*This article is part of our 2022 Global Market Outlook collection, where we highlight the key themes, trends, and levels to watch on our most traded products. We’ll be publishing these reports to our pages from December 13-20, so please visit the official 2022 Outlook hub page to see the whole collection!

More correlated assets and further Westernized Cryptos:

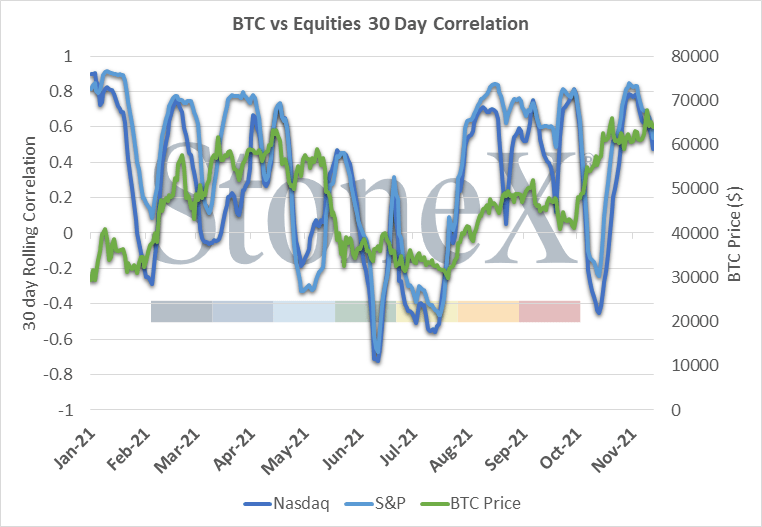

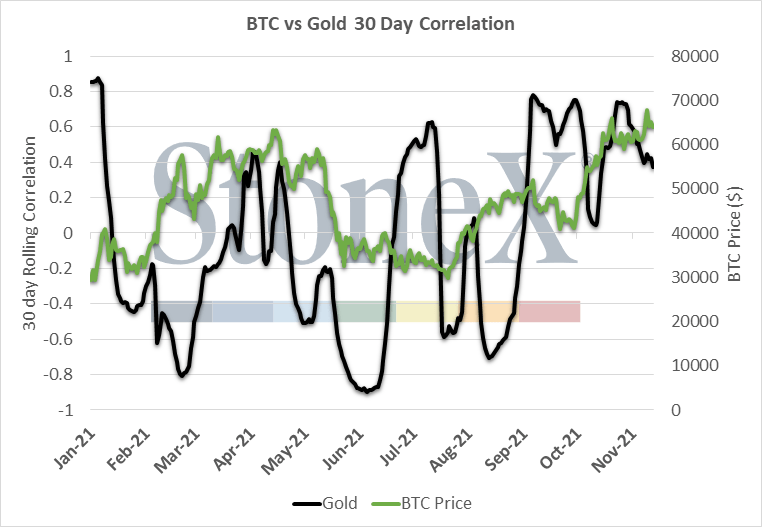

Many Crypto natives (including myself a while back) don’t appreciate, acknowledge, or admit the influential power the Macro environment has on Cryptocurrencies, but it is very important. All in all, Crypto is more of a capital asset rather than actual currencies; we have seen Cryptos maturing towards a genuine asset class, especially during this past year. It now has greater correlations with other major assets than before. This has also been reflected in the strong correlations between Bitcoin and AUD/JPY. The development of these correlations is critical as it reflects the integration of Bitcoin (and other cryptos) into the enlargement of portfolios. However, the more hawkish (monetary tightening) policy might result at least a short-term consolidation in all markets including Cryptos, while fear may occasionally lead to over-selling.

Source: Bloomberg Data & StoneX Visualization

Source: Bloomberg Data & StoneX Visualization

Source: Bloomberg

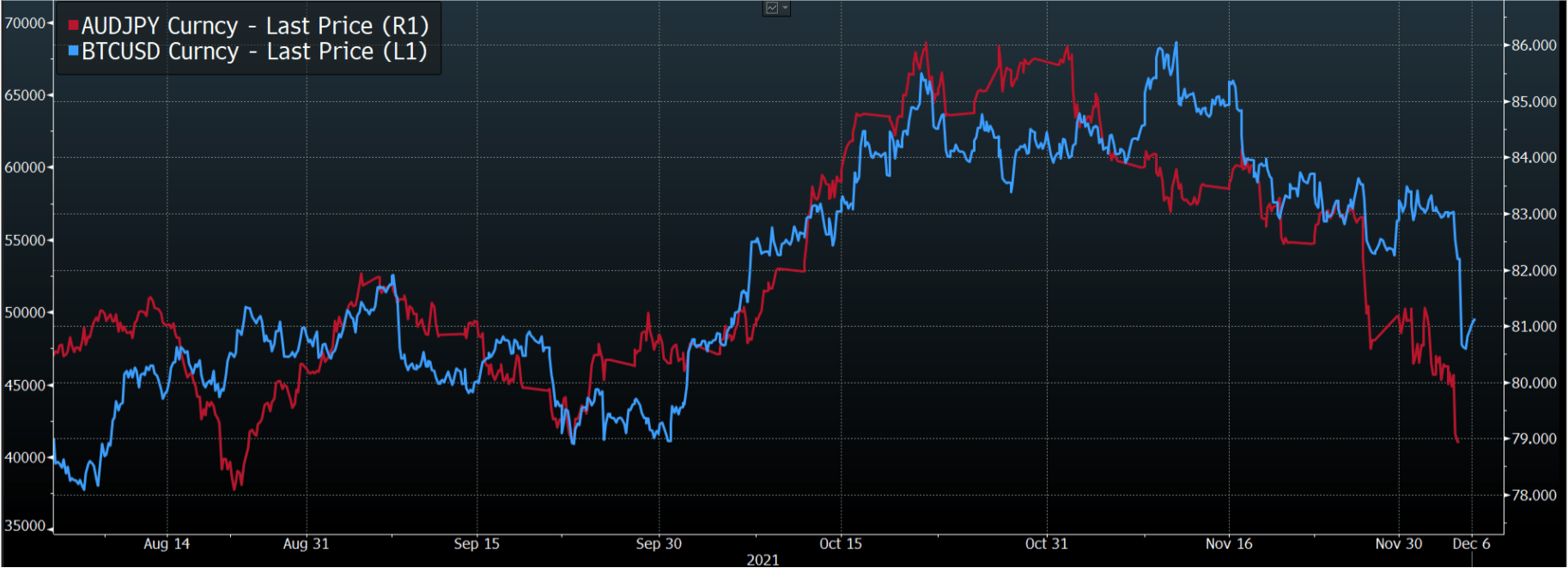

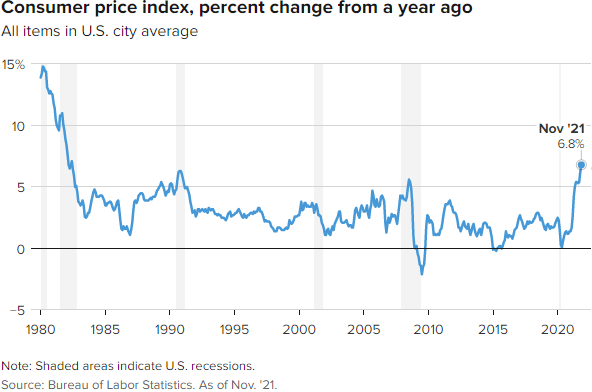

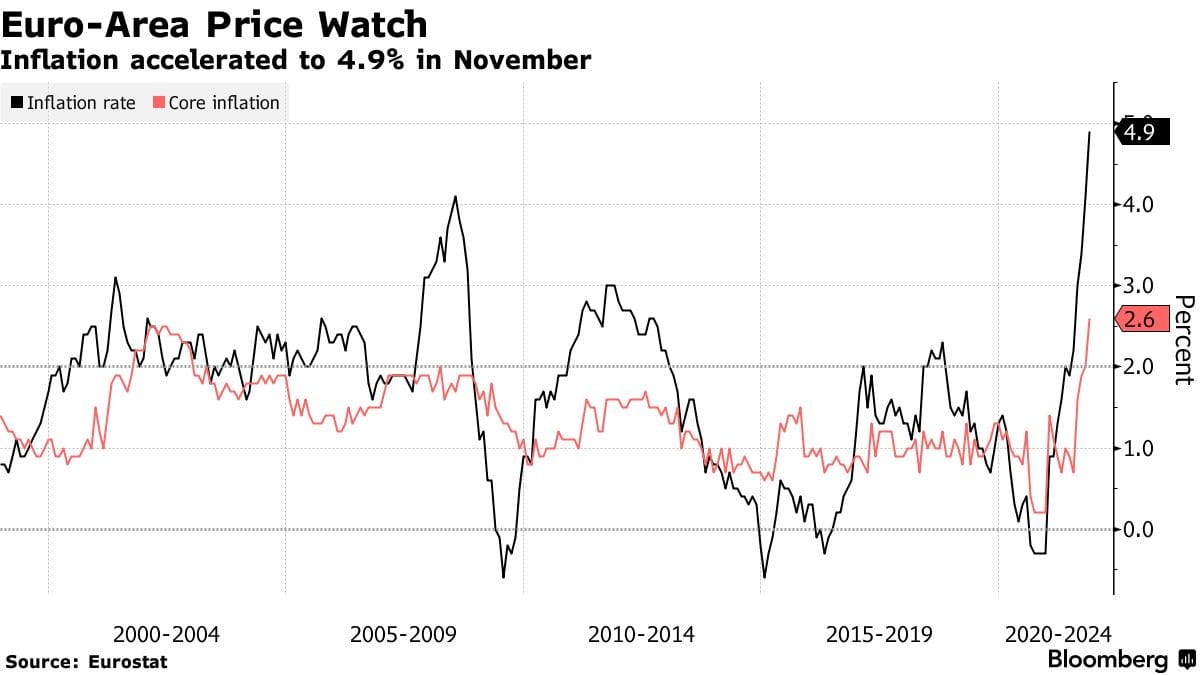

Covid is spreading around the globe, as is printed money and inflation. Both the U.S. and Europe are experiencing relatively extreme inflation – prices are rising at their highest level in several decades. The around and above 5% inflation rate will last for a while according to market estimates, prompting Fed Chairman Powell to drop the “transitory” label for inflation. While some politicians are still worried about Covid variants spreading and wanted to maintain economic stimulus, many are rushing to tighten policy, leading to a difficult decision for policymakers. For example, Europe still wants to maintain the stimulus for a while to help the economy despite the high inflation.

However, we will gain more clarity from U.S. Fed in upcoming FOMC meetings about the pace of tapering and timeline for raising interest rates most likely in mid-2022; that policy tightening could potentially dampen multiple assets. The rationale is that inflation is good for Bitcoin’s inflation hedge role, but inflation might eventually trigger a tightening in the macro policy environment that could limit money flow into all markets including Cryptos.

The focus globally continues to be the macro policies and economic recoveries post Covid, that could drive the Crypto market either way. Markets don’t like surprises, so if we see a quicker and larger than expected policy tightening, Crypto might then have downside risk. Though remember, when Bitcoin was invented after 2008 financial crisis, some believe its main purpose was to hedge for central authority failure. Thus, ongoing political divergence buys time for Crypto assets to reach this bull cycle’s parabolic top as many have wished, which may or may not happen. The key part to watch will be market access to institutional big money flow (U.S. spot ETFs, pension funds, institutional custody solutions, and broader trading registration licenses).

Source: BLS

Source: Eurostat, Bloomberg

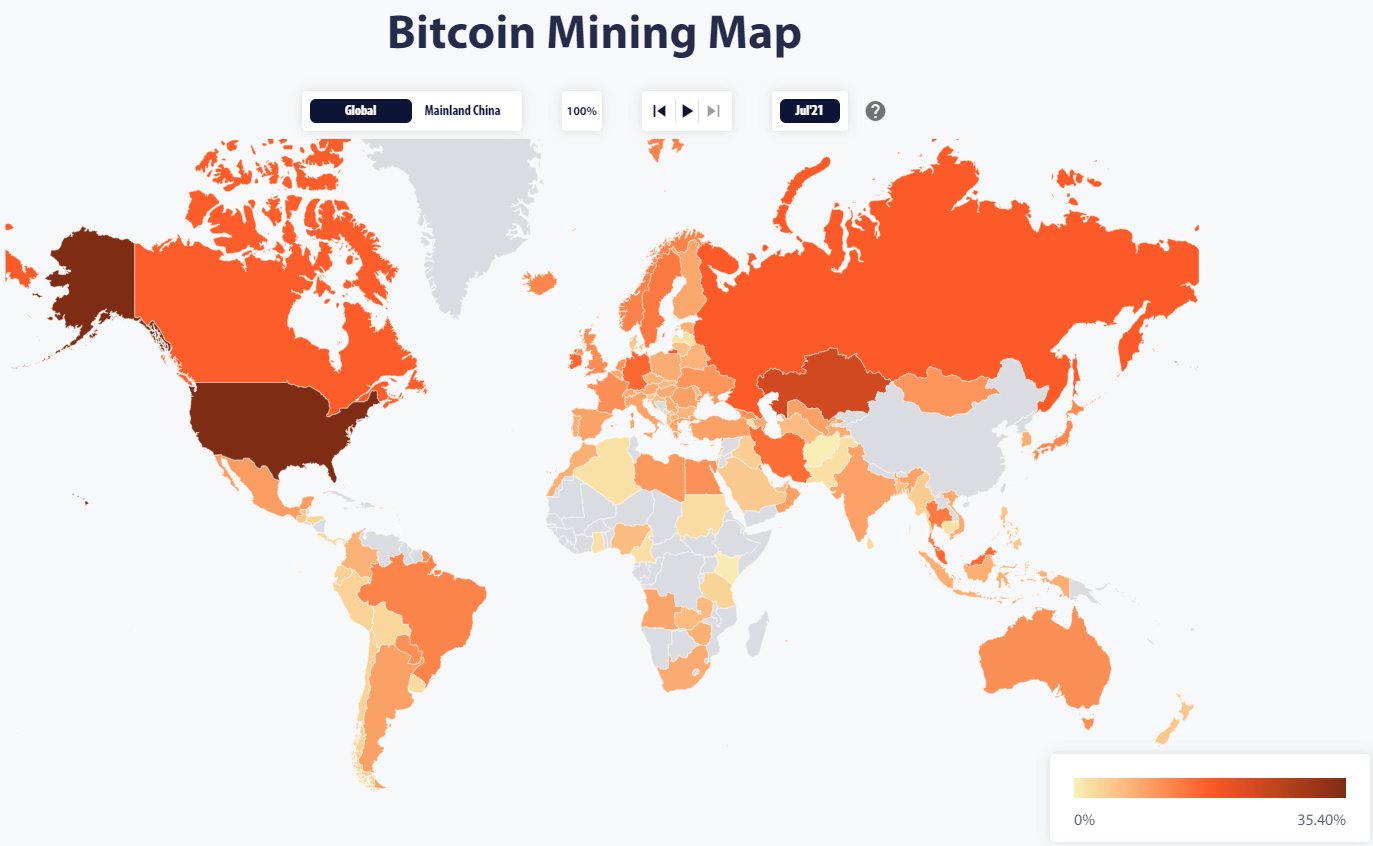

China’s global dominance in Bitcoin mining has gone down from 80% in 2017 to near 0% after its mining crackdown in May 2021, and the U.S. has become the largest bitcoin mining center as shown below. China has further shut down crypto trading and cleaned up all participants this year end. At the same time, India is banning Crypto payments, plus Binance (the largest Crypto exchange globally) has withdrawn its license application and shut down local operations in Singapore, which is used to be one of its largest presences.

Meanwhile, the U.S. Congress is actively organizing hearings to understand Crypto and related technology, to better embrace and regulate it. Thus, I like to use the term “cautiously embracing”, as the industry lobbyists’ vibe is that “If the U.S. doesn’t embrace it, then it will lose the opportunity to become the center of this innovation” seems to be gaining attention, though some doubt remains. The Crypto lobbyists and Bitcoin-friendly politicians, such as Commissioner Hester Peirce and Senator Cynthia Lummis, have been trying the best to educate regulatory leadership on how to learn and embrace Crypto. There are still some hurdles such as trading & holding transparency, occasional money laundering, scams and hacks that are preventing an expeditious lift from the Hill, but any major green light will pump the market and continue to boost the infrastructure development. The U.K. Financial Conduct Authority granted a major financial institution digital assets registration for custody and trade execution services, signaling the possibility of more open institutional access in U.K. market. I am expecting a more embracing but careful environment to continue to form in the Western countries through 2022 and beyond.

Source: Cambridge Centre for Alternative Finance

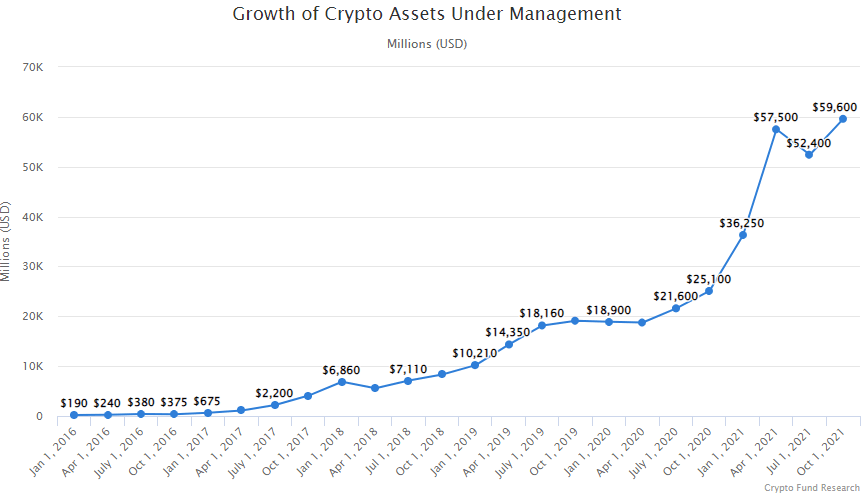

Maturing Crypto funds and potential institutional access:

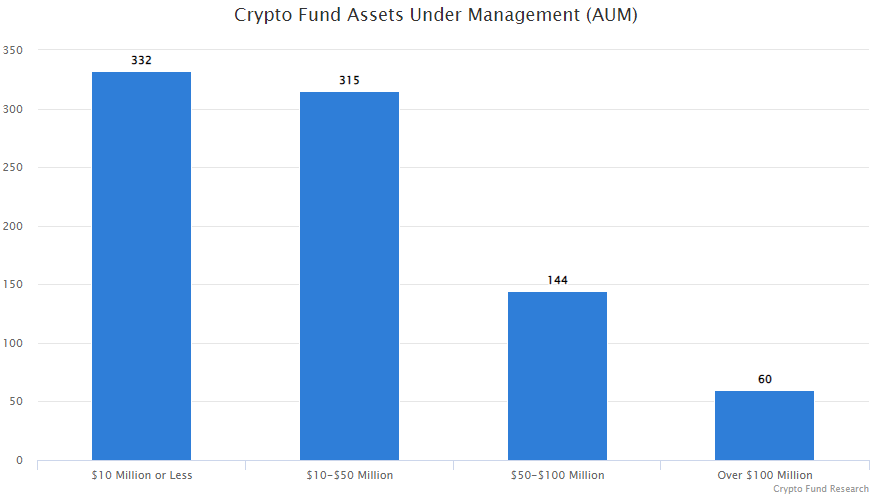

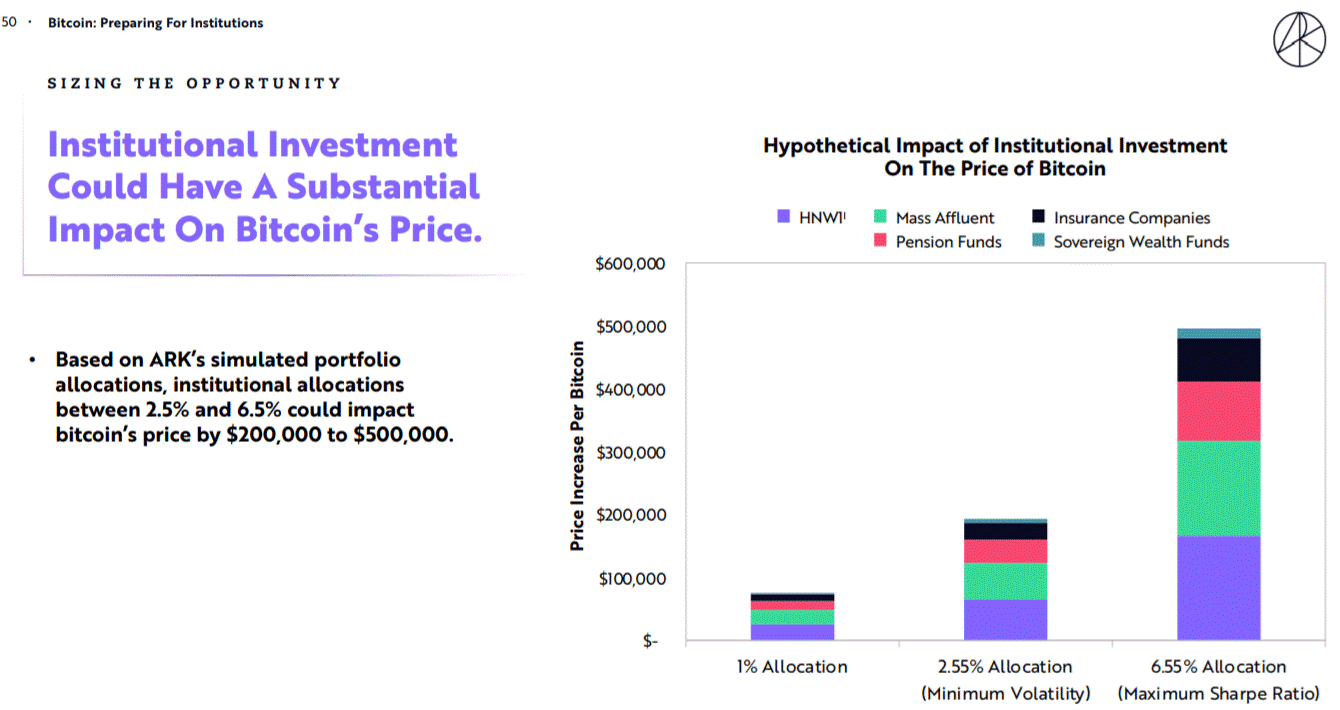

The Crypto funds have been growing and prospering at an accelerated rate since last summer after the Bitcoin reward halving, now nearing $60 Billion AUM with 60 of them over $100 Million. This indicates the improved maturity of the Crypto space with more funds to incubate the innovation toward real applications. Ark investment along with multiple other investors have forecasted Bitcoin to 4X or more off current prices in the next 4 years with the institutional access and exploratory participations. I personally don’t see it happening in 2022 as it will mean Crypto asset market cap could surpass gold’s $11 trillion market capitalization, especially given the potentially tightened monetary liquidity. But if Bitcoin’s digital gold reputation stands, it is a possibility to be seen in the next cycle, especially when more applications emerge.

Source: Crypto Fund Research

Source: Crypto Fund Research

Source: ARK

Trends and potential:

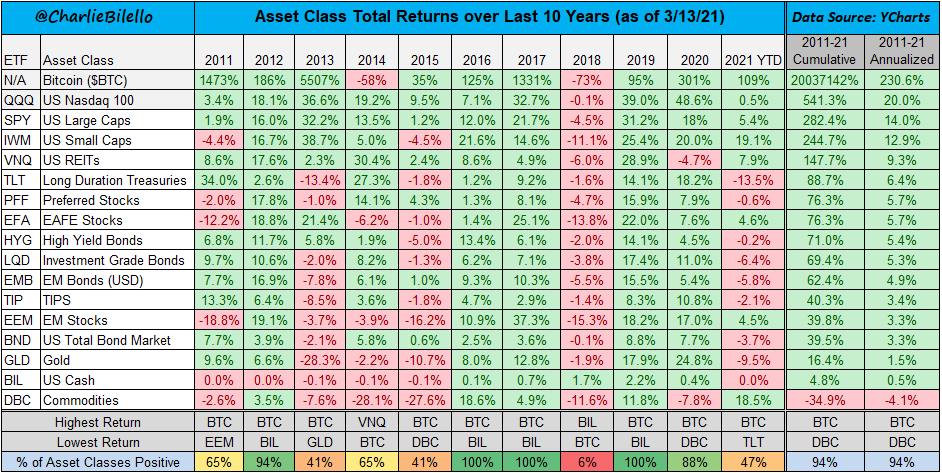

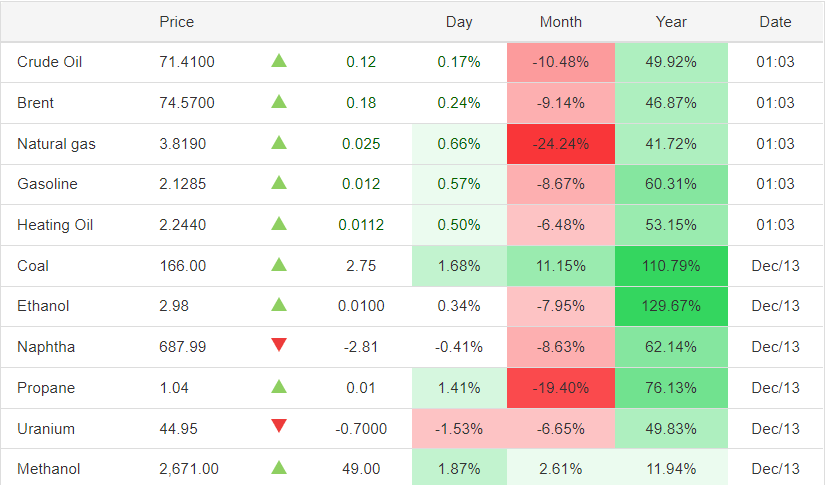

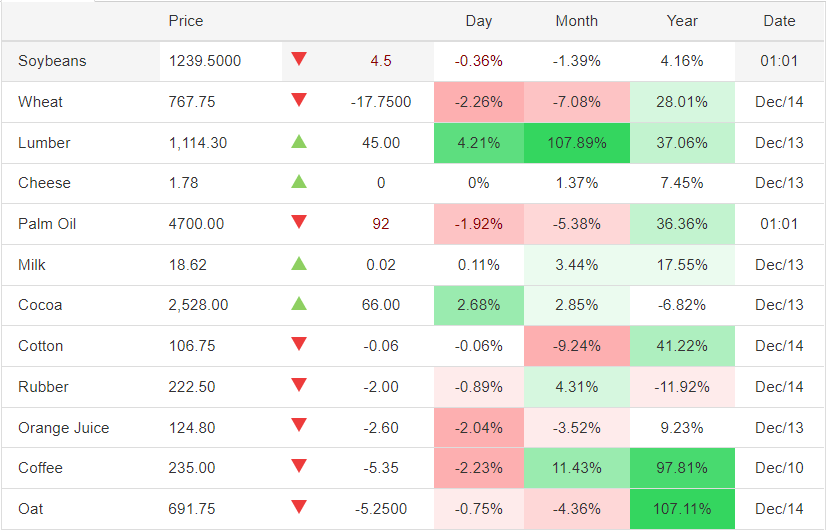

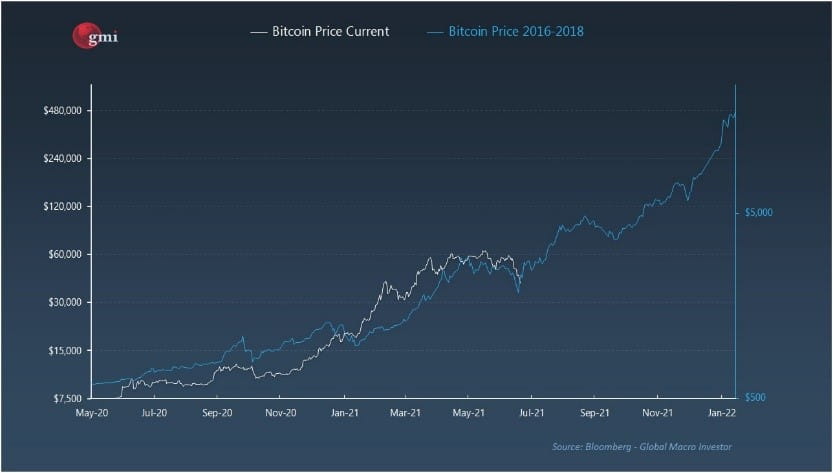

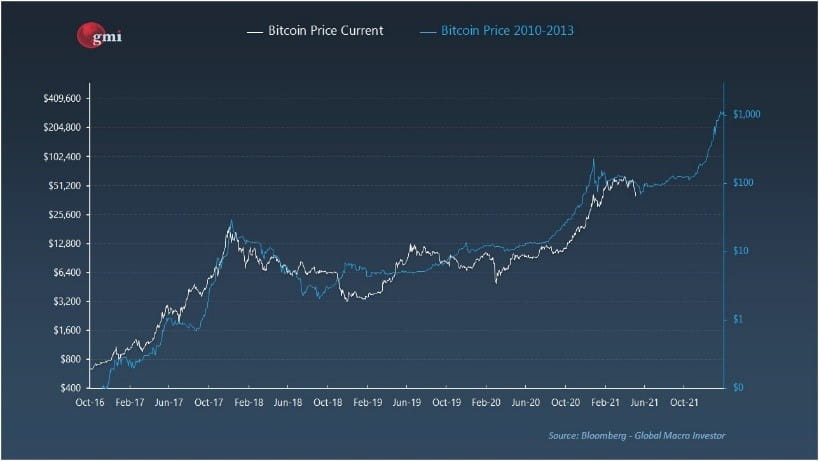

As amazing as the returns (20,000X) that Bitcoin has seen over the last 10 years are, this year it hasn’t been gaining as extreme returns as many models forecasted; Bitcoin has only nearly doubled, not even outperforming some traditional commodities. While not so satisfying, it means we might still have room to go, and the Bull is still here.

Ethereum on the other hand satisfied the investors with over 500% gain YTD, primarily due to the exponentially growing protocols and applications built on the Ethereum blockchain that require ETH to pay gas fees and for other activity usage. While smooth and easy to setup, Ethereum is plagued by its high network gas fees and scalability issues, losing market share to its competitors, including Solana, Avalanche, Terra, Cosmos, Polkadot, BSC and many other high performing blockchains that have been gaining momentum. Thus, a “Multichain Era” is probably the next phase to progress ahead. These other chains might not necessarily be Ethereum killers, but I envision them working together to improve the developer and user experience. Cross-blockchain bridge protocols are then crucial to these collaborations’ success.

Source: Charlie Bilello

Source: TradingEconomics.com

Source: TradingEconomics.com

Source: Bloomberg

Source: Bloomberg

Source: Twitter @TechDev_52

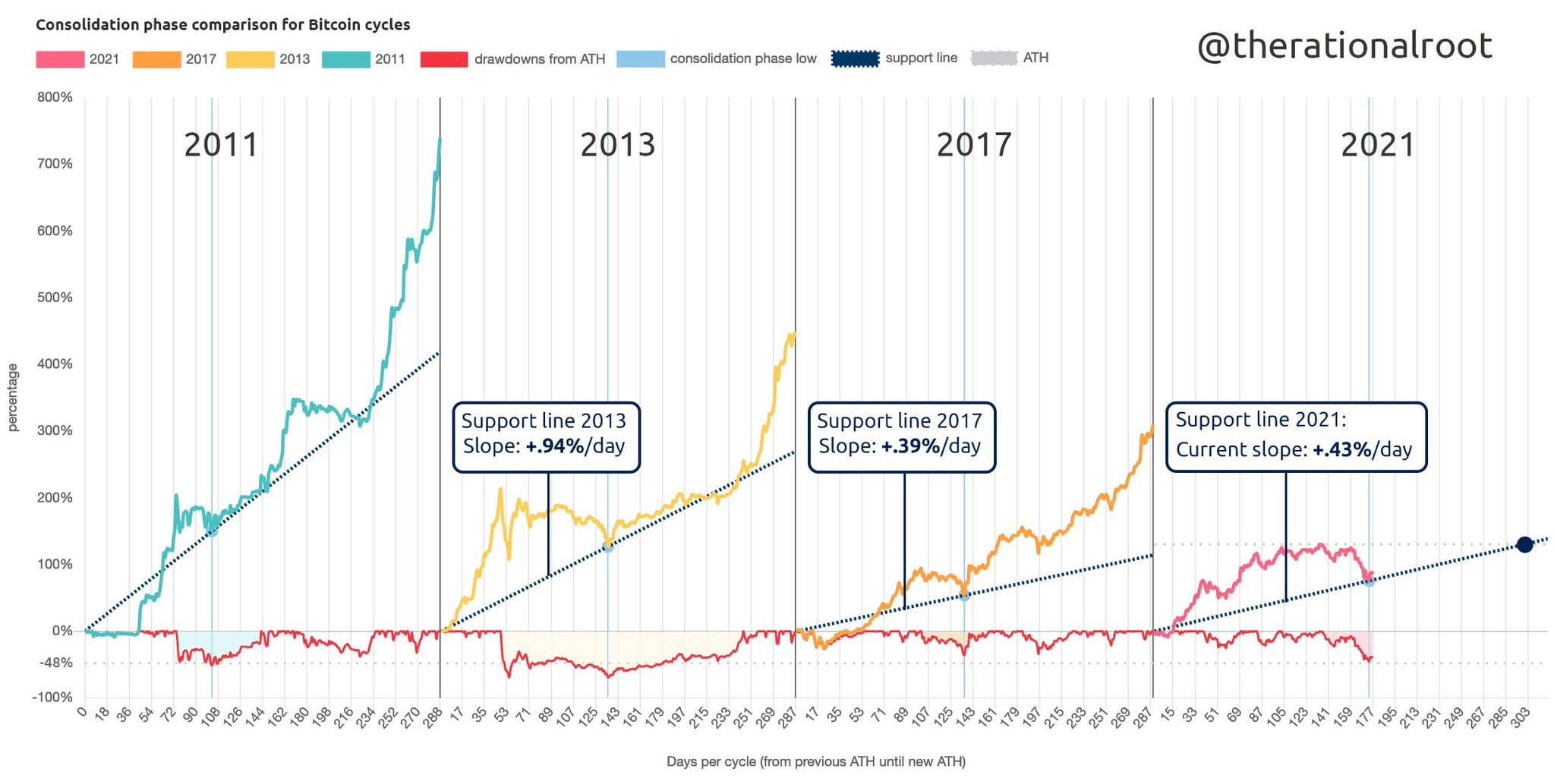

Decreasing marginal return and volatility in seasonality is due to more mature market structure. Recent technology upgrades are also very beneficial for the Bitcoin (Taproot) and Ethereum (ETH 2.0) networks to become mature and efficient. Besides, the other blockchains, protocols and applications have been making innovative progress that solidify the whole Crypto space.

Source: TheRationalRoot

This piece is a guest contribution to our 2022 Market Outlook from Youwei Yang, Director of Financial Analytics at the FCM division of StoneX Financial. Please visit the StoneX Market Intelligence portal and consider subscribing for more of Youwei and team’s research.