This morning, we saw the release of a proposed cryptoasset regulatory bill in the US. In classic Washington embellishment, the bill is touted as a “landmark bipartisan legislation that will create a complete regulatory framework for digital assets that encourages responsible financial innovation, flexibility, transparency and robust consumer protections while integrating digital assets into existing law.”

While this bill will undoubtedly undergo significant amendments even if it ultimately is passed as a law, there are some notable takeaways for crypto traders:

- First, most (legitimate) crypto development teams have been pleading for the US to develop such a comprehensive regulatory framework for years so they know the proverbial “lay of the land,” so passage of any of bill could be a long-term positive for the industry.

- It provides clear definitions of crypto securities and commodities, allowing issuers to determine in advance how new tokens would be regulated rather than fearing retroactive enforcement actions.

- Much of the regulatory enforcement under the new bill would fall on the CFTC, which is tasked with regulating commodities and futures. Most of the biggest tokens in the cryptoasset space, including Bitcoin and Ethereum, will be defined as “ancillary assets” and overseen by the CFTC.

- In a direct nod to the implosion of TerraUSD last month, the bill advocates for “100% reserve, asset type and detailed disclosure requirements for all payment stablecoin issuers.”

- The bill would make sub-$200 purchases using cryptoassets tax-free, reducing the tax reporting burden on many small-scale crypto users.

Ultimately, with Congress on track for its usual August recess and mid-term elections set for November, we’re unlikely to see any major movement toward passage of the bill until next year at the earliest, so the immediate trading implications may be limited.

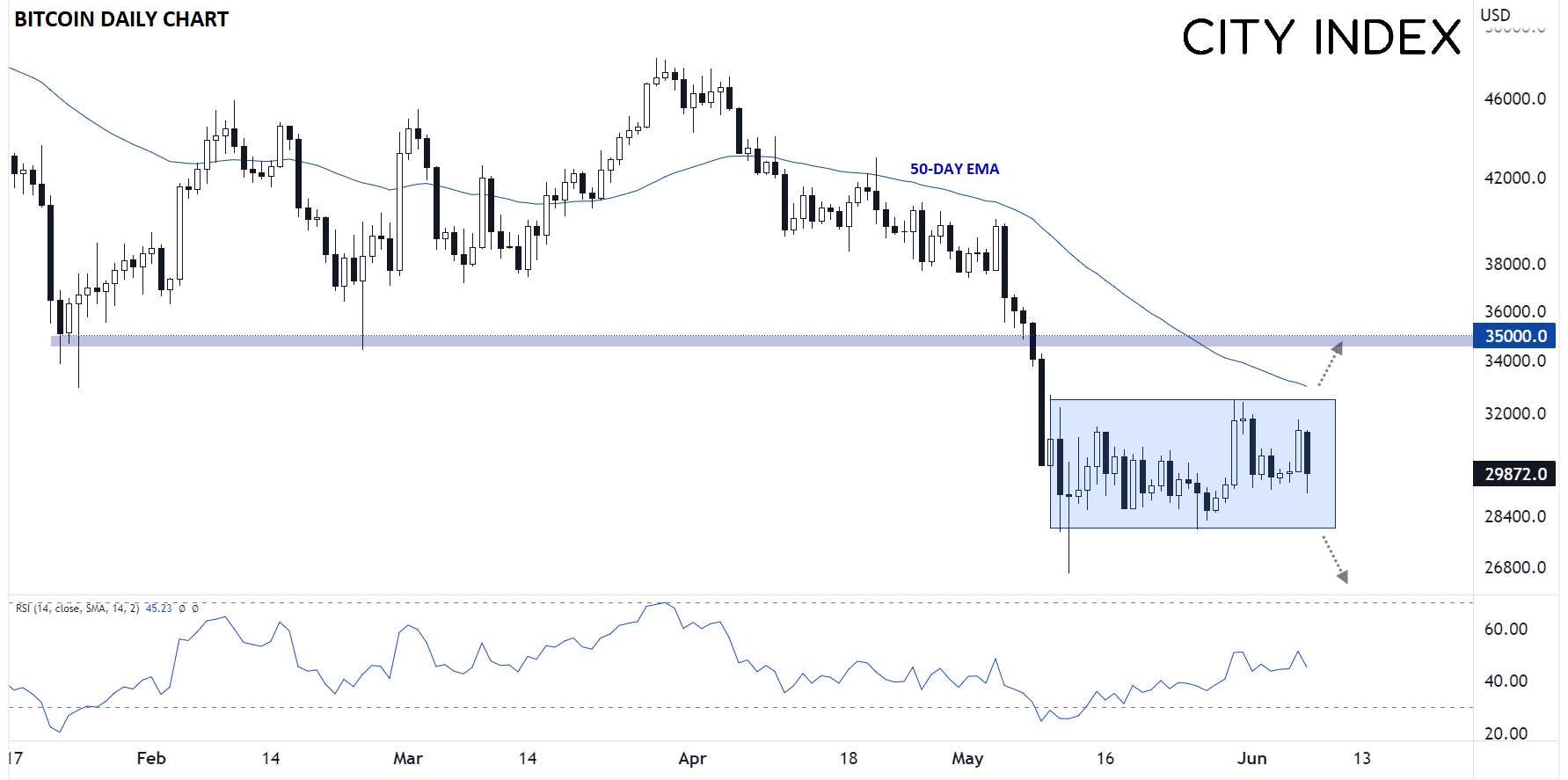

Bitcoin technical analysis

As my colleague Tony Sycamore noted a couple weeks ago, the fact that Bitcoin was consolidating in a tight range was a potential preliminary sign that the current “crypto winter” may have reached its apex in May, even if a thaw wasn’t necessarily imminent. As we flip the calendar to June, we’re seeing that same dynamic at play, where the more “quality” cryptoassets (mostly just Bitcoin and Ethereum) are at least hanging tough in tight ranges while the more speculative altcoins continue to bleed lower.

The granddaddy of modern cryptoassets has now spent nearly a month consolidating between resistance at $32,500 and support in the $28,000 area. This prolonged period of low volatility trade sets the stage for a higher-volatility move once Bitcoin breaks out of its range. Given the importance of Bitcoin to the broader cryptoasset space, a confirmed break lower from this range would be a bad omen for the entire asset class, with little in the way of support for Bitcoin until the 2017 highs near $20,000. Meanwhile, bullish breakout above $32,500 would point toward a continuation toward the January lows in the 35,000 range and raise hopes that the worst of the crypto winter may be behind us.

Source: StoneX, TradingView

To stretch our “crypto winter” analogy to its limits, temperatures have stopped getting colder for the last month, but we haven’t yet gotten the thaw that would hint spring is on the way, so crypto traders are keeping their coats close at hand in case we see an even deeper freeze.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade