When will Disney release Q1 earnings?

Disney will release first quarter earnings after US markets close on Wednesday February 8. A live audio webcast will be held on the same day at 1630 ET (1330PT).

Disney Q1 earnings consensus

Disney is forecast to report a 7.3% year-on-year rise in revenue in the first quarter to $23.4 billion and adjusted earnings per share are expected to fall over 29% to $0.75.

Disney Q1 earnings preview

This is a big quarter for Disney. It will be the first set of results since Bob Iger made a surprise return as chief executive with the board hoping he can once again revive the company’s growth prospects.

Still, that appointment has not been enough to stave-off shareholder pressure from activist investor Nelson Peltz, who bought a sizeable stake in the House of Mouse last year and is now pushing for a board seat in the hope of driving change. Disney has said it doesn’t need his help and that Peltz does not understand the business.

We should see Iger start to put his stamp on Disney once again by unveiling his new strategy for the business this week, which could see some restructuring and new cost-cutting plans introduced. Expectations are high, and Iger needs to show shareholders that he can replicate his success Disney enjoyed during his original stint. Peltz is thought to have been pushing for change before Iger’s return, suggesting the CEO has an opportunity to win over any disgruntled investors.

We have already seen Iger shift the management structure, empowering creative directors after his predecessor shifted more decision making out of their hands. Any broader restructuring unveiled this week could see job cuts, although the number of potential layoffs is not known.

Now, let’s dive into the results, starting with Disney’s theme parks, resorts and other experience-based offerings, which are expected to deliver its best set of post-pandemic results this quarter as they continue to recover from Covid-19. Revenue from the Parks, Experiences & Products unit is forecast to rise 11.6% to $8.1 billion and operating profit is expected to rise 7.8% to $2.6 billion.

Meanwhile, its other division driven by its array of content should benefit from a strong film slate, underpinned by the blockbuster release of the new Avatar film.

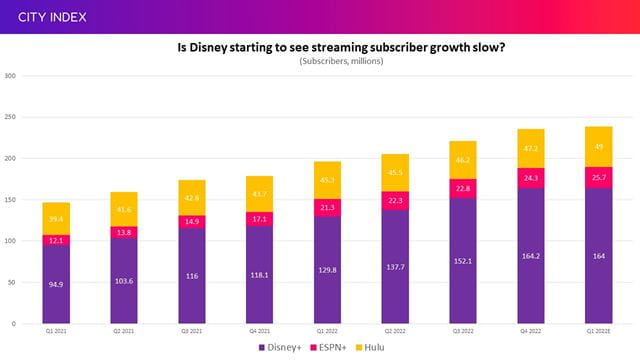

However, a lot more attention will be paid to Disney’s streaming services this quarter. Its subscriber base has grown at an impressive rate since Disney+ was introduced, but growth is now starting to slow. In fact, Disney+ is expected to lose 252,000 users in the period to end the quarter with 163.95 million subscribers on its books. That would be the first time Disney+ has lost users since being launched in late 2019. However, this should be a temporary blip because there was no IPL tournament on Hotstar in the period rather than a start of a new trend.

Plus, any drop at Disney+ will be countered by growth at ESPN+ and Hulu, which should hit 74.7 million subscribers. All three services combined, Disney should have ended calendar 2022 with 238.7 million subscribers.

(Source: Bloomberg)

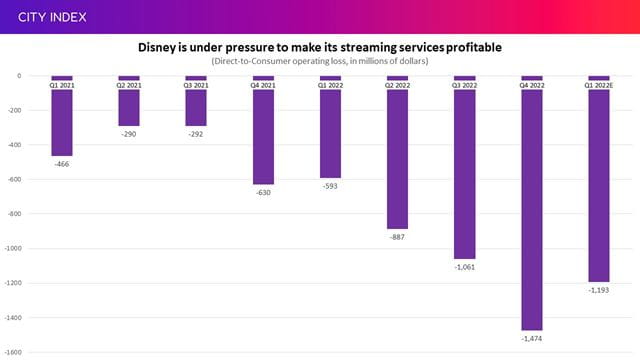

The rapid growth in Disney’s streaming service in recent years has been nothing short of impressive, especially as it has overtaken market leader Netflix. However, this has not been cheap, and its platforms are currently making large losses. Disney now needs to make streaming profitable, and we could see the company start to make progress. Losses are expected to start contracting after peaking in the fourth quarter. Demonstrating that it is on its way to escaping the red will be a key message.

‘With our expectation that peak losses are now behind us, Direct-to-Consumer operating results should improve going forward, as we lay the foundation for a sustainably profitable business model,’ said chief financial officer Christine McCarthy in the last quarter.

(Source: Bloomberg)

However, investors may need to be patient considering Wall Street believes Disney’s streaming services won’t become profitable until the second half of calendar 2024. Any signal that this will be achieved sooner would be bullish for the stock, although there is also the risk it could take longer – especially if subscriber growth slows. Disney added almost 57 million subscribers across its services in the last financial year but that is expected to slow to less than 34 million this financial year.

Some reports have suggested Disney could start to sell more of its licensed content to competitors to raise cash and shrink losses, which would mark a U-turn considering Disney has taken most of its content off rival platforms to make its own more attractive. Iger is also thought to be giving cinemas a boost by prioritising theatrical releases and deemphasising the focus on streaming.

Investors will hope that this trend of smaller streaming losses will continue in the next quarter, when we should see recent price hikes should feed through and as its new ad-supported tier that was launched in late 2022 gains traction. Rival Netflix has warned its own advertising business will be a slow burner and that it will take time for it to contribute to the bottom-line, but this gives Disney – which is far more experienced in advertising – to show off its skills. Disney has said the benefits from ads won’t be better realised ‘until later this fiscal year’.

Disney has said it is aiming to deliver high single-digit growth in both revenue and operating profit this financial year. Wall Street agrees that annual revenue can grow 9.5%, but remains unconvinced when it comes to profitability considering analysts believe operating income will grow less than 1%. New cost-cutting measures could change this view, so the jury is out and all eyes are on Iger.

Where next for DIS stock?

Disney shares have rallied over 30% since closing at their lowest level since 2014 at the very end of last year.

The stock has lost some momentum recently and found some resistance at $113, with the RSI in overbought territory. We will see the August peak of $125.30 come into the crosshairs if it can break above here, which is in-line with the average target price set by the 30 brokers that cover the stock. The stock may find some support around $108, but there is a risk we see it slide back toward $92 if it comes under renewed pressure.

Notably, when we look at the monthly chart, we can see that $113 has also provided a tough ceiling over the past 10 months.

Take advantage of extended hours trading

Disney will release earnings after US markets close and most traders must wait until they reopen the following day before being able to trade. But by then, the news has already been digested and the instant reaction in share price has happened in after-hours trading. To react immediately, traders should take their positions in pre-and post-market sessions.

With this in mind, you can take advantage of our service that allows you to trade Disney and other big-name stocks using our extended hours offering.

While trading before and after hours creates opportunities for traders, it also creates risk, particularly due to the lower liquidity levels. Find out more about Extended Hours Trading.

How to trade Disney stock

You can trade Disney shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Disney’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.