Market Summary:

- The Swiss franc was the weakest FX major on Thursday after the SNB surprised the consensus with a rate cut of 25bp (a move I warned that could happen yesterday)

- GBP was the second weakest FX major after the BOE began laying the groundwork to cut interest rates on Thursday, with Governor Bailey saying inflation was moving in the right direction and the sole two hawkish MPC voters dropping their vote to hike to a hold

- Weak PMI data from Europe also bought forward bets of ECB easing, weighed on the euro and sent the DAX to yet another record high

- Not wanting to miss out, the S&P 500 gapped up and printed its 19th record high of the year, although the minor retracement and small range brings a potential Island reversal into focus (a particularly bearish pattern, but requires a large gap would tomorrow)

- In all likelihood, the S&P 500 may try to fill the gap but could find support instead, given its reluctance to fall over so far

- With some central bans at or near dovish pivots, the relatively high yield the US offers saw the US dollar surge and yields move higher and a bullish engulfing candle formed on the US dollar index

- USD/CHF rose over 1% during its best day in a month and stopped just shy of my 0.9000 target, AUD/CHF also broke higher in line with yesterday’s bias and reached 0.59 – a break above which could mark the breakout of a multi-month bottom

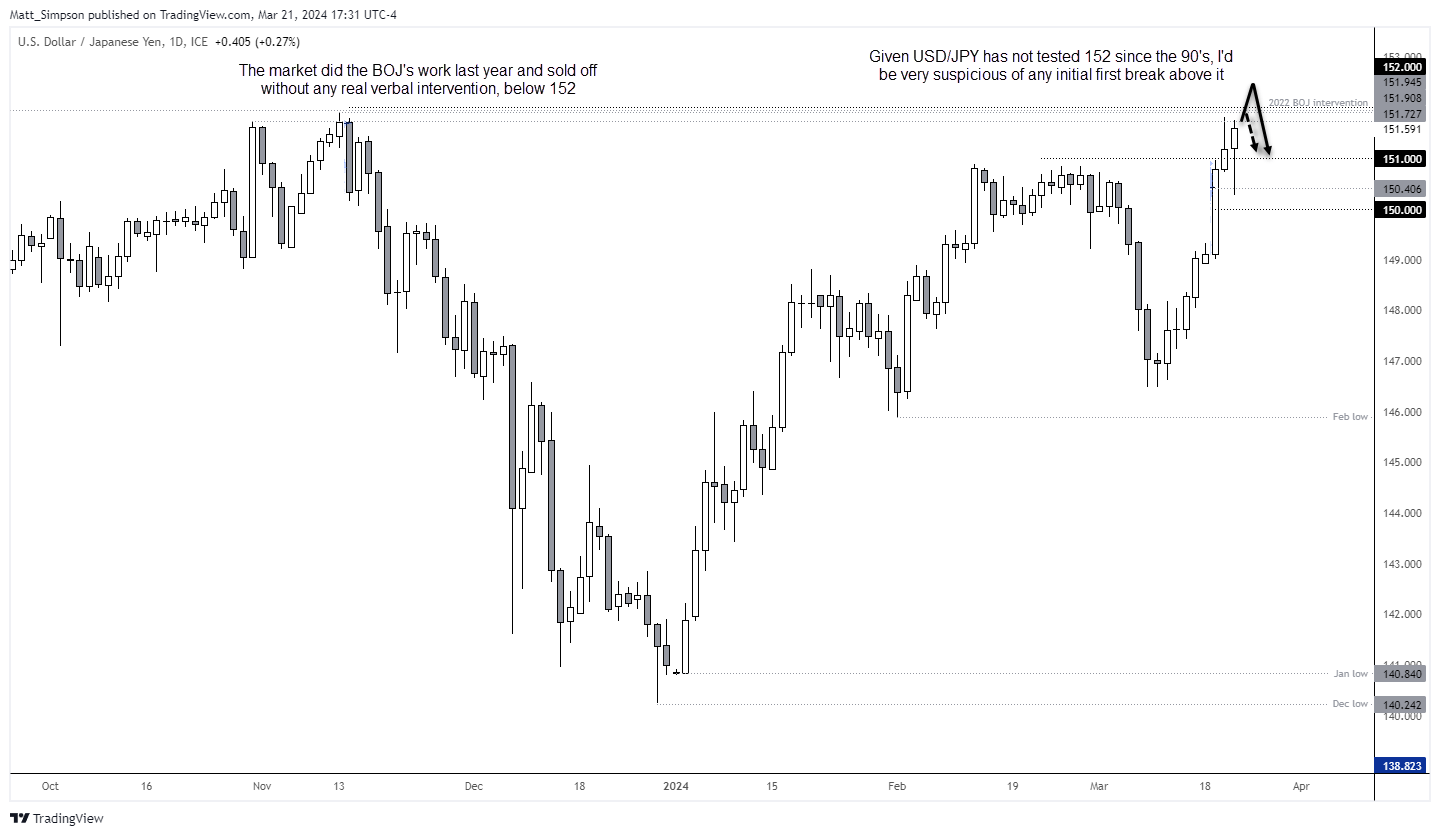

- USD/JPY rose for a third day and trades less than 30 pips from the 2023 high, bring a potential break above 152 into focus (and the evergreen question of whether the BOJ will begin to verbally intervene)

- BOJ Governor Ueda said the 0.1% ‘hike’ to 0% was designed to reduce market volatility further out

- Australia’s strong employment report saw bears cover as it leaves little wriggle room for RBA easing, with over 100k jobs added and unemployment fall from 4% to 3.7%

- Gold saw a false break above $2200 and closed the day with a bearish pinbar, to show all may not be well at these highs

Events in focus (AEDT):

- 10:30 – Japan’s CPI

- 11:01 – UK consumer confidence (GfK)

- 11:30 – RBA financial stability review

- 18:00 – UK retail sales

- 18:00 – German import prices

- 20:00 – German business confidence (Ifo)

- 23:30 – Canadian retail sales

- 00:00 – Fed Chair Powell speaks

- 07:00 – Fed member Bostic speaks

USD/JPY technical analysis:

We’re back to the evergreen question; will the BOJ or MOF begin to verbally intervene with the yen weakening at such a pace? It’s possible. But then it we go back to the 2023 high, the market did the work for them anyway to send the yen higher against its peers.

So todays chart is really more about highlight a potential pivotal level than making a call as to whether it will break above 152.Yied differentials continue to favour a higher USD/JPY, yet on the other hand traders remain heavily net-short Japanese yen futures, around level usually associated with bullish reversals for the yen (bearish for USD/JPY).

Given that USD/JPY is yet to even test 152 this millennia, let alone break above it, I’ll always be suspicious of a first break if one arrives. In which case, if we’re treated to a heroic break above 152 today or even next week, I’ll be monitoring its potential for a reversal back beneath that milestone level for a potential short trade. As this is likely to be where the buy-stop orders reside for the latest bulls of the rally – and that could trigger a burst lower.

Beyond that, it is down to the BOJ’s appetite to let the yen slide, as to how sustainable a move we could expect for any move above 152.

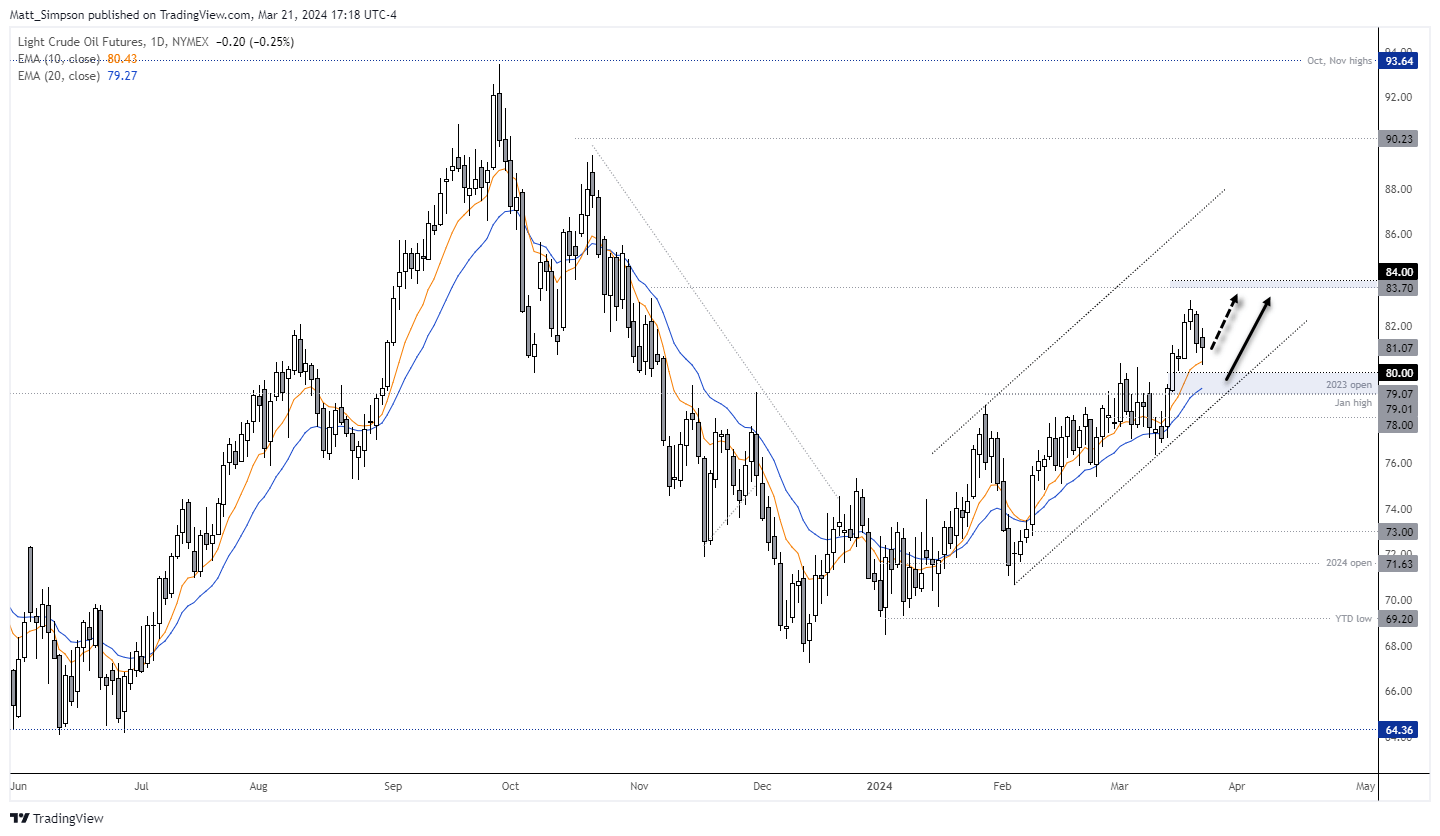

Crude oil technical analysis:

The daily chart shows an established uptrend for crude oil, and whilst it is yet to reach the $84 it remains a possibility. Stability has been found above $80 after a two-day retracement, and yesterday’s low held above the 10-day EMA. Perhaps the retracement is complete and momentum can now turn higher, but as one who is always suspicious of ‘false moves’ and spikes ahead of real moves, traders could also be on guard for such moves towards the $$79.07-$80 zone before the anticipated move higher begins.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade