US futures

Dow futures +0.12% at 34528

S&P futures +0.3% at 4420

Nasdaq futures +0.75% at 15040

In Europe

FTSE +0.50% at 7296

Dax +1.1% at 15765

- Tech stocks lead the gains

- Zoom & Lowe’s earnings impress

- USD recovers earlier losses

- Oil holds steady ahead of API inventory data

Tech stocks lead the gains, again

US stocks are set to open higher, with tech stocks once again leading the way as Nvidia earning optimism drives futures higher, and a tick lower in treasury yields added support.

After steep losses last week on worries over higher interest rates for longer, stocks are heading higher, extending gains from Monday. With little change to the fundamentals picture, the improved market mood appears to be stemming from optimism surrounding Nvidia’s earnings tomorrow. The stock rallied 9% in the previous session and is expected to advance further on the open.

Other tech stocks have been benefitting from the uplift in Nvidia. Tesla booked its biggest one-day gain yesterday.

Meanwhile, the US 10-year treasury bond yield slipped off yesterday’s 16-year high of 3.35%. The recent selloff in the bond market, which drove yields higher, was driven by bets that the Fed will lift interest rates higher for longer after hawkish FOMC minutes and data showing persistent strength in the US economy.

The market is still pricing in a pause in rate hikes in September, but the probability of a rate hike in November has risen to almost 39%.

Corporate news

Lowe’s rises after sticking by its full-year outlook. The DIY retailer beat EPS forecasts at $4.56 vs. $4.49 expected. However, revenue missed forecasts at $24.96 billion against $24.99 billion expected.

Macy’s is falling after the department store chain posted a drop in quarterly profit owing to heavy discounting and promotions to clear spring and summer merchandise.

Zoom posted Q3 results above expectations thanks to the business enterprise unit. This is a positive sign for the company as it attempts to recover following a post-pandemic slowdown and great competition.

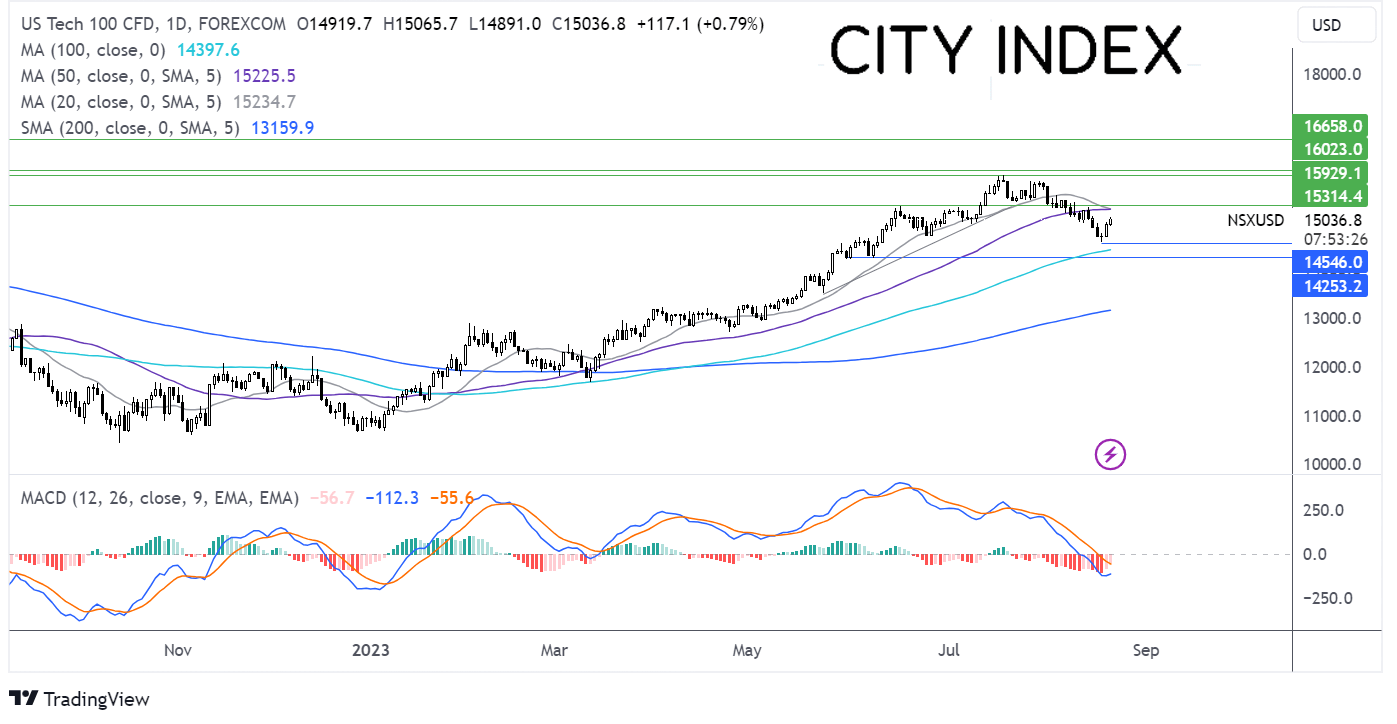

Nasdaq 100 forecast – technical analysis

After finding support at 14550, the Nasdaq 100 is attempting to push higher. The long lower wick on Friday’s candle, combined with the receding bearish bias on the MACD keep buyers hopeful of further upside. Buyers could look for a rise above 15200 – 15300 zone, which is the confluence of the 20 sma, the 50 sma, the June high and the March 2022 high. Meanwhile, sellers could be encouraged by the 20 sma crossing below the 50 sma. Sellers need to take out support at 14550 to expose the 100 sma at 14400. A break below here could be significant, given that the index has traded above the 100 sma since mid-January.

FX markets – USD recovers, EUR falls

The USD has risen off session lows and is trading flat ahead of the US open despite treasury yields ticking lower, and the upbeat market mood. Fed speakers will be in focus later in the session.

EURUSD is falling back below 1.09, paring earlier gains. The eurozone's current account surplus surged again in June amid higher goods exports and lower imports. The June current account balance was €35.8 billion versus €9.1 billion in May.

GBPUSD is holding steady above 1.2750 in relatively quiet trade. The pound remains supported by expectations that the BoE will continue to hike interest rates. UK data showed that the government borrowed less than expected in July at £4.3 billion, but debt interest payments hit a record high.

EUR/USD +0.28% at 1.0904

GBP/USD +0.05% at 1.2769

Oil holds steady ahead of API inventory data

Oil prices are holding steady, largely unchanged, as investors continue to weigh up concerns over China, higher interest rates, and the impact of supply cuts.

China’s oil imports from Saudi Arabia and Russia rebounded in August after declines in July. However, there are questions over whether the recovery is sustainable given the sluggish economic growth outlook in China as the post-Covid rebound stalls.

Meanwhile, the Fed could keep interest rates higher for longer, which could also hurt the demand outlook.

The deteriorating demand outlook is being matched by tighter supply expectations as OPEC+ countries Russia and Saudi Arabia cut production.

API crude oil inventory data is due later and is expected to show that inventories fell last week.

WTI crude trades -0.4% at $79.70

Brent trades -0.44% at $83.80

Looking ahead

21:30 API oil inventories