Households in the United States appear to be coping with the higher inflationary environment far better than those in Japan, underscoring the divergent monetary policy settings from their respective central banks that have pushed USD/JPY back towards decade highs. Until there’s greater uniformity in relative domestic economic performance, it’s difficult to see a meaningful reversal of the prevailing currency trend.

Divergent data underpins USD/JPY rally

You only need to look at recent consumer data from both nations to see why traders continue to flock to the dollar.

According to data released on Tuesday, Japanese household spending slumped 2.7% in July, far below the 0.7% increase expected. Spending has only increased twice so far this year, leaving the annual decline at 5%, the steepest since early 2021. In contrast, personal consumption expenditure in the United States remains resilient, jumping 0.8% in July, adding to increases of 0.6%, 0.2% and 0.6% over the preceding three months.

BOJ’s quest for sustained inflation has a long way to go

The data underscores why the Federal Reserve continues to warn that further monetary policy tightening may be required to curb inflationary pressures, and why the Bank of Japan is nowhere near the point where it can start to normalise policy settings too.

Yes, Japan’s export sector is benefitting from the weaker yen but that’s not being reflected across the broader economy yet. Inflation is high and real wages are going backwards, curtailing the ability for households to spend. And while Japan is importing plenty of inflation right now through the trade channel, until that stokes meaningful wages pressures and stronger household demand, the Bank of Japan will continue with existing policies such as yield control and negative interest rates.

USD/JPY dictated by US economic outlook

With the BOJ set to sit pat for the foreseeable future, it means a deterioration in domestic US data will likely be required to spark a meaningful reversal in USD/JPY. While some recent data has undershot lofty expectations, it’s hardly falling off a cliff and remains stronger than other developed economies. That suggests the USD/JPY uptrend sits on solid foundations right now.

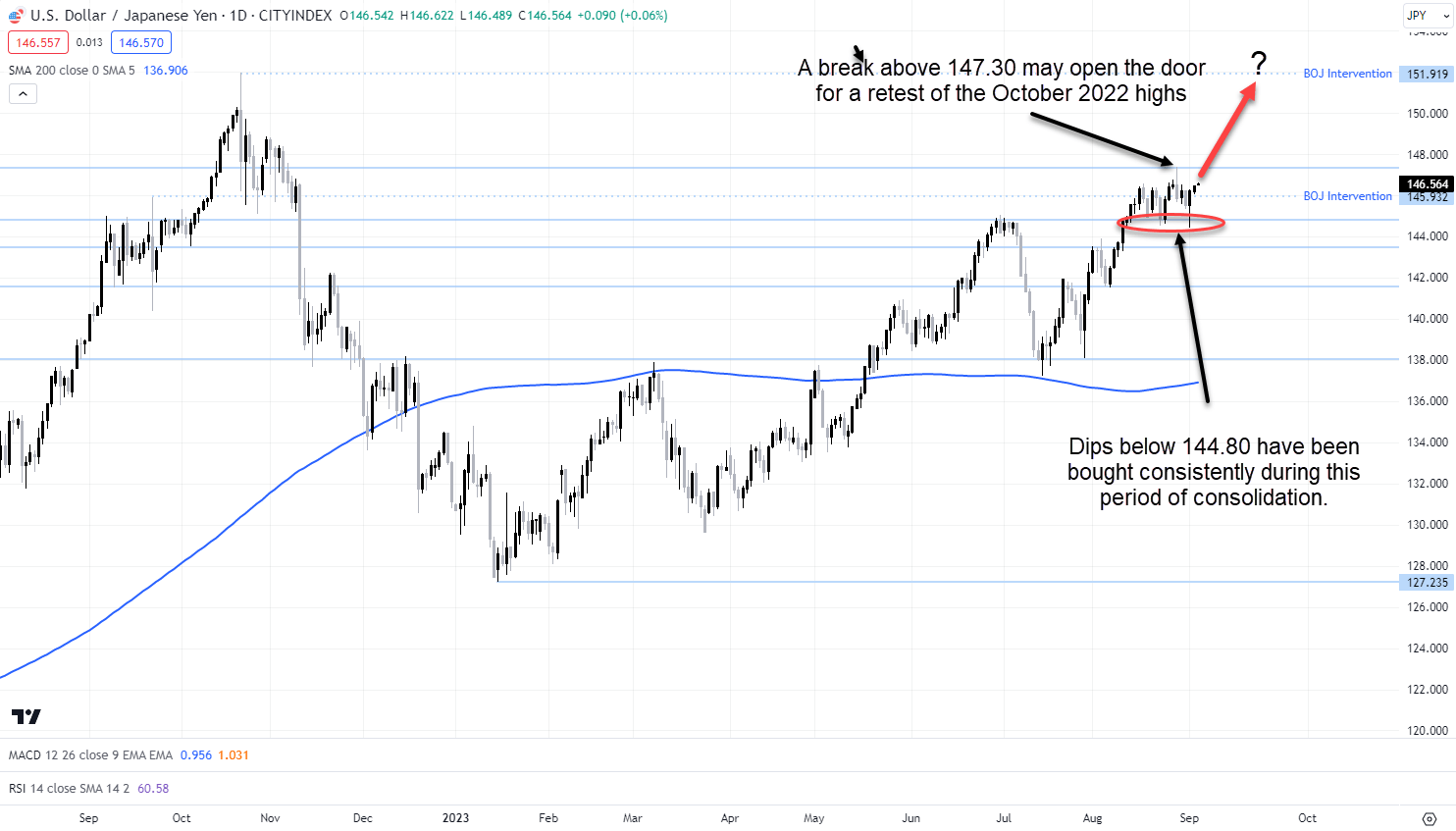

Dips below 144.80 have been bought in recent weeks, indicating that may be an appropriate level to enter or add to long positions with a stop below 144.50 for protection. Probes above 146.5 have been repelled of late, other than the pop in late August that took the pair above 147.30 – that’s the first upside target. A break above there opens the door to a possible move back towards the October highs last year.

Source: Trading View

Near-term events to watch

In the near-term, pay close attention to the upcoming US ISM non-manufacturing report, especially the figures measuring prices paid and employment. Those subindices were in focus in the manufacturing PMI last Friday, contributing to the turnaround in US yields and dollar. As the services sector is significantly larger proportion of the US economy, this is the key release to watch for USD/JPY. The report is out Wednesday.

As for the potential treat of Bank of Japan intervention, the risk appears overblown right now. The movements in the pair have been orderly and largely in line with yield differentials between Japan and the US across a variety of different tenors. Unless that changes, it’s hard to see the BOJ pulling the trigger.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade