- Going long on Wall Street example

- Short selling Coca-Cola example

- Going long on EUR/USD example

CFD index trading example: going long on Wall Street

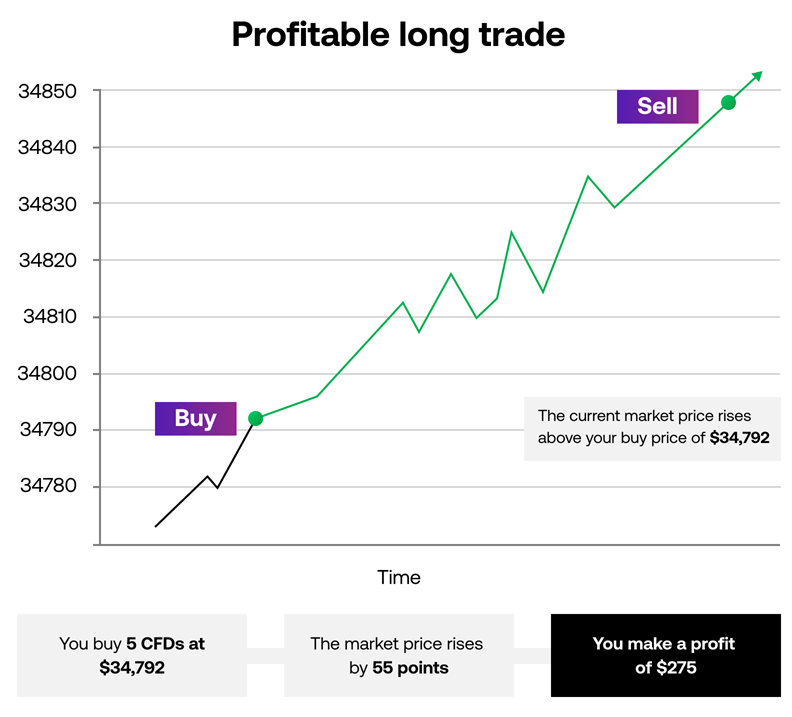

To illustrate how CFD trading works, let’s look at an example on Wall Street, City Index’s equivalent price for the Dow Jones.

The Wall Street index is currently trading at 34,790 /34,792. The first figure is the sell price and the second is the buy price – the difference between the two is the ‘spread’, which is the cost charged for opening the trade. You won’t pay a commission on index CFDs with City Index.

You think that US blue-chip stocks are in for a bull market, which would cause the Wall Street market to rise. So, you decide to open a long position by buying 5 Wall Street CFDs at 34,792.

Margin

To open your Wall Street position, you’ll need to have enough margin in your account. In this example, let’s say that Wall Street requires you to keep 5% of your position’s total value in your account as margin.

Your position is worth (34,792*5) $173,960, so you’ll need 5% of 173,960 to make the trade – $8,698.

The higher the value of your trade, the more money you’ll need to deposit. Alternatively, you could reduce your margin outlay by reducing the size of your position. If you only buy one CFD, you will only need $1,739.6 as margin.

Remember, though, that you’ll also need enough free equity in your account to sustain any losses and cover any costs. Otherwise, you risk a margin closeout.

Notice that your margin is calculated in USD, instead of AUD? That’s because, with CFD trading, your margin requirement, financing and any unrealised profit or loss will be in the base currency of the selected market. In this case, US dollars.

The City Index platform will automatically convert your margin, financing and P/L into your account’s base currency, though, so you don’t need to do it manually.

Risk management

When you open a CFD position, it’s a good idea to ensure that you have a risk-management strategy in place. Most traders will choose a profit target and maximum loss for any opportunity, then use stop losses and take profits to automatically close their position once either level is reached.

For this trade, you decide to target 75 points of profit, with a maximum loss of 25 points. You set a take profit at 34,867 and a stop at 34,767.

Profiting on a long index CFD trade

Let’s take a look at what would happen if your trade was a success.

The Wall Street index rises as you predicted, climbing 57 points to a new price of 34,847/34,849. That’s still a little off your take-profit target, but due to changing market conditions, you decide to close the position.

You bought 5 CFDs at the outset, so you now sell 5 CFDs at 34,847 to exit the trade.

34,847-34792 is 55 points. Your 5 CFDs earn you $5 for every upward point of movement, giving you a total profit of (55*5) $275.

If you had kept the position open over more than one day, your profit would be lower due to overnight financing.

Please note, P&L is listed in USD.

Losing on a long CFD trade

But what would have happened if the Wall Street Index had fallen instead?

Supposing the Wall Street index falls to 34,767/34,769, which triggers your stop loss and closes the position.

Your stop will automatically sell 5 CFDs at the new sell price of 34,767. This represents a 25-point loss in your trade which, when multiplied by the 5 CFDs, leaves you with a $125 loss. Please note, P&L is listed in USD.

CFD index example in summary

| Opening the trade | |

|---|---|

| Open price (buy) for Wall Street | 34792 |

| CFDs bought | 5 |

| Value of position | $173,960 |

| Margin requirement (5%) | $8,698 |

| Closing the trade for profit | |

| Closing price (sell) for Wall Street | 34847 |

| CFDs sold | 5 |

| Opening value | $173,960 |

| Closing value | $174,235 |

| Profit | $275 |

| Closing the trade for a loss | |

| Closing price (sell) for Wall Street | 34767 |

| CFDs sold | 5 |

| Opening value | $173,960 |

| Closing value | $173,835 |

| Loss | $125 |

| Learn more about index trading | |

All figures above are denominated in USD.

Stock CFD short selling example: Coca-Cola shares

You believe that Coca-Cola will fall over the coming weeks as the company is set to report a disappointing set of earnings. You decide to sell (go short) 50 CFDs.

At the time, you see Coca-Cola is trading at 50.05/50.06. To open a short position, you trade at the sell price – so you sell 50 CFDs at 50.05, with a stop loss at 56.05.

Margin and commission

Coca-Cola has a margin requirement of 20%, so you’ll need to deposit 20% of your position’s full value ($500.50) to make the trade. And because Coca-Cola is an equity, you’ll pay a commission to open the position – and another when you close it later.

Commission on US stocks is 2 cents per CFD or a minimum of $8. You’re below the minimum commission, so you pay $8.

All these costs are denominated in USD. Your City Index account will automatically convert your P&L to your chosen currency when you close the trade

Profiting from a short share CFD trade

You were right and Coca-Cola’s share price falls to 42.09/42.10 over the next three days. At this point, you decide to lock in your profits and close the trade. To do so, you’d need to buy 50 Coca-Cola CFDs at 42.10.

The market has moved by 7.95 (50.05-42.1) and as your 50 CFDs earn you $50 for each downward point of movement, you’d have made $397.50 gross profit.

However, you have paid a $16 commission on your position, which would reduce your overall profit to $381.50.

Keeping the position open for three days also means it will be subject to overnight financing. Financing on short positions is usually credited to your account – unless SOFR is below 2.5%, then it would be debited from you.

P&L is calculated in USD.

Losing from a short share CFD trade

Now let’s see what would have happened if Coca-Cola had risen instead.

Some hours after placing your trade you see that Coca-Cola has rallied. Thankfully, you had your stop loss in place which cut your losses at 56.05.

In this instance, your trade has lost 6 points, or $300. Taking commission into account, your overall loss is $316.

P&L calculated in USD.

CFD short selling example in summary

| Opening the trade | |

|---|---|

| Open price (sell) of Coca-Cola | $50.05 |

| CFDs sold | 50 |

| Value of position | $2,502.5 |

| Margin requirement (20%) | $500.50 |

| Commission @ 2CPS or minimum $8 | $8 |

| Closing the trade for profit | |

| Closing price (buy) of Coca-Cola | $42.10 |

| CFDs bought | 50 |

| Opening value | $2,502.5 |

| Closing value | $2,105 |

| Profit | $397.50 |

| Commission @ 2CPS or minimum $8 | $8 |

| Overall profit on the trade | $381.50 (profit - $16 commission) |

| Closing the trade for a loss | |

| Closing price (buy) of Coca-Cola | $56.05 |

| CFDs bought | 50 |

| Opening value | $2,502.5 |

| Closing value | $2,802.5 |

| Loss | $300 |

| Commission @ 2CPS or minimum $8 | $8 |

| Overall profit on the trade | $316 (loss + $16 commission) |

| Learn more about shares trading | |

All figures above are denominated in USD.

CFD forex example: Going long on EUR/USD

You believe the euro is going to strengthen against the dollar due. So, you decide to buy (go long) on 10,000 units of EUR/USD at 1.06600.

For every pip the price moved in your favour, you’d make $1, and for every pip it moved against you, you’d lose $1.

Margin

EUR/USD has a margin requirement of 3.33% of the notional value of the trade. So, you’d need to deposit 3.33% of your position’s full value (10,000 x 1.06600 = 10,660) to enter your trade.

This means your margin requirement would be $355.

The margin and profit & loss are calculated (and denominated) in the second, or counter currency of the pair – in this case the US dollar. City Index automatically converts trading P&L into your denominated account currency at the prevailing market rate at the time that the trade is closed.

Profiting from a forex CFD trade

Let’s say your prediction was correct, and the euro did rise in price against the dollar up to 1.06650.

That equals a 5-pip change, which would give you a profit of $5 – calculated as the closing price (1.06650) minus the open price multiplied by 1.

Losing from a forex CFD trade

However, if the euro fell against the US dollar instead, you might have to close your trade at a loss.

Let’s say it fell to 1.06500 instead. That would be a 10-pip change and result in a $10 loss – calculated as the opening price (1.06600), minus the closing price (1.06500) multiplied by 1.

CFD forex example in summary

| Opening the trade | |

|---|---|

| Open price (buy) for EUR/USD | 1.06600 |

| Units bought | 10,000 |

| Value of position | $10,660 |

| Margin requirement (3.33%) | $355 |

| Closing the trade for profit | |

| Closing price (sell) for EUR/USD | 1.06650 |

| Units sold | 10,000 |

| Opening value | $10,660 |

| Closing value | $10,665 |

| Profit | $5 |

| Closing the trade for a loss | |

| Closing price (sell) for EUR/USD | 1.06500 |

| Units sold | 10,000 |

| Opening value | $10,660 |

| Closing value | $10,650 |

| Loss | $10 |

| Learn more about forex trading | |

Financing will be automatically debited or credited from your account every night for the period that you hold your position.