Hong Kong Exchange (388.HK) Eyes on Further Upside After Taking a Short Break

Hong Kong Exchange (388.HK) is outperforming Hong Kong's Hang Seng Index. The company rose around 45% from March low, while the Hang Index was up only up about 13%. Hong Kong Exchange is benefited by the returning of Chinese listed companies from the U.S. market

In fact, Chinese companies are interested to kick off its secondary listing planning in Hong Kong Exchange as the U.S. Senate passed legislation that could restrict Chinese companies from listing on American exchanges or raise money from U.S. investors, unless they abide by Washington's regulatory and audit standards.

Recently, Rumors said Nasdaq-listed Yum China, operating famous catering brands in China, such as KFC and Pizza Hut, will launch the secondary list in Hong Kong Exchange to raise $2billion, reported Bloomberg citing Insider.

Besides, CICC lifted HKEX's target prices by 8% to HK$343 with the rate at Outperform. In addition, CICC also said the broker attributed this to quicker-than-expected listing of Chinese ADRs in Hong Kong and upcoming launches of new products.

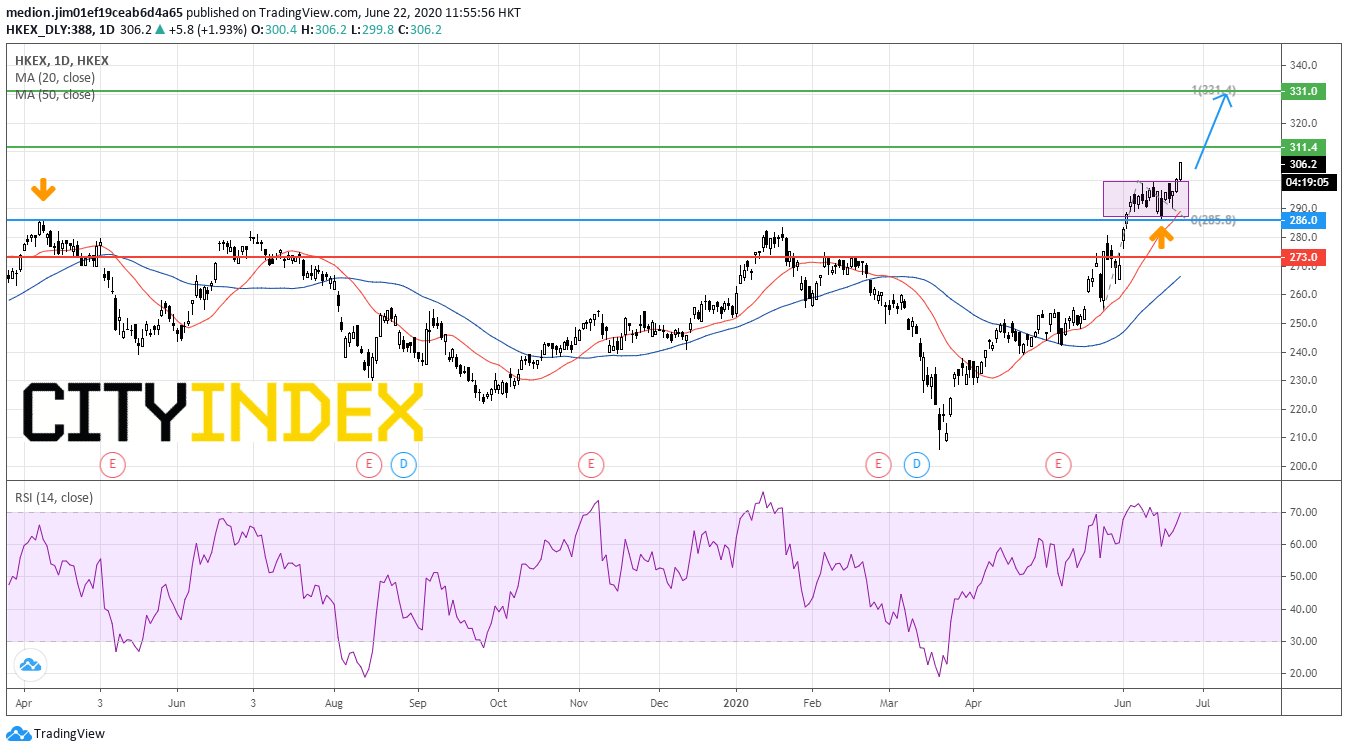

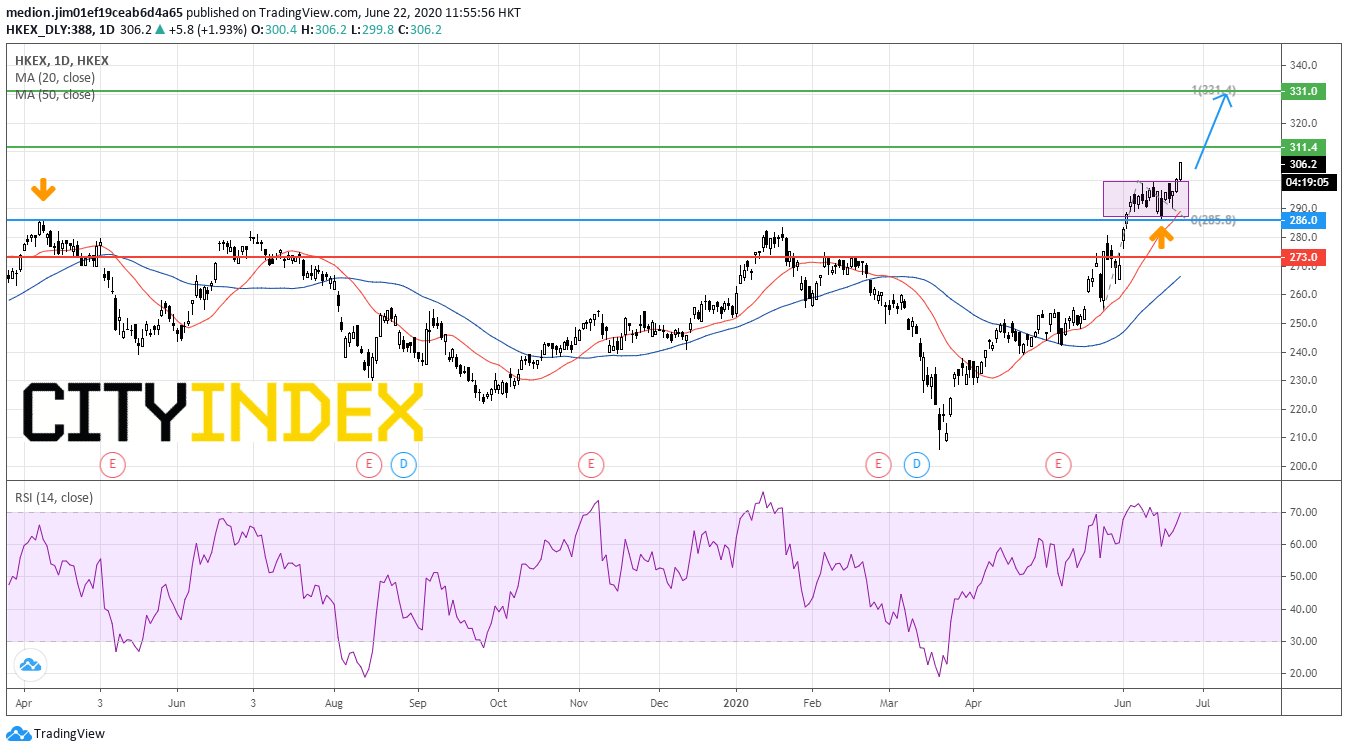

From a technical point of view, the stock broke above the recent consolidation zone on the daily chart. It indicates the resumption of the recent up trend. Besides, the lower Boundary of consolidation zone is above the 2019 high at HK$286, indicating that the stock has successfully broken this strong resistance level.

Besides, the rising 20-day moving average is pushing the prices higher. It would be good to use the 20-day moving average as trailing support level.

Bullish Readers could set the key support level at HK$286 (around the 20-day moving average and overlapping support level), while resistance levels would be located at HK$311.40 (record high) and HK$331 (100% measured move).

Source: GAIN Capital, TradingView

In fact, Chinese companies are interested to kick off its secondary listing planning in Hong Kong Exchange as the U.S. Senate passed legislation that could restrict Chinese companies from listing on American exchanges or raise money from U.S. investors, unless they abide by Washington's regulatory and audit standards.

Recently, Rumors said Nasdaq-listed Yum China, operating famous catering brands in China, such as KFC and Pizza Hut, will launch the secondary list in Hong Kong Exchange to raise $2billion, reported Bloomberg citing Insider.

Besides, CICC lifted HKEX's target prices by 8% to HK$343 with the rate at Outperform. In addition, CICC also said the broker attributed this to quicker-than-expected listing of Chinese ADRs in Hong Kong and upcoming launches of new products.

From a technical point of view, the stock broke above the recent consolidation zone on the daily chart. It indicates the resumption of the recent up trend. Besides, the lower Boundary of consolidation zone is above the 2019 high at HK$286, indicating that the stock has successfully broken this strong resistance level.

Besides, the rising 20-day moving average is pushing the prices higher. It would be good to use the 20-day moving average as trailing support level.

Bullish Readers could set the key support level at HK$286 (around the 20-day moving average and overlapping support level), while resistance levels would be located at HK$311.40 (record high) and HK$331 (100% measured move).

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM