Recapping the key drivers of the AUDUSD’s fall, despite abandoning its yield target policy, the RBA’s base case for rate hikes remains not until 2024. A sharp repricing in the interest rate market followed the meeting, reducing front-end yield support for the AUDUSD.

Also undermining the AUDUSD, a stronger US jobs report, and continued declines in key commodity prices. Aluminium has fallen 20% from its recent highs, crude oil touched a four-week low, and iron ore dropped another 12%.

The fall in iron ore is of most concern for the AUDUSD. The factors behind its fall are set to remain, including falling steel demand, a power crunch, rising iron ore inventories, and efforts to limit pollution ahead of the Beijing Winter games.

This week the key event on the Australian calendar for the AUDUSD is the release on Thursday morning of Labour Force data for October.

The market is looking for a 50k rise in employment, while the unemployment rate is expected to rise from 4.6% to 4.7% due to a lift in the participation rate following the end of lockdowns in NSW, VIC, and the ACT.

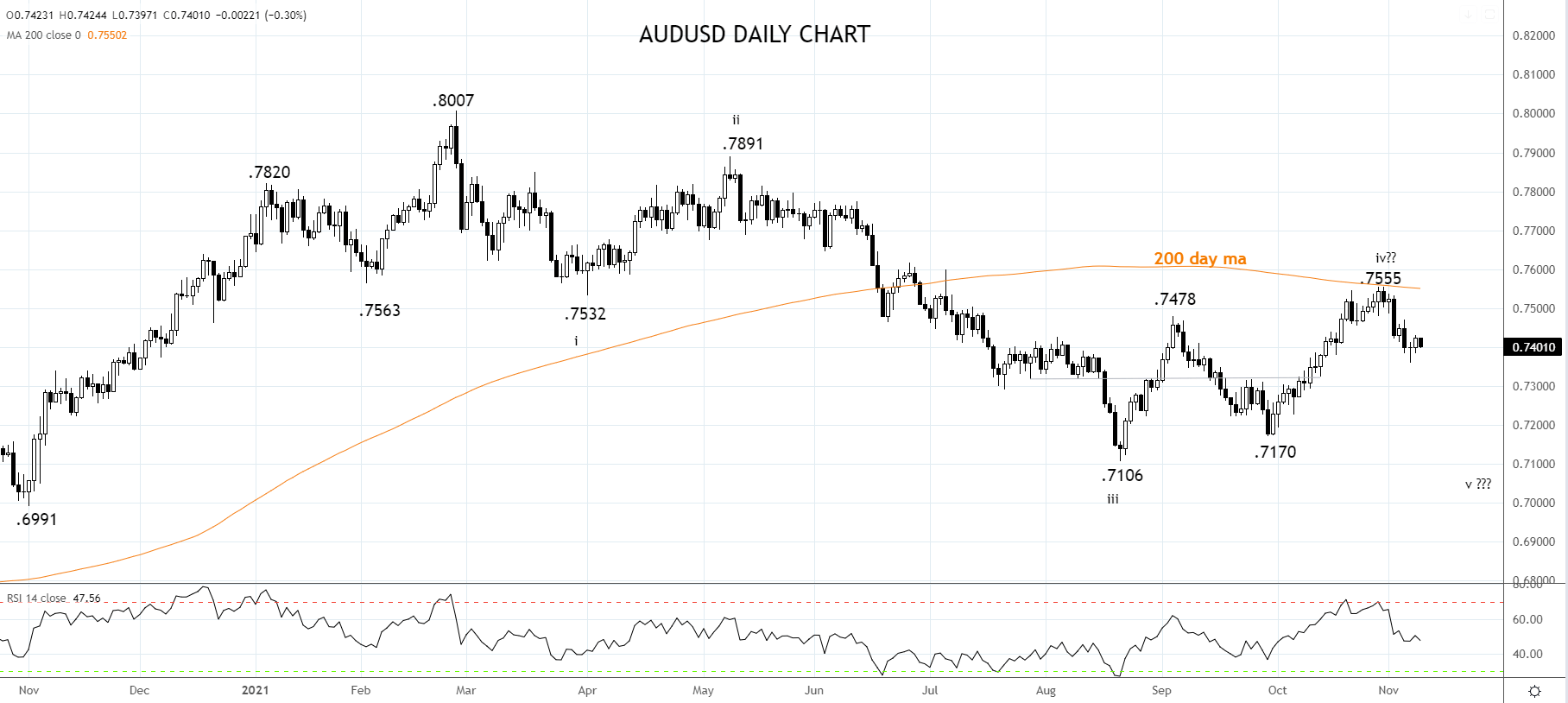

Due to the combination of bearish macro factors mentioned above and despite expectations of good jobs data, a bearish bias remains for the AUDUSD reinforced by the technical setup.

Providing the AUDUSD remains below its recent swing high and the 200-day moving average at .7555, the expectation is for the decline to extend towards support at .7320 in the short term, with a scope towards .7100c in the medium term.

Source Tradingview. The figures stated areas of November 9th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade