USD/JPY remains supported on dips despite breaking the uptrend that began late last year, continuing to benefit from raucous risk appetite and historically wide interest rate differentials with the United States. But where does the next leg higher come from? That’s the question traders need to be asking right now. US yields have risen a long way as Fed rate cut expectations were curtailed, leaving spreads with Japanese bonds at levels not seen in months.

But can that trend continue, especially when the Fed is talking about cutting rates while the Bank of Japan is readying for a rate hike this month or next? Risk appetite, another factor influencing USD/JPY performance, is also extremely elevated. Ballooning yield differentials and euphoric markets; It rarely gets better for USD/JPY bulls.

Until the macro backdrop changes, it points to range trade at historically high levels. Longer-term, however, risks remain to the downside given the likelihood of substantial yield differential compression. But that's for another day.

Rates, energy and risk appetite

When considering the near-term USD/JPY outlook, you need to focus on events that could alter the global interest rate outlook, risk appetite or energy prices . When you look at USD/JPY was being influenced by in February, they were the big three.

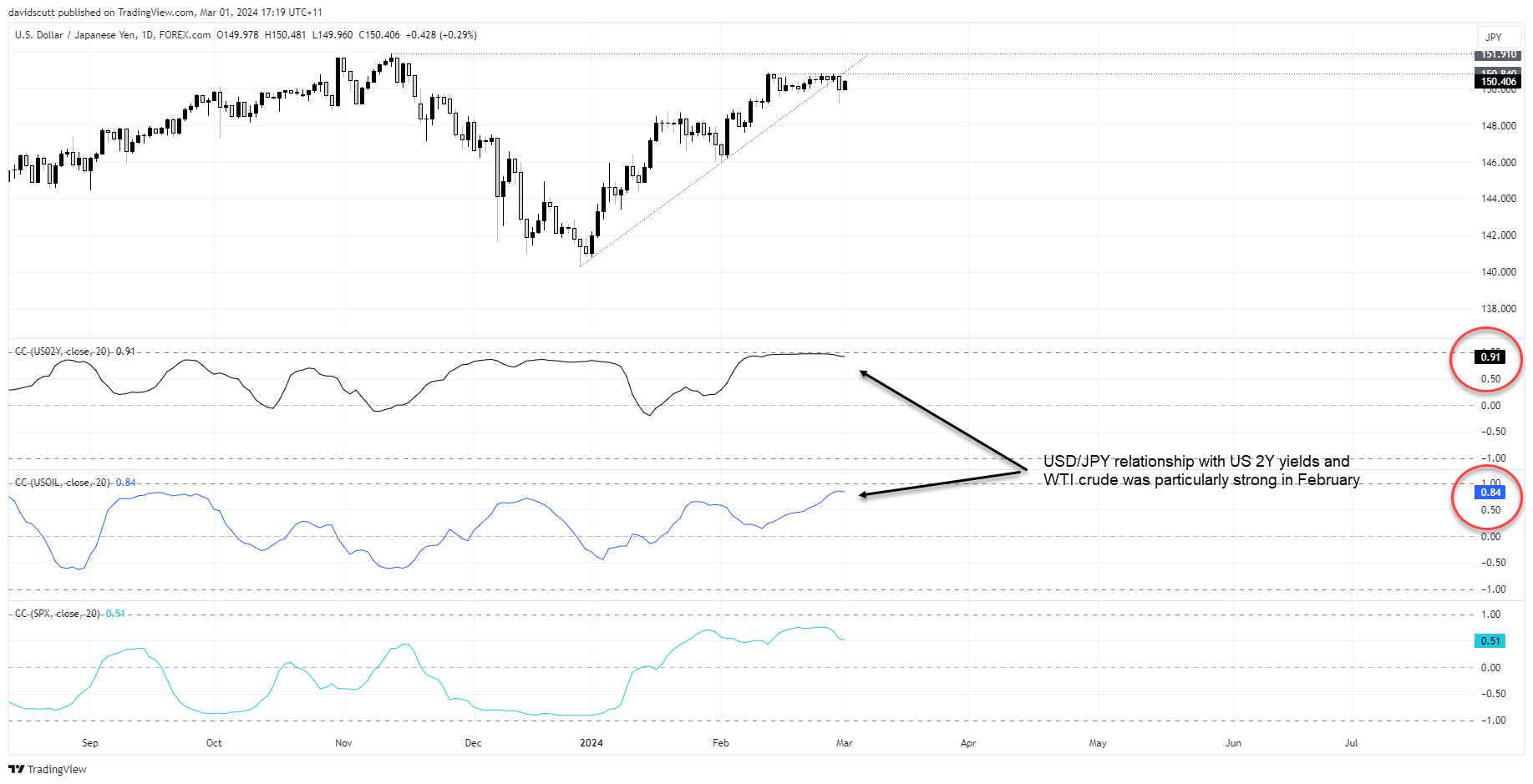

This chart shows the rolling 20-day correlation between USD/JPY against US two-year yields, WTI crude oil and S&P 500, in that order top to bottom. The relationship with yields and crude was particularly strong. With the S&P, which I use as a proxy for sentiment, it was a little looser.

While correlations do not mean causation, when you filter the results using fundamentals, it’s a reasonable assumption to suggest they were driving USD/JPY movements. That means known events that could impact those areas will likely impact USD/JPY this week.

BOJ speeches, Tokyo inflation, Powell and payrolls the events to watch

Looking at the calendar next week, it’s full of data, speeches and central bank announcements but only a handful are likely to meaningfully impact USD/JPY.

In Japan, Tuesday’s Tokyo inflation report will be scrutinised for signs that disinflationary forces aren’t intensifying further. On the same day, BOJ Governor Kazuo Ueda will speak, although it’s hard to see him deviating from the message that more evidence of wage pressures will be required to feel confident about the prospect of sustained inflation pressures.

His BOJ counterpart Hajime Takata’s appearance on Thursday may receive more attention following his hawkish speech last week, including suggesting he hasn’t made up his mind on whether the BOJ should abandon negative interest rates as soon as this month. When, not if, it seems.

In the US, Jerome Powell will address Congress on Wednesday and Thursday. Fed officials have been consistent with their messaging recently, so you’d expect Powell to do the same. Rates are likely to be reduced later this year depending on the data not deviating too far from forecast. But another thing that has been consistent recently is how inconsistent Powell has been. He delivered a dovish surprise in December only to rollout a hawkish one in January!

When it comes to US data, ISM services on Tuesday, JOLTs survey on Wednesday and non-farm payrolls on Friday are the events to watch. When evaluating each, ask yourself what it means for the view that Fed will cut rates three or four times this year? Markets will only meaningfully react if they prompt a big deviation on consensus.

Outside those events, the Bank of Canada and ECB rate decisions on Wednesday and Thursday respectively may generate volatility, although they are largely in the same position as the Fed. Waiting to cut. Not cutting.

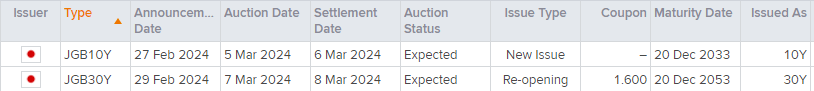

The bond auction schedule is quiet, although a 10 and 30-year offering in Japan is worth keeping an eye on given the flow through to yield differentials with the US.

Source: Refinitiv

Hard to see further upside for US yields near-term

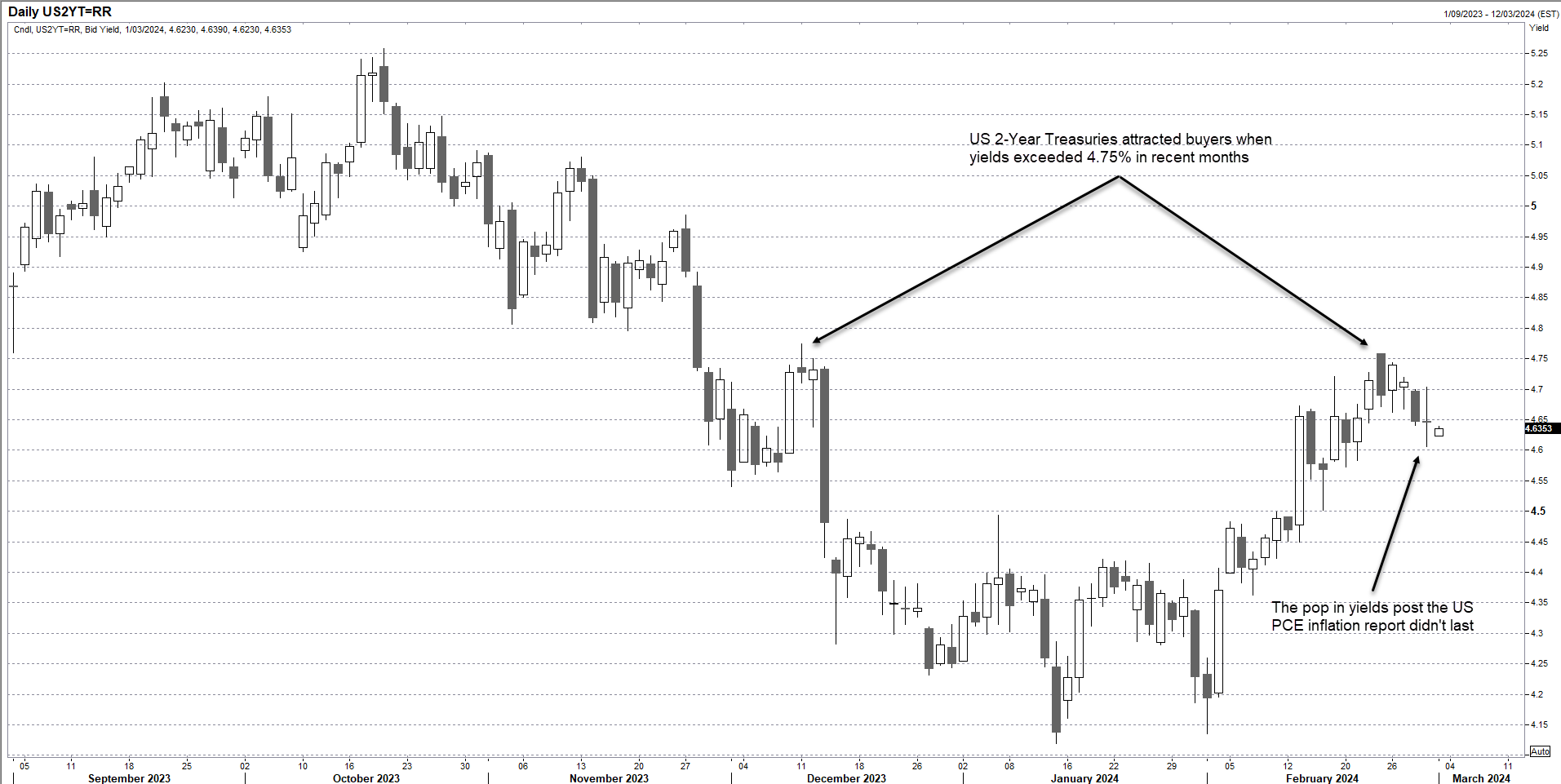

While USD/JPY is flying towards the close of Asian trade on Friday, it’s not being accompanied by widening yield differentials between the US and Japan. Capital flows may be a factor given it’s the start of a new month, but unless rate differentials don’t matter anymore, I suspect the diminishing yield pickup will begin to weigh on USD/JPY, keeping it rangebound below the highs set in November.

Having slashed Fed rate cut bets this year from more than seven to a little over three in the space of six weeks, it’s hard to see much further upside for US yields near-term. You could argue risks are skewed in the other direction given economic resilience and sticky inflation is now the norm rather than exception.

Source; Refinitiv

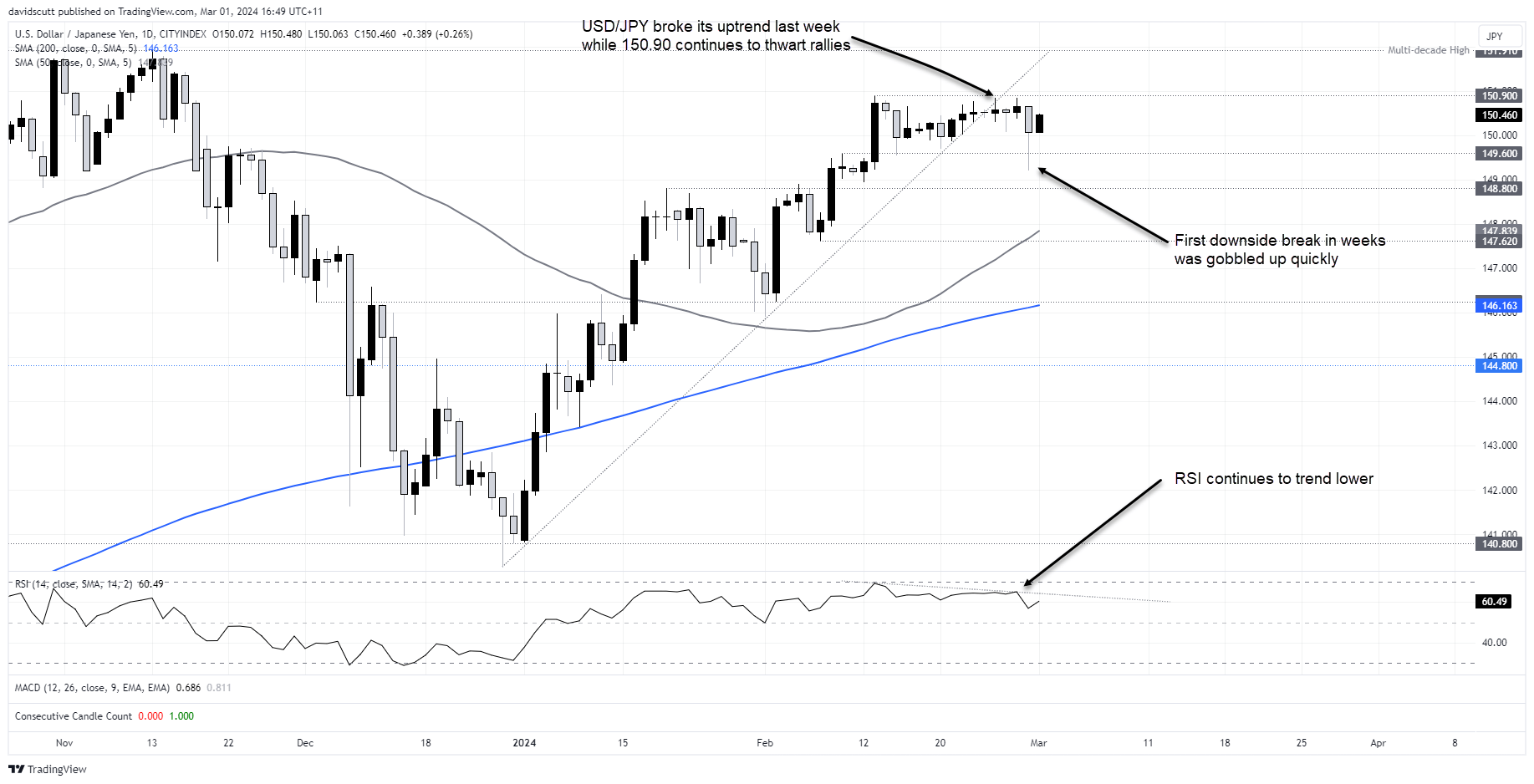

USD/JPY seeking catalysts for sustained break

When it comes to the charts, Thursday’s big reversal has seen USD/JPY move back to familiar territory, stuck between support at 149.60 and resistance at 150.90. While the fightback, followed by a potential bullish inside candle on Friday, suggests we may see another test of 151.90 shortly, it had plenty of opportunities in February to do so and never got close. Having broken the uptrend from late December, upside risks appear to be diminishing. RSI continues to trend lower, not higher. That's another negative.

It points to the most successful strategy being continuing to trade the range, waiting for a definitive break either higher or lower. With exceptional conditions for USD/JPY upside already in place, if it can’t test November’s highs now, when will it ever?

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade