- Nasdaq analysis: After last year's rate-cut euphoria, investors question stocks' rapid ascent

- Retail sales top expectations, increasingly likelihood of rate-cut delay

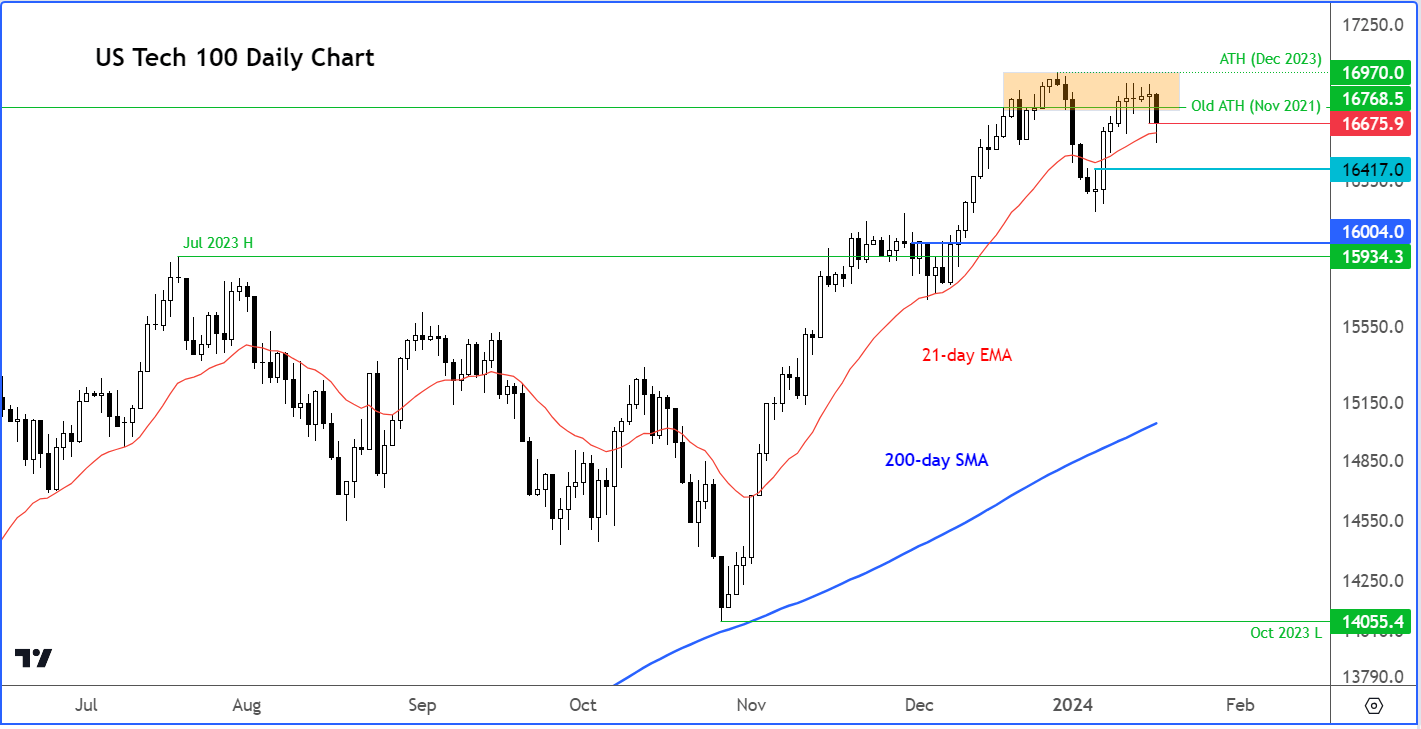

- Nasdaq 100 technical analysis shows index hitting into resistance

In the wake of the dovish rate-cut euphoria that had propelled stocks to record highs at the close of the previous year, many investors are now left wondering whether they pushed stocks too high, too soon.

Video Nasdaq analysis: Fed push-back weighing on major indices

US stock indices bounced off their lows once cash markets opened, but the selling pressure is likely to resume without a fundamental change in the current macro backdrop. Earlier, Asia Pacific markets and European indices tumbled, causing US futures to fall sharply, as global indices extended their losses from the previous session. For Chinese markets, it was just more of the same, where every recovery attempt has proven to be futile for months owing to concerns about the health of the world’s second largest economy, with the latest retail sales and GDP data disappointing expectations. As well as concerns over China, there are fears that major central banks around the world will not be in a rush to cut interest rates after all. Today, the ECB President suggested that borrowing costs could come down in the summer rather than spring. In the UK, the FTSE plunged as CPI rose to 4%, its first rise in 10 months.

In the US, the markets have been soaring in recent months because of expectations over the Fed rate cuts in 2024. But the rally has stalled in recent days, amid renewed concerns over the Federal Reserve's potential inclination to maintain higher interest rates for an extended period beyond market expectations.

Risk sentiment was dampened following comments by Federal Reserve governor Christopher Waller. While acknowledging the positive trajectory of inflation, Waller suggested a measured approach, cautioning against any haste in considering near-term rate cuts. He highlighted the resilience of the US economy, and downplayed expectations of an imminent reduction in interest rates as a result.

Retail sales top expectations

Judging by latest macro data from the US, you can understand why the Fed is cautious. Waller's remarks came before the release of December's US retail sales data, which surpassed expectations with a month-on-month increase of 0.6% vs. 0.4% expected. Sales showed improvement from November's 0.3% print.

We also had better-than-expected readings in today’s other data releases including industrial production and NAHB Housing Market Index.

The robust retail performance underscores the strength of the US consumer, defying concerns associated with interest rates at a 22-year high. It further supports the view that the US economy is poised for a soft landing, aligning with the Federal Reserve's less dovish stance.

Looking ahead, the market awaits insights from additional Fed speakers scheduled for today, including New York Federal Reserve President John Williams. Any comments pertaining to the outlook for inflation or interest rates are poised to exert significant influence on market sentiment and shape the trajectory of trading activity in the coming sessions.

Nasdaq analysis: Key levels to watch

Source: TradingView.com

The Nasdaq formed several doji candles in recent days as it closed in on the December’s record high at 16970, suggesting heightened indecision by market participants. Incidentally, December’s record was set just a spitting distance from the previous record in November 2021 at 16768. Therefore, the area between these two levels, marks a key resistance zone. The bulls will need to see a daily close above this 16768-16970 area to tip the balance back in their favour. The bears will be desperate to defend their ground here, although they must still create a distinct reversal pattern to bring out the bears en masse and chase away the bulls. The next potential support below Tuesday’s low of 16675 is seen around 16417.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade