Market Summary:

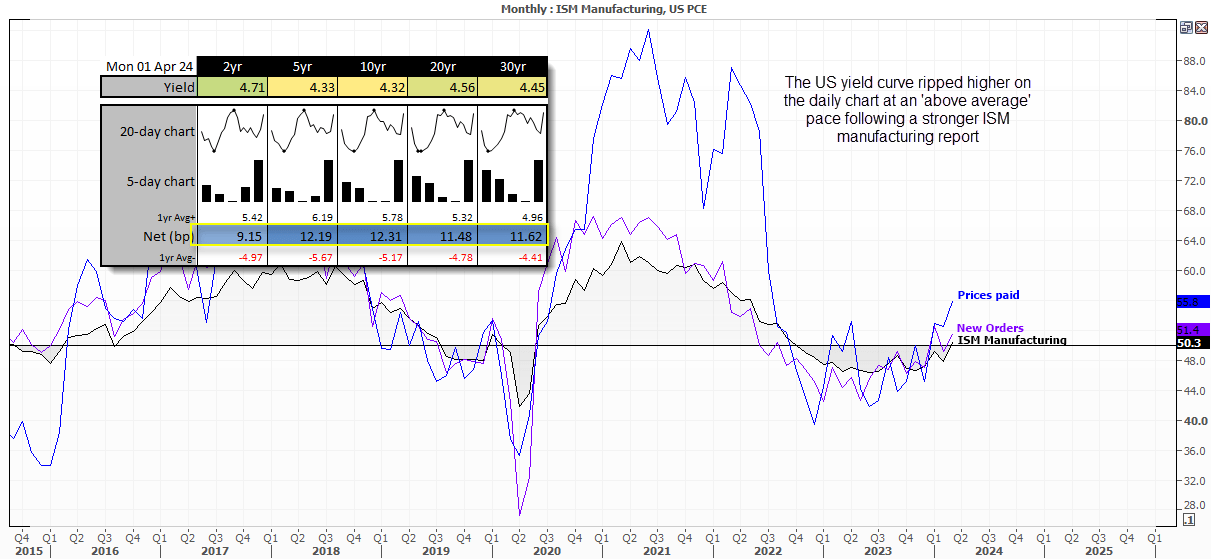

ISM manufacturing expanded (above 50) for the first month in 18 in March, with 'new orders' and 'prices paid' expanding in tandem.

'Prices paid' is generally more volatile and expanded at its fastest pace since June 2022. But still, there's no immediate signs of a top for these inflationary pressures, and core PCE remains at 2.8% y/y (Fe target is 2%).

This saw the US yield curve rip higher at an 'above average' pace on the daily chart and the US dollar rise against all FX majors. The US dollar index finally touched my 105 target before pulling back slightly, having broken above trend resistance form the 2022 high on Thursday.

It could be a big week for the US dollar and global markets in general with the ISM services and nonfarm payroll reports more than capable of single-handedly swaying sentiment for Fed policy this year. As any continued strength in these reports likely bolster bullish bets for these markets on renewed doubts of the Fed’s ability to cut rates multiple times ahead of the US election.

- GBP/USD was the weakest major and fell to an 8-week low, on bets the BOE could cut rates sooner and more aggressively than the Fed, even if the BOE recently said markets were pricing in 'too many' cuts.

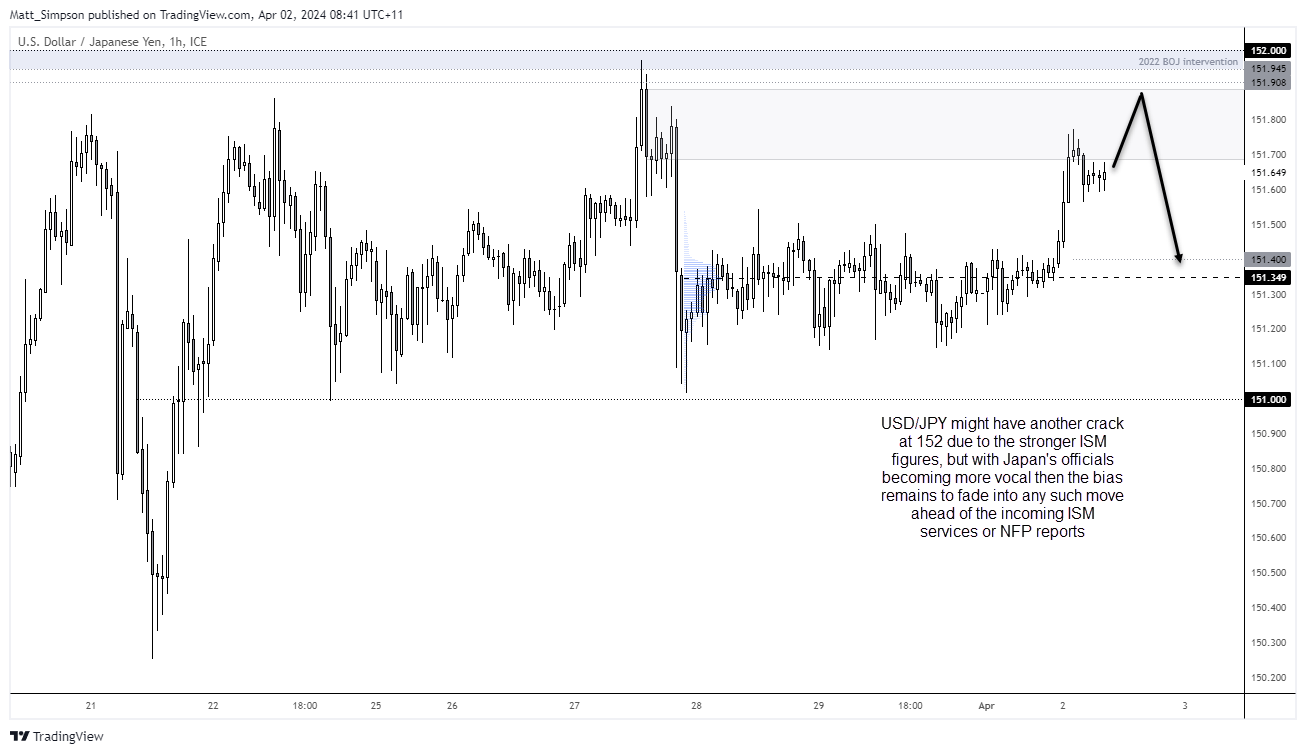

- USD/JPY formed a bullish engulfing bar on the daily chart, which brings another crack into focus (a level it has failed to touch since 1990 and Japan’s officials seem keen to verbally intervene when it nears it).

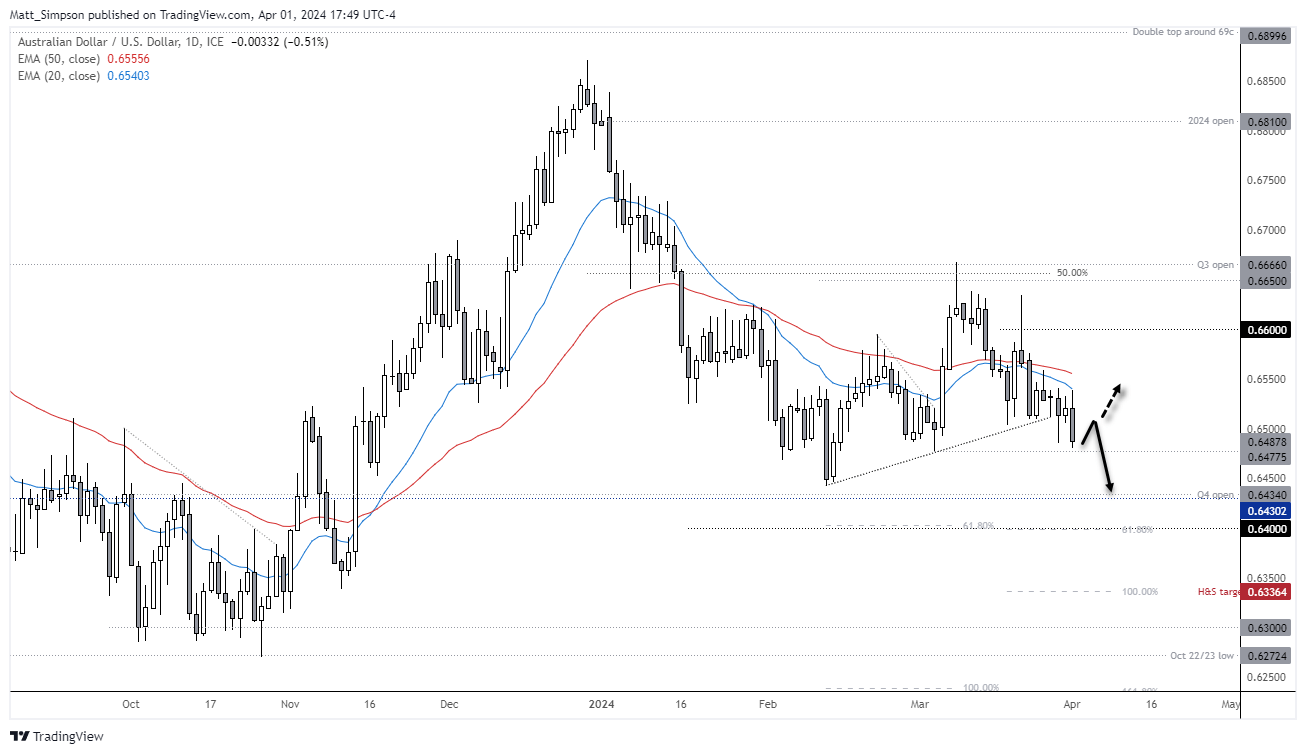

- AUD/USD teased with a break beneath Thursday’s low and shows the potential to move lower from here if US yields and the dollar continue to rise

- Gold reached a fresh record high and broke above $2050, however it looks set to form a bearish pinbar in the daily chart which suggests a near-term signs of exhaustion. Although the low-volume trade of East Monday also needs to be factored in.

- China’s manufacturing PMI also expanded slightly for the fist time in six months according to official data from NBS. At 50.8, manufacturing PMI is its most expansive in in 1-year, services PMI rose at its fastest pace in 9 months and the composite in 10 months

- The private Caixin PMI manufacturing read also expanded at 51.1, its fastest rise in 13 months

Events in focus (AEDT):

- 09:00 – Australian manufacturing PMI

- 09:10 – RBA Assistant Governor Kent speaks (The Future System for Monetary Policy Implementation – at the Bloomberg Australia Briefing)

- 09:50 – Fed member Cook speaks

- 10:00 – South Korean inflation 9Not a market mover, but can be good to keep an eye on Asian inflation figures for general sentiment)

- 11:30 – RBA minutes, Australian job adverts (ANZ)

USD/JPY technical analysis:

The significance of 152 has not gone unnoticed on USD/JPY, given it has failed to touch that level since June 1990. It came very close and within three pips of the milestone level on Wednesday, but no cigar. A small bullish engulfing day formed and places USD?JPY less than a day’s trade away from the infamous 152 level. But traders would be wise to remember that Japan’s officials become increasingly verbal against a weaker yen, the closer USD/JPY trades to 152.

Knowing markets, I suspect they’ll have another crack at 152 anyway as Asian traders may want to respond to the strong ISM manufacturing report. But I continue feel any such move may be met with a selloff, and for USD/JPY to remain within the 101-152 range at least until the ISM services or NFP reports arrive to break the deadlock.

AUD/USD technical analysis:

AUD/USD closed beneath 65c for the first time this month on Monday, and it shows the potential to move lower from here. I had outlined a potential head and shoulders top last week, yet such patterns require an aggressive break of the neckline – and that does not appear to have occurred. Regardless, a break of the 0.6477 low assumes further downside and brings the Q4 open / 0.6450 level into focus for bears.

We may see a minor bounce from current levels today, but we much keep I mind that the assistance RBA governor speaks and the minutes are released at 11:30 AEDT, and if dovish enough could prompt the next leg lower.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade