“There are decades where nothing happens; and there are weeks where decades happen”

– Vladimir Ilyich Lenin

While it would be hard to say there are decades (or even months) where “nothing” happens in the cryptoasset space, this week nonetheless felt extraordinarily significant for the cryptoasset space.

The big news was the collapse of the UST algorithmic stablecoin and the broader Terra blockchain. At the start of the week, Terra’s flagship LUNA token traded above $60 and boasted a $40B market capitalization, making it one of the 10 largest cryptoassets on the planet. Following a classic “run on the bank” panic (some self-proclaimed “LUNAtics” would call it a coordinated attack on the token), it trades at about $0.01, essentially a total loss for the Terra community on the magnitude of Bernie Madoff’s $60B+ ponzi scheme. Even those who were skeptical of LUNA’s tokenomics were shocked by the speed of the implosion.

The full impact of the event is still being fleshed out, with speculation that other protocols and funds may have suffered catastrophic losses related to Terra’s collapse, but the most obvious fallout from this week’s events for the broader crypto market will likely come from the regulatory side. Major financial regulators in the US, UK, and beyond have been slow to issue clear regulations to protect consumers and clarify the proverbial “playing field” for developers. The massive disintegration of a so-called “stablecoin” that many everyday investors thought was a safe, conservative investment has pushed crypto to the top of financial regulators’ “to do” lists.

Indeed, within 24 hours of Terra’s collapse, US Treasury Secretary Janet Yellen was imploring the Senate Banking Committee to urgently pass new legislation, noting that “[stablecoins] run risks that could threaten financial stability.” The UK government, which recently announced that it was exploring ways to make stablecoins a valid form of payment, won’t be far behind.

In the short term, regulation poses a significant risk for the broader crypto markets, and even stalwarts like Bitcoin and Ethereum are unlikely to be spared. Even if these inevitable new restrictions clarify the regulatory landscape in the long run, they are likely to make it more difficult to buy cryptoassets in the short term, to say nothing of the damage to market sentiment cause by a top token imploding in just 48 hours. Even the diehard crypto believers who have seen multiple bull-bear cycles are battening down the hatches for another crypto winter.

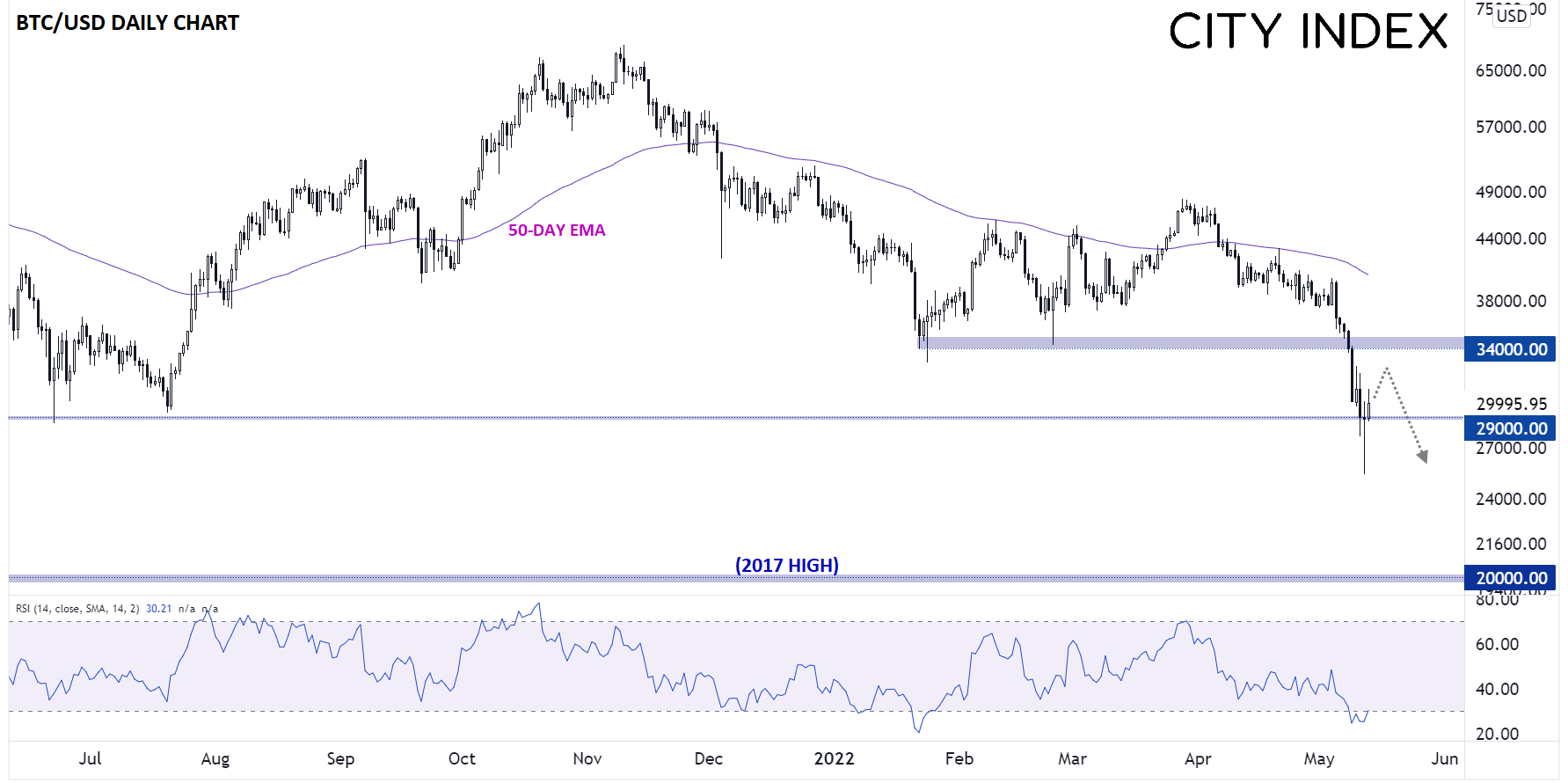

Bitcoin technical analysis

As the chart below shows, the granddaddy of cryptoassets, Bitcoin, dropped to its lowest level since 2020 yesterday. If the bearish thesis plays out as many expect, Bitcoin may fall all the way toward 20,000 in the coming months, where the euphoric 2017 peak coincides with the 200-week MA, which has historically put a floor under the price in past “crypto winters.” Coincidentally, that area also marks the level where Microstrategy, which owns roughly 130K BTC, would receive a margin call on its holdings:

Source: StoneX, TradingView

Of course, when sentiment is so one-sided and prices are so deeply oversold, we can often see a bottom form. In the short-term, the key area to watch will be 34,000, the lows from January and February of this year. If Bitcoin manages to break conclusively back above that area, the outlook for the entire crypto market starts to look more constructive.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade