CFD index trading

Trade CFDs on 20 major global Indices from the ASX 200 (Australia 200) and Dow Jones (Wall Street) to the DAX (Germany 40).

-

Compelling CFD index pricing

Fixed spreads from 1 point and margins as low as 5%

-

24-hour trading and support

Customer service round the clock

-

No commission

Avoid commission on CFD index trading

Why trade CFD indices?

CFDs are a popular way to trade indices. City Index offers a choice of 20+ global indices in Europe, US, Canada and Asia-Pacific.

-

Ultra-competitive index pricingLow retail margins from 5%, and tight, fixed spreads from 1 point.

-

No commissionPay no commission on index trades.

-

Round-the-clock trading and support24-hour trading with breaks on many CFD indices, plus dedicated support.

-

A wide range of trading choicesTake advantage of cash, futures and options trading.

Major CFD index markets

Our performance in numbers

*StoneX retail trading live and demo account holders globally since Q4 2020.

Index CFDs: cash vs futures

City Index offers two ways to trade CFDs on indices: cash CFDs and futures.

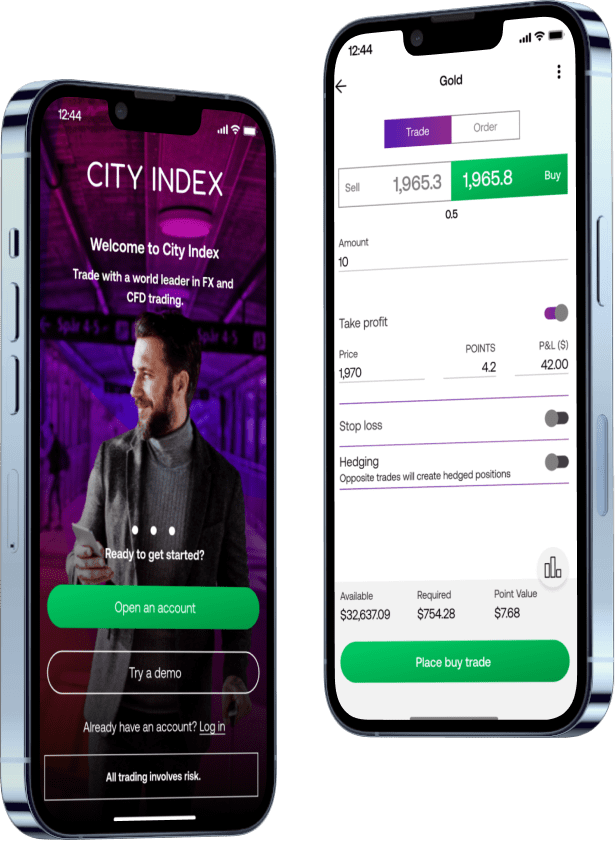

Powerful mobile apps

Don’t miss a trading opportunity – access our mobile apps for advanced charts, intuitive platforms and multi-device functionality.

TradingView charting

Complete with one-tap dealing, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access insightful market data on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

How to trade CFD indices

To trade CFD indices, you need an account with a CFD provider. Then, you simply choose your index market, whether you’d like to go long (buy) or short (sell) and how many contracts you want to trade. You can also add stops and limits to aid with risk management.

Your profit or loss is dictated by how far your index market moves from when you open your position to when you close it.

To get started, open your City Index trading account.

CFD index trading FAQs

How do you trade index CFDs?

To trade index CFDs you need to follow these 5 steps:

- Open a CFD trading account, and then add some funds. Opening an account only takes minutes

- Choose the index you want to trade. The City Index platform comes with lots of technical and fundamental analysis tools to help you find your first opportunity, including Performance Analytics

- Buy the market if you think your index will rise, or sell it if you think it will fall

- Choose how many CFDs to buy or sell, which will determine your profit or loss. The value of an individual contract will differ based on the underlying market

- Add a stop-loss to limit your overall risk, then execute your order

To close your position, you make the opposite trade to when you opened it. If you bought five CFDs at the outset, for instance, you’d sell five CFDs now. If the index has moved in your chosen direction, you’ll make a profit. If it hasn’t, you’ll make a loss.

What index CFDs can I trade?

Your City Index CFD trading account gives you access to 21 major global indices – including the Australia 200 (ASX200), Wall Street (the Dow Jones), the Germany 40 (DAX 40) and the UK 100 (FTSE 100) – plus thematic indices covering areas such as cannabis and FAANG stocks.

Here’s a list of the benchmark index CFD markets we offer:

- Australia 200 CFD

- China A50 CFD

- EU Stocks 50 CFD

- France 40 CFD

- Germany 40 CFD

- Hong Kong 50 CFD

- India 50 CFD

- Italy 40 CFD

- Japan 225 CFD

- Netherlands 25 CFD

- Singapore Index CFD

- Spain 35 CFD

- Switzerland 20 CFD

- UK 100 CFD

- CBOE UK 250 CFD

- US Small Cap 2000 CFD

- US SP 500 CFD

- US Tech 100 CFD

- Wall Street CFD

To start trading, open your CFD account.

What is an index CFD?

An index CFD is a type of contract for difference (CFD) that enables you to go long and short on global index markets. Like other types of CFD, they work using contracts that track the live price of their underlying market. In this case, that market is a stock index.

The CFD entitles you to exchange the difference between the index’s price from when you open your position to when you close it. Buy one Australia 200 CFD at 7000 and sell it at 7100, and you’ll make a $100 profit. If the Australia 200 falls to 6900, you’ll make a $100 loss. That’s because an Australia 200 CFD earns AU$1 for every point that the ASX moves.

Learn more about how CFDs work.