Key takeaways

- Major cryptoassets like Bitcoin and Ethereum may have seen their lows for this cycle last year.

- Regulatory and macroeconomic risks may still lead to a short-term pullback.

- Ethereum’s contracting supply, even in the depths of a crypto winter, bodes well for relative outperformance vs. Bitcoin.

If you haven’t been watching closely, you may be surprised to hear that major cryptoassets like Bitcoin and Ethereum are up by nearly 50% from their FTX-implosion lows set a little over three months ago.

The strong price action in major cryptoassets has some enthusiasts questioning whether we’ve seen the end of the so-called “crypto winter,” paving the way for the next big bull market. The answer to that question is nuanced, but there is certainly a compelling case that the worst of the winter is behind us, though crypto traders shouldn’t necessarily be donning their tank tops, swim trunks, and sunglasses quite yet!

The collapses of a dozen+ major crypto companies amidst a widespread deleveraging in the space led to arguably the worst “forced selling” of cryptoassets that the asset class has seen in its brief existence. From that perspective, it’s looking increasingly likely that the troughs we saw in Bitcoin and Ethereum last year may mark the lows for this cycle.

However, as the recent turmoil at crypto bank Silvergate has shown, the space is far from out of the woods, and the biggest risk to monitor is the potential for draconian regulations in the US and Europe. After the politically well-connected former CEO of FTX, Sam Bankman-Fried, fell from grace late last year, US policymakers are more skeptical than ever toward crypto. The potential collapse of crypto’s largest bank could raise fears that crypto volatility will spill over into the traditional banking system.

The other major risk for cryptoassets relates to the macroeconomic environment. With inflation and labor markets across the developed world proving more resilient than anticipated, it’s likely that central banks will have to raise interest rates more aggressively, and leave them at an elevated level for longer, than previously expected. Higher interest rates provide a more compelling alternative investment and represent a headwind for more speculative markets, like cryptoassets.

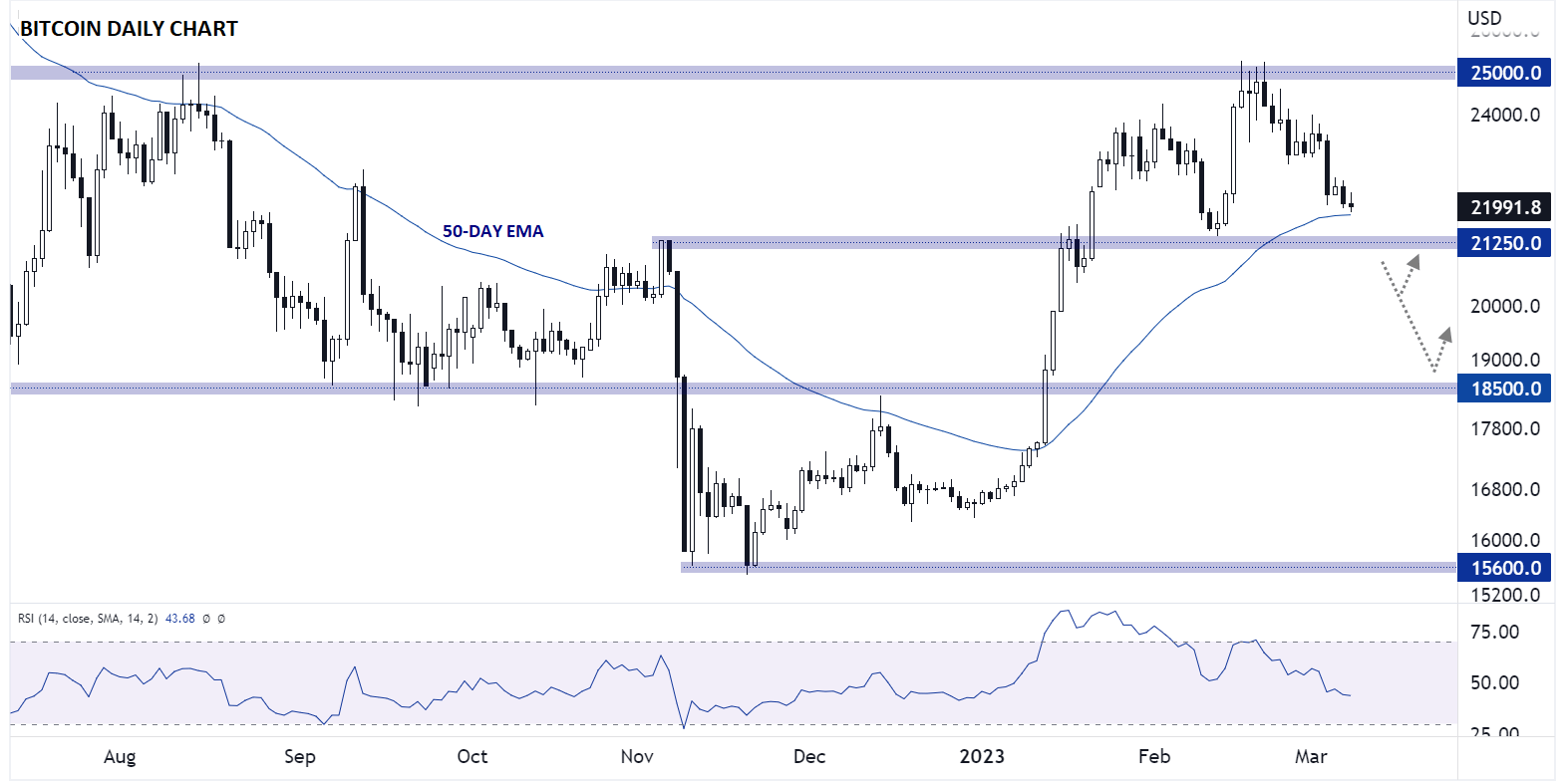

Bitcoin technical analysis

As the chart below shows, the world’s oldest cryptocurrency once again stalled out at previous resistance at $25K last month. Given the aforementioned risks, a dip back toward previous-resistance-turned-support at 21,250 looks relatively likely, and move down toward the psychologically significant $20K level or even $18,500 cannot be ruled out. As it stands though, long-term “hodlers” are likely to scoop up any dips toward last year’s lows as a potential “higher low” forms.

Source: StoneX, TradingView

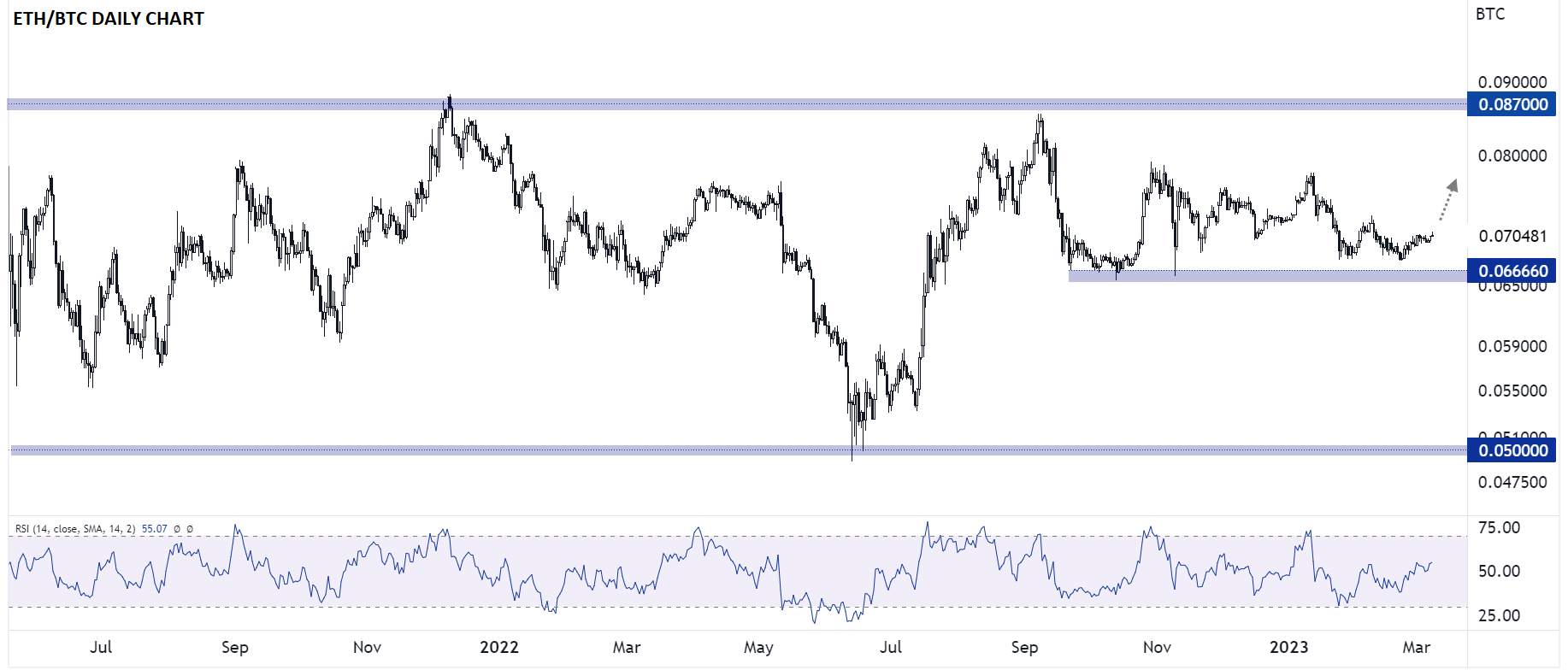

Ethereum technical analysis

Looking at the world’s second largest cryptoasset, one narrative to watch in the coming months is the deflationary supply of Ethereum. Thanks to the transition to proof-of-stake and EIP-1559 “burning” a portion of the gas used for transactions, the total supply of ETH has been declining at a -0.4%/year rate, even in the depths of the crypto winter; this rate could well accelerate toward -1 or -2%/year in the next bull market. To put it simply, while the supply of Bitcoin will continue to increase until 2140, when we’re all dead, the supply of Ethereum already hit its maximum supply last year (assuming a baseline level of network usage).

That dynamic could bode well for a potential “flippening” in the next cycle. Looking at the ETH/BTC chart, the prices of the two largest cryptoassets have been relatively flat compared to one another for nearly two years. A rally back toward 0.087 in this ratio and an eventual break above that level could portend a period of outperformance in Ethereum.

Source: StoneX, TradingView

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX