The Australian Federal Election is just five days away. Both polling and betting markets have the ALP well ahead. As illustrated by Brexit, Donald Trump’s election in 2016 and the Australian Federal Election in 2019, neither are fool proof.

However, unlike the 2019 election where the ALP's Bill Shortens economic policies included controversial reforms to negative gearing, capital gains concession and the treatment of franking credits, this time around the economic policies of the major parties are similar.

The lack of a polarising politician and economic policy in this race, means it is significantly less likely that the polls are wrong in 2022. It also means that should Anthony Albanese become the 31st Prime Minister of Australia, the markets are unlikely to be too concerned.

The one caveat here is if neither major party wins enough seats to form a government, then both parties will seek the help of independents to form a government.

In return for their support, independents may insist on policies that are less market-friendly. Examples include the Green’s economic policies of a 6% wealth tax on billionaires, and a Corporate Super–Profits Tax of 40%. In this event, expect the AUDUSD and the ASX200 to take a short-term hit when they re-open next Monday morning.

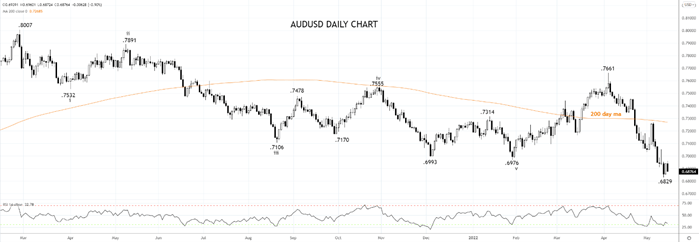

Aside from this outcome, the main drivers of the AUDUSD and the ASX200 will remain the same thematics that have driven markets in recent months including, inflation, rate hikes, supply chain disruptions and growth concerns. All of which keep us bearish in the medium term.

However, in the short term, after Tuesday's capitulation which took the ASX200 into our 7000/6950ish downside target, we moved to a neutral bias looking for a recovery towards 7200. We suspect near the 7200 level will be where the current bounce ends before another leg lower.

For the AUDUSD, after reaching our initial downside target last week, the January 2016 .6826 low, a modest recovery is possible this week before the downtrend resumes towards the next layer of support near .6600c.

Source Tradingview. The figures stated are as of May 16th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade