- Japan continues to experience disinflation, like other advanced economies before it

- While core inflation remains above the BOJ target, slower global growth could see disinflation turn to outright deflation

- Japanese yen pairs, like USD/JPY and GBP/JPY, will remain driven by interest rate expectations outside of Japan

Disinflation is gripping Japan as seen in other advanced economies before it, underlining the difficulties facing the Bank of Japan (BOJ) in eradicating the deflationary mindset that has dogged the nation for decades. With near-term prospects for a BOJ rate hike dimming, it means the outlook for USD/JPY will remain dictated by gyrations in US bond yields, impacting yield differentials between the two nations.

According to the Japanese government, inflation dipped 0.1% in December following a 0.2% decline in November, seeing the increase on a year earlier slow to 2.6% from 2.8% a month earlier. Excluding fresh food prices, core inflation slowed further on an annualised basis, dropping to 2.3% from 2.5% in November. The outcome was in line with market expectations and marked the slowest increase since June 2022.

Inflation remains above BOJ target but is slowing

The BOJ targets core inflation of 2% over the economic cycle. While the rate remains above that level, it has been trending lower over the past year, now barely sitting at half the 4.2% level seen in January last year.

Excluding both food and energy prices, core-core inflation – which is more akin to underlying inflation pressures in other developed economies – grew 3.7% from a year earlier, still uncomfortably high but slowing from the 4.3% level reported in August last year.

BOJ faces tricky path to possible rate hikes

With disinflation remaining, the BOJ faces a tricky decision on whether to begin normalising monetary policy by abandoning negative interest rate which have been in place for nearly a decade, running the risk it could disinflation into outright deflation by slowing the economy and strengthening the Japanese yen. Lifting interest rates when the global economy is slowing with other central banks cutting interest rate could easily see that happen given Japan’s deflationary mindset.

Wage growth only one factor underpinning the BOJ expectations

BOJ policymakers are hoping wage negotiations set to conclude at the end of the fiscal year in March will help to foster inflationary forces, helping to boost demand and consumer prices. While we won’t know the outcome for several months, recent wage data has come in well short of expectations, seeing markets pare expectations for BOJ rate hikes this year.

Looking at swaps markets, Japan’s overnight rate is now seen sitting at just 6 basis point, around half the level seen in October last year. It was nearing close to 0% last week. While that implies the BOJ will be able to lift benchmark overnight rates from -0.1%, the longer it waits to begin the process, the greater the risk is may do more harm than good.

At this stage, markets are betting policy normalisation will begin in April, just as other central banks are predicted to start easing policy settings. For USD/JPY, whether or the BOJ succeeds is far less important than what happens with US rates given they remain at elevated relative to recent history, providing scope for two-way directional risks given economic uncertainty and the United States’ mounting government debt bill.

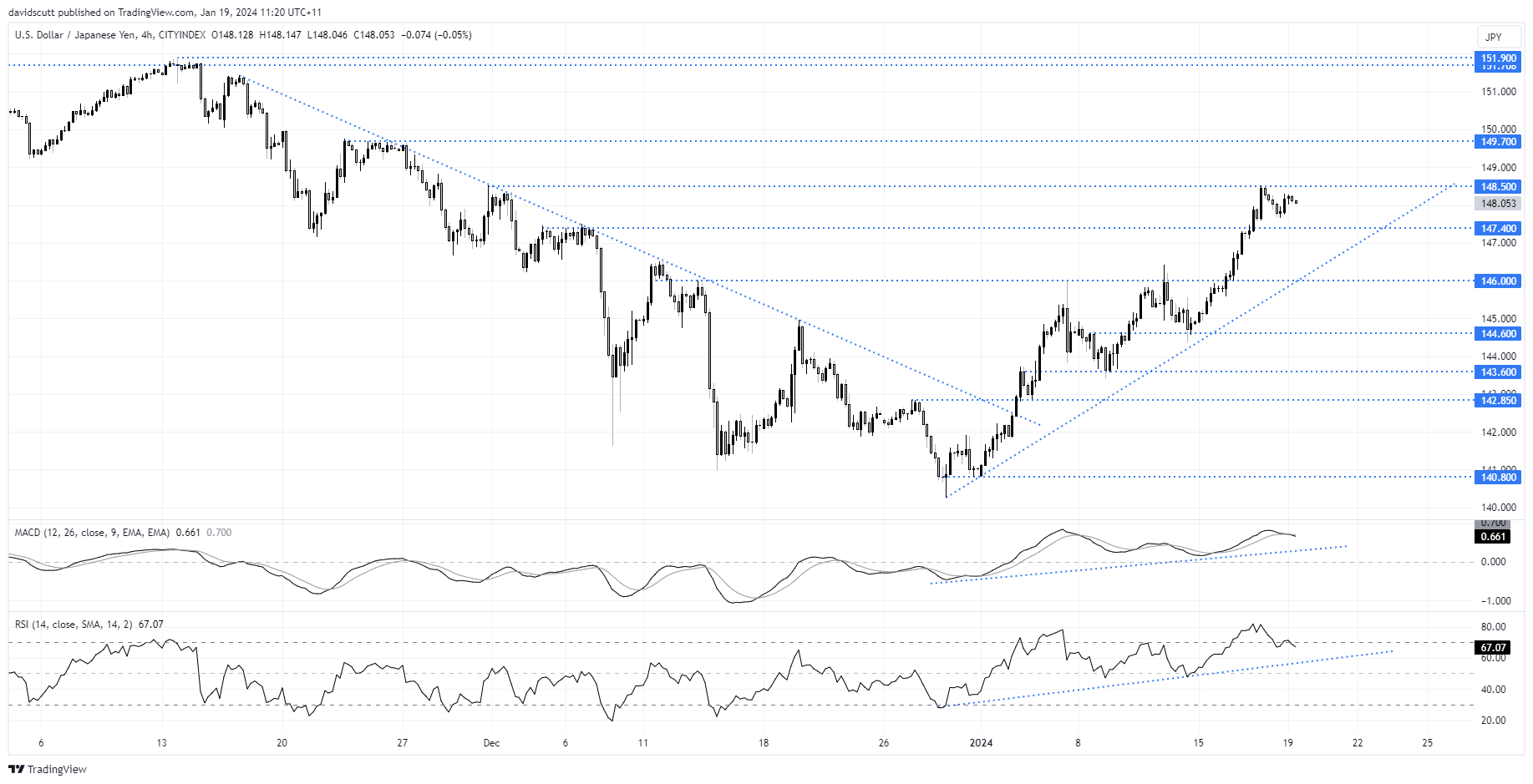

USD/JPY rallying on widening interest rate differentials

Looking at USD/JPY, the widening in interest rate differentials between the US and Japan over recent weeks has provided a rich environment for dip-buyers to move in. For benchmark 10-year government bonds, the yield advantage the US enjoys over Japan has over 30 basis points since the start of the year, seeing USD/JPY lift nearly eight big figures to over 148.

Unless global economic activity really starts to rollover or markets add to already aggressive US rate cut bets of nearly six 25-point reductions in 2024, the path of least resistance for USD/JPY remains higher near-term, as indicated by RSI and MACD remaining in uptrends.

A break of 148.50 could lead to a push to 149.70, taking the pair closer to the multi-decade highs struck last year. On the downside, horizontal support is located at 147.40 and 146.00, with uptrend support located in between. To push any lower would likely require increased concern about the prospect for a hard economic landing globally.

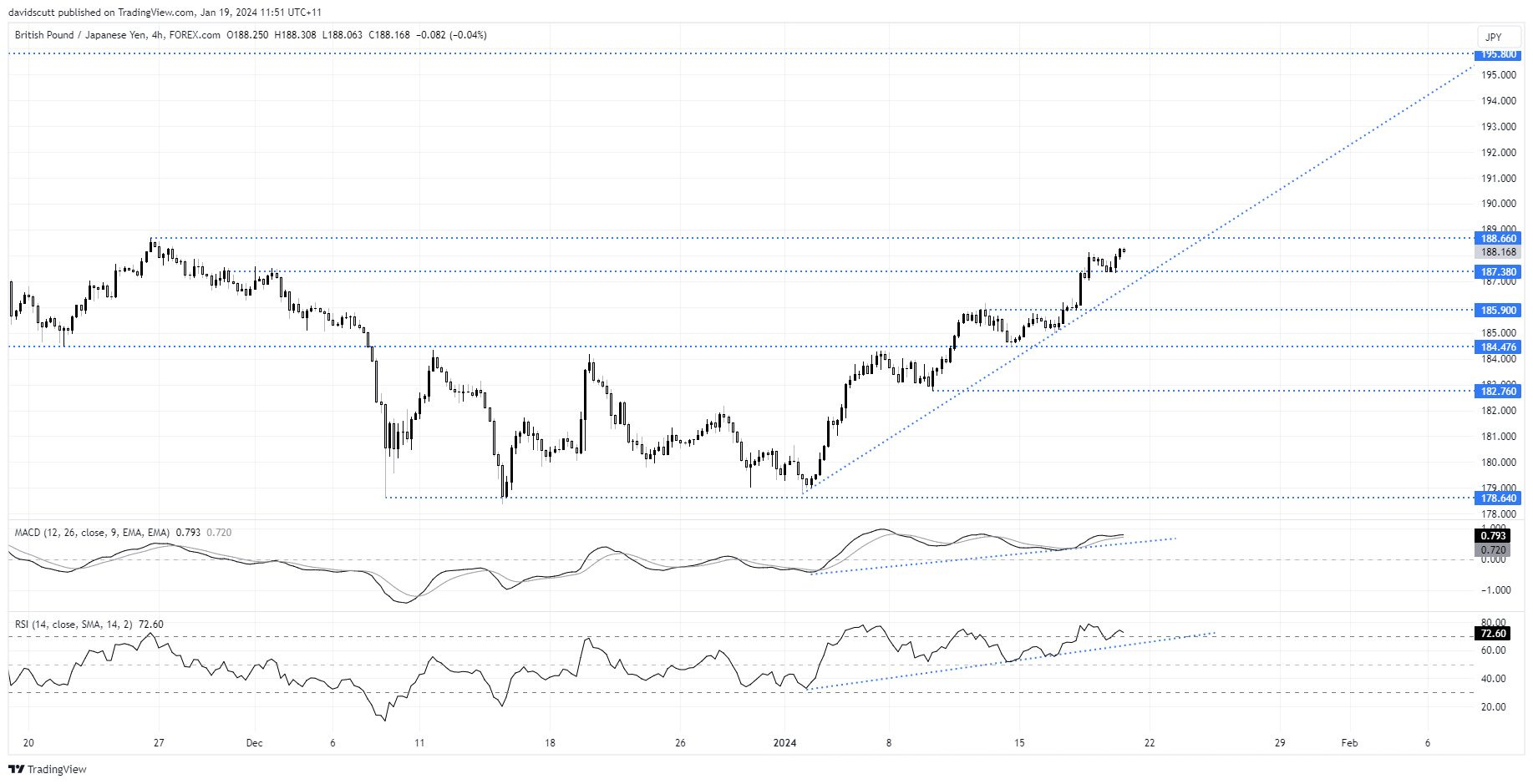

GBP/JPY gains on trimmed BoE rate hike bets

Like USD/JPY, GBP/JPY has a similar setup, assisted by an unwinding of rate cut bets from the Bank of England in response to stronger-than-expected cire and services inflation figures for December. Should it be able to break cleanly through 188.66 – where it stalled in late December, there’s not a lot of visible resistance seen until above 195, providing potential for an extension of the current move.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade