- USD/JPY analysis: Will the yen make a comeback with BoJ finally ending negative rates?

- Attention turns to FOMC policy decision, with traders expecting dot plots to point to 2 cuts in 2024 – but is a hawkish Fed already priced in?

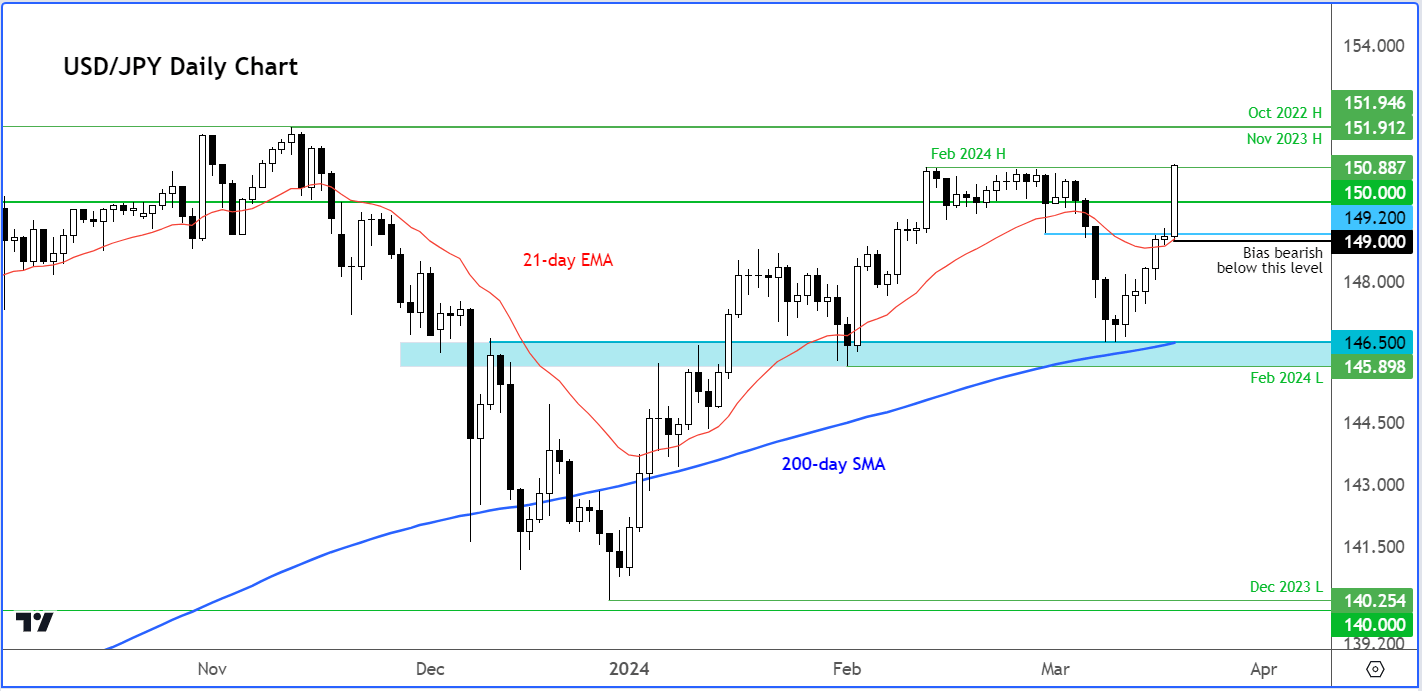

- USD/JPY technical analysis points higher, but do watch out for a potential false breakout

USD/JPY analysis video plus insights into other FX majors and commodities

The big news today and the biggest moves in FX were all related to the Bank of Japan raising rates for the first time in 17 years, ending negative interest rates and ETF purchases. The US Federal Reserve will be in focus next on Wednesday, followed by the Swiss National Bank and Bank of England on Thursday. With the BoJ finally tightening its belt and the Fed moving towards cutting interest rates, many traders are now wondering what impact this will be having on the USD/JPY over the short-, medium- and long-term horizons.

USD/JPY analysis: Will the yen make a comeback with BoJ finally ending negative rates?

Well, the yen has fallen in initial response across the board, following the BoJ’s dovish rate hike, with the USD/JPY breaking February’s high of 150.88 by late European trade.

However, I do think the yen is going to make a comeback in the not-too-distant future, and potentially in a big way should we see a few more rate hikes in the coming months, or expectations thereof rises due to further strength in inflation or wages data.

Another factor that FX investors will be pondering over is to the with bond yields. With domestic yields now able to rise a bit more freely, will Japanese investors swap foreign bonds in favour of JGBs? After all, it is not cheap to buy foreign debt if you are a Japanese investor. Purchasing Treasuries for example involves JPY to USD conversion, introducing FX risk. To hedge this, they incur additional costs, rendering 10y Treasuries pricier and making it less attractive than it is for US investors.

So, in the long-term, it is all about how high Japanese interest rates will rise relative to how low the rest of the world, or the case of the USD/JPY pair, US interest rates head.

It is worth noting that by letting the yen to weaken further, the Japanese authorities will effectively be importing more inflation into the economy. To deal with this, tighter monetary policy will be required down the line. That in turn, should make the yen less appealing from a carry trade point of view. But this will be a long-term macro factor.

USD/JPY analysis: Attention turns FOMC policy decision

In the more immediate term, for the yen to gain ground on the dollar, we will need to see some weakness in US bond yields, which puts the upcoming FOMC decision into a sharp focus. What the USD/JPY bears will need to see is Powell and co still indicting three rate cuts for 2024. However, if they signal that rate cuts are going to be less than the market expects then in that case the USD/JPY could well break above recent years’ highs of just under 152.00 handle before deciding on its next move.

USD/JPY technical analysis

TradingView.com

With the USD/JPY breaking sharply higher, with strong bullish momentum behind it, the bulls are clearly in charge, and we may well see further short-term gains now that it has broken above the high it had reached in February of just under 150.90.

However, do watch out for a potential false breakout scenario, though, just because now the BoJ has started to make things more interesting, while the rest of the major central banks are heading towards cutting interest rates.

The next key reference point to watch is last year’s high at just under the 152.00 handle where the USD/JPY had also peaked in 2022. Could we potentially see a triple top form there or a false breakout scenario? It is possible, but we must see it first.

In terms of support, 150.00 then 149.20 are among the key levels to watch if we get a pullback post FOMC. The line in the sand is now at 149.00 for me, today’s pre-BOJ low. Should the USD/JPY drop below that level, then a sharp sell-off could be the outcome. It could also mark a potential top in the pair.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade