Global stock markets have been shaken by the Russia-Ukraine conflict. Ukraine’s foreign ministry said this morning that Russia has launched a ‘full scale invasion’ and the fast-moving picture has injected fresh uncertainty and volatility into the markets.

Let’s have a look at how different stocks and sectors are responding and what to expect when US markets open today.

Bank stocks

Banking stocks are trading lower today as fears grow the Russia-Ukraine crisis will derail the global economic recovery from the pandemic, with European players taking a significant hit this morning thanks to their exposure to Russia.

In the UK, the Big Four banks of Lloyds, NatWest, Barclays and HSBC are all trading 4% to 9% lower today as fears over the economic recovery overshadow a bumper earnings season that was rounded-off today.

That trend looks set to continue when US markets open today, with Bank of America down 4.8%, Bank of NY Mellon down 3.5%, Bank of America is trading 4.8% lower, JPMorgan is down 3.8% and US Bancorp is down 2.9%.

Travel stocks

Travel stocks are also coming under pressure as the crisis threatens to significantly disrupt operations and routes, with Ukraine having closed its airspace this morning.

UK airline stocks IAG and easyJet, as well as cruise operator Carnival, are all trading down around 8% today while Hungarian-based airline Wizz Air is down 15%. US airlines are also likely to come under pressure today and US cruise operators are also following lower with Royal Caribbean down 6.9% before the bell and Norwegian Cruise Line trading down 8.8% after reporting results.

Energy stocks

Energy stocks have pushed higher today as oil prices soared passed $100 per barrel for the first time since 2014, driven by fears the crisis will cause disruption to supplies. News reports suggest UK and European gas prices surged over 40% today, with Russia thought to account for around 40% of Europe’s gas supplies.

UK traders can consider Shell (+3.9%) and BP (-3.4%). Notably, Shell has been among the minority to find higher ground in the UK today while BP is trading lower. However, the picture is more complicated for BP, which has more exposure to Russia and is a significant shareholder in Rosneft.

US oil companies are also leading the charge higher ahead of the US open today, with Marathon Oil trading up 4.8%, Occidental Petroleum up 3.8%, Chevron up 3.3% and Devon Energy trading 3.6% higher.

Mining stocks

The threat of supply disruptions has also sent the price of other commodities surging higher today, bringing mining companies onto the radar that will benefit from any rise in prices.

Gold, which provides a safe haven for investor’s cash during uncertain times, has pushed higher today and this has fed through to producers. Fresnillo (+7.6%) was one of just five companies trading higher today within the FTSE 100, while Hochschild Mining (+11%) was leading the push higher in the FTSE 250 alongside Centamin (+4.6%).

Semiconductor and tech stocks

While tighter supply is good news for some, it is bad news for the end markets that rely on commodities to create the technology we all rely on.

The crisis could exacerbate the shortage in chips that has plagued tech stocks over the past couple of years. Reports suggested this morning that Ukraine supplies over 90% of semiconductor-grade neon gas to US firms that is key for the chipmaking process. Fortunately, tech companies have been stockpiling due to existing shortages of materials and components and have made efforts to diversify their supplies already.

The crisis could push up costs in a market that is already seeing prices spiral higher thanks to inflation and supply chain disruption. AMD and NVIDIA are both down over 5% this morning and other tech stocks that also rely on chips are on the radar, with Apple down 4% before the bell and Tesla down 7.8%.

Defence stocks

Defence stocks are faring better than the wider market today as investors bet heightened geopolitical tensions will increase demand for their products and services.

In the UK, BAE Systems (+5.4%) is trading higher today, although this is also thanks to better-than-expected results that were released this morning.

Defence outfit Northrop Grumman is trading 3.8% higher in US premarket trade today, while Lockheed Martin is up 2.7% and Raytheon is trading 2.2% higher.

Stocks operating in Russia and Ukraine

Companies that are based in Russia or Ukraine or that have significant exposure to either country are understandably being shunned by markets today over fears the crisis and the introduction of sanctions could significantly disrupt operations.

In the UK, Russian miner Polymetal (-41%) and steelmaker Evraz (-30%) are the two biggest fallers in the FTSE 100 today while Ukrainian iron ore producer Ferrexpo (-32%) and Russian gold miner Petropavlovsk (-28%) are atop the loser board in the FTSE 250.

How to trade stocks

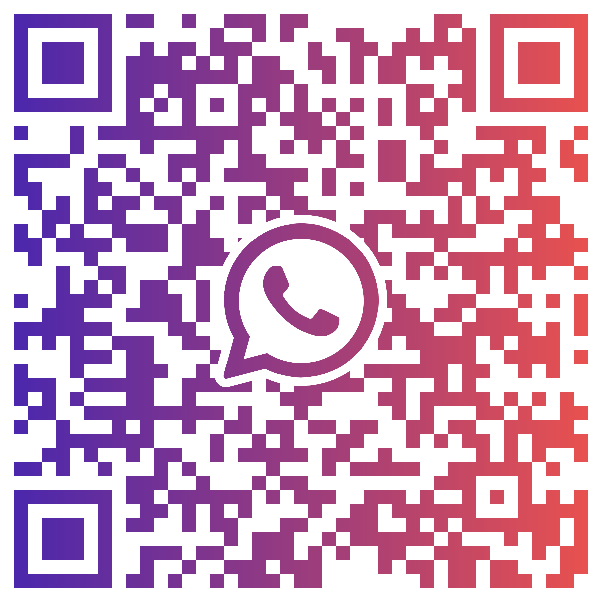

You can trade all these top stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock you want in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can try out your trading strategy risk-free by signing up for our Demo Trading Account.