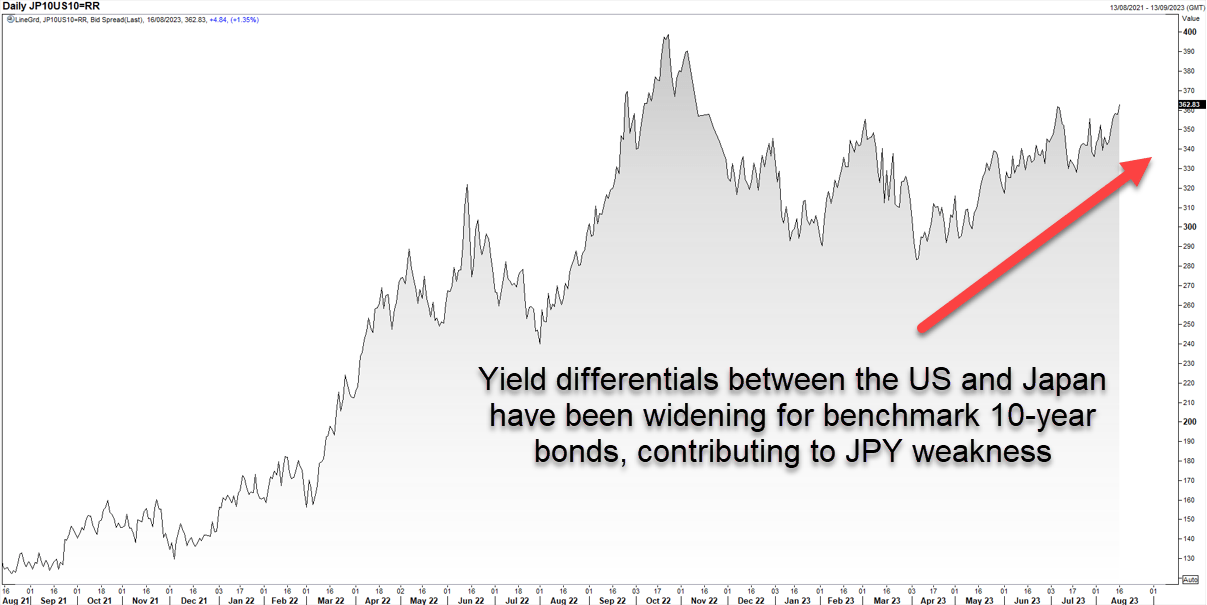

Widening yield differentials between the United States and Japan suggest the rally in USD/JPY is justified from a fundamental perspective, questioning whether Japan’s Ministry of Finance should attempt to counteract market forces by instructing the Bank of Japan to directly intervene in FX markets to support the yen.

BOJ policies are contributing to JPY weakness

Ballooning yield differentials between US and Japanese government debt is largely due to the BOJ’s ongoing efforts to cap yields on Japanese government bonds (JGB) through its yield curve control (YCC) program, counteracting market forces which have been squeezing yields higher in other sovereign debt such as Treasuries. And while the BOJ announced a more flexible framework regarding its bond buying program last month, widening the tolerance range for where benchmark yields would be permitted to deviate from its 0% to target to 1% from 0.5%, it’s already stepped in on several occasions since to prevent yields from lifting beyond 0.66%.

Intervening in FX to counteract intervention in JGBs doesn’t make sense

The other factor few are talking about in the FX intervention debate is that it also reflects US dollar strength against a basket of currencies, not just the yen. Look at the Australian dollar or Chinese yuan, for instance. In this environment, it suggests any FX intervention will be ineffective beyond the short-term. The BOJ will have more success allowing JGB yields to rise if it wants to support the yen on a sustainable basis. Perhaps that may be the playbook this time with the BOJ’s more flexible YCC approach?

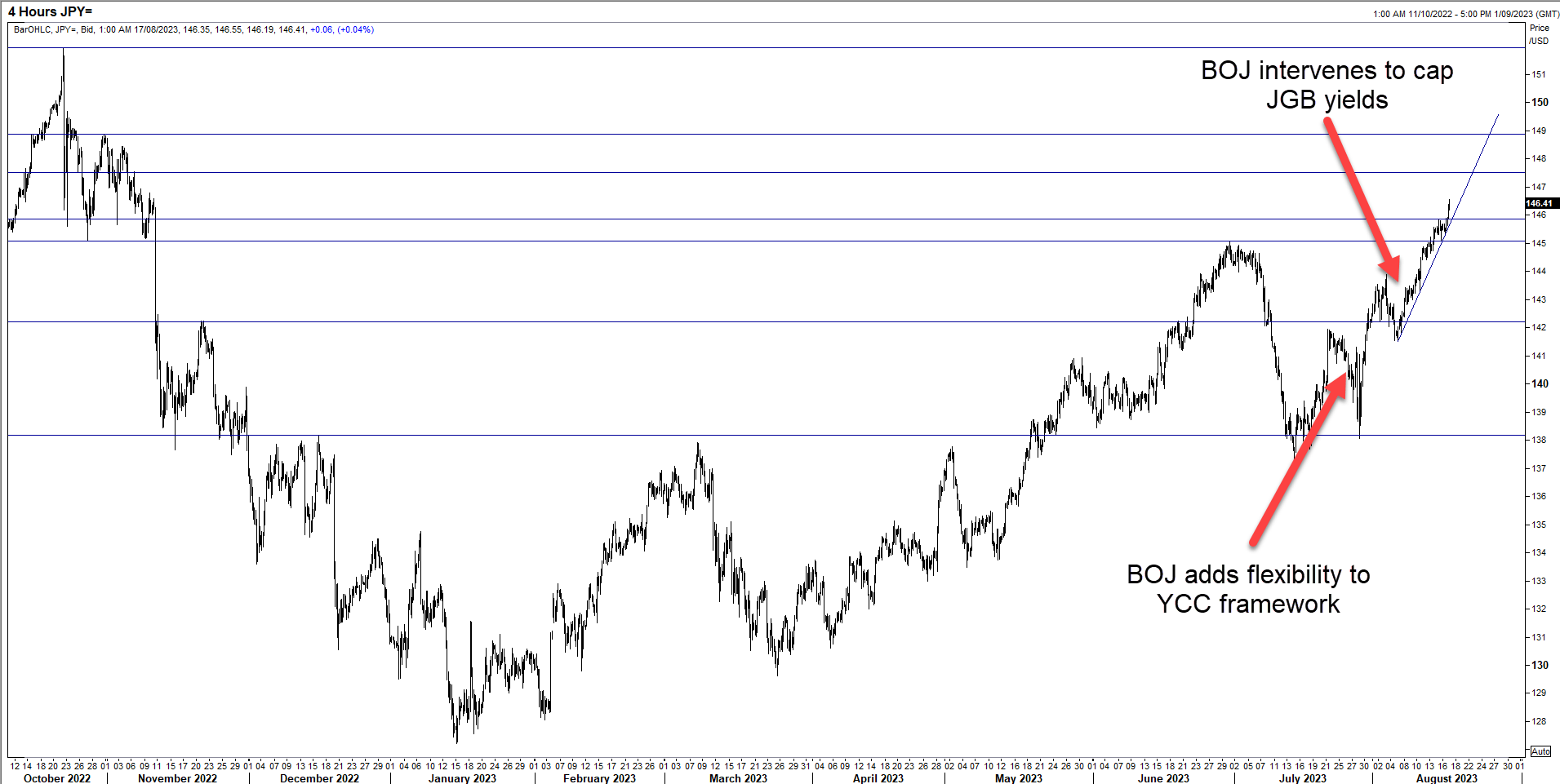

Intervention appears unlikely near-term

Even though we’ve seen Japanese finance minister Shunichi Suzuki on the wires this week firing the first warning shots on a possible FX intervention, we’re yet to see a deluge of commentary from officials on yen movements which have occurred before previous intervention episodes. And if verbal intervention attempts fail, the next step is usually for the BoJ to conduct “spot checks” on FX levels with trading desks. If history is any guide, that’s the moment you should reconsider holding or adding to long USD/JPY positions. The next step after that has been for the BOJ to pull the trigger.

USD/JPY remains in solid uptrend

The USD/JPY remains in a solid uptrend, consolidating above July’s peak of 145 this week before pushing higher again overnight, coinciding with another move higher in US Treasury yields. Near term, buyers may step in below 146 and again at 145. On the upside, it did a bit of work around 147.50 in October last year – that could be where it gravitates towards next.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade