- Yen analysis: JPY could rise further if yields decline

- GBP/JPY among the more interesting yen pairs to watch

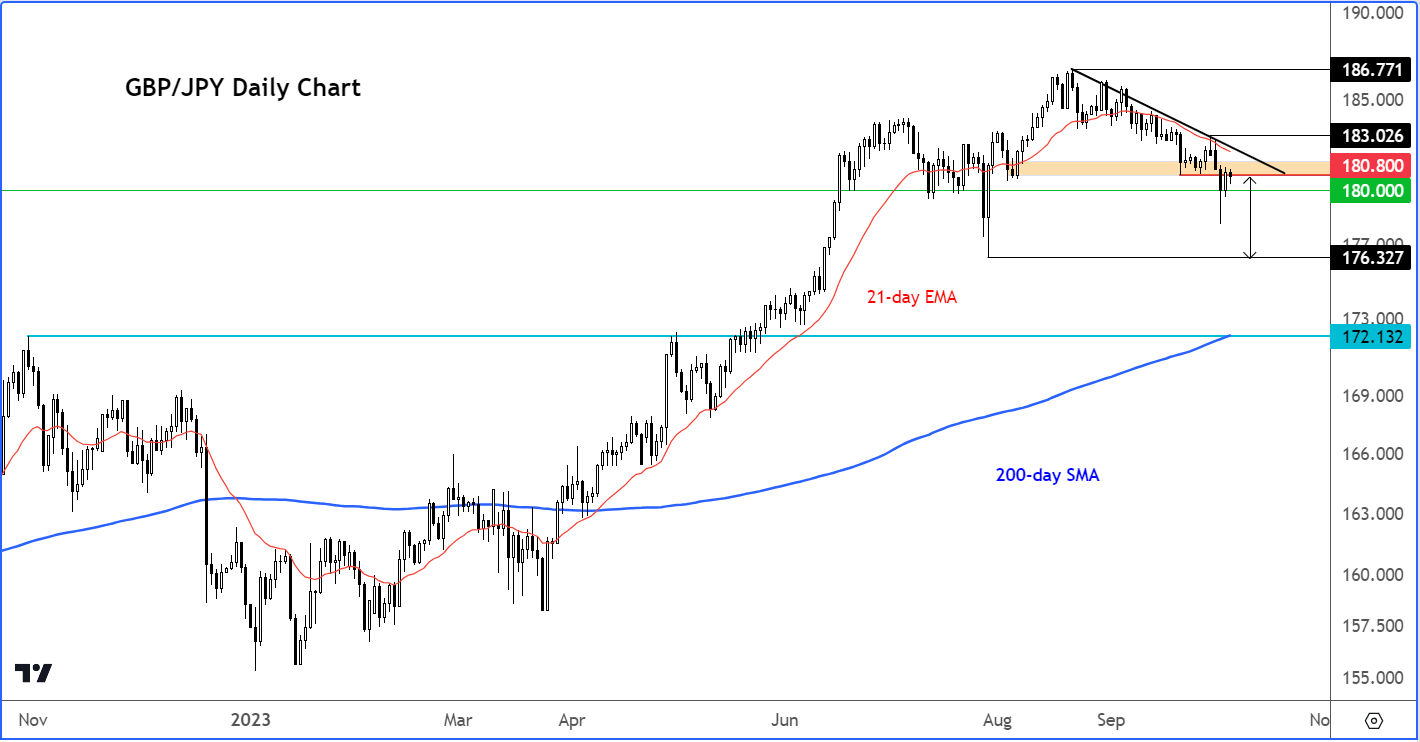

- GBP/JPY technical analysis point lower

The GBP/JPY is among the yen pairs we are monitoring as they could fall further, after the Bank of Japan’s apparent intervention and in light of the drop in bond yields we saw on Wednesday.

While there was no confirmation that the BoJ intervened in FX markets, but that big drop in the USD/JPY and other yen crosses on Tuesday certainly point that way. There was no news out then, and while you could argue that profit-taking around 150.00 was a factor, it can’t have been that big of a factor to move rates down more than 200 pips in a matter of a few seconds.

Yen analysis: JPY could rise further if yields decline

In FX, there has been no major currency weaker than the yen for much of this year. The fact that the Japanese yen has underperformed the most is because of two major reasons. First, and foremost, it is because of the BoJ’s current policy stance, which has remained ultra-loose despite all other major central banks tightening their belts aggressively over the past two years. Secondly, Japan is an oil importing nation, which means crude prices are even more expensive there due to a weakening exchange rate. This has been further hurting consumers’ disposable incomes.

But with oil prices falling, and yield taking a nosedive on Wednesday, the yen may find more buyers moving forward. Low-yielding currencies such as the yen will become comparatively more attractive again if yields start heading lower again. On top of this, there is the potential for more intervention from Japan, which could limit the downside for the JPY.

On Wednesday we saw yields take a nosedive and that has kept the pressure on the USD/JPY and other yen crosses following their sharp falls on Tuesday. Though that move has stalled somewhat so far today, there is a good chance we may see renewed weakness start to creep into bond yields moving forward, as global economic weakness starts to catch up with the US.

Today’s weekly jobs claims point to a healthy labour market, but if those ADP private payrolls can be trusted more (they haven’t been very reliable, truth be told), employment is finally cooling down, helping to ease inflationary pressures further. The big 5% drop in oil prices we saw on Wednesday, and the additional 2% drop so far today, will have also diminished inflation risks. So, keep an eye on bond yields to see if Wednesday marked a top, or was it just a temporary stop ahead of a move to 5%. This week’s main macro event on the economic calendar is the US nonfarm payrolls report. Expect lots of volatility around the time when the numbers are released.

GBP likely to remain under pressure amid UK concerns

Things can only get better for the UK, right? Well, maybe not. The UK economy is on its knees, and this is reflected in the pound weakening across the board in recent weeks. Next Thursday, we will get the latest monthly GDP estimate, along with several other UK economic pointers. Last time, the monthly GDP estimate for August showed a much larger drop of 0.5% than expected, which wiped out the gains from July. Let’s see how the warm weather impacted growth in September. GBP bulls will need to see a sharp rebound. But will they get that?

The more forward-looking economic indicators such as the Purchasing Managers’ Indices (PMIs) have not only remained in the contraction territory (<50.0), but the pace of the weakness have been deteriorating. The manufacturing PMI has remained below 50.0 for 13 consecutive months, with the monthly prints missing the already-downbeat expectations for the past 6 months. The services PMI has only moved below 50.0 a couple of months ago, but it too has been missing expectations for the last 5 consecutive months.

The PMIs suggest the near-term UK outlook is gloomy. This argues against a speedy recovery in GBP/JPY and other pound crosses.

Yen analysis: GBP/JPY technical levels to watch

Source: TradingView.com

The GBP/JPY has broken some short-term support levels already, including most recently 180.80. While price has recovered nicely since that sharp drop on Tuesday, it has remained below that 180.80 level, which has now turned into resistance. So, the short-term path of least resistance remains to the downside, and we may get some real traction should the Guppy go on to break below 180.00 support. If that were to happen, then 176.30 could be the next downside target.

On the upside, a break above the bearish trend line is needed to tip the balance back in the bulls’ favour. If that scenario plays out, then we would drop our short-term bearish bias on this pair.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade