy 2 Wall Street CFDs with an opening price of 35,420.

You place a GSLO at 35300, which means the maximum loss on the trade would be (35,420-35,300) x 2 = $240.

The stop premium for Wall Street is 1.8x the quantity of CFDs and would therefore be 1.8 x 2 = $3.60 if your GSLO was triggered.

The required margin is calculated as follows:

Trade Size x Stop Distance x 1.1

In this example, your margin requirement would be: 2 x 120 x 1.1= $264

As a result of high volatility, the price of the Wall Street Index moves against you and unexpectedly drops from 35,420 to 35,259.

Despite market gapping, your trade closes automatically at your specified GSLO price of 35,300.

Your total loss on the trade is therefore $240 (maximum risk) + $3.60 (stop premium) = $243.60

If you had placed a standard stop loss order, then your position would have closed at the next available price (35,259) and resulted in a loss of $322.

How does a GSLO benefit my trading?

Our GSLOs are a cost effective way of managing your trading risk and with no premium to pay upfront you’ll have added peace of mind during times of volatility. You can attach a GSLO to a position in the knowledge that you will only pay a premium should the stop be triggered.

Our expanded GSLO offering now also covers more markets than ever before including major equities, indices, forex (FX) and commodities giving you more protection on a wider range of financial markets. If you already have an open position, you can add a new GSLO via the deal ticket in the trading platform and will still only pay a premium if your GSLO is triggered.

Guaranteed stop losses are most useful:

- If you're trading in volatile markets

- If you want access to higher leverage

- If you don't want to risk more than your initial deposit

- If the market is prone to gapping (remember, markets can gap both ways)

How does using a GSLO fit into my trading plan?

Risk management is a crucial part of any trading strategy, especially when you are a less experienced trader. Trading the financial markets is similar to running a business and ensuring you have the right protection against losses is fundamental to ensuring you don’t lose too much too quickly.

GSLOs are particularly beneficial in volatile markets or at times of extreme volatility where there is a risk of the markets gapping. They can also help ensure that you don’t risk more than your initial deposit by capping any potential loss at a risk level set by you.

Additionally, when placing a guaranteed stop loss order, you are limiting your maximum risk, so we ask you for a lower margin. This frees up additional funds for you to trade with.

How much does a GSLO cost?

The cost of your GSLO is based on the size of the position you wish to cover. You will only pay a premium if your GSLO is triggered and this will appear on your next statement as a separate charge. The charge or premium you pay is calculated differently for different markets either as:

Number of points x quantity of your position (For example indices like Wall Street or Germany 40)

OR

Percentage x notional trade value (For example equities like Apple or Facebook)

How do I place a GSLO?

To place a GSLO on any financial market, open the deal ticket in the trading platform and select the direction of the trade you would like to place, either Buy or Sell. Next, enter the quantity of your order. You can do this by entering a figure manually or by selecting a pre-determined quantity using the drop-down menu option.

- Open the menu on the ‘Stops’ section by clicking the down arrow

- Select ‘guaranteed stop loss’

- Fill in the price and quantity to determine the level at which your position will close out. Remember to tick the ‘guaranteed stop loss’ checkbox

Once you have filled in all the information for your stop order, click the ‘Place Trade’ Button and your position will be opened with a GSLO attached.

Can I change my GSLO after making a trade?

Yes, you can change the level of a GSLO after placing a trade by opening your position and amending the price or quantity at which your GSLO will be triggered. You will not be charged for amending a GSLO on an open trade.

Can I add a GSLO to an existing position?

If you have a current position that you would like to add a GSLO to, visit the open positions tab in the trading platform, find the trade you wish to add a stop order to, open the menu by selecting the down arrow next to the market name and select ‘amend position’.

Within the deal ticket, select ‘guaranteed stop loss’ from the ‘Edit stop loss and take profit’ section and then select the price and quantity at which you would like your GSLO to be triggered. Finally, select ‘Update position’.

There is no additional charge for adding a GSLO to an open trade.

Note: The market will need to be open for you to add a GSLO.

Can I cancel a GSLO?

Yes, you can cancel any GSLO on your CFD trading account at any time, free of charge. Simply select the ‘amend position’ option from the menu and uncheck the guaranteed stop checkbox.