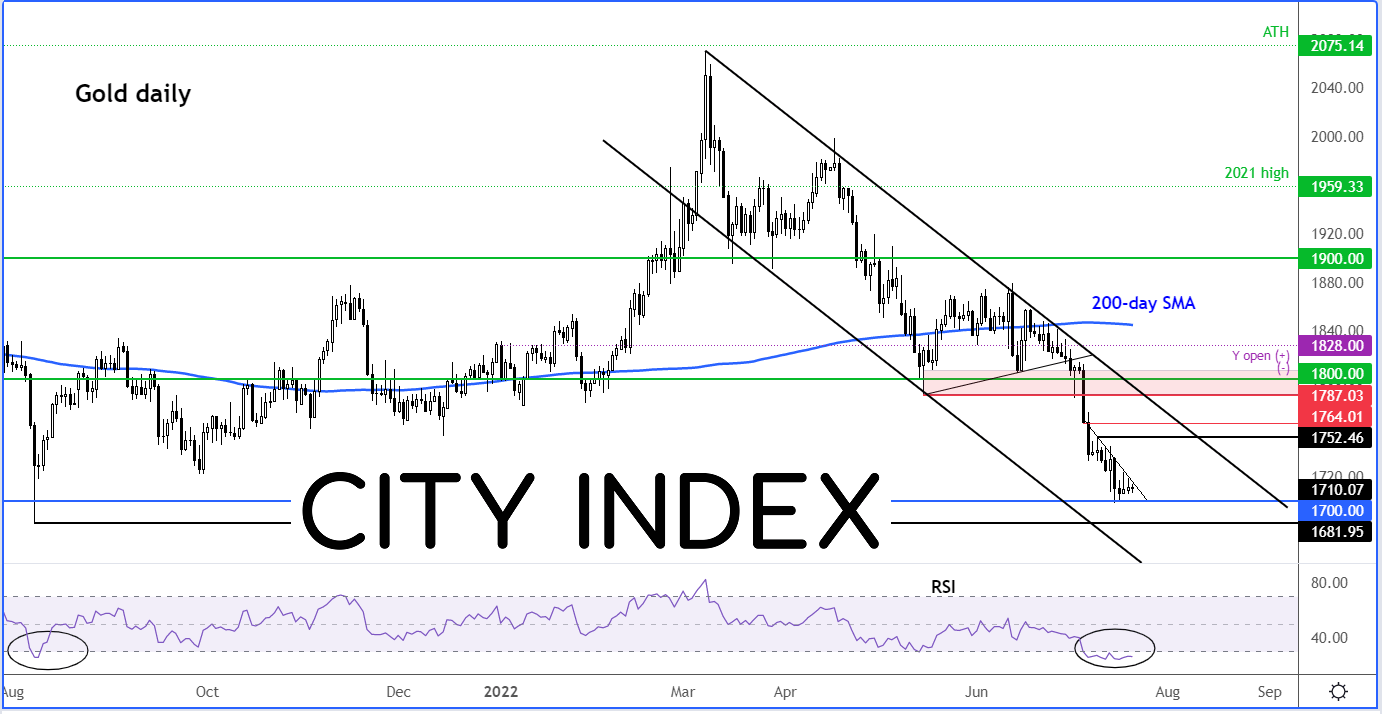

Gold prices have been somewhat stable near $1700 over the past few days, following a drop of 18% from the March high at $2070. There is a possibility we will see a low form around current levels, although so far, we haven’t seen any evidence of that. Indeed, gold was flat on the week at the time of writing, with prices having come off the session highs. Gold bulls were hoping to see an end to the 5-week losing streak. But will it be able to recover?

Looking at other markets, there is hope that gold might be able to find some much needed support here. The other precious metal, silver, has found some love around the $18 mark in recent days. Meanwhile, other risk assets have also recovered off their multi-month or multi-year lows, including Bitcoin, copper, and European and US stock indices. All this has coincided with a slightly weaker US dollar, with the euro, Aussie and kiwi all showing good form.

While not a lot has changed fundamentally, there is some hope that soon we might see the end of aggressive central bank tightening because peak inflation could be nigh.

We have seen a number of key commodity prices come down sharply over the past few months, raising hopes that inflation will also head lower. Among others, wheat and cotton were down about 40% from their peaks earlier this year, with corn down about 25% from its corresponding high. There are also some early signs of disinflation starting to appear, as my colleague Matt Simpson highlighted earlier.

If inflation does come down, as we expect that it might, then this will renew hopes that the Fed and other central banks will stop their aggressive tightening in the not-too-distant future, and possibly even go in reverse in order to prevent a severe recession.

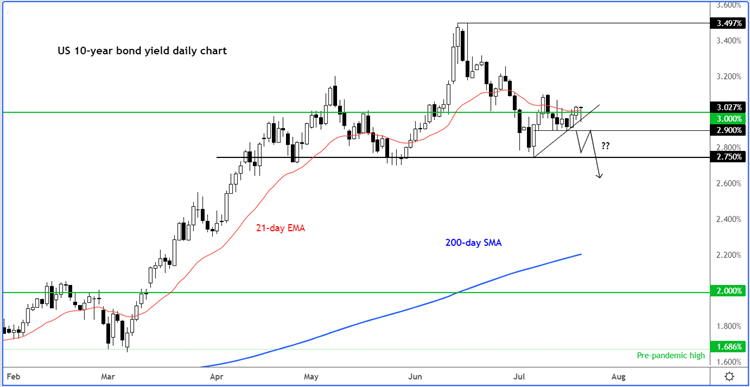

This is why it is important to keep an eye on bond yields, as that is where the so-called “smart money” is at. The US 10-year Treasury yield has struggled to hold above 3% in recent times, which is definitely a welcome sign for risk assets – and gold. But it needs to start falling and soon, otherwise gold will struggle to stay afloat.

Gold itself is definitely not out of the woods just yet. But prices are severely oversold as per the RSI indicator – although this is not to be taken as a sign of strength for the underlying gold price, for it shows the opposite. That being said and given everything mentioned above, I would imagine some dip-buying might take place around current levels – especially with support at around $1700 being tested here (give or take $10). As traders, though, we must see a reversal pattern here on gold, before thinking of any long trades, so that we have a clear invalidation level to work against.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade