Key takeaways

- High risk NIO could miss expectations in Q2 after poor sales performance in April and May

- NIO will face another test in Q3 as we get a first proper look at whether its new and refreshed product line-up can provide fresh momentum to sales

- NIO margins are past the trough and are starting to recover, but risks linger over its ability to rebuild profitability

- NIO shares are stuck in a downtrend and recently hit three-year lows

When will NIO release Q1 earnings?

Chinese electric vehicle maker NIO is scheduled to release results for the first quarter of 2023 before US markets open on Friday June 9. A conference call will be held on the same day at 0800 ET (2000 in Hong Kong).

NIO Q1 earnings consensus

NIO is forecast to report a 17.8% year-on-year rise in revenue in the first quarter to RMB11,679 million and its adjusted loss ADS is expected to swell to RMB2.64 from RMB0.79 the year before.

NIO Q1 earnings preview

We already know that NIO delivered 31,041 vehicles in the first quarter, over 20% more than what it shipped the year before but at the bottom-end of its guidance range and shy of estimates.

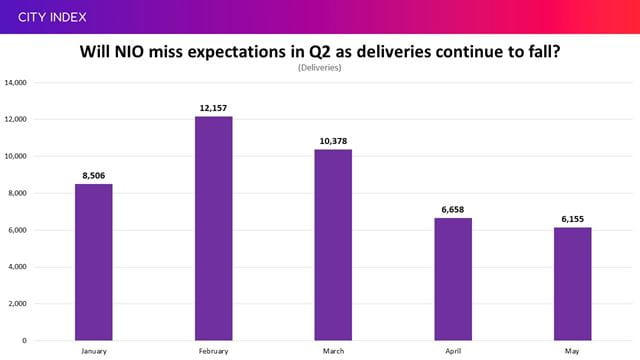

What is more concerning is that deliveries have fallen in April and May compared to what we saw in the first quarter, which will prompt concerns about the ramp-up.

(Source: Company reports)

That will place the onus on its outlook for the second quarter. Wall Street anticipates NIO can deliver over 47,600 cars in the period, but it has so far delivered just 12,813 in the first two months – leaving it with an almighty task of shipping over 34,700 vehicles in June if it wants to meet expectations!

That suggests there is a high risk of NIO falling short. Keep an eye on the deliveries guidance for the second quarter to see how this compares to Wall Street’s estimates, as well as revenue, with analysts anticipating NIO can book sales of around RMB15,833 million in the second quarter.

The hope is that new models will refresh the product line up and provide some much-needed momentum to sales. NIO launched the ES6 and EC7 in May and that has been followed by the ET5 Touring this month, having also recently revamped some of its older models. That makes the third quarter hugely significant as it will be a real test of whether its new line-up has attracted more demand or not.

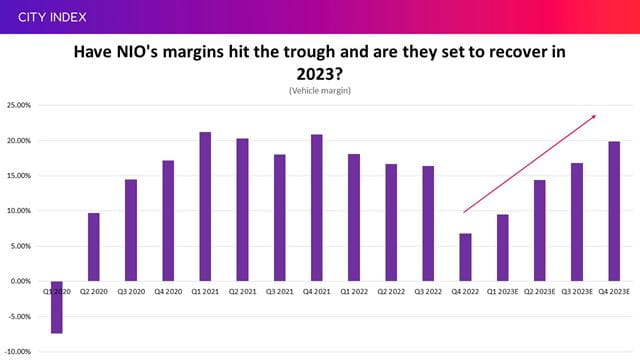

The other major job facing NIO, along with its rivals, is the need to limit losses and find a path to profitability. We saw NIO’s vehicle margin come in at just 6.8% in the fourth quarter of 2022. That was the smallest profit made on each vehicle since the measure turned positive two years ago. Fortunately, markets believe this marked the trough and that the margin will start to recover in the first quarter to 9.5% with hopes that this will continue to recover sequentially throughout the remainder of 2023.

(Source: Company reports, with estimates from Bloomberg)

Margins contracted in 2022 as NIO suffered from rampant inflation, supply chain problems and disruption from the government’s determination to contain Covid-19. Most of these headwinds have now eased. Battery costs are coming down, supply bottlenecks have been alleviated and China is now focused on reopening the economy after abandoning its crackdown on Covid-19.

There are risks to NIO rebuilding its profitability. The company continues to invest heavily. R&D expenditure more than doubled in 2022 and other costs are also on the rise as NIO builds out more infrastructure and facilities, demonstrated by the rollout of new battery-swapping sites and its expansion into Europe and beyond. Plus, weaker demand has also sparked a price war in China as companies fight for more limited demand and that may put NIO at a disadvantage considering it is regarded as a more premium, and therefore pricey brand. The fact most of NIO’s delivery growth in 2023 has come from its cheaper ET5 sedan suggests appetite is more limited for pricier models at present. That may leave NIO with a trade-off between sacrificing profitability to encourage demand or risk losing sales, especially as Chinese automakers have lost some enticing subsidies this year. Ideally, the new models that NIO has launched will be able to drive-up demand while also helping improve the average selling price and margins.

Where next for NIO stock?

NIO shares have fallen almost 20% since the start of the year, having formed a series of lower-highs and lower-lows. The stock hit its lowest level in three years at just $7 last week before rebounding.

The stock would need to break above the resisting trendline that has proven a reliable ceiling over the past seven months in order to install confidence that it has found new momentum. Currently, that requires a sustained move above around $8.30, in-line with the 50-day moving average. The job beyond here is to climb above the last two peaks at $8.85 and then $10. That would pave the way for a much larger jump toward the 2023-highs over $13.

Notably, the 29 brokers that cover the stock see greater upside potential with an average target price of $14.39, although this has been steadily falling this year.

The new floor sits at $7 following those recent lows. A slip below here could see it fall toward $6.60 and then $5.60, in-line with the brief levels of support we saw in June 2020. A much larger drop below $4 is on the cards if these levels fail to hold.

Take advantage of extended hours trading

NIO will release earnings before US markets open and most traders must wait until they reopen the before being able to trade. But by then, the news has already been digested and the instant reaction in share price has happened in after-hours trading. To react immediately, traders should take their positions in pre-and post-market sessions.

With this in mind, you can take advantage of our service that allows you to trade NIO and other tech stocks using our extended hours offering.

While trading before and after hours creates opportunities for traders, it also creates risk, particularly due to the lower liquidity levels. Find out more about Extended Hours Trading.

How to trade NIO stock?

You can trade NIO shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘NIO’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.