- EUR/AUD is trading near its 200DMA and uptrend support, providing decent risk-reward for traders depending on how the price evolves.

- Upside momentum has been waning with the pair reversing hard late last week

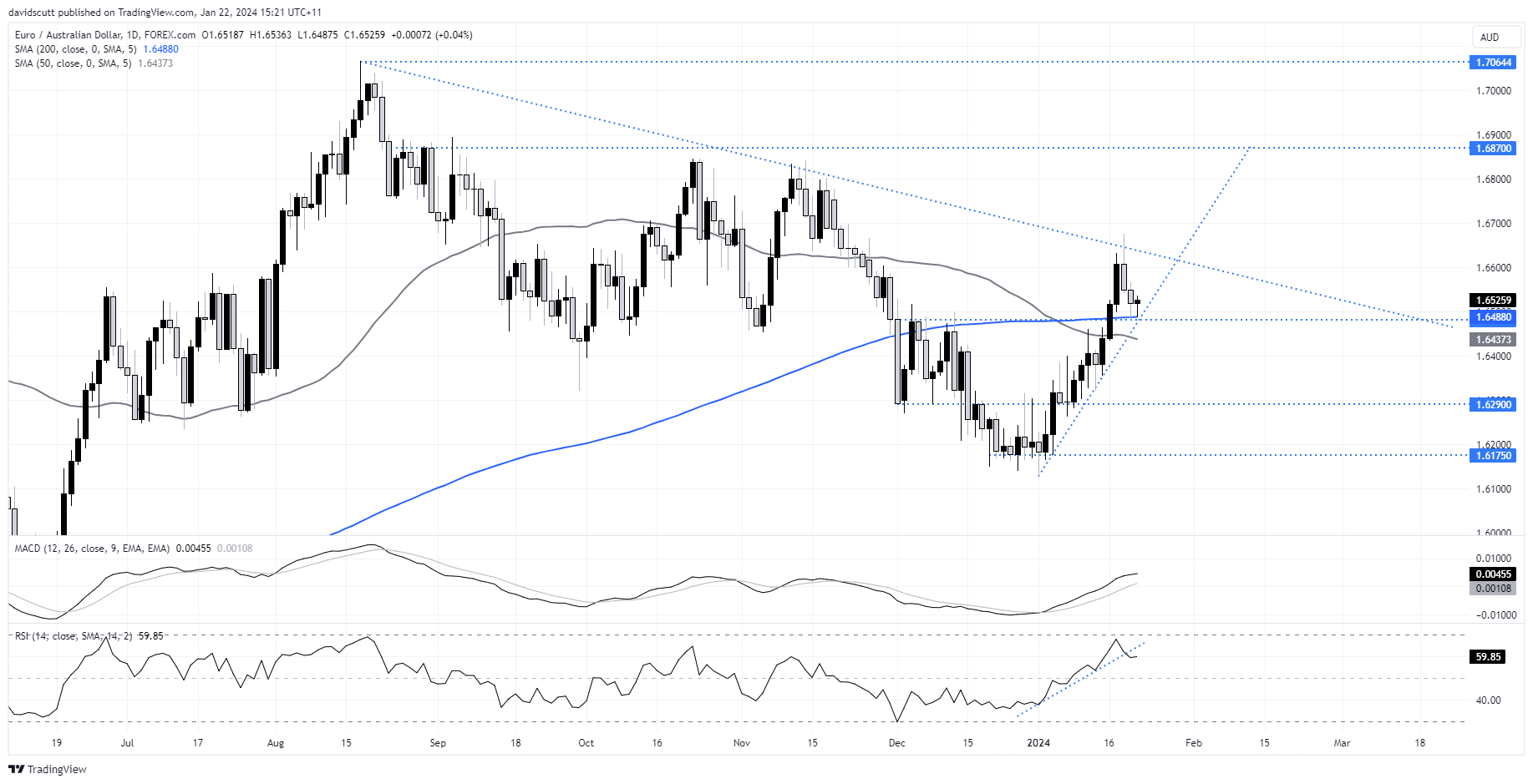

The proximity of EUR/AUD to its 200-day moving average and uptrend support presents an opportunity for traders to position for either a bounce or break from this technical juncture, providing favourable risk-reward depending on which way the price moves.

EUR/AUD 200DMA provides a level to build a trade around

Having rallied earlier in the year on a stronger US dollar and higher US bond yields, a scenario the AUD typically struggles to combat more than EUR, the pair was rejected at downtrend resistance on Thursday last week following the release of Australia’s unusually weak December jobs report. The subsequent reversal has seen EUR/AUD retest its 200DMA, a level it has respected on most occasions dating back to early 2022.

The reversal, coinciding with RSI breaking its uptrend from the beginning of the year, suggests upside momentum is flagging. However, with intersection of the 200DMA and uptrend support holding firm, there’s no guarantee we’ll see a deeper pullback than that already seen. It may only be early days for the latest daily candle, but the early signs only act to underline that point.

On the upside, downtrend resistance is found around 1.6640, allowing those considering longs to place a stop below the 200DMA, providing a decent risk-reward setup. Alternatively, a break of the 200DMA may be even more appealing for those considering shorts with only the 50DMA standing in the way of a potential retest of 1.6290, a level that previously acted as resistance support over the past two months. A stop above the 200DMA would provide protection against a reversal.

As for fundamentals considerations, I detailed why the risk environment may remain favourable this week in an earlier post.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade