- Crude oil analysis: Macro environment for oil remains bullish

- Crude oil technical analysis: WTI rises towards $75 key level

- Bullish momentum is gathering pace, making oil less appealing for bears

Crude oil prices have bounced back to rise to a new high on the week, recovering impressively from a weak start to extend the winning streak to 5th session. The recovery comes after oil prices came noticeably off their highs from the day before, following a sizeable rally on the back of concerns over supply disruptions as the world’s biggest shipping companies diverted journeys away from the Red Sea.

Why did oil prices ease off highs on Monday?

Part of the reason why oil prices came off their highs on Monday is that traders were not quite sure how much of an impact Houthi rebels targeting ships travelling to Israel will have on oil prices, and whether the gains could last long. So, they were probably happy to book some profit, with the idea of going back in when prices dipped a little. Judging by today’s recovery, it looks like that dip was indeed bought back, keeping the recent bullish momentum alive.

The longer-term impact on oil prices of Houthis attacks on oil tankers through the red sea is a complicated one, but the attacks do have immediate repercussions: delay in delivery of crude and higher shipping costs. So, the oil price gains are justified. But it is very difficult to say how long the gains will last for or how much higher will prices go from here on, just on the back of this factor alone.

Crude oil analysis: Macro environment for oil remains bullish

Still, ignoring the Houthi attacks and despite concerns about demand, the overall macro environment for oil remains bullish anyway. Ongoing supply cuts from OPEC+ would have limited further downside for oil prices anyway. But with the increased supply costs due to oil tankers halting sails through the Red Sea strait, oil prices are finding immediate support as well. Recent remarks from Saudi Arabia's energy minister hint at potential extensions or deepening of supply cuts beyond Q1. Russia also expressed intentions to further reduce oil exports. Betting against the success of the OPEC+ seems unwise, as they are already significantly holding back supplies.

Meanwhile, oil prices are showing positive technical signals on the charts.

Crude oil technical analysis: WTI rises towards $75 key level

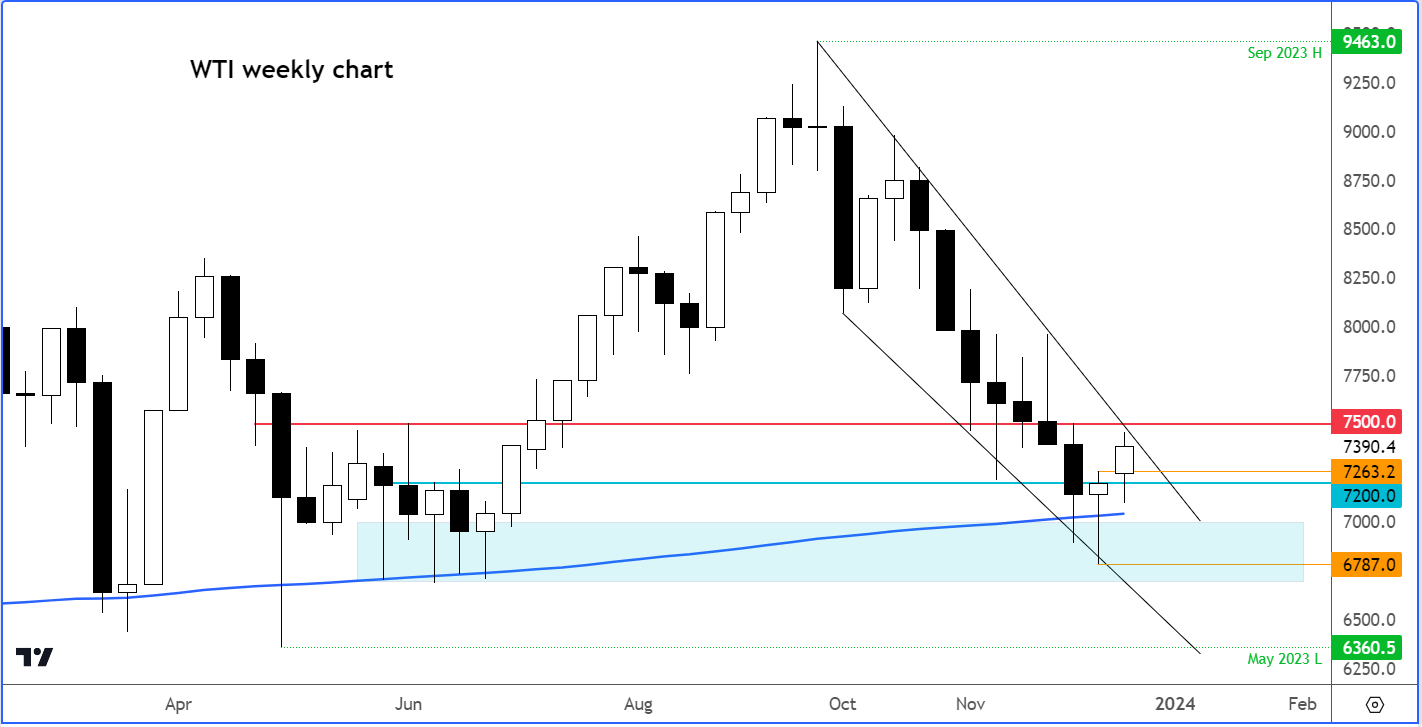

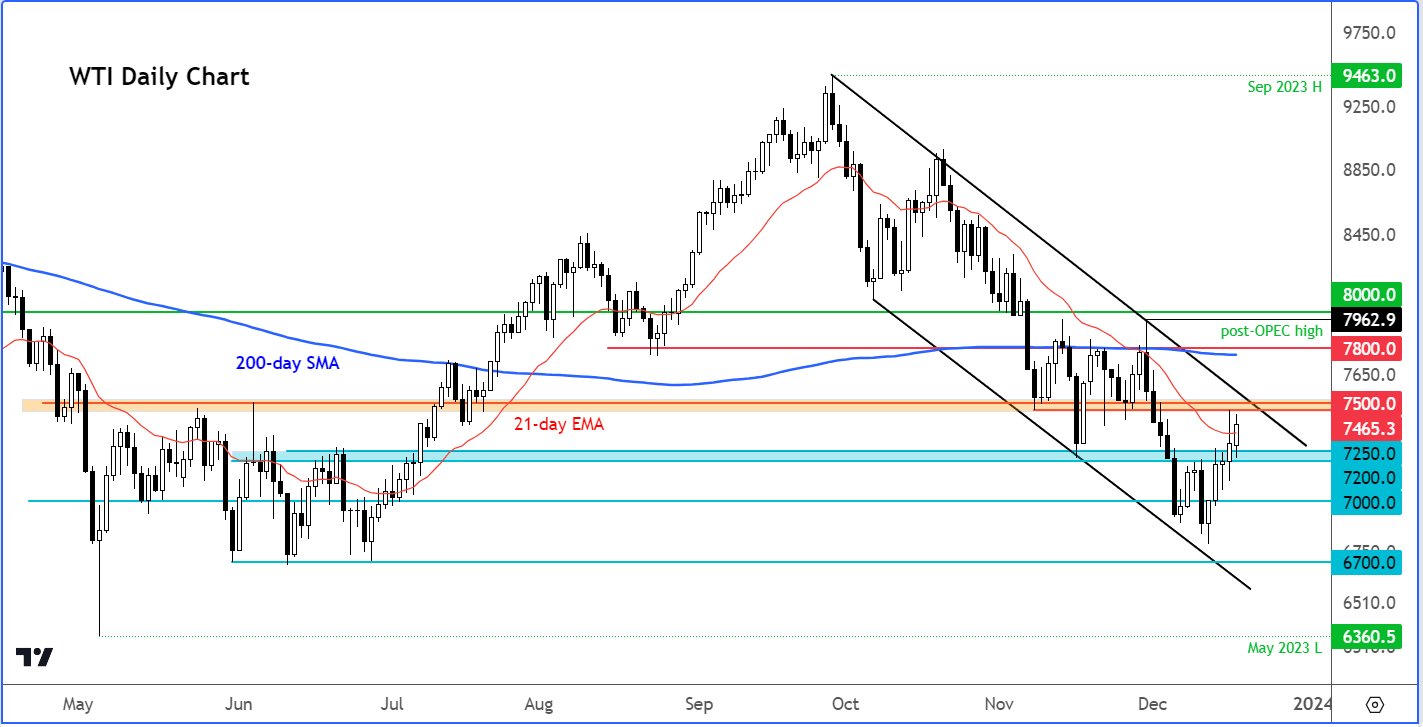

The primary feature on the weekly chart is the hammer candle that was formed last week, which was particularly significant as it was formed around the rising 200-week average. We have seen some upside follow-through which is always a good sign. Now, another ideal scenario for the bulls involves WTI breaking through the resistance trend of the bearish channel and surpassing last week's high, around $75.

Specifically, it is the orange shaded area between $74.65 and $75.00, previously serving as both support and resistance, which needs to give way now.

Given the bearish trend since September, caution is warranted while oil hovers around or within this zone. It's crucial to remain cautious in any case. A key test of the bullish reversal is when prices dip to test support levels, which must hold on any short-term dips. And judging by today’s price action, with WTI finding strong support from the previous resistance zone of $72.00 to $72.50, the bulls are gaining more and more control. With the bullish momentum gathering pace, this is making oil less and less appealing for the bears.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade