- USD/JPY has a strong relationship with US bond yields right now. Buoyant risk appetite may be another factor behind its push above 150

- Japan’s events calendar is busy but the main events for USD/JPY will likely come from US data and Federal Reserve speeches

- The risk of Bank of Japan intervention appears unlikely unless USD/JPY rallies sharply

- USD/JPY looks tired after rallying over ten big figures in under a month. While it’s within touching distance of multi-decade highs, it could be due a period of consolidation or even modest downside near-term

The Japanese yen continues to dance to the tune of US interest rate expectations and broader risk sentiment, meaning events that may influence either of those areas should be the focus for USD/JPY traders this week.

Inflation reports from the United States, Japan and Eurozone top the list, creating ample event risk, especially towards the back end of the week. That’s when the best trading opportunities in USD/JPY may be found given the potential for market volatility. Fresh multi-decade highs may even be on the cards should traders continue to pare rate cut expectations for the Federal Reserve this year.

USD/JPY is dancing to the US interest rate tune

When it comes to the key driver of USD/JPY movements, interest rate differentials between Japan and the United States continue to top the list. With US bond yields pushing higher on signs of reemerging inflationary pressures and ongoing resilience in the economy, it makes sense that USD/JPY continues to trend higher.

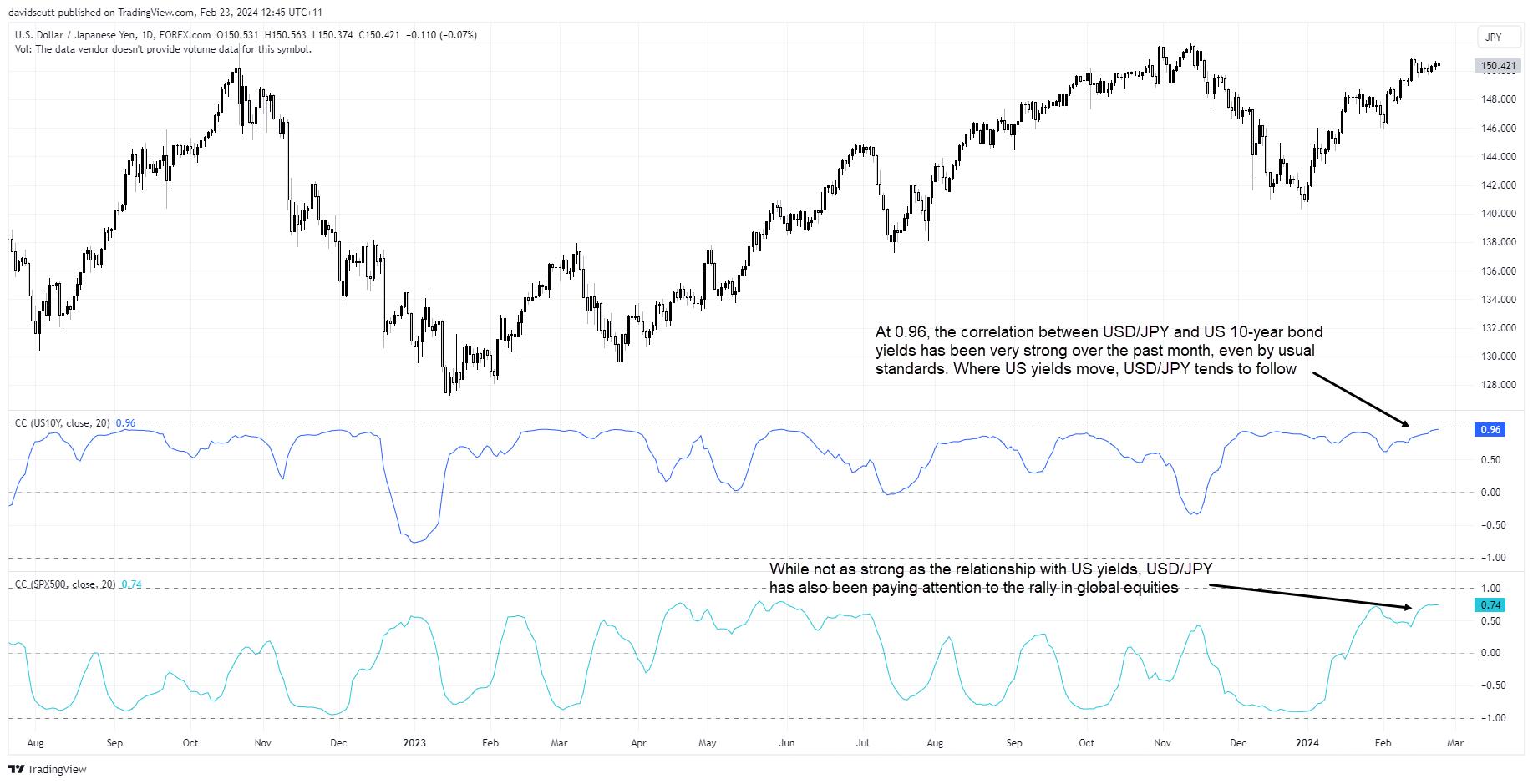

As seen in this chart below tracking movements in USD/JPY against the relationship it’s had with US 10-year bond yields over the past month, it’s clear they’re essentially the same, running with an extremely strong correlation of 0.96. A score of 1 means they move in lockstep, so this reading is extreme even for USD/JPY.

Yield differentials skinnier but risk appetite is stronger

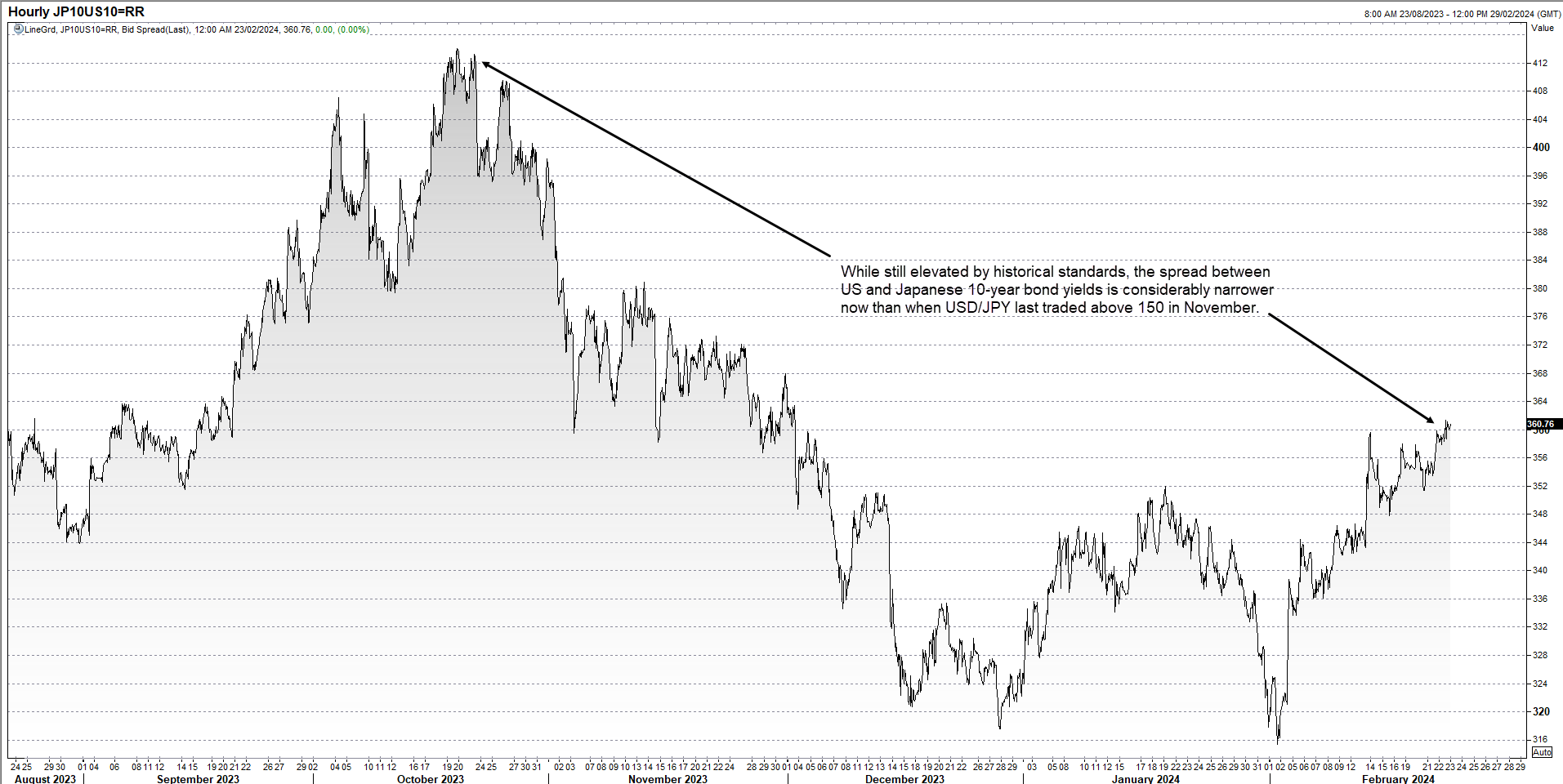

However, one noticeable feature of the latest USD/JPY rally is that it’s occurred despite yield differentials between the US and Japan being considerably skinnier than what they were when USD/JPY was last at these levels in the final quarter of 2023.

Here’s the differential in US and Japanese bond yields for a 10-year term, currently sitting at around 360 basis points. When USD/JPY was last above 150, that differential stood at over 400 basis points. It’s the same story for shorter timeframes such as two and five years with the USD continuing to offer greater returns than JPY but not to the same degree seen before the Fed pivoted towards rate cuts.

Source: Refinitiv

While that suggests downside risk for USD/JPY based solely on yield differentials, there’s another powerful factor that may explain the divergence: risker asset classes are rallying around the world, helping to funnel capital out of Japan via carry trades in search of greater returns elsewhere.

Underneath the rolling correlation between USD/JPY and US 10-year yields in the first chart, I’ve also looked the relationship between USD/JPY and the S&P 500 over the same timeframe. While not as strong as US bond yields, at 0.74, the correlation has been decent over the last month.

For mine, that may explain why USD/JPY is eyeing multi-decade highs despite skinner yield differentials between the two nations.

US events calendar appears more influential than Japan’s

Armed with an understanding on what’s driving USD/JPY, the next task is to evaluate what known events may influence the US rate outlook and/or investor risk appetite next week. While Japan’s calendar is brimming with data, including a consumer price inflation report, I question how influential it will be for USD/JPY given it’s the US side of the equation that’s in charge of interest rate differentials right now.

Yes, there’s plenty of speculation on whether the Bank of Japan will abandon negative interest rate policy either next month or April, but the implications for yield differentials pale in comparison to the swings in US rate outlook.

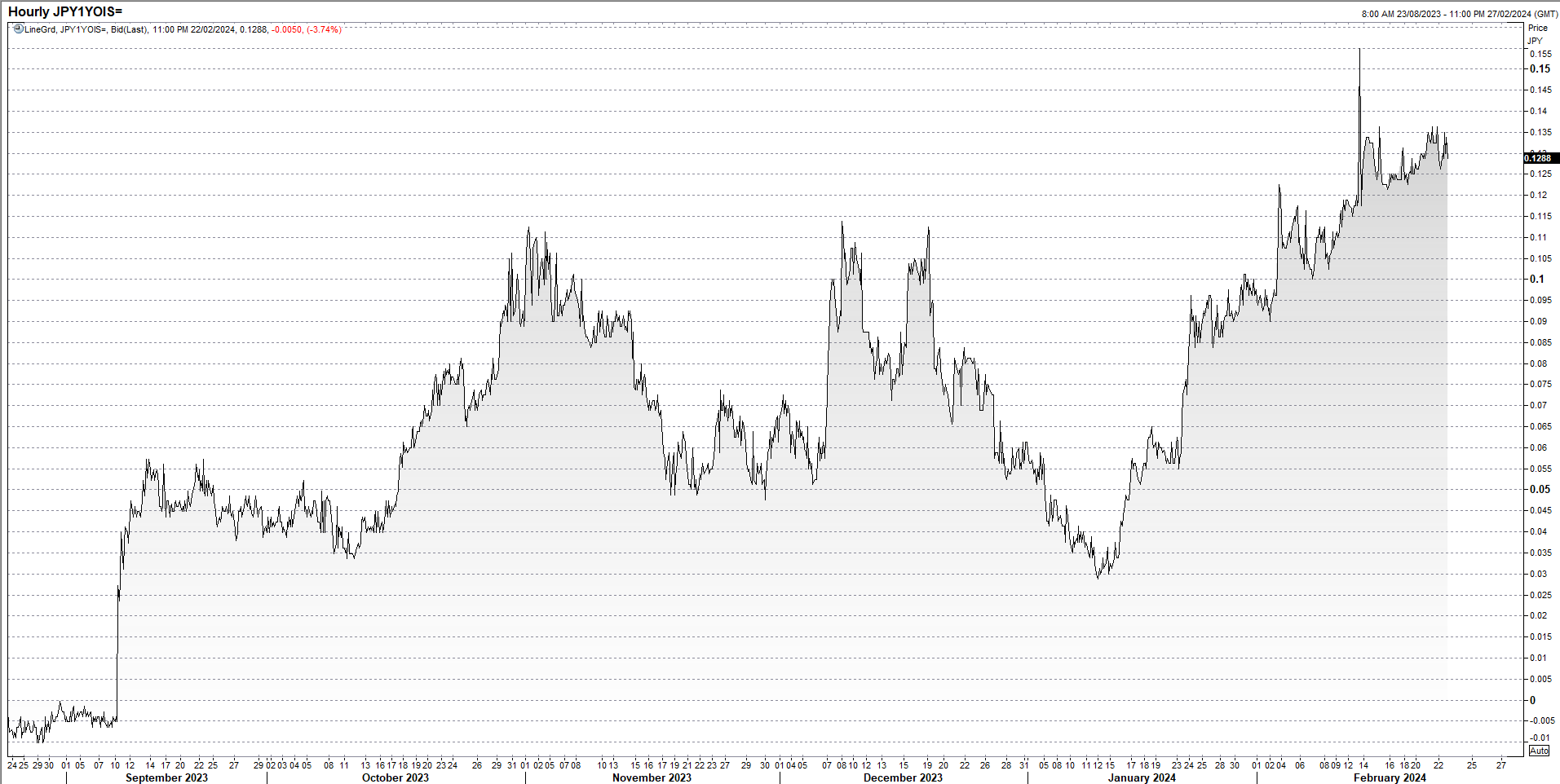

To demonstrate this point, one-year overnight index swaps – which reflect where the market sees the Bank of Japan’s overnight interest rate in one year’s time – sits just under 0.13% right now, implying a little over 20 basis points of hikes are expected over this period. While longer-dated yields can and do move more than overnight rates, when we’re talking about rate differentials measured in the hundreds of basis points, 20 is nothing – it’s a rounding error.

Source: Refinitiv

Don’t just focus on the inflation reading

Eyes immediately turn to Thursday’s core personal consumption expenditure (PCE) deflator, the technical name for the Fed’s preferred underlying inflation indicator. Right now, the Cleveland Fed Nowcast model – which aims to predict inflation trends in real time – points to increase of 0.32% for January, a hot number that is not compatible with inflation returning to Fed’s 2% target if repeated.

But markets are expecting that following upside surprises in CPI and PPI for January earlier this month, meaning only a big beat or miss will likely move USD/JPY in a significant manner. While it doesn’t get the same attention, trends in incomes and consumption within the same report may be just as influential given resilience in the US economy is a major factor why the Fed is not rushing to cut interest rates.

The market twitchiness towards activity indicators means Wednesday’s Q4 GDP revision, along with jobless claims and several regional Fed surveys, may also move the dial if they offer information contrary to the prevailing trend. The Fed speaking calendar is another potential catalyst for volatility, so I’d advise checking on the schedule which is updated frequently. The link can be accessed by here.

Outside US and Japanese events, Eurozone inflation and China PMIs on Friday are other events that could meaningfully influence interest rate and FX markets. Intervention to strengthen the yen from the Bank of Japan on behalf of the Japanese government is another risk to consider, although it remains low in the absence of significant and rapid strengthening in the dollar.

USD/JPY appears tired after rapid ascent

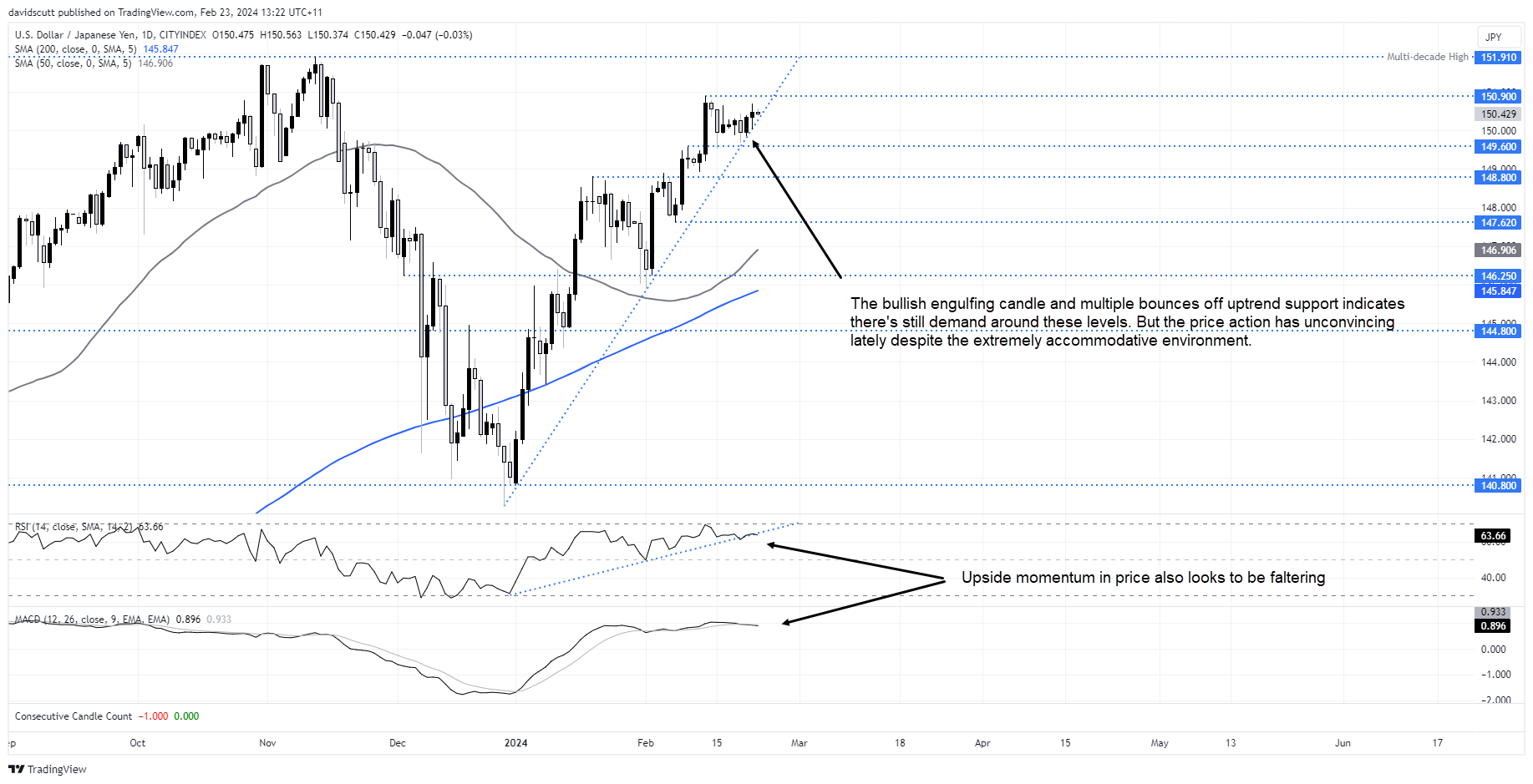

Halfway through the Asian session on Friday, the technical picture for USD/JPY remains clear-cut with the pair remaining in the uptrend established in late December.

However, there are signs of exhaustion creeping in after rallying ten big figures in under two months. Upside momentum is rolling over with RSI and MACD either threatening or having broken their respective uptrends.

The price action has also been unconvincing with the pair unable to bounce strongly off uptrend support seen earlier in the rally. Yes, the bullish engulfing candle on Wednesday, coupled with the trendline being respected, suggests there’s plenty of willing buyers around. However, without rate differentials ballooning further or accelerating gains in riskier assets, will that deliver meaningful upside and a retest of the highs just under 151.95? Maybe, but it’s hardly a compelling case.

I get the sense the uptrend may break before we see a test the highs, putting USD/JPY on track for a potential period of consolidation or even modest downside. On the upside, 150.90 and 151.91 are the levels to watch. On the downside, should the uptrend give way, 149.60, 148.80 and 147.62 would be initial downside targets for shorts.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade