The Dow Jones appears to be the most willing participant of the three key U.S. equity indices in exploring the downside after closing for a second day below the uptrend support from the March 2020 low.

In the F.X. space, the U.S dollar index has benefited from risk aversion buying the past three sessions. Should the U.S. dollar continue to rally on the back of further equity weakness, the NZDUSD appears vulnerable.

While New Zealand’s covid outbreak now appears under control enabling the government to lift restrictions across most of the country, possibly as early as this afternoon, Auckland is expected to remain in lockdown until late September.

Based on this, Goldman Sachs forecast the current lockdown to shave 3.5-4ppt off Q3 GDP. While this is unlikely to stop the RBNZ from raising rates in October and November of this year, it increases the risks that the NZDUSD may be susceptible to a pullback.

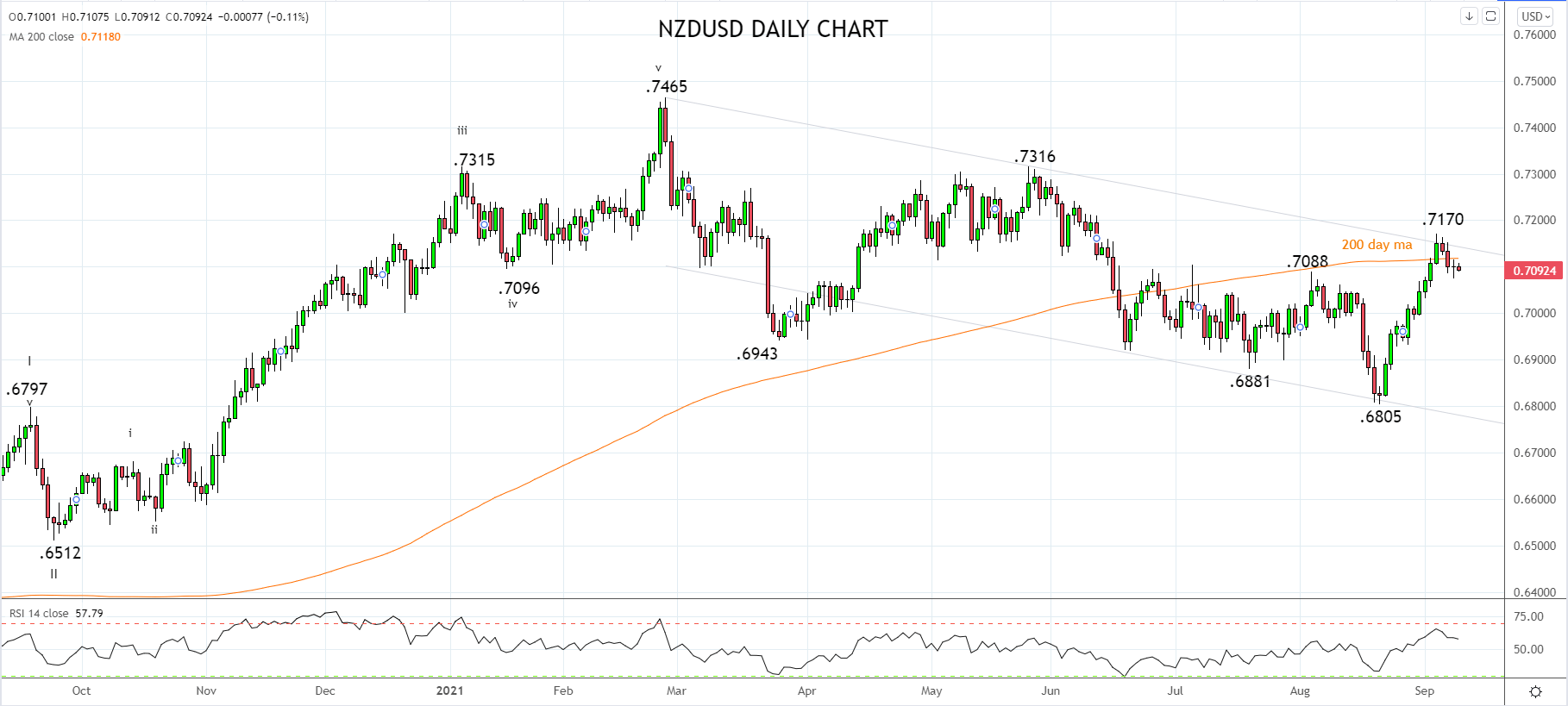

In recent weeks, the NZDUSD rallied over 5% to a high of .7170, above the 200 day moving average at .7118, and trend channel resistance at .7150 from the February .7465 high.

The move to the .7170 high appears to have been a false break higher out of a well-established trend channel. If U.S. stock markets continue to wobble, it would not be difficult to imagine some mean reversion in the NZDUSD back below .7000c.

As such, consider opening short NZDUSD positions near .7100c, with a stop loss placed above .7175 and looking to take partial profit near .7000c and again near .6950.

Source Tradingview. The figures stated areas of September 9, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation